Highlights

Main Zone

- 0.97% Ni, 0.45% Cu, 0.07% Co, 0.80 g/t Palladium, 0.27 g/t Platinum over 16.4m in Hole PN-23-023

Including - 1.08% Ni, 0.50% Cu, 0.08% Co, 0.91 g/t Palladium, 0.31 g/t Platinum over 13.5m

- 1.37% Ni, 0.44% Cu, 0.10% Co, 1.11 g/t Palladium, 0.57 g/t Platinum over 5.6m

- 0.57% Ni, 0.17% Cu, 0.04% Co, 0.47 g/t Palladium, 0.18g/t Platinum over 14.8m in Hole PN-23-024

Including - 0.92% Ni, 0.32% Cu, 0.06% Co, 0.59 g/t Palladium, 0.34g/t Platinum over 4.85m

And - 1.03% Ni, 0.17% Cu, 0.07% Co, 1.13 g/t Palladium, 0.1g/t Platinum over 2.3m in Hole PN-23-024

- Drilling has completed for the winter season, and will resume in the summer. Holes PN-23-025 to PN-23-035 are awaiting assay results, and several have encountered significant intervals of massive sulfides.

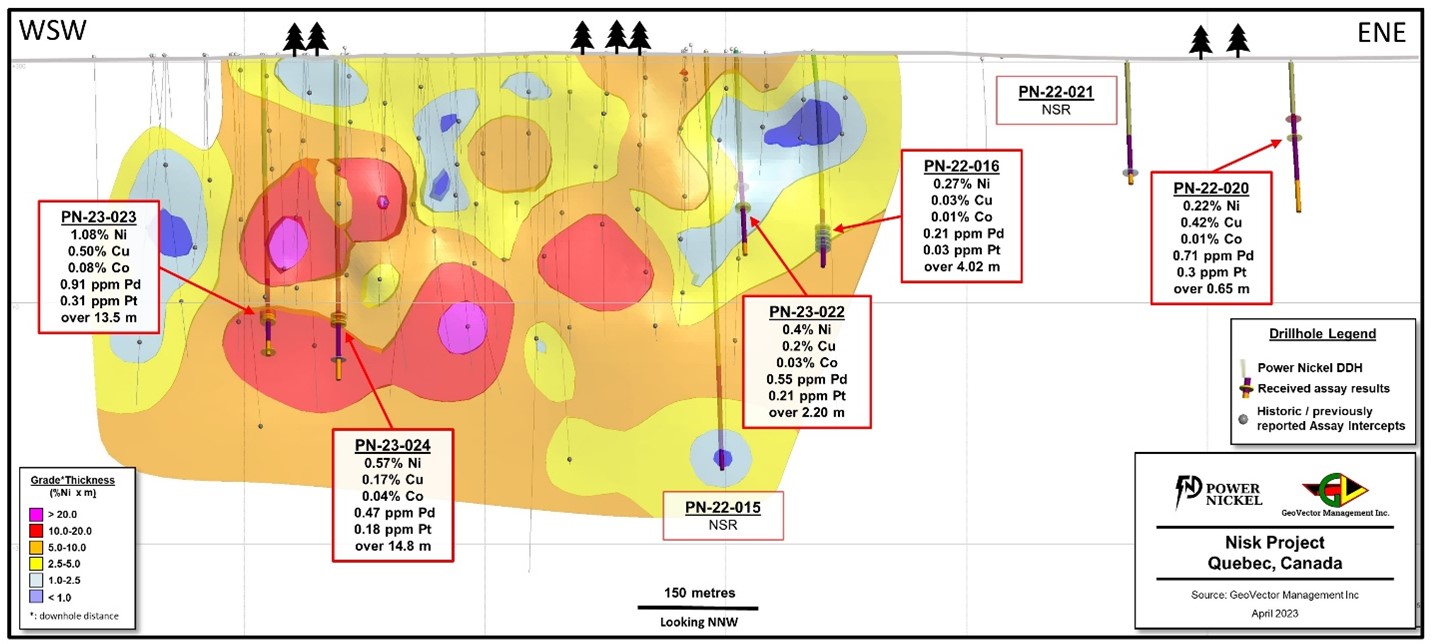

Power Nickel Inc. (the "Company" or "Power Nickel") (TSXV:PNPN)(OTCQB:PNPNF)(Frankfurt:IVVI) continues to confirm the presence of high-grade Ni-Cu-Co-PGE mineralization in the Main Zone of its Nisk project near James Bay, Quebec. In addition, step out exploration drilling 800m east of the Main Zone shows indications of a new Ni-Cu-Co-PGE zone within the same ultramafic sequence of rocks. The Main Zone drill results for holes PN-23-23 and PN-23-24 extend mineralization up dip from previous high-grade holes into an area previously believed to be a low grade zone between two high grade lodes (Figure 1

New Discovery 800m east of Main Zone

0.22% Ni, 0.42% Cu, 0.01% Co, 0.71 g/t Palladium, 0.31 g/t Platinum over 4.9m Hole PN-22-020

Late in the fall 2022 drill program, two holes (PN-22-020 and PN-22-021) tested an exploration target at shallow depths approximately 800m and 600m respectively east of the high-grade Main Zone (Figure 1). Hole PN-22-021 did not intersect sulphide mineralization, but further to the east hole PN-22-020 intersected three (3) zones of sulphides with significant Ni-Cu-Co-PGE mineralization (Table 1). This hole contained low amounts of sulphides but with a high ratio of Ni-Cu-Co-PGE mineralization. The area will require further testing for potential massive sulphide zones, and both holes are good candidates for downhole EM surveying to look for off-hole EM conductors.

In a March 1 news release, hole PN-22-018 was listed as NSR (no significant results), but further analysis of initial assay results from this hole revealed a low-grade Ni/PGE zone over 7.5m and it is reported here (Table 1).

Table 1 below presents the significant results received from the remaining fall 2022 program and the initial holes from the winter 2023 program.

Table 1: Significant results from the 2022 drilling program.

Hole ID | UTM E1 | UTM N1 | Length (m) | Azimuth (°) | Dip (°) | From (m) | To (m) | Interval Length2 (m) | Au (g/t) | Ni (%) | Cu (%) | Co (%) | Pd (g/t) | Pt (g/t) |

| PN-22-015 | 460176 | 5728829 | 544.4 | 157.3 | -76 | NSR - hole was lost in ultramafic host rocks | ||||||||

| PN-22-016 | 460313 | 5728831 | 321 | 152.9 | -58 | Hole lost 1m of core in mineralized zone | ||||||||

| PN-22-018 | 459537 | 5728552 | 465 | 180.4 | -70 | 427.00 | 434.50 | 7.50 | 0.01 | 0.29 | 0.01 | 0.02 | 0.37 | 0.09 |

| PN-22-019 | 459802 | 5728686 | 262.74 | 152.2 | -66 | Hole lost short of target | ||||||||

| PN-22-020 | 460917 | 5728876 | 219.07 | 161.1 | -61 | 85.00 | 86.50 | 1.50 | 0.01 | 0.81 | 0.09 | 0.04 | 1.00 | 0.03 |

| And | 100.00 | 102.25 | 2.25 | 0.13 | 0.13 | 0.35 | 0.01 | 0.74 | 0.30 | |||||

| And | 112.60 | 117.50 | 4.90 | 0.05 | 0.22 | 0.42 | 0.01 | 0.71 | 0.31 | |||||

| PN-22-021 | 460722 | 5728815 | 178.24 | 162 | -61 | NSR | ||||||||

| PN-23-022 | 460238 | 5728735 | 315 | 164.9 | -66 | 208.46 | 208.96 | 0.50 | 3.75 | 0.33 | 0.04 | 2.95 | 0.04 | 0.03 |

| Including | 238.95 | 241.15 | 2.20 | 0.01 | 0.40 | 0.20 | 0.03 | 0.55 | 0.21 | |||||

| PN-23-023 | 459658 | 5728641 | 423.02 | 158.1 | -67 | 358.65 | 375.05 | 16.40 | 0.02 | 0.97 | 0.45 | 0.07 | 0.80 | 0.27 |

| Including | 360.65 | 374.15 | 13.50 | 0.03 | 1.08 | 0.50 | 0.08 | 0.91 | 0.31 | |||||

| Including | 360.65 | 366.25 | 5.60 | 0.03 | 1.37 | 0.44 | 0.10 | 1.11 | 0.57 | |||||

| PN-23-024 | 459746 | 5728651 | 433.03 | 162.9 | -70 | 315.00 | 316.00 | 1.00 | 0.26 | 0.15 | 0.33 | 0.02 | 1.03 | 0.29 |

| And | 345.00 | 359.80 | 14.80 | 0.01 | 0.57 | 0.17 | 0.04 | 0.47 | 0.18 | |||||

| Including | 345.00 | 349.85 | 4.85 | 0.02 | 0.92 | 0.32 | 0.06 | 0.59 | 0.34 | |||||

| And Including | 357.50 | 359.80 | 2.30 | 0.01 | 1.03 | 0.17 | 0.07 | 1.13 | 0.01 | |||||

- UTM NAD83, Zone 18N.

- True widths are estimated to be 70% of the Interval Length.

Fourteen (14) holes totaling 5370.67 metres were completed in the fall of 2022 for the second phase of drilling at Nisk. At the time of writing, an additional fifteen (15) holes totalling 5210 m have been completed in the winter 2023 drill program.

Figure 1 - Longitudinal view of the Nisk Main presenting the currently available assay results.

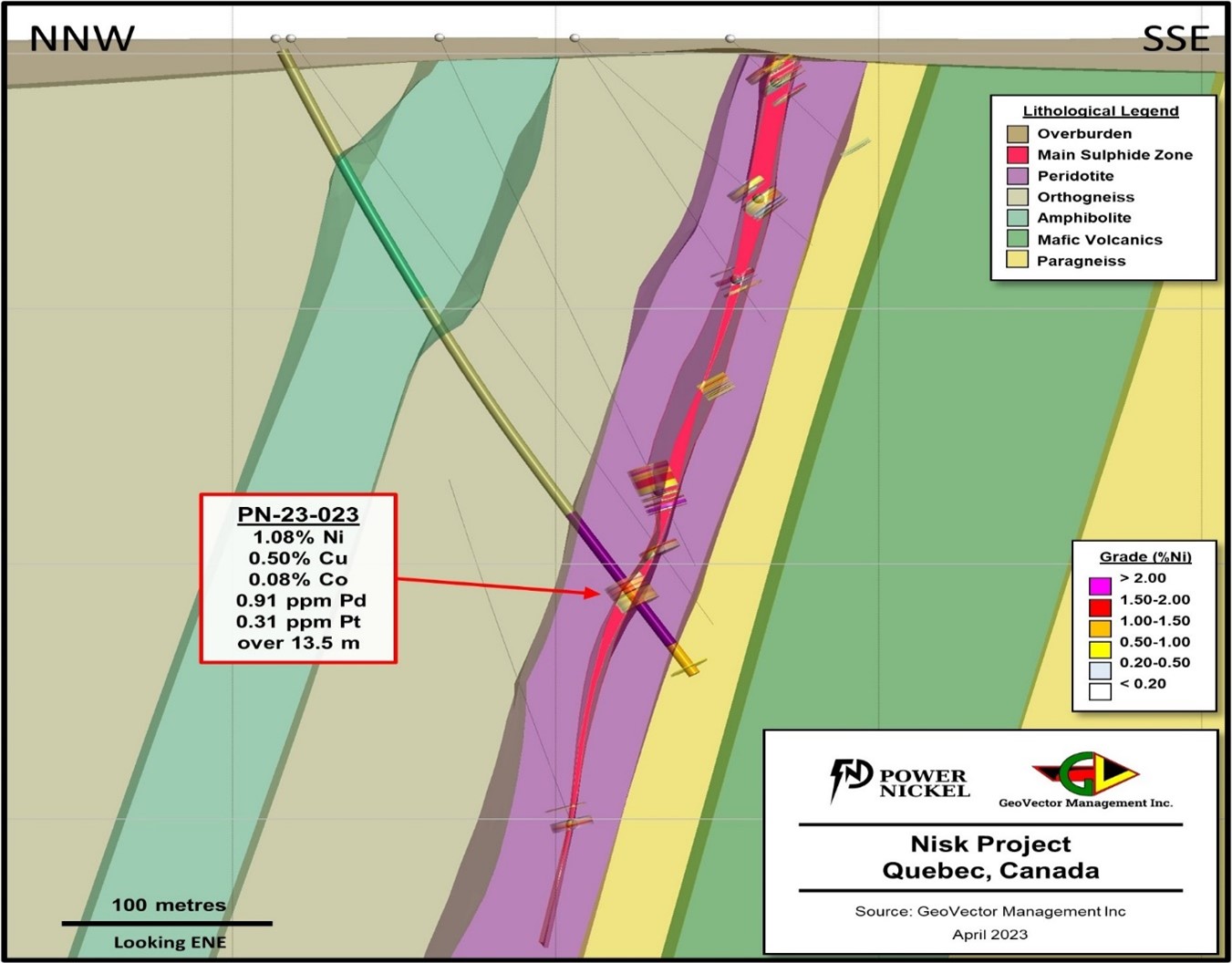

Figure 2 - Cross section view presenting current assay results in hole PN-23-023

"We are very pleased with the ongoing success of our exploration drilling at Nisk. Hole PN-23-023 assays were as pretty as its PICTURE (Figures 2 & 3). It was another excellent intersection. The team has done an amazing job piecing together the underground mystery of this deposit and we believe we have learned some invaluable clues both with our East and West exploration away from the main zone on where our next Pod like Nisk main may lie," commented Power Nickel CEO Terry Lynch

Figure 3 - Picture of massive sulphides in drill core from hole PN-23-023

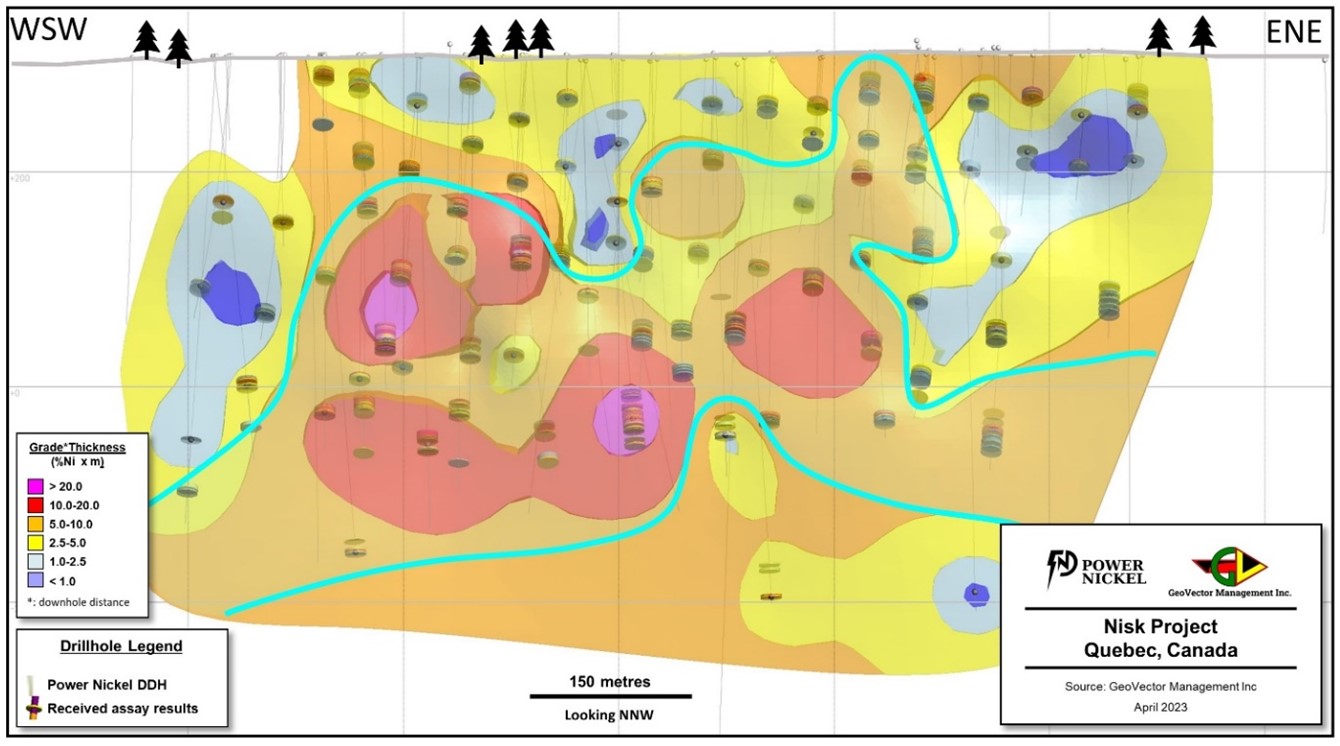

In order to help our investors and interesting parties review the work being done, we have created some images to help with the visualization of our project (Figures 4 & 5). Below is a side view of how Power Nickel conceptualize the River of Nickel flowing within the green outline below to the surface and back down to a depth of about 400 metres over almost a kilometre.

Figure 4 - Conceptual ‘River of Nickel' at Nisk outlined in long section.

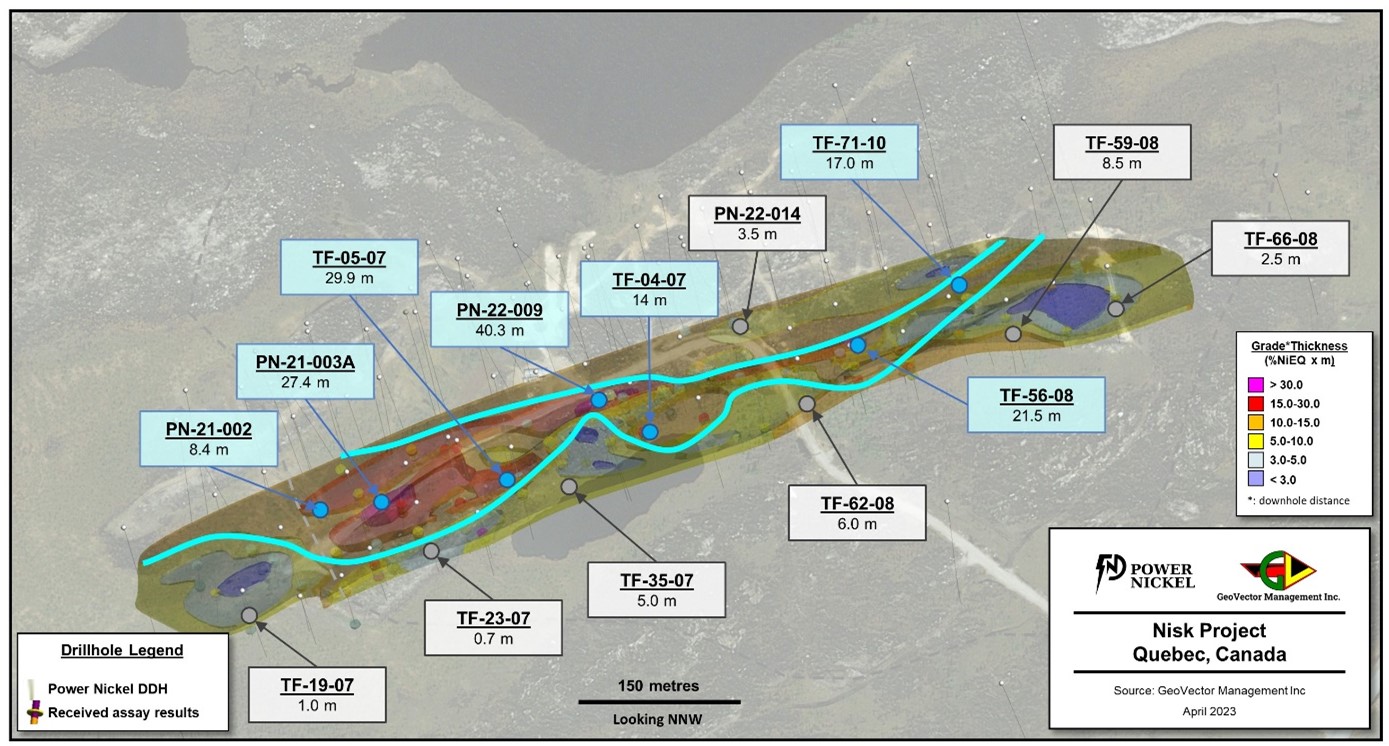

Looking at the top view, we can see both the flow of the river of nickel and the width of mineralization we have discovered.

Figure 5 - Conceptual ‘River of Nickel' in plan view at Nisk Main Zone.

Promotion & Communication Expense

Recent changes in guidance on IR and Communication spending require BC Reporting issuers to comment on their program spending in this respect. We have committed to the following programs.

Winning Media - $60,000 USD for digital marketing services in compliance with the Policies and guidelines of the TSX Venture Exchange and other applicable legislation, Virtus Media Group -$50,000 USD for digital marketing services in compliance with the policies and guidelines of the TSX Venture Exchange and other applicable legislation from now until the end of June. Machai Capital Inc - $100,000 CAD for digital marketing services in compliance with the policies and guidelines of the TSX Venture Exchange and other applicable legislation.

About the Nisk Project

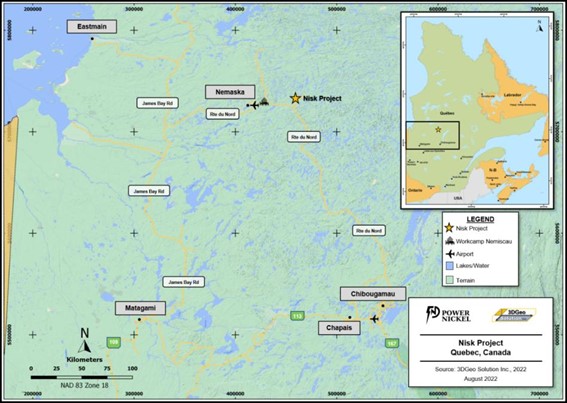

The Nisk Project is located in the southern portion of the Eeyo Istchee James Bay territory, Québec, the site of a number of mining projects improving infrastructure (Figure 6).

Power Nickel completed the acquisition of its option to acquire up to 80% of the Nisk Project from Critical Elements Lithium Corp. (CRE:TSXV). The Nisk Project comprises a large land position (20 kilometres of strike length) with numerous high-grade Nickel intercepts.

Figure 6 - Location of the Nisk Project with respect the current infrastructure available in the area.

QAQC and SAMPLING

GeoVector Management Inc is the Consulting Company retained to oversee the drilling program, which includes core logging and sampling of the drill core.

All samples were submitted to and analyzed at ALS Global ("ALS"), an independent commercial laboratory located in Val-d'Or, Québec for both the sample preparation and assaying. ALS is a commercial laboratory independent of Power Nickel with no interest in the Nisk Project. ALS is an ISO 9001 and 17025 certified and accredited laboratory. Samples submitted through ALS are run through standard preparation methods and analysed using ME-ICP61a (33 element Suite; 0.4g sample; Intermediate Level Four Acid Digestion) and PGM-ICP27 (Pt, Pd, and Au; 30g fire assay and ICP-AES Finish) methods. ALS also undertake their own internal coarse and pulp duplicate analysis to ensure proper sample preparation and equipment calibration.

GeoVector's QAQC program includes regular insertion of CRM standards, duplicates, and blanks into the sample stream with a stringent review of all results.

The results presented in the current Press Release are complete. QAQC and data validation was performed on these holes and no material errors were observed.

Qualified Person

Eric Hébert, Géo, Ph.D. from GeoVector Management Inc and consultant to Power Nickel, is the independent qualified person who has reviewed and approved the technical disclosure contained in this news release.

About Power Nickel Inc.

Power Nickel is a Canadian junior exploration company focusing on high-potential copper, gold and battery metal prospects in Canada and Chile.

On February 1, 2021 Power Nickel (then called Chilean Metals) completed the acquisition of its option to acquire up to 80% of the Nisk project from Critical Elements Lithium Corp. (CRE:TSXV)

The NISK property comprises a large land position (20 kilometres of strike length) with numerous high-grade intercepts. Power Nickel is focused on expanding the historical high-grade nickel-copper PGE mineralization with a series of drill programs designed to test the initial Nisk discovery zone and to explore the land package for adjacent potential Nickel deposits.1

Power Nickel announced on June 8th, 2021 that an agreement has been made to complete the 100% acquisition of its Golden Ivan project in the heart of the Golden Triangle. The Golden Triangle has reported mineral resources (past production and current resources) in total of 130 million ounces of gold, 800 million ounces of silver and 40 billion pounds of copper (Resource World). This property hosts two known mineral showings (gold ore and magee), and a portion of the past-producing Silverado mine, which was reportedly exploited between 1921 and 1939. These mineral showings are described to be Polymetallic veins that contain quantities of silver, lead, zinc, plus/minus gold, and plus/minus copper.

Power Nickel is also 100-per-cent owner of five properties comprising over 50,000 acres strategically located in the prolific iron-oxide-copper-gold belt of northern Chile. It also owns a 3-per-cent NSR royalty interest on any future production from the Copaquire copper-molybdenum deposit, that was sold to a subsidiary of Teck Resources Inc. Under the terms of the sale agreement, Teck has the right to acquire one-third of the 3-per-cent NSR for $3-million at any time. The Copaquire property borders Teck's producing Quebrada Blanca copper mine in Chile's first region.

For further information on Power Nickel Inc., please contact:

Mr. Terry Lynch, CEO

647-448-8044

For further information, readers are encouraged to contact:

Power Nickel Inc.

The Canadian Venture Building

82 Richmond St East, Suite 202

Toronto, ON

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains certain statements that may be deemed "forward-looking statements" with respect to the Company within the meaning of applicable securities laws. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential", "indicates", "opportunity", "possible" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, are subject to risks and uncertainties, and actual results or realities may differ materially from those in the forward-looking statements. Such material risks and uncertainties include, but are not limited to, the Company's ability to raise sufficient capital to fund its planned activities at the NISK Property and for general working capital purposes; the timing and costs of future activities on the Company's properties; maintaining its mineral tenures and concessions in good standing; changes in economic conditions or financial markets; the inherent hazards associates with mineral exploration and mining operations; future prices of metals; changes in general economic conditions; accuracy of mineral resource and reserve estimates; the potential for new discoveries; the ability of the Company to obtain the necessary permits and consents required to explore, drill and develop the projects and if obtained, to obtain such permits and consents in a timely fashion relative to the Company's plans and business objectives for the projects; the general ability of the Company to monetize its mineral resources; and changes in environmental and other laws or regulations that could have an impact on the Company's operations, compliance with environmental laws and regulations, dependence on key management personnel and general competition in the mining industry. Forward-looking statements are based on the reasonable beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by law, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

1The resource estimates at Nisk are historical in nature and the Company's geology team has not completed sufficient work to confirm an NI 43-101 mineral resource. Mineral resource information is derived from the technical report titled "Resource Estimate for the NISK-1 Deposit, Lac Levac Property, Nemiscau, Québec" dated December 2009. The key assumptions, parameters, and methods used to prepare the mineral resource estimates are set out in the technical report. This report, prepared by RSW Inc in 2009, can be found on the SEDAR website.

SOURCE: Power Nickel Inc.

View source version on accesswire.com:

https://www.accesswire.com/751575/Hole-23-Delivers-Power-Nickel-Final-Drill-Results-from-the-Fall-2022-Drill-Program-and-Initial-Drill-Results-from-Winter-2023