Company Highlights:

- Base Case shows US$424M post tax NPV5, 33.1% IRR, with a 2.3 year payback at a US$2,300/oz gold price

- Upside Case shows US$972M post tax NPV5, 59.3% IRR, with a 1.4 year payback at a US$3,900/oz gold price

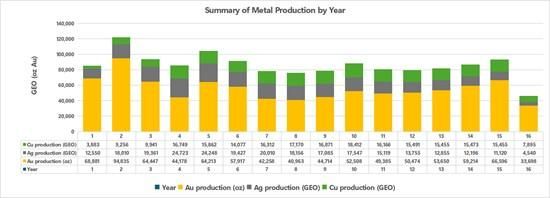

- 1.31M GEOs produced over a 15.3 year mine life, averaging approximately 85,700 GEOs/yr (94,000 GEOs/yr over Years 1-5) at a co-product AISC of US$1,390/GEO

- Initial capital expenditure of US$195.3M for an open pit, heap leach mine and SART plant, including owner's costs, contingency and initial working capital requirements

- Average annual free cash flow of US$47.6M at $2,300/oz gold price (US$104.5 at $3,900/oz) driven by 0.73 g/t AuEq life of mine head grade, low strip ratio (0.3:1) and low sustaining capital

- Indicated resource of 240Mt grading 0.63 g/t AuEq for 4.9M GEOs (0.38g/t gold, 13.78g/t silver, 0.10% copper), and an Inferred resource of 24Mt grading 0.52 g/t AuEq for 0.4M GEOs (0.28g/t gold, 13.67g/t silver, 0.09% copper), providing significant upside opportunities if property boundary constraints lifted

Vancouver, British Columbia--(Newsfile Corp. - December 11, 2025) - Heliostar Metals Ltd. (TSXV: HSTR,OTC:HSTXF) (OTCQX: HSTXF) (FSE: RGG1) ("Heliostar" or the "Company") is pleased to announce strong economics in an updated Prefeasibility Study ("PFS") for its 100% owned Cerro del Gallo project located in the state of Guanajuato, Mexico.

Heliostar CEO, Charles Funk, commented, "The Cerro del Gallo Prefeasibility Study demonstrates a mine that fits perfectly with Heliostar's growth trajectory to larger, lower cost operations. The project has low CAPEX, shows strong free cash flow at a conservative gold price and significant resource upside. With this study the value of Cerro del Gallo to Heliostar has now been established, having been delayed due to our initial focus on operations following the acquisition of the mines and properties in November 2024. This study confirms Cerro del Gallo as an important development project in the Heliostar portfolio, and the Company plans to continue technical work, permitting and community engagement to advance the project to a feasibility level. Organic growth from Ana Paula first, and later from Cerro del Gallo, is planned to launch Heliostar to 300,000 ounces of annual gold equivalent production by the end of the decade."

The technical report supporting this news release will be available on SEDAR+ (www.sedarplus.ca) and on the Company's website (www.heliostarmetals.com) within the next 45 days. The Cerro del Gallo technical report that is the subject of this news release will use United States dollars (USD or US$) unless otherwise noted.

Cerro del Gallo Prefeasibility Study Overview

The Prefeasibility Study is based on the current reserve base of 2.27M GEOs of Probable Mineral Reserves as shown in the Mineral Reserves Update effective July 31, 2025.

The study outlines a 15.3 year mine life, producing 85,700 koz gold equivalent ounces ("GEOs") per year at an average total cash cost of $1,252/GEO and an all-in sustaining cost (AISC) of $1,390 GEO, and costing $195.3M in initial capital expenditures ("CAPEX") to bring into production. At the base case gold price of $2,300 per ounce, this results in an after-tax NPV of $424M, an IRR of 33.1% and a payback period of 2.3 years.

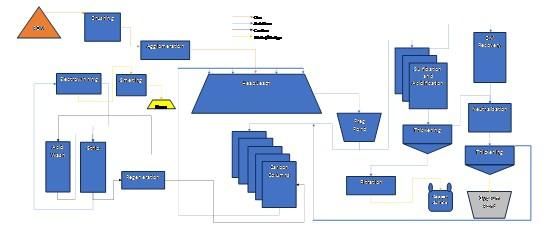

The Cerro del Gallo project is envisaged as a 6 million tonne-per-year open-pit mining operation using conventional drill, blast, load, and haul methods, with mining activities performed by a contractor-supplied fleet. Ore will be crushed using a multi-stage crushing circuit, including conventional crushing and High Pressure Grinding Roll ("HPGR"), and stacked on a lined heap-leach pad. Leaching will use conventional cyanide solution application. Pregnant solution will be processed through an adsorption, desorption and recovery ("ADR") circuit for gold recovery, producing gold doré on-site. Copper and silver dissolved in solution will be recovered through a sulphidization, acidification, recycling, and thickening ("SART") circuit and shipped to smelters.

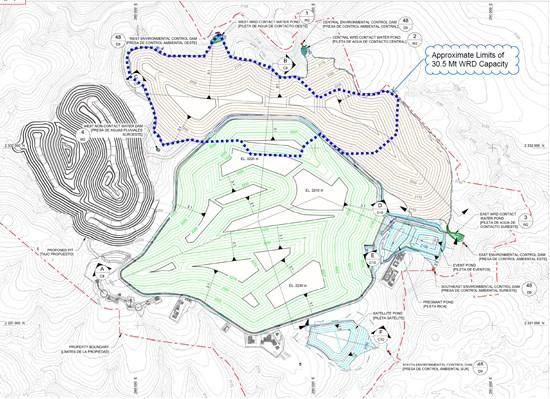

A dedicated waste rock storage facility will be located adjacent to the open pit, sized according to life-of-mine requirements, with engineered drainage and environmental controls. Processing residues will consist primarily of leached material on the heap-leach pad; therefore, no conventional tailings storage facility will be required. Site infrastructure will include an upgraded connection to the national power grid, a reliable water supply from permitted local wells, and supporting buildings such as a maintenance shop, warehouse, administration offices, security facilities, and expanded camp accommodations for operational staff.

Key Highlights

| Forecast Production Highlights | ||

| Ore Feed | 6,000 | Ktpa |

| Strip Ratio | 0.32:1 | W:O |

| Grade - LOM | 0.73 | g/t AuEq |

| Grade - Years 1-5 | 0.80 | g/t AuEq |

| Life of Mine Produced | 1,310 | Koz GEO |

| Processing Rate | 16,438 | Tpd |

| Process Recovery (Gold / Silver / Copper) | 59.4 / 49.3 / 61.8 | % |

| Life of Mine | 15.3 | Years |

| Annual Production - LOM | 85.7 | Koz GEO |

| Annual Production - Years 1-5 | 94.2 | Koz GEO |

| Forecast Financial Highlights | |||

| Average Cash Costs (US$ per GEO) 1 | $1,252 | /oz | |

| Average AISC (US$ per GEO) 1 | $1,390 | /oz | |

| Total Initial Capital Cost | $195.3 | M | |

| Total Sustainable Capital Cost | $160.3 | M | |

| Total Life of Mine Capital Cost 2 | $355.6 | M | |

| Forecast Return Estimates based on Gold Price 1, 2 | ||

| US$2,300/oz 3 | US$3,900/oz 4 | |

| IRR | 33.1% | 59.3% |

| NPV @ 5% discount | $423.9M | $972.4M |

| Payback | 2.3 years | 1.4 years |

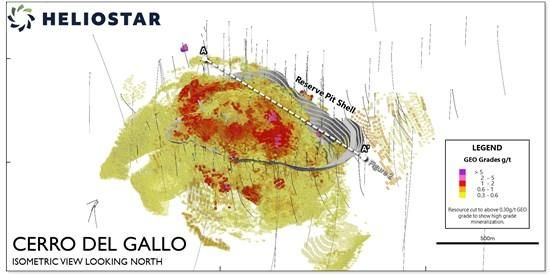

Figure 1 - Isometric View of Cerro del Gallo Resource with Reserve Pit Shell

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7729/277693_7638a1be94ca1834_001full.jpg

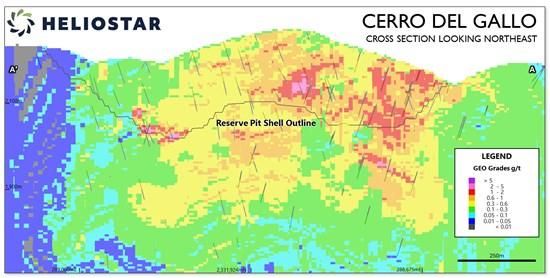

Figure 2 - Cross Section through Cerro del Gallo Resource with Reserve Pit Shell

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7729/277693_7638a1be94ca1834_002full.jpg

Forecast Operating Cost Estimates

Operating costs at the Cerro del Gallo Project will benefit from the simplicity of a truck and shovel open pit mine, very low strip ratio, and access to low-cost grid power and regional infrastructure. The crush-agglomerate-heap-leach-ADR-SART flowsheet utilizes industry standard equipment and processes. It supports efficient processing of the Cerro del Gallo ore with moderate reagent use and no requirement for milling or conventional tailings storage.

Estimations of total cash costs average US$1,252/GEO, with AISC of US$1,390/GEO over the 15.3-year mine life. Revenue credits from copper and silver recovered through the SART circuit further strengthen operating margins and contribute to a robust, long-life cost profile.

Total Operating Cost Summary

| Operating Costs | Operating Cost (US$/GEO) | Operating Cost (US$/t ore) |

| Total mining | $274.02 | $3.79 |

| Total processing | $658.44 | $9.12 |

| Total site general and administrative | $65.61 | $0.91 |

| Smelter, Refinery and Transport | $68.55 | $0.95 |

| Cash operating costs | $1,066.62 | $14.77 |

| Production taxes | $80.29 | $1.11 |

| Royalties | $105.12 | $1.46 |

| Total cash costs | $1,252.03 | $17.33 |

| Sustaining capital costs | $138.2 | $1.91 |

| Total AISC | $1,390.23 | $19.25 |

Forecast Capital Cost Estimates

The initial capital cost for the project is estimated to be $195.3M including $15.6M for initial working capital (60 days) and $22.3M in total contingency. The total initial required capital expenditure will benefit from proximity to infrastructure and the assumption of a contractor-supplied fleet. Sustaining capital costs are primarily related to completion of a powerline to the site and three leach pad expansions. The cost estimate is based on more advanced work that will progress into a feasibility study, however, it includes a contingency of 17.5% of the total cost.

The Company's LOM plan allocates US$132.0M for reclamation work at the end of the mine life.

Forecast Capital Cost Summary

| Capital Costs | Initial (US$M) | Sustaining (US$M) | Total LOM (US$M) |

| Mining Costs | $1.4 | - | $1.4 |

| Mobile Equipment | $3.9 | - | $3.9 |

| Site & Utilities General | $10.2 | - | $10.2 |

| Power Generation & Site Distribution | $11.0 | - | $11.0 |

| Crushing Circuit | $28.8 | - | $28.8 |

| Agglomeration | $4.9 | - | $4.9 |

| Stacking System | $6.8 | - | $6.8 |

| Heap Leach Solution | $21.1 | - | $21.1 |

| SART Plant | $20.3 | - | $20.3 |

| Recovery Plant | $13.3 | $35.1 | $48.4 |

| Reagents | $2.5 | - | $2.5 |

| Laboratory | $2.9 | - | $2.9 |

| Total direct costs | $127.2 | $35.1 | $162.3 |

| Spare Parts | $5.7 | - | $5.7 |

| Initial Fills | $0.9 | $0.9 | |

| Contingency | $22.1 | $8.8 | $30.9 |

| Indirect Costs | $6.5 | - | $6.5 |

| Other Owner's Costs | $3.6 | - | $3.6 |

| EPCM | $13.8 | - | $13.8 |

| Working Capital (60 days) | $15.6 | -$15.6 | - |

| Closure and reclamation | - | $132.0 | $132.0 |

| Total indirect costs | $68.2 | $125.2 | $193.4 |

| Total Costs (excluding IVA) | $195.3 | $160.3 | $355.6 |

Economic Analysis

The economic analysis shows a base case after-tax net present value at a discount rate of 5% of US$423.9M, an after-tax internal rate of return of 33.1%, and a payback period of 2.3 years at US$2,300/oz gold. The projected mine life is 15.3 years in the PFS. Approximately 1,310k GEOs (888 koz gold, 22.2 Moz silver and 59 kT copper) are projected to be produced and sold over the life of the mine.

Summary Economic Results

| Project Valuation Overview | Units | After Tax | Before Tax |

| Total cash flow | US$ M | $724.1 | $1,166.9 |

| Average annual cash flow | US$ M | $47.6 | $76.3 |

| Average annual cash flow - Years 1-5 | US$ M | $77.6 | $104.7 |

| NPV @ 5.0% (base case) | US$ M | $423.9 | $699.4 |

| Internal rate of return | % | 33.1% | 44.9% |

| Payback period | Years | 2.3 | 1.8 |

| Payback multiple | x | 4.4 | 6.5 |

Metal Prices

The gold market has experienced significant upward price movement in the past few years. The gold price at the effective date of the technical report is about 83% above the base case gold price used in the study.

The sensitivity analysis presents gold price scenarios up to US$4,100/gold ounce (near spot prices) to understand the potential impact of continued gold price movements. From the base case price of $2,300/oz, a change in the average gold price of 10% (US$230/gold ounce) would change the after-tax NPV5% by approximately US$76.2M.

The economics of the Prefeasibility Study are most sensitive to changes in gold price and grade and less sensitive to operating costs and initial capital costs.

Gold Price Sensitivity Analysis

| Gold Price (US$/oz Gold) | Net Cash Flow (US$M) | After-Tax NPV @ 5.0% Discount Rate (US$ M) | IRR (%) | Payback Period (years) | Payback Multiple |

| 900 | -$43.38 | -$60.62 | - | 9.5 | 0.8 |

| 1,100 | $66.08 | $9.89 | 6.1% | 5.6 | 1.3 |

| 1,300 | $176.64 | $79.94 | 12.4% | 3.9 | 1.8 |

| 1,500 | $286.0 | $148.8 | 17.3% | 3.1 | 2.3 |

| 1,700 | $395.4 | $217.6 | 21.6% | 3.5 | 2.8 |

| 1,900 | $505.3 | $286.8 | 25.7% | 2.9 | 3.4 |

| 2,100 | $614.7 | $355.4 | 29.5% | 2.6 | 3.9 |

| 2,300 | $724.1 | $423.9 | 33.1% | 2.3 | 4.4 |

| 2,500 | $833.5 | $492.5 | 36.7% | 2.0 | 4.9 |

| 2,700 | $942.8 | $561.0 | 40.1% | 1.9 | 5.4 |

| 2,900 | $1,052.2 | $629.6 | 43.5% | 1.8 | 5.9 |

| 3,100 | $1,161.6 | $698.2 | 46.8% | 1.7 | 6.4 |

| 3,300 | $1,270.9 | $766.7 | 50.0% | 1.6 | 6.9 |

| 3,500 | $1,380.3 | $835.3 | 53.2% | 1.5 | 7.4 |

| 3,700 | $1,489.66 | $903.85 | 56.3% | 1.4 | 7.9 |

| 3,900 | $1,599.03 | $972.41 | 59.3% | 1.4 | 8.5 |

| 4,100 | $1,708.40 | $1,040.97 | 62.3% | 1.3 | 9.0 |

Figure 3 - Planned Cerro del Gallo Site Layout

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7729/277693_7638a1be94ca1834_003full.jpg

Figure 4 - Cerro del Gallo Process Flow Sheet

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7729/277693_7638a1be94ca1834_004full.jpg

Figure 5 - Cerro del Gallo Planned Production Schedule

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7729/277693_7638a1be94ca1834_005full.jpg

Next steps

The next steps by Heliostar at Cerro del Gallo will focus on conversion of resources to reserves and additional resource growth.

This plan includes additional resource and reserve drilling, updating geological interpretations, metallurgical testing and trade off studies. Positive changes to the gold price have resulted in an increase to the potential size of the reserve. Additional metallurgical analysis and data points are required on the deposit to support this increase.

The Company intends to drill with a focus on increasing both mineral resources and reserves and to improve the geological interpretation for the deposit. Mineralization remains open to the north and at depth. The north is considered a high potential target for reserve growth but historically was not drilled due to surface access limitations. The drill density decreases at depth as noted in Figure 2 with in-fill drilling having potential to improve resource classifications. Further, mineralization is open at depth with potential to expand resources.

Subject to confirming the extent of the mineral resource at Cerro del Gallo, the Company intends to refine the planned process flowsheet, start preparing permitting and social plans and commence work to prepare a feasibility study. Development of Cerro del Gallo is planned after Ana Paula has been commissioned and is in production.

Mineral Resource Estimates

Mineral Resources for the Cerro del Gallo deposit were updated as part of the 2025 Prefeasibility Study and are summarized in the accompanying table. The Mineral Resources have an effective date of July 31, 2025, and are reported on an in-situ basis in accordance with the 2014 Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves.

Mineral Resources Statement

| Classification | Material Type | NSR Cutoff | Tonnes (kt) | Grade | Contained Metal | ||||||

| Au g/t | Ag g/t | Cu % | AuEq g/t | Gold (koz) | Silver (koz) | Copper (t) | AuEq (koz) | ||||

| Indicated | Oxide | $11.81 | 10,733 | 0.41 | 17.92 | 0.09 | 0.60 | 141 | 6,184 | 9,659 | 207 |

| Mix Oxide | $10.66 | 13,613 | 0.28 | 11.12 | 0.08 | 0.50 | 123 | 4,867 | 10,890 | 219 | |

| Mix Sulfide | $11.81 | 70,066 | 0.40 | 13.70 | 0.09 | 0.68 | 901 | 30,862 | 63,060 | 1,532 | |

| Sulfide | $11.23 | 145,572 | 0.38 | 13.77 | 0.11 | 0.62 | 1778 | 64,447 | 160,129 | 2,902 | |

| Total | 239,984 | 0.38 | 13.78 | 0.10 | 0.63 | 2,944 | 106,359 | 243,739 | 4,859 | ||

| Inferred | Oxide | $11.81 | 2,042 | 0.19 | 21.08 | 0.09 | 0.40 | 12 | 1,384 | 1,838 | 26 |

| Mix Oxide | $10.66 | 1,604 | 0.14 | 16.12 | 0.07 | 0.40 | 7 | 831 | 1,123 | 21 | |

| Mix Sulfide | $11.81 | 10,501 | 0.28 | 13.75 | 0.11 | 0.57 | 95 | 4,642 | 11,552 | 192 | |

| Sulfide | $11.23 | 10,300 | 0.33 | 11.74 | 0.07 | 0.51 | 109 | 3,888 | 7,210 | 169 | |

| Total | 24,448 | 0.28 | 13.67 | 0.09 | 0.52 | 224 | 10,746 | 21,722 | 408 | ||

Notes to accompany Mineral Resources table:

Mineral Reserve Estimates

Mineral Reserves for the Cerro del Gallo deposit as part of the 2025 Prefeasibility Study have an effective date of July 31, 2025, are reported at the point of delivery to the leach facility, and are stated in accordance with the 2014 CIM Definition Standards for Mineral Resources and Mineral Reserves.

The Mineral Reserves estimate is based on a 6 Mtpa open-pit mining operation, with ore processed through the established crushing, agglomeration, heap-leach, ADR, and SART circuits. The resulting Mineral Reserves statement is provided in the following table.

Mineral Reserves Statement

| Classification | Material Type | Tonnes (kt) | Grade | Contained Metal | ||||||

| Au g/t | Ag g/t | Cu % | AuEq g/t | Gold (koz) | Silver (koz) | Copper (t) | AuEq (koz) | |||

| Probable | Oxide | 9,198 | 0.46 | 18.46 | 0.08 | 0.65 | 137 | 5,459 | 7,714 | 193 |

| Mix Oxide | 4,411 | 0.42 | 10.74 | 0.09 | 0.64 | 59 | 1,524 | 4,115 | 91 | |

| Mix Sulfide | 38,761 | 0.50 | 15.26 | 0.10 | 0.80 | 629 | 19,020 | 37,354 | 995 | |

| Sulfide | 39,524 | 0.53 | 15.00 | 0.12 | 0.78 | 670 | 19,064 | 45,557 | 997 | |

| Total | 91,893 | 0.51 | 15.25 | 0.10 | 0.77 | 1,495 | 45,066 | 94,740 | 2,275 | |

Notes to accompany Mineral Reserves table:

Qualified Persons

The technical report for the Cerro del Gallo Project will be prepared for Heliostar Metals Ltd. by Mr. Ted Eggleston, Ph.D., RM SME, PGEO, Mr. Tim Kuhl, MSc, RPG, RM-SME, Mr. Jeffrey Choquette, P.E., Mr. Marvin Silva, PhD, PE, PEng., Mr. Todd Minard P.E., Mr. Travis Manning, P.E., QP, Mr. Carl Defilippi, RM SME, and Ms. Dawn Garcia, CPG. Each of these Qualified Persons has reviewed and approved the technical information contained in this news release in their area of expertise and are independent of the Company.

Qualified Persons with Respect to this News Release

Gregg Bush, P.Eng. and Mike Gingles, the Company's Qualified Persons, as such term is defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects, have reviewed the scientific and technical information not derived from the updated technical reports and included in this news release in the Company Overview, Commentary by the Company on Relevant Matters and Commentary by the Company on Next Steps and Permitting sections for each property and have approved the disclosure herein.

Data Verification

The Qualified Persons for the technical reports verified the data in the report for their areas of expertise and concluded that the information supported Mineral Resource estimation, and could be used in mine planning and economic analysis. The verification completed by each Qualified Person is discussed in each technical report and included site visits, and could include data audits, evaluation of the suitability of data for use in estimation and mine planning, quality assurance and quality control checks, review of available technical and economic study data, review of data collection and evaluation methods, review of production data including reconciliation where available, review of actual cost data for operations, and review of third-party inputs to forecasts.

The Company's Qualified persons verified the information that was not derived from the technical reports. The data verification included site visits, data audits, review of available study data, review of data collection and evaluation methods, review of production data including reconciliation where available, review of actual cost data for operations, and review of third-party inputs to forecasts, and consideration of the Company's plans for the projects.

About Heliostar Metals Ltd.

Heliostar is a gold mining company with production from operating mines in Mexico. This includes the La Colorada Mine in Sonora and the San Agustin Mine in Durango. The Company also has a strong portfolio of development and exploration stage projects in Mexico and the USA. These include the Ana Paula project in Guerrero, the Cerro del Gallo project in Guanajuato, the San Antonio project in Baja Sur, all in Mexico and the Unga project in Alaska, USA.

FOR ADDITIONAL INFORMATION PLEASE CONTACT:

| Charles Funk President and Chief Executive Officer Heliostar Metals Limited Email: charles.funk@heliostarmetals.com Phone: +1 844-753-0045 | Rob Grey Investor Relations Manager Heliostar Metals Limited Email: rob.grey@heliostarmetals.com Phone: +1 844-753-0045 |

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

This news release contains "forward-looking statements" and "forward-looking information" (together, "forward-looking statements") within the meaning of applicable Canadian securities laws and the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, are forward-looking statements and are based on the opinions and estimates of management as of the date hereof. Forward-looking statements in this release include, but are not limited to: the economic potential or projections of the PFS, including, but not limited to, estimates of capital and operating costs, mine life, throughput, grades, recoveries, production rates, payback period, NPV and IRR; statements regarding expected timing, scope and cost of planned exploration, drilling, metallurgical and engineering programs, or any future work or social programs generally; the anticipated timing of completion of a Feasibility Study; expectations concerning permitting, submission and approval of amendment applications; the timing and potential development of an underground decline or early-works program; the potential for additional mineralization at depth and future exploration success or improvements in resource classification; the availability of the PFS within the prescribed deadline, the Company's plans regarding financing arrangements, including the potential for a project finance facility; the expectation that cash flow from existing operations may fund future development; projections of future metal prices; the potential for Cerro Del Gallo to be placed into production and the timing thereof; and other statements regarding the Company's future plans, strategies, objectives, expectations and intentions.

Forward-looking statements are based on a number of assumptions considered reasonable by management at the time of making such statements, including, without limitation: the accuracy of the PEA assumptions and parameters; that required permits and approvals will be obtained on reasonable terms and within expected timeframes; the availability of financing for exploration and development activities on acceptable terms; that projected metallurgical recoveries and operating costs will be achieved; that community and governmental support for operations will continue; the reliability of certain assumptions and known risks; and general stability in economic and market conditions, exchange rates and commodity prices.

Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those expressed or implied. Such risks include, without limitation: the preliminary nature of the PFS; risks related to exploration, development, permitting and operating activities; cost escalation and inflation; geopolitical or economic uncertainty or force majeure events; changes in metal prices and exchange rates; financing and liquidity risks; community and environmental risks; reliance on contractors and third parties; title, tax and legal risks; and those risks set out in the Company's continuous disclosure filings available on SEDAR+ (www.sedarplus.ca).

There can be no assurance that the Cerro del Gallo Project will be developed into a producing mine or that the results of the PFS will be realized. The purpose of the forward-looking statements is to provide information about management's current expectations and plans and may not be appropriate for other purposes. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this release. Except as required by applicable securities laws, the Company does not undertake to update any forward-looking statements, whether as a result of new information, future events or otherwise.

No Production Decision: The Company cautions that it has not made a production decision with respect to the Cerro del Gallo Project. Any such decision would only be made following completion of a Feasibility Study, the arrangement of project financing, and receipt of all necessary permits and approvals.

Cautionary Note to U.S. Investors

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability, and U.S. investors are cautioned that terms such as "Measured," "Indicated" and "Inferred Mineral Resource" are recognized and required by Canadian regulations but may not be comparable to similar terms used in U.S. reporting standards.

Non-IFRS Financial Measures

This news release includes certain non-International Financial Reporting Standards ("IFRS") performance measures, including cash costs ("Cash Costs") and all-in sustaining costs ("AISC"). These measures are not standardized financial measures under IFRS and may not be comparable to similar measures used by other issuers. They are provided as additional information to investors and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS. Cash Costs and AISC are common financial performance measures in the gold mining industry but do not have any standardized meaning under IFRS. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use these metrics to evaluate the economic performance of mining projects and their potential to generate operating earnings and cash flow.

AISC is calculated in accordance with the guidelines published by the World Gold Council ("WGC") in 2013, as updated in 2018, which define AISC as the sum of total cash costs, sustaining capital expenditures, and corporate general and administrative costs, among other items. Other companies may calculate this measure differently due to variations in underlying principles and policies applied. Note that in respect of AISC metrics disclosed herein, corporate general and administrative expenses have not been included, as such economics are presented at the project level.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/277693