Great Pacific Gold Corp. (TSXV: GPAC,OTC:GPGCF) (OTCQX: GPGCF) (FSE: V3H) ("Great Pacific Gold," "GPAC," or the "Company") announces results and updates from its flagship Wild Dog Project ("Wild Dog" or the "Project"), located on the island of New Britain, East New Britain Province, Papua New Guinea ("PNG").

Diamond drilling began at the Project in May 2025 with a single drill rig and focused on the Sinivit target, a portion of the 15 km Wild Dog epithermal structural corridor. In 2025, 16 holes were drilled over 3,000 meters with two high-grade shoots defined: the Southern Oxide Shoot and the Northern Sulphide Shoot. Results from holes one through fourteen were previously released (see Table 1) with excellent results, particularly in the Northern Sulphide Shoot, including WDG-08: 8.4 meters @ 50.1 g/t AuEq and WDG-14: 9.5 m @ 13.75 g/t AuEq.

Drilling at the Project continued through the Christmas and New Year period, targeting expansion of the mineralised zones at the Northern Sulphide Shoot which is open at depth and to the North.

Key Highlights:

-

WDG-15 (Sinivit Northern Sulphide Shoot) intercepted:

13.48 m @ 8.08 g/t AuEq from 210.22 m (7.41 g/t Au, 0.31% Cu, 16.37 g/t Ag);

including: 3.78 m @ 10.89 g/t AuEq from 210.22 m (10.04 g/t Au, 0.39% Cu, 20.64 g/t Ag),

Including: 4.50 m @ 14.62 g/t AuEq from 219.20 m (13.45 g/t Au, 0.55% Cu, 26.50 g/t Ag).

Second diamond drill rig scheduled to arrive on February 4th and be mobilized to site for drilling starting in early February. The Wild Dog camp expansion and supporting site infrastructure is complete and ready to support a significant increase in drilling activity in 2026.

The first drill rig will continue operating at Sinivit, advancing drilling at the Northern Sulphide and Southern Oxide shoots while also testing two additional high-priority targets. The second rig will be deployed to systematically test priority targets along the 15-kilometre Wild Dog Structural Corridor, including Kasie Ridge, Kavasuki and Mengmut. This two-rig approach allows the Company to advance work at Sinivit while evaluating multiple discovery targets across the corridor.

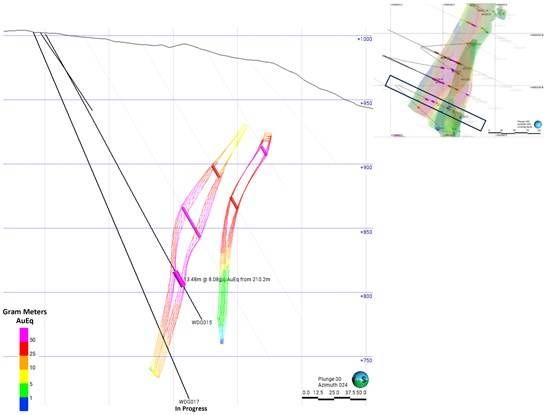

"The Northern Sulphide Shoot continues to deliver strong, high-grade results as drilling progresses down the structure. Hole 15 intersected the main Wild Dog Structure approximately 50 metres below the deepest previously drilled intercept and returned higher grades than the hole above, reinforcing the strength and continuity of the system at depth. Hole 17 is now nearing completion and represents a further 50 to 60 metre step-out below Hole 15 (see Figure 1).

While Rig 1 remains focused on expanding and defining the high-grade shoots at Sinivit, we are very excited to commence first-pass reconnaissance drilling at Kasie Ridge with Rig 2 in early February. Kasie Ridge is located at the northern end of the Wild Dog Structural Corridor with excellent access. Recent integration of inverted MobileMT geophysics with high-resolution LiDAR has elevated it to our highest-priority target. The combined datasets indicate a large-scale high-sulphidation epithermal target beneath an advanced argillic lithocap extending approximately 1.5 to 2.0 kilometres in strike length and several hundred metres in width," stated Callum Spink, VP Exploration.

Figure 1: Northern Sulphide Shoot cross-section looking north, illustrating the position of WDG-15 (current results) relative to the nearest historical drill hole, and WDG-17, which is currently in progress. Intervals shown represent downhole lengths.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11018/281541_03a3fdb7f4e48b70_002full.jpg

Wild Dog 2026 Drill Program

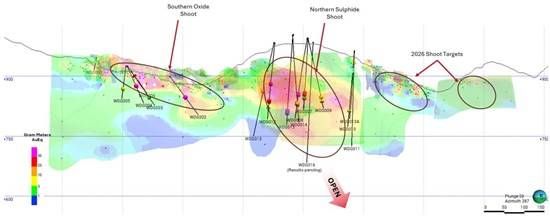

The Company plans to continue drilling at the Sinivit target with its first diamond drill rig, focusing on expansion and definition of the Southern Oxide and Northern Sulphide shoots while also testing two additional high-priority targets along strike to the north toward Kavasuki (Figure 2).

Figure 2: Long section through the Sinivit target looking west, showing the currently defined high-grade shoots and two additional targets planned for testing in H1 2026.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11018/281541_03a3fdb7f4e48b70_003full.jpg

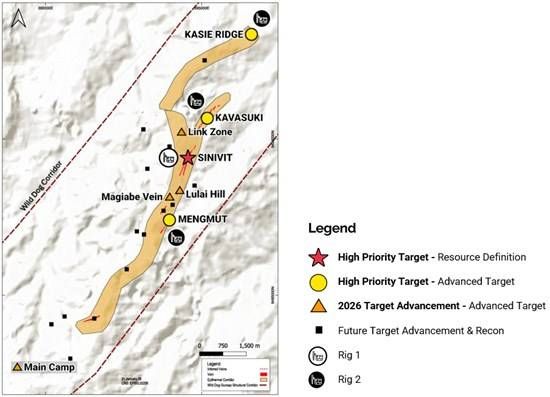

In preparation for the commencement of the second rig, drilling in February, the Company has established a clearly defined and ranked pipeline of exploration targets along the 15-kilometre Wild Dog Structural Corridor. The targets presented here represent the highest-priority opportunities identified to date and will be tested systematically in order of priority, while additional earlier-stage targets continue to be advanced through the pipeline in parallel. Over the coming months, the Company plans to outline a focused and exciting exploration program at Wild Dog, reflecting the broader depth of opportunities across the Project and supporting sustained, disciplined exploration activity beyond the current drilling phase (Figure 3).

Initially Rig #2 will test Kasie Ridge, followed by Kavasuki and Mengmut.

Kasie Ridge

Kasie Ridge is a large, potential high-sulphidation epithermal target defined by a 400-500m wide advanced argillic alteration cap with no previous drilling. Kasie Ridge has the potential to be a new epithermal/porphyry system, materially expanding district scale beyond Sinivit.

Scale and alteration intensity are consistent with major epithermal or porphyry-related systems.

Advanced argillic lithocaps have the potential to overlie or flank high-grade mineralization at depth.

Illustrates district-scale discovery potential beyond the Sinivit epithermal footprint.

Key Geological Evidence

Advanced argillic assemblage (kaolinite ± dickite ± pyrophyllite, with zunyite) confirms high-temperature, acidic hydrothermal conditions.

Coincident MobileMT resistivity, magnetics, and LiDAR define a focused altered body.

Intersecting NW-NNW structures may represent strong fluid pathways consistent with an up-flow zone.

Geometry and alteration zoning reflect similar lithocap/high-sulphidation epithermal characteristics seen in tier-one systems.

Figure 3: Wild Dog Structural Corridor pipeline of epithermal targets developed from historical and recent work on the Project.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11018/281541_03a3fdb7f4e48b70_004full.jpg

Kavasuki

Kavasuki is a known epithermal vein system located approximately 1 km north of Sinivit (along the same structure). Historic drilling has defined high-grade gold mineralization over a 900-meter strike length. Kavasuki represents a rapid pathway to resource growth by confirming continuity in a proven high-grade epithermal system.

Previously demonstrated high grades and widths.

Mineralization identified, but poorly tested.

Clear opportunity to unlock value through additional drilling.

Key Geological Evidence

-

Historic shallow drilling (46 holes, ~2,900 m) intersected multiple strong intercepts including:

15.6 m @ 2.5 g/t Au

17.2 m @ 5.8 g/t Au

Extensive trenching (3.5 km) returned 28 m @ 4.5 g/t Au (inc. 14m @ 7.11g/t Au)

Structural reinterpretation indicates vein may dip east (not recognized by previous work).

Mineralization remains open at depth and along strike.

Mengmut

Mengmut is an epithermal vein system located 1.5-2.0 km south of Sinivit with a potential strike length of over 500 meters. The target is defined by high-grade surface geochemistry. Mengmut has the potential to deliver a new Sinivit-style discovery with minimal drilling and strong leverage to success.

Sinivit-style geology and setting, but largely untested at depth.

New structural interpretation suggests historic drilling poorly executed/oriented.

Possible along-strike extension of Sinivit epithermal system.

Key Geological Evidence

High-grade surface sampling up to 19.1 g/t Au and 1.25% Cu

Trenching returned 4 m @ 2.5 g/t Au and 30 m @ 0.6 g/t Au, demonstrating continuity beyond spot samples.

Re-interpretation of mapping, structure, and vein textures supports an east-dipping vein geometry.

On behalf of Great Pacific Gold:

Greg McCunn

Chief Executive Officer and Director

For further information, visit gpacgold.com or contact:

Investor Relations

Phone +1-778-262-2331

Email: info@gpacgold.com

Complete Wild Dog GPAC Drilling Results

Since commencing in May 2025, GPAC has completed 16 drill holes at Sinivit with hole 17 in progress. Details of the drilling are shown in Table 1, with key assay results received to date shown in Table 2.

Table 1: Wild Dog Drill Hole Details (PNG94 UTM Zone 56 coordinates).

| Hole ID | Easting | Northing | RL | Dip | Azi | Max Depth (m) | Status |

| WDG-01 | 394358.3 | 9488853.5 | 945 | -50 | 115 | 40.1 | Abandoned |

| WDG-02 | 394426.0 | 9489024.2 | 900 | -53 | 050 | 124.6 | Completed |

| WDG-03 | 394384.9 | 9488926.5 | 924 | -50 | 053 | 127.6 | Completed |

| WDG-04 | 394384.8 | 9488926.5 | 924 | -50 | 75 | 120.6 | Completed |

| WDG-05 | 394384.8 | 9488926.5 | 924 | -50 | 116 | 105.9 | Completed |

| WDG-06 | 394428.6 | 9488923.1 | 911 | -50 | 352 | 69.0 | Completed |

| WDG-07 | 394457.5 | 9489375.0 | 993 | -61 | 114 | 201.3 | Completed |

| WDG-08 | 394455.5 | 9489373.0 | 993 | -57 | 127 | 224 | Completed |

| WDG-09 | 394459.5 | 9489374.0 | 993 | -58 | 85 | 203 | Completed |

| WDG-10 | 394475.1 | 9489484.0 | 965 | -58 | 111 | 220.1 | Completed |

| WDG-10A | 394476.1 | 9489484.0 | 965 | -57 | 114 | 200.4 | Completed |

| WDG-11 | 394474.1 | 9489484 | 965 | -68 | 114 | 253.4 | Completed |

| WDG-12 | 394413.7 | 9489301.5 | 982 | -52 | 113 | 235.2 | Completed |

| WDG-13 | 394408.5 | 9489301.2 | 983 | -63 | 102 | 261.3 | Completed |

| WDG-14 | 394389.2 | 9489995.9 | 1002 | -55 | 103 | 258.3 | Completed |

| WDG-15 | 394385.7 | 9489385.6 | 1003 | -60 | 115 | 253.3 | Completed |

| WDG-16 | 394395.1 | 9489407.2 | 984 | -70 | 116 | 339.2 | Completed |

| WDG-17 | 394383.76 | 9489357.5 | 1002 | -67 | 114 | tbd | In Progress |

Table 2: Wild Dog Drill Hole Key Assay Results

| Hole ID | From (m) | To (m) | Interval1 (m) | Gold (g/t) | Silver (g/t) | Copper (%) | Gold Eq.2 (g/t) |

| WDG-02 | 65.00 | 72.00 | 7.00 | 5.49 | 68.84 | 2.96 | 10.93 |

| including | 65.00 | 67.00 | 2.00 | 10.73 | 114.64 | 2.23 | 15.55 |

| WDG-03 | 102.00 | 104.30 | 2.30 | 1.68 | 6.48 | 0.12 | 1.94 |

| including | 103.55 | 104.30 | 0.75 | 4.05 | 10.90 | 0.17 | 4.45 |

| WDG-04 | 62.00 | 68.00 | 6.00 | 8.31 | 27.56 | 1.15 | 10.43 |

| including | 64.00 | 68.00 | 4.00 | 12.25 | 36.76 | 1.63 | 15.22 |

| including | 64.00 | 66.40 | 2.40 | 19.76 | 57.75 | 2.59 | 24.48 |

| WDG-05 | 72.00 | 77.00 | 5.00 | 1.32 | 11.71 | 0.25 | 1.85 |

| including | 72.00 | 75.00 | 3.00 | 1.97 | 15.36 | 0.31 | 2.64 |

| WDG-06 | 12.00 | 15.50 | 3.50 | 4.61 | 48.36 | 4.86 | 12.79 |

| including | 13.70 | 14.30 | 0.60 | 7.44 | 73.40 | 10.42 | 24.61 |

| WDG-07 | 153.00 | 163.00 | 10.00 | 2.99 | 10.92 | 0.32 | 3.61 |

| including | 153.00 | 158.10 | 5.10 | 4.77 | 14.54 | 0.54 | 5.79 |

| WDG-07 | 172.00 | 173.20 | 1.20 | 7.30 | 93.50 | 1.14 | 10.17 |

| including | 172.50 | 173.20 | 0.70 | 12.00 | 157.00 | 1.94 | 16.86 |

| WDG-08 | 154.00 | 162.40 | 8.40 | 46.46 | 59.63 | 1.90 | 50.12 |

| including | 154.00 | 157.80 | 3.80 | 93.31 | 128.72 | 4.08 | 101.19 |

| including | 157.00 | 157.80 | 0.80 | 322.00 | 84.50 | 12.89 | 343.17 |

| WDG-08 | 180.00 | 188.00 | 8.00 | 1.95 | 4.19 | 0.13 | 2.20 |

| including | 180.00 | 184.00 | 4.00 | 3.32 | 3.71 | 0.16 | 3.62 |

| WDG-09 | 169.00 | 174.00 | 5.00 | 4.49 | 7.98 | 0.22 | 4.93 |

| including | 169.00 | 171.00 | 2.00 | 10.31 | 15.35 | 0.42 | 11.14 |

| WDG-09 | 182.40 | 185.00 | 2.60 | 2.74 | 43.86 | 2.04 | 6.45 |

| including | 182.80 | 184.30 | 1.50 | 4.17 | 54.13 | 2.51 | 8.72 |

| WDG-10 | 173.60 | 175.60 | 2.00 | 1.73 | 28.12 | 0.63 | 3.04 |

| WDG-10 | 184.50 | 185.20 | 0.30 | 4.20 | 100.00 | 0.99 | 6.90 |

| WDG-12 | 123.20 | 129.10 | 5.90 | 13.96 | 12.15 | 0.19 | 14.40 |

| including | 126.60 | 129.10 | 2.50 | 31.29 | 24.68 | 0.29 | 32.04 |

| WDG-12 | 177.00 | 182.80 | 5.80 | 5.12 | 15.29 | 0.59 | 6.23 |

| including | 179.00 | 182.00 | 3.00 | 9.06 | 28.41 | 1.06 | 11.05 |

| WDG-13 | 134.50 | 139.60 | 5.10 | 3.38 | 6.08 | 0.25 | 3.85 |

| WDG-14 | 200.77 | 210.22 | 9.45 | 12.61 | 16.36 | 0.59 | 13.72 |

| including | 204.30 | 208.20 | 3.90 | 31.25 | 34.76 | 1.30 | 33.69 |

| WDG-15 | 210.22 | 223.70 | 13.48 | 7.41 | 16.37 | 0.31 | 8.08 |

| including | 210.22 | 214.00 | 3.78 | 10.04 | 20.64 | 0.39 | 10.89 |

| 219.20 | 223.70 | 4.50 | 13.45 | 26.50 | 0.55 | 14.62 | |

Notes:

| |||||||

Qualified Person

The technical content of this news release has been reviewed, verified and approved by Callum Spink, the Company's Vice President, Exploration, who is a member of the Australian Institute of Geoscientists, MAIG, and a Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Spink is responsible for the technical content of this news release. Mr. Spink is not independent of the Company.

Quality Assurance / Quality Control (QAQC)

The Company adheres to industry best practices for Quality Assurance and Quality Control. Drill core samples were sawed into equal halves and the selected one-half core was submitted to Intertek Minerals Ltd. in Lae, Papua New Guinea, an ISO 9001-certified laboratory. Samples were securely sealed in poly-weave bags with single-use tie-locks to maintain chain of custody. Analytical testing is completed using fire assay for gold, preliminary copper and silver assays are reported from results generated by aqua regia digestion and atomic absorption (AA) copper determination. The results are updated with assay results using MS48 (multi-element 4-acid digestion ICP/AA).

Diamond drill hole WDG-02 was drilled using a combination of HQ and PQ diameter core, while the holes WDG-03 to WDG-09 were drilled with PQ. Holes WDG-10 onwards were drilled with HQ diameter core. Certified reference materials (standards) and blanks were inserted into the sample stream in accordance with industry-standard protocols. Blanks were routinely inserted after high-grade intervals, and certified standards were included at a frequency of at least 5%. All assay batches received to date have passed QAQC review and fall within acceptable tolerance limits. Core recoveries for all holes were within acceptable ranges, with sampling procedures carefully managed in intervals where ground conditions were variable or fragile.

About Great Pacific Gold

Great Pacific Gold's vision is to become the leading gold-copper development company in Papua New Guinea ("PNG"). The Company has a portfolio of exploration-stage projects in PNG, as follows:

Wild Dog Project: the Company's flagship project is located in the East New Britain province of PNG. The project consists of a large-scale epithermal target, the Wild Dog structural corridor, stretching 15 km in strike length and potentially over 1,000 metres deep based on a recent MobileMT geophysics survey. The survey also highlighted the Magiabe porphyry target, adjacent to the epithermal target and potentially 1,000 metres in diameter and over 2,000 metres deep. Drilling of the epithermal structure on the Sinivit target has yielded high-grade results, including WDG-08 which intercepted 8.4 metres at 50 g/t AuEq from 154 metres. The current drilling program will extend into 2026 with second drill rig expecting to be operational in early February 2026.

Kesar Project: located in the Eastern Highlands province of PNG and contiguous with the mine tenements of K92 Mining Inc. ("K92"), the Kesar Project is a greenfield exploration project with several high-priority targets in close proximity to the property boundary with K92. Multiple epithermal veins at Kesar are on strike and have the same orientation as key K92 deposits, such as Kora. Exploration work to date by the Company at the Kesar Project has shown that these veins have high grades of gold present in outcrop and very elevated gold in soil grades, coincident with aeromagnetic highs. The Company conducted a diamond drill program on key target areas at the Kesar Project from November 2024 to May 2025 and have developed a follow-up Phase 2 program for 2026.

Arau Project: also located in the Eastern Highlands province of PNG, the Arau Project is south of and contiguous to the mine tenements of K92. Arau contains the highly prospective Mt. Victor exploration target with potential for a high sulphidation epithermal gold-base metal deposit. A Phase 1 Reverse Circulation drilling program was completed at Mt. Victor in August 2024, with encouraging results. The Arau Project includes the Elandora licence, which also contains various epithermal and copper-gold porphyry targets.

The Company also holds the Tinga Valley Project in PNG.

Forward-Looking Statements

Information set forth in this news release contains forward-looking statements that are based on assumptions as of the date of this news release. These statements reflect management's current estimates, beliefs, intentions and expectations. They are not guarantees of future performance. Great Pacific Gold cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by many material factors, most of which are beyond their respective control. Such factors include, among other things: risks and uncertainties relating to Great Pacific Gold's limited operating history, its exploration and development activities on its mineral properties and the need to comply with environmental and governmental regulations. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, Great Pacific Gold does not undertake to publicly update or revise forward-looking information.

Mineralization at the properties held by K92 Mining Inc. and at the Wafi-Golpu deposit is not necessarily indicative of mineralization at the Wild Dog Project.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/281541