May 13, 2025

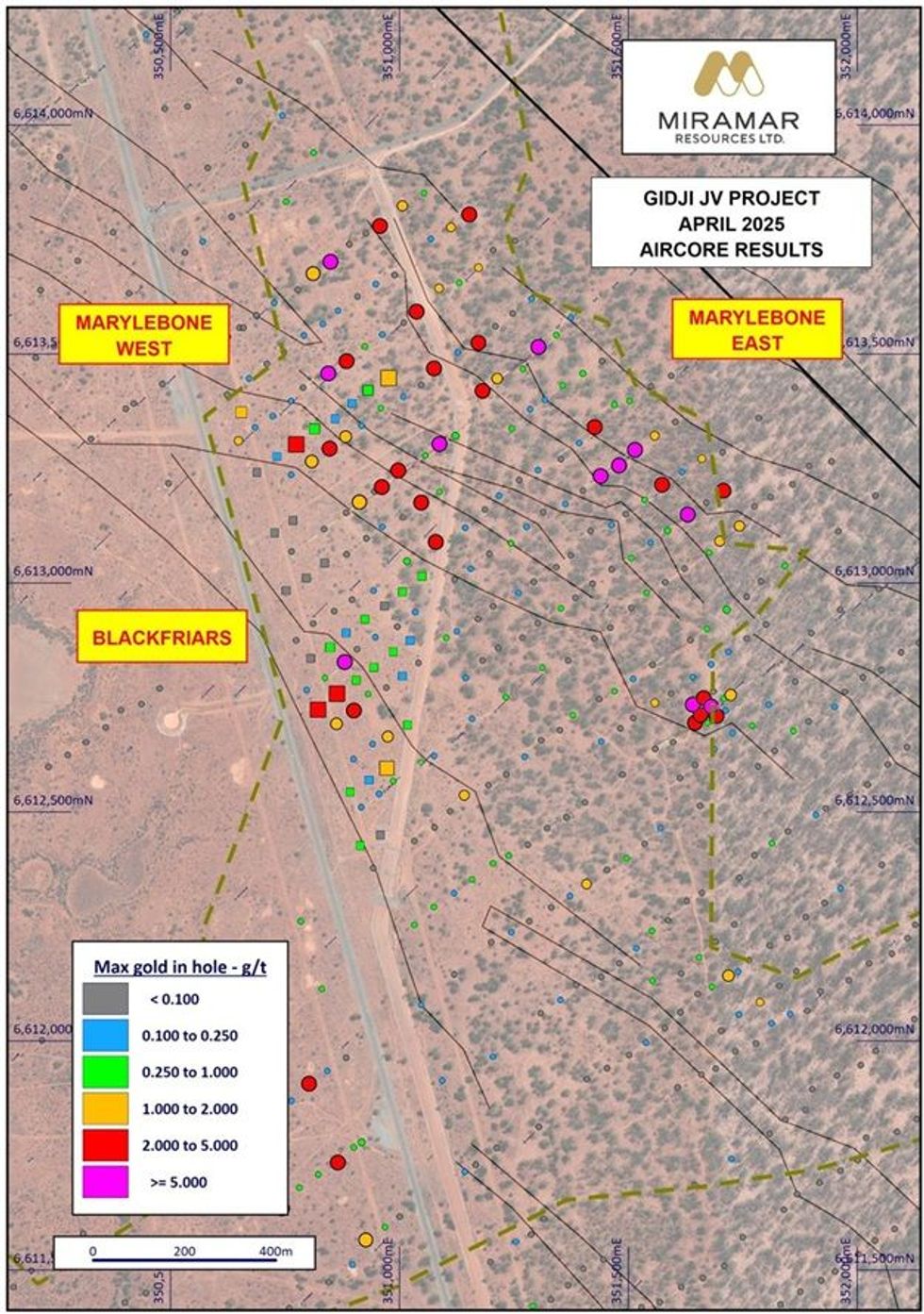

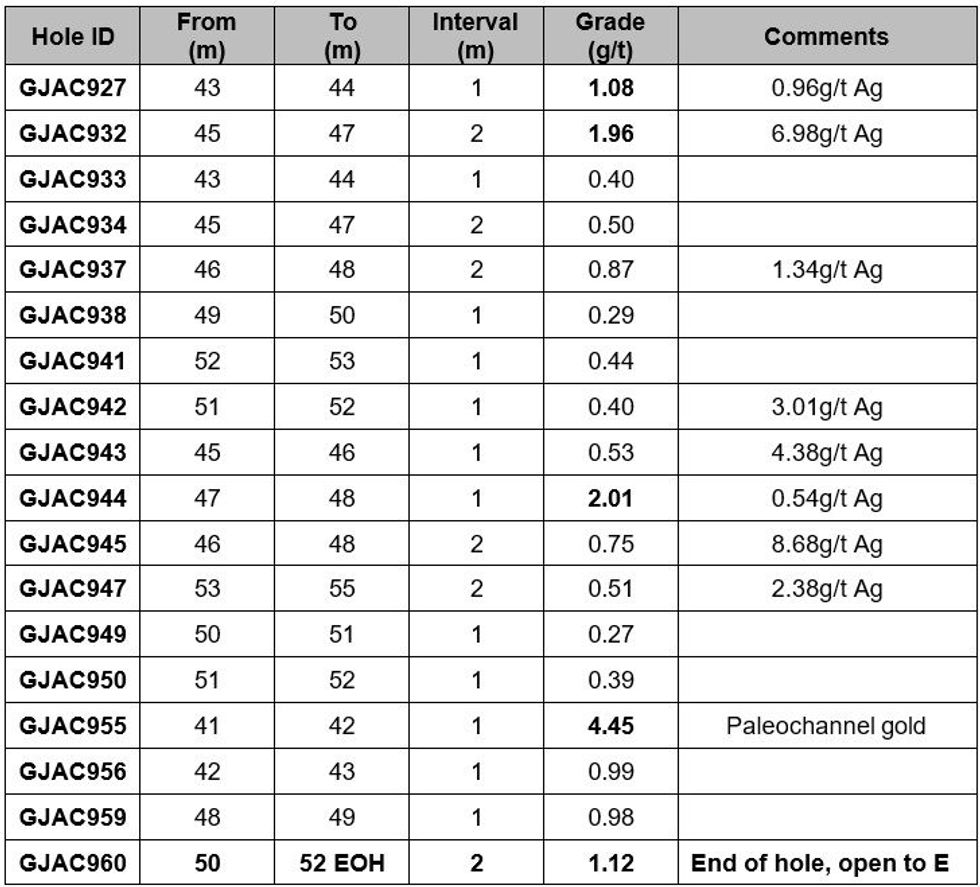

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) advises that initial assays from the current aircore drilling campaign at the Gidji JV Project include several significant gold results.

Miramar’s 80%-owned Gidji JV Project (“Gidji” or “the Project) is located approximately 15 kilometres north of Kalgoorlie and surrounded by multiple gold mining and processing operations, including Northern Star Resources Limited’s Kalgoorlie gold operations (Figure 1).

Miramar’s Executive Chairman, Mr Allan Kelly, said the first results from the current programme confirmed and extended the extensive supergene gold footprint discovered in previous drilling.

“The new results increase the footprint of the high-priority Blackfriars target, which shares several similarities to the multi-million-ounce Paddington gold deposit along strike to the north, including its location at the contact between the Boorara Shear Zone and the Black Flag Beds,” he added.

“This is the first systematic drilling at Gidji after a break of almost 3 years whilst, at the same time, the Australian dollar gold price has risen from $2,500/oz to well over $5,000/oz,” Mr Kelly said.

Current and previous drilling has outlined an extensive area of flat-lying supergene gold across multiple targets at Gidji, despite the stripped weathering profile under the Gidji Paleochannel.

The current drilling programme consists of approximately 180 aircore holes and aims to further refine bedrock drill targets under the younger transported paleochannel sediments.

Drilling commenced before Easter, was suspended due to heavy rainfall and recommenced on 6 May.

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

M2R:AU

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

4h

High-Grade Extensions at BD Deposits for Resource Growth

Aurum Resources (AUE:AU) has announced High-Grade Extensions at BD Deposits for Resource GrowthDownload the PDF here. Keep Reading...

6h

Precious Metals Price Update: Gold, Silver, PGMs Stage Recovery After Crash

It's been a wild week of ups and downs for precious metals prices.Gold, silver and platinum have already recorded new all-time highs in 2026. But this week, the rally reversed course — only briefly, but in a big way, as is the case with such highly volatile markets.Let’s take a look at what got... Keep Reading...

8h

Centurion Minerals Ltd. Announces Revocation of MCTO

CENTURION MINERALS LTD. (TSXV: CTN) ("Centurion" or the "Company") announces that the British Columbia Securities Commission ("BCSC") has revoked the management cease trade order ("MCTO") previously issued on December 1, 2025 under National Policy 12-203 - Management Cease Trade Orders.The... Keep Reading...

03 February

Fabi Lara: What to Do When Commodities Prices Go Parabolic

Speaking against a backdrop of record-high gold and silver prices, Fabi Lara, creator of the Next Big Rush, delivered a timely reality check at this year’s Vancouver Resource Investment Conference. Addressing a packed room that included a noticeable influx of first-time attendees, she urged... Keep Reading...

03 February

Joe Cavatoni: Gold Price Drop — Why it Happened, What's Next

Joe Cavatoni, senior market strategist, Americas, at the World Gold Council, breaks down gold's record-setting run past US$5,500 per ounce as well as its correction. "At the end of this, you're looking at a lot of people who were pushing the price higher — speculative in nature — pulling back... Keep Reading...

03 February

Gold-Copper Consolidation Continues as Eldorado Moves to Acquire Foran

Eldorado Gold (TSX:ELD,NYSE:EGO) and Foran Mining (TSX:FOM,OTCQX:FMCXF) have agreed to combine in a share-based transaction that will create a larger, diversified gold and copper producer with two major development projects that are set to enter production in 2026.Following completion under a... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00