- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

December 04, 2023

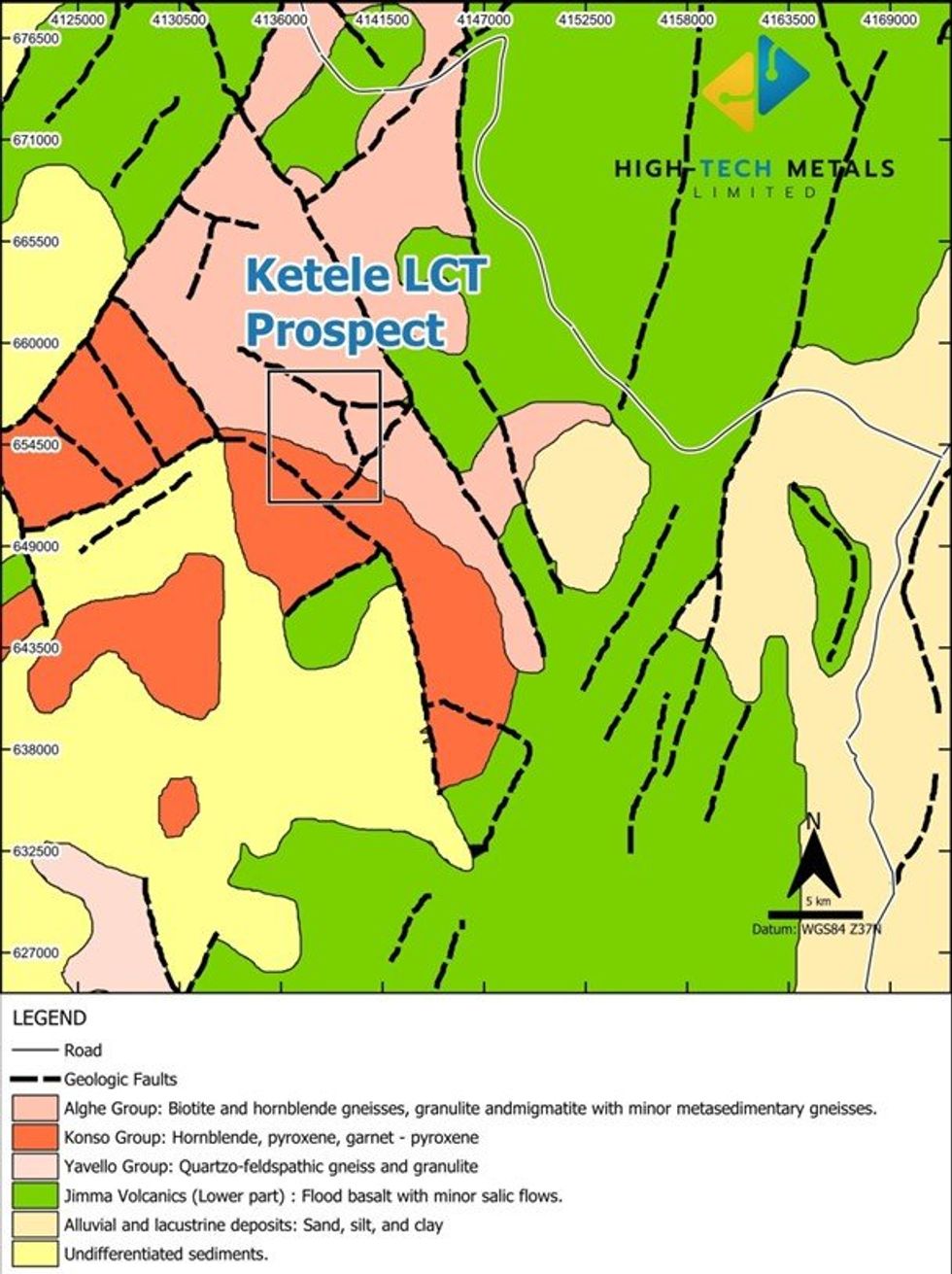

High-Tech Metals Limited (ASX: HTM) (High-Tech, HTM or the Company), a critical battery minerals exploration company, is pleased to announce that the Company has been granted the Ketele Exploration License (MOM-EL-05096-2023) in Ethiopia. This license will form the foundation of our exciting new Ketele LCT Project (“Ketele” or the “Project”).

HIGHLIGHTS

- HTM expands critical minerals portfolio through grant of the Ketele Exploration License which, located in mineral rich Ethiopia, is considered prospective for LCT (lithium-cesium- tantalum) mineralisation.

- Ethiopia is home to the Kenticha Lithium and Tantalum Mine.

- Ketele LCT Project covers 42km2 in prospective geology with no modern exploration.

- Work programme has commenced to evaluate the potential for lithium and associated elements with results expected in the coming weeks. This will assist in the investigation of potential spodumene-bearing pegmatites.

The award of Ketele provides the Company exclusive access to explore new, undrilled tenure, offering significant potential to further enhance the Project which is located 400 km southwest of the capital city of Addis Ababa and 150 km west of the Kenticha Li-Ta Mine.

The Ketele LCT Project is underlain by metamorphic rocks of the Southern Ethiopian Shield and large, regional faults known to focus the intrusion of pegmatites elsewhere. Historical reports suggest the presence of pegmatites in the area which will be the focus of the first phase of exploration work currently underway.

Sonu Cheema, Executive Director, commented:

"HTM continues to progress its critical battery minerals focus through the award of the Ketele LCT Project, in one of Africa’s mineral rich countries, Ethiopia. We are excited to be working with the federal government & local communities and look forward to assisting them in developing their critical minerals opportunities.

The Company has commenced a programme of works to realise the exploration potential of the newly granted license through geological mapping, geochemical surveys and rock chip sampling. We look forward to providing further exploration updates as these activities progress.”

Next Steps

The initial year of exploration at Ketele, which has already started, includes:

- Continued data compilation and desktop studies;

- Geological and geochemical surveys;

- Identification of potential mineralisation of Lithium, Cesium and Tantalum; and,

- Investigate and define the potential extent of pegmatite bodies hosting spodumene (Lithium).

HTM is committed to responsible exploration practices and takes measures to minimize the impact of its exploration activities on the environment and local communities.

Click here for the full ASX Release

This article includes content from High-Tech Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

HTM:AU

The Conversation (0)

08 November 2023

High-Tech Metals

Capitalizing on Exploration Upside Potential of a Historic Cobalt Project

Capitalizing on Exploration Upside Potential of a Historic Cobalt Project Keep Reading...

12 January 2025

Appointment of Chief Executive Officer

High-Tech Metals (HTM:AU) has announced Appointment of Chief Executive OfficerDownload the PDF here. Keep Reading...

20 January

Top 3 ASX Cobalt Stocks (Updated January 2026)

Cobalt is used in a wide variety of industrial applications, with lithium-ion batteries for electric vehicles (EVs) and energy storage systems as the largest demand segment. As an important battery metal, cobalt's fate is tied to demand for EVs. The EV market may be facing headwinds now, but the... Keep Reading...

19 January

Cobalt Market Forecast: Top Trends for Cobalt in 2026

Cobalt metal prices have trended steadily higher since September of last year, entering 2026 at US$56,414 per metric ton and touching highs unseen since July 2022. The cobalt market's dramatic reversal began in 2025, when it shifted from deep oversupply to structural tightness after a decisive... Keep Reading...

19 January

Top 5 Canadian Cobalt Stocks (Updated January 2026)

The cobalt market staged a dramatic turnaround in 2025, lifting sentiment across equity markets after years of oversupply and near-record price lows. Early in the year, the Democratic Republic of Congo’s (DRC) decision to suspend cobalt exports sparked a major price rebound, with benchmark metal... Keep Reading...

13 January

Cobalt Market 2025 Year-End Review

The cobalt market entered 2025 under pressure from a prolonged supply glut, but the balance shifted sharply as the year unfolded, due almost entirely to intervention from the Democratic Republic of Congo (DRC).After starting the year near nine year lows of US$24,343.40 per metric ton, cobalt... Keep Reading...

31 October 2025

Top 5 Canadian Cobalt Stocks (Updated October 2025)

Cobalt prices regained momentum in the third quarter of 2025 as tighter export controls from the Democratic Republic of Congo (DRC) fueled expectations of a market rebound. After languishing near multi-year lows early in the year, the metal surged to US$47,110 per metric ton in late October, its... Keep Reading...

27 October 2025

Top 3 ASX Cobalt Stocks (Updated October 2025)

Cobalt is used in a wide variety of industrial applications, with lithium-ion batteries for electric vehicles (EVs) and energy storage systems as the largest demand segment. As an important battery metal, cobalt's fate is tied to EVs. While EV demand may be facing headwinds now, the long-term... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00