September 23, 2024

Poseidon Nickel (ASX: POS, the Company) is pleased to provide an update on the gold exploration programs at Black Swan.

- Reconnaissance soils sampling has identified several gold anomalies

- Anomalies extend over multiple soil traverses (between 400m to 800m) along the interpreted gold bearing structures

- Wilson’s Prospect – several positive coincident attributes established

- A coherent gold anomaly defined (up to 54ppb Au) that is 1.4km by 1km in size and remains open to the south

- The gold anomaly extents capture the locations of the previously announced gold nuggets and anomalous rock chip samples that graded up to 1.25g/t Au in gossanous quartz veins1,2

- Several historical gold drill intersections with assay results >1g/t Au, including 0.4m @ 6.41 g/t Au2, are also located within the anomaly area, despite only 5% of all historical drillhole samples being assayed for gold

- The layered indicators for gold potential at Wilson’s Prospect point to a highly prospective exploration target as evaluation programs continue

- Gold exploration programs underway

- High priority infill soil and further grab sampling programs are underway to better define soil trends at Black Swan. Infill results will be used to optimise drill targets

- At Lake Johnston, maiden reconnaissance soil surveys have been completed across the newly acquired Mantis tenement and submitted for analysis - results awaiting

CEO, Brendan Shalders, commented, “During August 2024 the Company completed a wide spaced reconnaissance soil sampling program across the entire landholding at Black Swan which was assayed for the full suite of elements.

Soil sample assay results have noted four promising gold in soil anomalies. The extents of the anomalies and morphology appear to be tracing the prospective gold bearing structures throughout the geological sequence at Black Swan which have never been systematically tested for gold.

There is little outcrop at Black Swan thus reconnaissance surface geochemical surveys are considered a cost-effective exploration technique to quickly identify areas of gold anomalism. Due to the significant dilution of the soil profile as it is mainly comprised of sands and clays, the gold values recorded are usually only at low levels (ppb). The importance of a gold in soil anomaly is it often presents a vector to a prospective gold system below, and in its original undiluted setting, maybe at much higher grades, hence drilling is required to effectively test the target.

We are particularly excited about the gold targets that are presenting at the Wilson’s Prospect. Results of the separate work programs to date are showing several positive coincident attributes underpinning the prospectivity for the targets. These include the establishment of a large coherent gold in soil anomaly with a footprint that captures the locations of the previously reported gold nuggets, anomalous rock chip samples and historical drilling intersections grading up to 6.41g/t Au.

Despite the historical gold intersections, only 5% of all drillhole samples at Black Swan were assayed for gold. Given the lack of gold assays and the historical focus on nickel, the gold potential at Black Swan has been somewhat overlooked.

High priority infill soil sampling programs are underway to better define drill targets and progress the planning for low-cost shallow drilling programs.

We are also awaiting the results from the Lake Johnston soil programs completed in early September 2024. Once received and interpreted the company plans to continue to undertake additional programs to progress and established any newly identified gold targets within the portfolio.”

Gold in Soil Anomalies at Black Swan

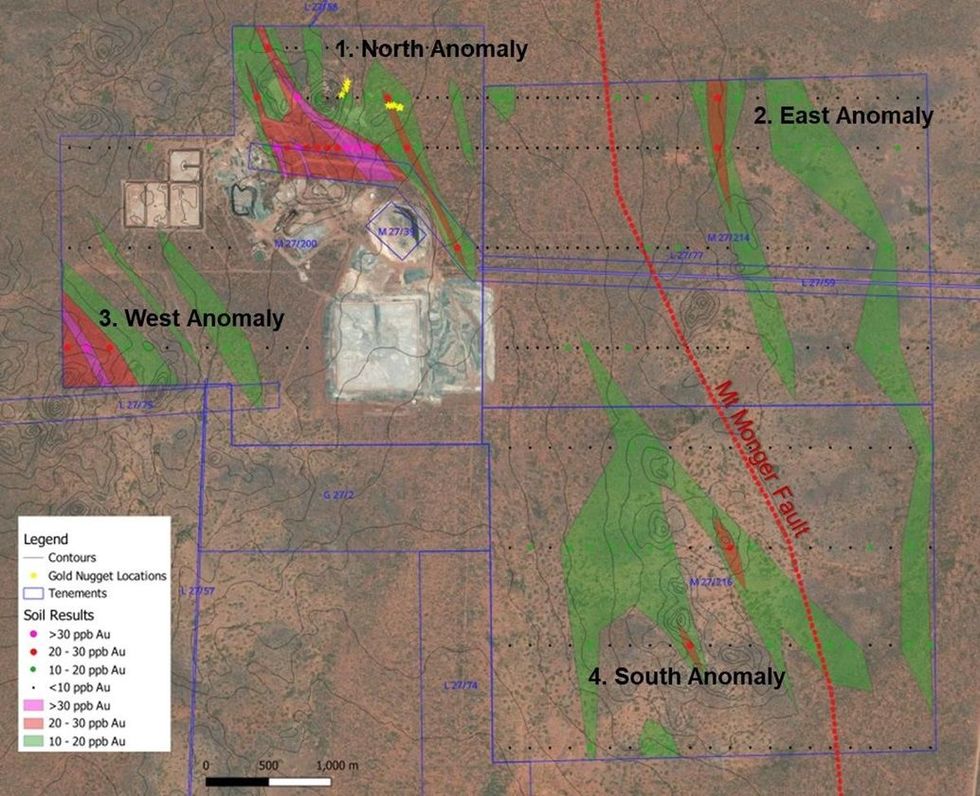

During August 2024 the Company collected 362 soil samples from a wide spaced reconnaissance soil sampling program over the entire Black Swan tenement package on 800m and 400m space traverses with sampling intervals of between 80m and 160m. The soil samples were tested using the UltraFine+ technique identifying four coherent anomalies across the program (refer Figure 1).

Gold assay results from the soil sampling, tabled in Appendix 1, grade up to 54ppb and present four distinct gold in soil anomalies spread across the Black Swan tenements. Importantly these anomalies correlate to the interpreted secondary structural corridors emanating NNE off the larger north striking Mt Monger Fault (see Figure 2 for interpreted location of Mt Monger Fault).

The Black Swan project is situated within the Boorara Geological Domain which hosts a number of gold mines including the nearby Kanowna Belle, Mungarra and Gordon Sirdar projects, as recently announced in ASX announcement “Gold Prospectivity Enhanced at Black Swan and Lake Johnston” re- released 16 August 2024.

Click here for the full ASX Release

This article includes content from Poseidon Nickel Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00