Investing in Graphene Companies

Top 9 Global Lithium Stocks (Updated January 2026)

Top 5 Canadian Nickel Stocks

Lithium Market 2025 Year-End Review

Top 10 Copper-producing Companies

What Was the Highest Price for Copper?

Overview

Grid Battery Metals (TSXV:CELL,OTCQB:EVKRF) is a Canada-based exploration company focused on high-value battery metals required for the electric vehicle (EV) market. The company, formerly called Nickel Rock Resources, changed its name to Grid Battery Metals in April 2023 and started trading on the TSXV under the ticker CELL.

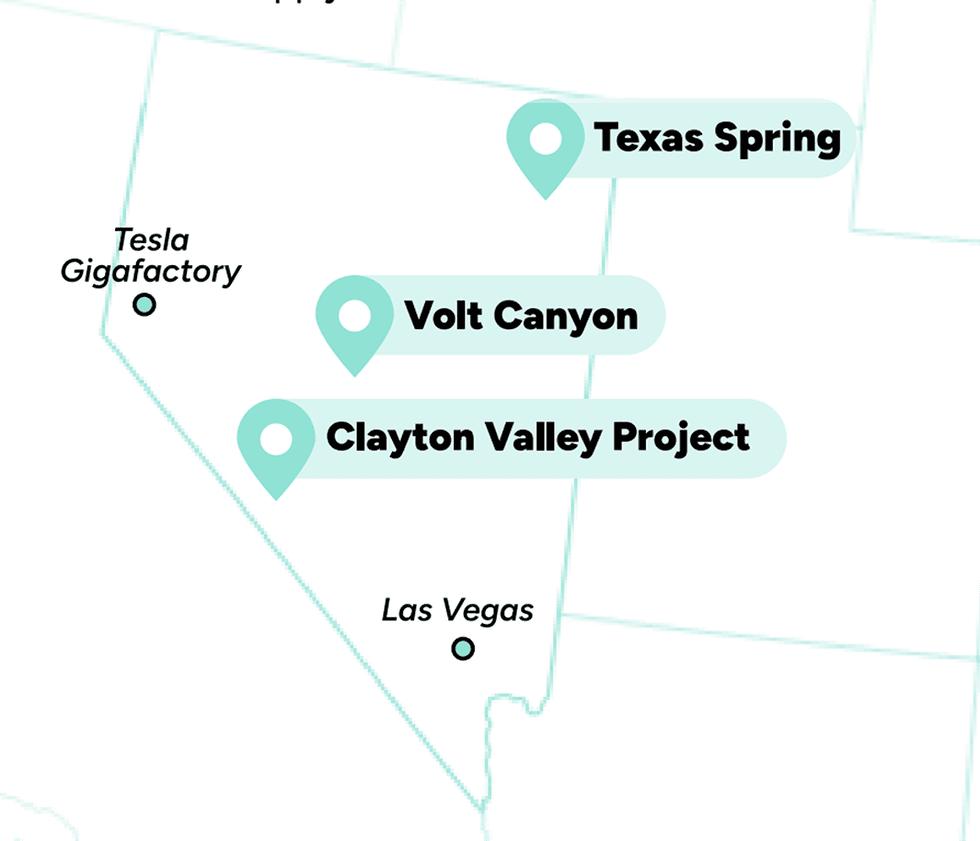

Grid is focused on EV battery metals exploration through its highly prospective lithium and nickel properties in North America. Grid has three lithium properties in Nevada: Texas Springs, Clayton Valley, and Volt Canyon. The Texas Springs property in Elko County covers approximately 2,500 hectares and is adjoining the southern boundary of the Nevada North Lithium Project owned by Surge Battery Metals (TSXV:NILI). Surge recently announced high-grade lithium of up to 8,070 parts per million (ppm) lithium on the Nevada North lithium project, which increases the likelihood of a large-scale high-grade lithium discovery at Texas Spring. Initial soil sampling at Texas Spring by Grid have shown high-grade lithium over 5,600 ppm as announced on February 7, 2024.

The company has completed the first phase of its initial exploration program at Texas Springs, which included a CSAMT geophysical survey and a detailed soil sampling on a 50-meter by 100-meter spacing. Results from these two exploration programs will be key to determining its 2024 exploration plan and possible drilling locations for clay-based lithium targets.

The 2,300-acre Clayton Valley property is immediately north of Albemarle’s (NYSE:ALB) Silver Peak lithium project, the only producing lithium mine in North America. The property has strong potential to host both lithium brine deposits as well as clay-hosted deposits.

Grid has filed the NI 43-101 technical report for the Clayton Valley lithium project, using the results of prior soil samples, geophysical surveys, and drilling on the property, to help identify structure and target areas favorable to lithium accumulation and determine next steps for its overall exploration plan. The company also commenced its 2024 exploration program for the property with Rangefront Geological to perform a detailed soil sampling on a 250 metre x 250 metre spacing, and to oversee an MT geophysical survey performed by KLM Geoscience.

The Volt Canyon lithium property features sediment-hosted lithium clay targets and has excellent accessibility, enabling exploration and exploitation throughout the year. Although limited exploration has been conducted in the immediate area, regional sediment samples in the region taken by the US government returned up to 108 parts per million (ppm) lithium near the property.

Shareholders should benefit from the company’s strategy of divesting its nickel assets into a separate public company. Grid has completed the spin off its British Columbia nickel property into a new company, ACDC Battery Metals, which has commenced trading on the TSX Venture Exchange under the symbol ACDC.

Grid’s management and geological team has been actively exploring for EV battery metals in Nevada for over a decade. They have been successful in finding and funding new lithium discoveries and had a number of successful exits from companies, the most recent being Surge Battery Metals, where they were responsible for the discovery of the Nevada North Lithium Project. The management’s successful track record of lithium exploration in Nevada provides confidence about the company’s future.

The support from both the US and Canadian governments through subsidies and favorable legislation continues to drive EV adoption. In particular, both countries have committed to supporting the mining industry for key battery metals with legislation like the US Inflation Reduction Act, which provides both financial and functional support to the mining industry. Buoyed by government policy, US electric vehicle sales are projected to surpass 4.6 million units by 2030 (versus the 2023 estimate of 1.3 million).

Automakers cannot produce electric vehicles without access to battery metals such as lithium and nickel. Fear of missing out is pushing automakers to lock supplies of minerals for electric vehicle batteries. As such, we are seeing increasing partnerships between miners and auto OEMs. Automakers, including General Motors, Ford, BMW, Tesla and Stellantis, have committed large investments in direct financing of mines. We see more carmakers following suit as they strive to own the full supply chain from mine to product.

In mid-2024, Grid Battery Metals expanded its exploration land holdings in Northern British Columbia with a copper property of 17 mineral claims comprising 27,525.24 hectares. The region hosts numerous operating mines, and good infrastructure including experienced exploration and supporting services.

Get access to more exclusive Nickel Investing Stock profiles here