Frontier Lithium Inc. (TSX.V: FL) (FRA: HL2) (OTC: LITOF) ("Frontier" or the "Company") is pleased to provide a progress update on the infrastructure projects supported by Natural Resources Canada's (NRCan) Critical Minerals Infrastructure Fund ("CMIF") for the Company's flagship PAK Lithium Project (the "PAK Project" or the "PAK Lithium Project") in northwestern Ontario.

In March 2025, Frontier finalized contribution agreements under CMIF, securing up to approximately $6.1 million in non-repayable contribution funding to advance the following two projects (collectively, the "Projects"):

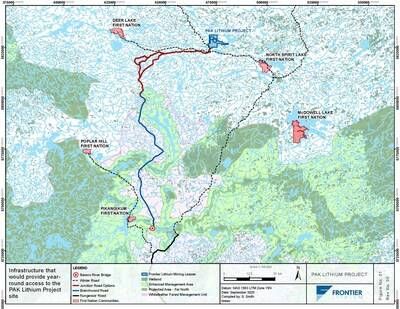

- All-Season Road Engineering and Design Project (Junction Road): Pre-construction engineering, design, permitting, and environmental studies for approximately 56 kilometres (Figure A) of an all-season two-lane road required to connect the PAK Project to Ontario's provincial highway network.

- PAK Clean Energy Project : Engineering, design, and permitting for a substation and transmission line to integrate the PAK Project into the Wataynikaneyap power grid, ensuring long-term, sustainable electricity supply.

Frontier continues to advance engineering, environmental, permitting, and Indigenous engagement activities to support shovel-ready status for these Projects and Frontier intents to apply to stream 2 under the CMIF program to be reimbursed for 50% of the eligible costs for these Project.

Projects Progress in 2025

In 2024 and 2025 over $3 million has been invested in advancing critical infrastructure under the CMIF program. The Company anticipates allocating up to an additional $8.9 million by 2028 as activities expand, including consultation, permitting and engineering for both these Projects and Frontier will apply under the CMIF program to be reimbursed for 50% of the eligible costs for these Project.

Over the course of 2026, the All-Season Road Engineering and Design Project plans to complete consultation and the remaining 20% of the engineering plans, designate the preferred route, and finish the permitting process under Ontario's One Project One Process framework (1P1P). This work is anticipated to cost $2.6 million and will aim to enable construction of the all-season Junction Road to begin as early as 2027.

The capital required for the PAK Clean Energy Project in 2026 is estimated to be $2.9 million which will complete assessments for the required technical upgrades to the existing infrastructure, the environmental assessments and permitting requirements for on-lease infrastructure and any remaining geotechnical drilling that is required for site infrastructure impacted by the electricity connection. These works are being completed along side the Province of Ontario's October announcement (available here) of the twinning of the power lines to Red Lake, Ontario, in order to support new mining projects, such as the PAK Project, located north of Red Lake.

Strategic Importance

These Projects are integral to both Ontario and the Canadian Critical Minerals Strategy (CCMS), addressing infrastructure gaps essential for bringing critical mineral deposits like the PAK deposit into production. Frontier's PAK Project is recognized as one of Ontario's largest and highest-grade lithium resources, forming the foundation for a fully integrated mine-to-chemicals operation to supply lithium chemicals for electric vehicle and energy storage markets across North America.

"Road and power investments are generational infrastructure, not just for the PAK Lithium Project, but also for others within the region, including local and Indigenous communities. As we advance permitting and pre-construction, we are ensuring benefits flow regionally while Canada strengthens a secure, domestic critical minerals supply chain." said Trevor Walker, President & Chief Executive Officer of Frontier.

"Building the infrastructure needed to unlock Canada's critical minerals potential is essential to getting Canadian minerals to markets, which will diversify our trade, strengthen our economic and national security and sovereignty, create good domestic jobs, and support the clean energy transition. Through the Critical Minerals Infrastructure Fund, our new government is investing in roads and clean power that not only help move projects like Frontier's PAK Lithium Project toward production, but create significant benefits for the communities around these projects. Canada has what the world wants, and we are building big things again, to make sure we can deliver for Canadians and allies abroad," said the Honourable Tim Hodgson, Minister of Energy and Natural Resources.

ON BEHALF OF THE BOARD OF DIRECTORS

Trevor Walker

President & Chief Executive Officer

About Frontier Lithium

Frontier Lithium Inc. is a pre-production mining company with an objective to become a strategic and integrated supplier of premium spodumene concentrates as well as battery-grade lithium salts to the growing electric vehicle, and energy storage markets in North America. The Company's PAK Lithium Project maintains the largest land position and resource in a premium lithium mineral district located in Ontario's Great Lakes region.

About the PAK Lithium Project

The PAK Lithium Project is a fully integrated critical minerals initiative in Ontario, developing a high-grade, large scale lithium resource. Operated as a joint venture between Frontier (92.5%) and Mitsubishi Corporation (7.5%), the project is advancing in parallel with a mine and mill, north of Red Lake, Ontario and a downstream lithium conversion facility in Thunder Bay, Ontario, which are both key to supporting a secure domestic lithium supply for the clean energy transition. A 2025 Mine and Mill Feasibility Study (FS), prepared by DRA Global Limited and entitled National Instrument 43-101 Technical Report FS PAK Lithium Project, Mine and Mill, outlines a 31-year Project life with an after-tax net present value of $932 million at an 8% discount rate and an after-tax internal rate of return of 17.9%.These results have been disclosed in the Company's press release dated May 28, 2025, and the accompanying technical report was filed on SEDAR+ (www.sedarplus.ca) on July 9, 2025.

Cautionary Note Regarding Forward-Looking Statements

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical fact constitute forward-looking statements. Forward looking statements contained in this news release may include, but are not limited to, estimated capital allocated by the Company to the Projects, the CMIF program, its funding and eligible cost reimbursements, the PAK Lithium Project and its estimated economics, and statements with respect to: capital requirements and private and/or public financing initiatives and completion of these financings (if any), estimated mineral resources, estimated capital costs to construct a mine and conversion facilities, estimated operating costs, estimated cash flows, net present value, the feasibility study and references thereto, and statements that address future production, resource and reserve potential, exploration drilling, exploitation activities and events or developments that the Company expects, including but not limited to capital and operating costs, timelines, internal rates of return, and project development milestones.

Forward-looking statements involve inherent risks and uncertainties. Risk factors that could cause actual results to differ materially from those in forward looking statements include: market prices for commodities, increases in capital or operating costs, construction risks, availability of infrastructure including roads, regulatory and permitting risks, exploitation and exploration successes, continued availability of capital and financing, financing costs, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and those actual results or developments may differ materially from those projected in the forward-looking statements. For more information on the Company, please review the Company's public filings available at www.sedarplus.ca.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE Frontier Lithium Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/February2026/04/c3705.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/February2026/04/c3705.html