December 17, 2023

Peak Rare Earths Limited (ASX: PEK) (“Peak” or the “Company”) is pleased to announce the first set of assays from its exploration programme targeting the multi-commodity potential of the Ngualla carbonatite system, with results demonstrating further widespread and shallow mineralisation of niobium, phosphate and rare earths within the highly prospective Northern Zone target area.

- Drilling for the 2023 exploration programme successfully completed

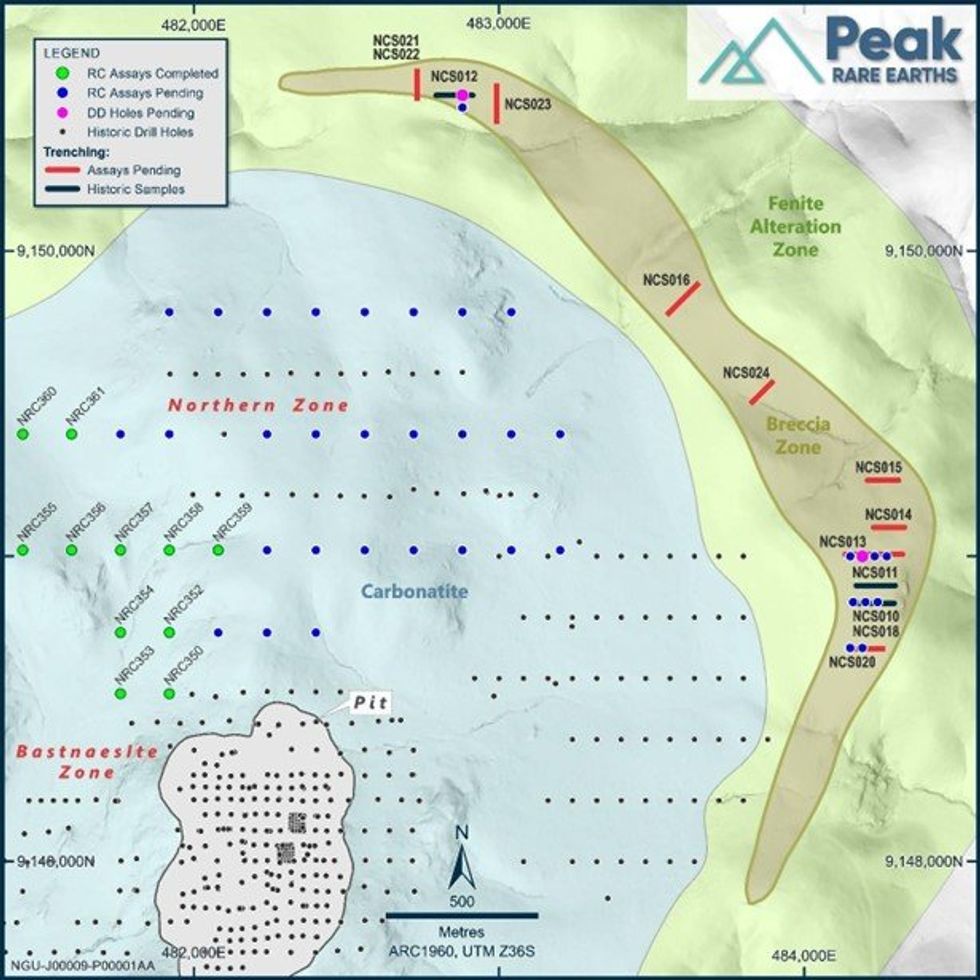

- 57 holes for a total of 4,190m drilled across the highly prospective Northern Zone and Breccia Zone targets (3,979m of RC drilling and 211m of DD drilling)

- Northern Zone and Breccia Zone are located ~2km North and North-East, respectively, from the Bastnaesite Zone that forms the basis of the Ngualla Rare Earth Project’s Ore Reserves and Mineral Resources

- Assays received for the first batch of RC samples from 13 holes within the Northern Zone, confirming widespread and shallow mineralisation of niobium, phosphate and rare earths

- NRC352: 10m at 0.55% Nb2O5 from surface including 4m at 0.69% Nb2O5 from 6m, as well as 6m at 1.42% TREO from surface

- NRC356: 14m at 0.55% Nb2O5 from 14m including 10m at 0.61% Nb2O5 from 14m, as well as 14m at 14.5% P2O5 from 16m

- NRC359: 24m at 0.40% Nb2O5 from surface; 10m at 0.49% Nb2O5 from 28m including 4m at 0.72% Nb2O5 from 30m; and 10m at 13.6% P2O5 from 12m

- Rare earths mineralisation includes elevated levels of heavy rare earth elements dysprosium and terbium

- Further assays from the Northern and Breccia zones are imminent, with a number of key targets still pending

Results follow the recent completion of Peak’s exploration drilling campaign where a total of 57 holes for 4,190m were successfully completed across the Northern Zone and Breccia Zone prospects. Peak awaits assay results of numerous key targets from across these two areas with results anticipated through early 2024.

Commenting on the first assay results, the CEO of Peak, Bardin Davis, said:

“The first assay results are very encouraging and demonstrate widespread and shallow mineralisation of niobium, phosphate and rare earths in the outer region of the Northern Zone. We are eagerly awaiting results from key targets within the central region of the Northern Zone, where we have previously encountered high-grade intercepts of these commodities. We remain of the view that the Ngualla Deposit is world-class with the potential to support a multi-generational and multi-commodity mining project.”

Exploration programme overview

Peak commenced an exploration programme earlier in the year focusing on the multi- commodity potential of the Ngualla carbonatite complex. Whilst Ngualla remains highly prospective for a range of critical commodities, the broader deposit remains largely unexplored given the historical focus on the central rare earth zone (which forms the basis of the Ngualla Project’s Ore Reserves and Mineral Resources). Importantly, the existing Special Mining Licence (“SML”) for the Ngualla Rare Earth Project (“Ngualla Project”) extends to any other minerals found to occur in association with rare earth elements.

Drilling pertaining to the current exploration programme has focused on the Northern Zone and Breccia Zone; two highly prospective targets within the Ngualla deposit. Key objectives of this drilling campaign included:

1. Understanding the outer extent of mineralisation of niobium, phosphate and rare earths within the Northern Zone;

2. Progressing infill drilling within the Northern Zone to augment previous drilling from 2012, where Peak encountered shallow and high-grade mineralisation of niobium, phosphate and rare earths (See Appendix 1.a); and

3. Undertaking a maiden drilling programme within the Breccia Zone where previous rock chip and trench sampling in 2017 demonstrated significant fluorite and rare earth mineralisation (see Appendix 1.b).

Drill targets in the Northern Zone have been informed by a geological model developed by SRK as part of the exploration programme.

Click here for the full ASX Release

This article includes content from Peak Rare Earths Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00