Grande Portage Resources Ltd. (TSXV:GPG)(OTCQB:GPTRF)(FSE:GPB) ("Grande Portage" or the "Company") is pleased to announce that, further to its recently filed updated **NI #43-101 Mineral Resource Estimate, the Company has developed a Conceptual Mining Plan to determine the optimal development pathway for its Herbert Gold project located in SE Alaska

To that end, earlier this year, the Company engaged the services of OreLogic LLC, a consulting firm providing mine planning and project development services. OreLogic is led by Kyle Mehalek, formerly Chief Mining Engineer at Hecla Mining's Greens Creek Mine in southeast Alaska, one of the largest and lowest-cost primary silver mines in the world.

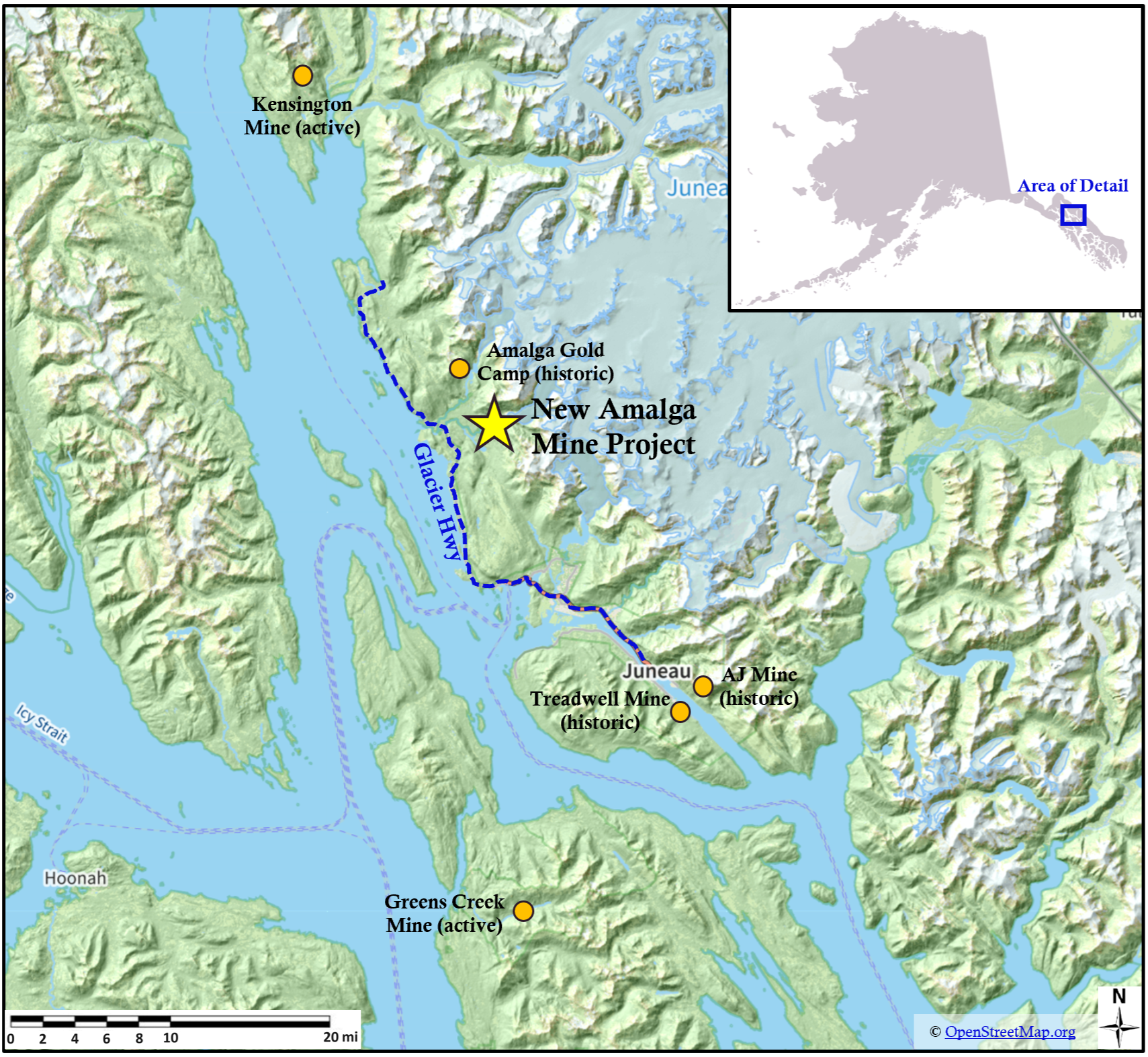

The Company's gold deposit, formerly known as the Herbert Gold project, has been re-named the "New Amalga Mine Project" in recognition of the gold mining heritage of the local project area. The historic Amalga Gold Camp located approximately four miles (6.5km) from the project site, produced tens of thousands of ounces of lode gold during the early 20th century. Today, little evidence remains from this once-bustling hub of mineral production, the site having been overtaken by the rapidly advancing temperate forest.

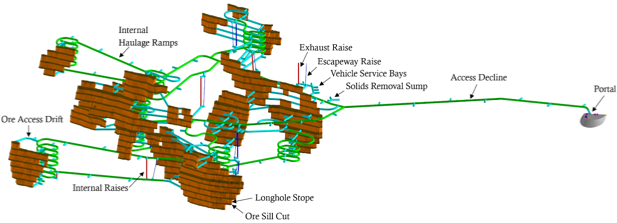

The Conceptual Mining Plan evaluates the development of a selective underground mining operation which would extract high-grade material with minimal dilution. Due to the project's location near tidewater and less than 4 miles (6.5km) from existing paved highway, the Company considers off-site processing to be the most favourable configuration and is investigating numerous business opportunities including strategic partnerships, potential use of third-party facilities around the Pacific Rim, and direct shipment to smelters in East Asia.

The Company's board of directors, management and its advisors assess that an offsite-processing configuration for the New Amalga Mine is the optimal development pathway, providing a number of potential benefits including:

Elimination of the requirement to develop a tailings disposal facility near the mine. No tailings would be generated at the site.

Elimination of the requirement for permanent waste rock storage facilities. All waste rock generated from mine access development would be returned to the underground workings for stope backfill.

No use of gold processing reagents at the site.

Dramatically reduced land usage and overall environmental footprint.

Greatly simplified post-mining closure and reclamation.

De-risking of the environmental review and permitting process.

Minimization of project construction CAPEX.

The scope of the Company's Conceptual Mine Plan includes underground mine design, underground development and production scheduling, surface facilities design and layout, ore transportation and logistics planning, ore marketing evaluation and internal financial modelling. Use of "real world" inputs and benchmarking against existing mining operations has been extensively applied.

Ian Klassen, President and CEO comments: "We are extremely pleased to deliver a few key milestone developments thus far in 2024. Our updated mineral resource estimate continues to confirm that the deposit has grown and is open to future expansion. Importantly, the deposit has continued to mature and expand whilst maintaining world-class high gold grades. The now completed Conceptual Plan was a comprehensive and time-consuming undertaking. The Company wishes to thank OreLogic and Kyle Mehalek, in particular, for his vision, common sense approach and underground mining development expertise. The Plan is an important step forward to better understand how to best maximize this gold asset whilst continuing to focus on what's in the best interests of the local community and the regulatory regimes in southeast Alaska. Our commitment is to exceed all regulatory requirements and environmental expectations while also contributing to the local economy and creating valuable, long term job opportunities for the hard-working residents of the Juneau area".

Grande Portage intends to continue to advance the New Amalga Mine project using a Direct Shipping Ore (DSO) platform and to that end it expects to announce further steps in due course.

** Indicated Resources of 1,438,500 ounces at 9.47gpt gold and Inferred Resources of 515,700 ounces at 8.85gpt gold (See Company news releases dated June 12, 2024 & July 22, 2024).

Fig. 1 Project Location near paved highway and tidewater

Fig. 2 View of Conceptual Underground Mine Layout for the New Amalga Mine

Kyle Mehalek, P.E.., is the QP within the meaning of NI 43-101 and has reviewed and approved the technical disclosure in this release. Mr. Mehalek is independent of Grande Portage within the meaning of NI 43-101.

About Grande Portage:

Grande Portage Resources Ltd. is a publicly traded mineral exploration company focused on the Herbert Gold discovery situated approximately 25 km north of Juneau, Alaska. The Company holds a 100% interest in the Herbert property. The Herbert Gold property system is open to length and depth and is host to at least six main composite vein-fault structures that contain ribbon structure quartz-sulfide veins. The project lies prominently within the 160km long Juneau Gold Belt, which has produced over seven million ounces of gold.

The Company's updated NI#43-101 Mineral Resource estimate reported at a base case mineral resources cut-off grade of 2.5 grams per tonne gold (g/t Au) and consists of: an Indicated Resource of 1,438,500 ounces of gold at an average grade of 9.47 g/t Au (4,726,000 tonnes); and an Inferred Resource of 515,700 ounces of gold at an average grade of 8.85 g/t Au (1,813,000 tonnes), as well as an Indicated Resource of 891,600 ounces of silver at an average grade of 5.86 g/t Ag (4,726,000 tonnes); and an Inferred Resource of 390,600 ounces of silver at an average grade of 7.33 g/t silver (1,813,000 tonnes).

ON BEHALF OF THE BOARD

"Ian Klassen"

Ian M. Klassen

President & Chief Executive Officer

Tel: (604) 899-0106

Email: Ian@grandeportage.com

Cautionary Statement Regarding Forward-Looking Information

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties as described in the Company's filings with Canadian securities regulators. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Please note that under National Instrument 43-101, the Company is required to disclose that it has not based any production decision on NI 43-101-compliant reserve estimates, preliminary economic assessments, or feasibility studies, and historically production decisions made without such reports have increased uncertainty and higher technical and economic risks of failure. These risks include, among others, areas that are analyzed in more detail in a feasibility study or preliminary economic assessment, such as the application of economic analysis to mineral resources, more detailed metallurgical and other specialized studies in areas such as mining and recovery methods, market analysis, and environmental, social, and community impacts. Any decision to place the New Amalga Mine into operation at levels intended by management, expand a mine, make other production-related decisions, or otherwise carry out mining and processing operations would be largely based on internal non-public Company data, and on reports based on exploration and mining work by the Company and by geologists and engineers engaged by the Company.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICE PROVIDER (AS THAT TERM IS DEFINED UNDER THE POLICIES OF THE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS RELEASE

SOURCE: Grande Portage Resources Limited

View the original press release on accesswire.com