Frontier Lithium Inc. (TSXV: FL,OTC:LITOF) (FRA: HL2) (OTCQX: LITOF) ("Frontier" or the "Company") is pleased to announce its financial results for the six month period ended September 30, 2025, and highlights from this interim period are set out below. The financial statements and the related management's discussion and analysis for the period ended September 30, 2025 have been filed on SEDAR+ and can be viewed under the Company's profile at www.sedarplus.ca and on the Company's website at www.frontierlithium.com.

The Company continues to advance its PAK lithium project (the "PAK Lithium Project" or "Project") and assess the viability of constructing and operating a fully-integrated lithium mine and chemicals processing facility to deliver battery-grade lithium carbonate and lithium hydroxide for the burgeoning lithium-ion battery market in North America.

Highlights for the Quarter Ended September 30, 2025, and Recent Developments

Financial

As at September 30, 2025, the Company had cash and cash equivalents of $14.9 million, supported in part by the receipt of $909,000 in reimbursement from government funding programs and an additional $634,000 in proceeds from the exercise of stock options. This liquidity positions the Company to meet its current corporate and administrative requirements while advancing key development and strategic objectives.

Exploration and Development

There has been no drilling on the PAK Lithium Project since September 2024. A full record of drilling results from Phase I through Phase XIV (2013–2024) are available in the NI 43-101 Technical Report filed on July 9, 2025 by the Company.

The Company continues environmental baseline studies and related technical work required to advance project permitting.

On July 9, 2025, the Company published the Mine and Mill Feasibility Study ("Mine and Mill FS") dated effective May 28, 2025. The Mine and Mill FS outlines a standalone operation producing 200,000 tonnes per year of 6% lithium oxide ("Li₂O") spodumene concentrate ("SC6"), reporting a post-tax net present value of $932 million (8% discount rate) and a post-tax internal rate of return of 17.9%. The Mine and Mill FS incorporates updated mineral resources, a chemical grade lithium concentrate (CG SC6) price assumption of US$1,475 per tonne, and a USD/CAD exchange rate of 1.37.

The Mine and Mill FS considers a 31-year mine life supported by reserves at both the PAK and Spark deposit, with grades of 1.96% Li₂O and 1.44% Li₂O respectively and demonstrates a competitive C1 cost of $602 per tonne of concentrate sold.

The Company has also initiated the Lithium Conversion Facility Feasibility Study ("Lithium Conversion Facility FS"), led by Fluor Canada Ltd., with completion expected in the first half of 2027.

Permitting, Government and Regulatory

In October 2025, the Company was selected as the first participant in Ontario's One Project, One Process ("1P1P") Framework Guidance initiative. The program is intended to streamline and modernize provincial permitting, improving coordination among ministries and Indigenous partners and enabling more efficient review timelines for advanced mineral projects.

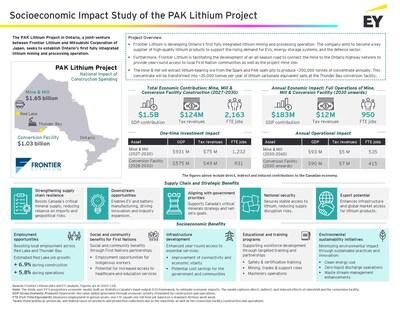

Frontier is also pleased to recently report the findings of an independent socioeconomic impact study completed by Ernst & Young LLP (EY) for the Company's proposed integrated mine, mill, and conversion facility in Northwestern Ontario. The study underscores the transformative economic contribution of the PAK Lithium Project to the region and to Canada's broader Critical Minerals Strategy, highlighting its importance within the G7 Critical Minerals Production Alliance. EY's analysis estimates that construction of the Company's mine, mill, and conversion facility would generate approximately $1.5 billion in gross domestic product ("GDP"), $124 million in tax revenues, and 2,163 full-time equivalent jobs over a three-year construction period. Over 30 years of operations, the PAK Lithium Project is expected to contribute $183 million in GDP annually, $12 million in annual tax revenues, and support 950 full-time equivalent jobs. These results reinforce the Project's potential to anchor a resilient, North American battery materials supply chain and meaningfully support the global energy transition. For further details on the study, see the full EY Socioeconomic Impact Study on Frontier Lithium's website at https://www.frontierlithium.com/socioeconomic.

Corporate

The Company also announces the departure of Mr. David Ewing, Vice President of Sustainability and External Affairs of the Company, effective December 12, 2025. Trevor Walker, President and CEO, thanks Mr. Ewing for his leadership and contributions in sustainability, Indigenous relations, and regulatory engagement. A management transition plan has been established to ensure continuity of Sustainability deliverables as the Project advances.

Infrastructure

The Company continues to collaborate with Federal and Provincial governments and Indigenous communities on northern infrastructure planning, including all-season road and power access required to support commercial operations and long-term project development.

Outlook

With a positive Mine and Mill FS and the Lithium Conversion Facility FS underway, the Company continues to advance plans for integrated, scalable lithium production in Ontario. Work is ongoing to secure necessary infrastructure, further engineering, and long-term agreements with Indigenous rights holders to support the transition from exploration to development.

Annual General Meeting Results

The Company further announces the voting results from its annual general meeting of shareholders of the Company (the "Meeting"), which was held on Thursday, November 27, 2025, at the Company's head office in Sudbury, Ontario, Canada. All meeting matters and resolutions put before the shareholders of the Company, and as more fully described in the Company's Notice of Annual General Meeting of Shareholders and Management Information Circular, dated October 14, 2025, were approved by the requisite majority of votes cast at the Meeting.

About Frontier Lithium

Frontier Lithium Inc. is a pre-production mining company with an objective to become a strategic and integrated supplier of premium spodumene concentrates as well as battery-grade lithium salts to the growing electric vehicle, and energy storage markets in North America. The Company's PAK Lithium Project maintains the largest land position and resource in a premium lithium mineral district located in Ontario's Great Lakes region.

About the PAK Lithium Project

The PAK Lithium Project is a fully integrated critical minerals initiative in Ontario, developing a high-grade, large scale lithium resource. Operated as a joint venture between Frontier (92.5%) and Mitsubishi Corporation (7.5%), the project is advancing in parallel with a mine and mill, north of Red Lake, Ontario and a downstream lithium conversion facility in Thunder Bay, Ontario, which are both key to supporting a secure domestic lithium supply for the clean energy transition. A 2025 Mine and Mill Feasibility Study (FS), prepared by DRA Global Limited and entitled National Instrument 43-101 Technical Report FS PAK Lithium Project, Mine and Mill, outlines a 31-year Project life with an after-tax net present value of $932 million at an 8% discount rate and an after-tax internal rate of return of 17.9%.These results have been disclosed in the Company's press release dated May 28, 2025, and the accompanying technical report was filed on SEDAR+ (www.sedarplus.ca) on July 9, 2025.

Cautionary Note Regarding Forward-Looking Statements

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical fact constitute forward-looking statements. Forward looking statements contained in this news release may include, but are not limited to, the EY study estimates including but not limited to gross spending, GDP, wages, full time equivalent employment and possible tax revenue, the PAK Lithium Project and its estimated economics, and statements with respect to: capital requirements and private and/or public financing initiatives and completion of these financings (if any), estimated mineral resources, estimated capital costs to construct a mine and conversion facilities, estimated operating costs, estimated cash flows, net present value, the Feasibility Study and statements that address future production, resource and reserve potential, exploration drilling, exploitation activities and events or developments that the Company expects, including but not limited to capital and operating costs, timelines, internal rates of return, and project development milestones.

Forward-looking statements involve inherent risks and uncertainties. Risk factors that could cause actual results to differ materially from those in forward looking statements include: market prices for commodities, increases in capital or operating costs, construction risks, availability of infrastructure including roads, regulatory and permitting risks, exploitation and exploration successes, continued availability of capital and financing, financing costs, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and those actual results or developments may differ materially from those projected in the forward-looking statements. For more information on the Company, please review the Company's public filings available at www.sedarplus.ca.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE Frontier Lithium Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2025/27/c4308.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2025/27/c4308.html