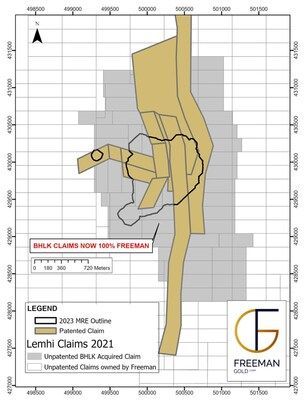

Freeman Gold Corp. (TSXV: FMAN) (OTCQB: FMANF) (FSE: 3WU) (" Freeman " or the " Company ") is pleased to announce it has amended the Option Agreement with BHLK-2 LLC, a limited liability company (the " Option "). Freeman now has made all the necessary payments to exercise the Option to purchase 46 unpatented claims (see Figure 1). These claims surround the central core of patented claims and contain a portion of the Lemhi resource. This acquisition is part of the Company's strategy to accelerate development and consolidate ownership of the Lemhi Project. Additionally, the 2023 Lemhi Preliminary Economic Assessment envisages using some of these claims in connection with the tailings storage facility.

On August 19, 2019 , the Company entered into an option agreement to acquire a 100% interest in an additional 46 unpatented mining claims located in Lemhi County, Idaho . To exercise the Option, the Company was required to pay an aggregate of US$1,000,000 over a period of seven years with the final payment of US$550,000 due on August 19, 2026 . The Company has negotiated a final payment of US $525,000 and made the payment fulfilling the terms of the agreement.

The Company also announces the appointment of Julie Van Baarsen as interim Chief Financial Officer effective September 1, 2025 . Ms. Van Baarsen will succeed Bassam Moubarak who has acted as both Chief Executive Officer and Chief Financial Officer of the Company while the Company conducted a search. Mr. Moubarak remains Chief Executive Officer and Director of the Company.

Ms. Van Baarsen is a Chartered Professional Accountant with over 30 years of experience. She has held various senior financial positions as Chief Financial Officer, Vice President - Finance, Director of Finance, and Controller at several public companies in the telecom and mining sectors, including companies with operating mines in Central America and British Columbia. She obtained her Chartered Accountant designation in 1993 while working at Grant Thornton LLP.

About the Company and Project

Freeman Gold Corp. is a mineral exploration company focused on the development of its 100% owned Lemhi Gold project (the "Project" ). The Project comprises 30 square kilometres of highly prospective land, hosting a near-surface oxide gold resource. The pit constrained National Instrument 43-101 ( "NI 43- 101" ) compliant mineral resource estimate is comprised of 988,100 ounces gold ( "oz Au" ) at 1.0 gram per tonne ( "g/t" ) in 30.02 million tonnes (4.7 million tonnes Measured (168,800 oz) & 25.5 million tonnes Indicated (819,300 oz)) and 256,000 oz Au at 1.04 g/t Au in 7.63 million tonnes (Inferred). The Company is focused on growing and advancing the Project towards a production decision. To date, 525 drill holes and 92,696 m of drilling has historically been completed (Murray K., Elfen, S.C., Mehrfert, P., Millard, J., Cooper, Schulte, M., Dufresne , M., NI 43-101 Technical Report and Preliminary Economic Assessment, dated November 20, 2023 ; www.sedarplus.ca ).

The recently updated price sensitivity analysis (see Freeman's news release dated April 9, 2025 ) shows a PEA with an after-tax net present value (5%) of US$329 million and an internal rate of return of 28.2% using a base case gold price of US$2,200 /oz; Average annual gold production of 75,900 oz Au for a total life-of-mine of 11.2 years payable output of 851,900 oz Au; life-of-mine cash costs of US$925/oz Au; and, all-in sustaining costs of US$1,105 /oz Au using an initial capital expenditure of US$215 million * .

* Note: Mineral resources that are not mineral reserves do not have demonstrated economic viability. The preliminary economic assessment is preliminary in nature, that it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized.

The technical content of this release has been reviewed and approved by Dean Besserer , P. Geo., VP Exploration of the Company and a Qualified Person as defined by the NI 43-101.

On Behalf of the Company

Bassam Moubarak

Chief Executive Officer

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward Looking Information

This news release contains certain "forward-looking information" and "forward-looking statements" (collectively "forward-looking statements") within the meaning of applicable securities legislation. All statements, other than statements of historical fact, included herein, without limitation, statements relating to the future operations and activities of Freeman, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as "expects", "anticipates", "believes", "intends", "estimates", "potential", "possible", and similar expressions, or statements that events, conditions, or results "will", "may", "could", or "should" occur or be achieved. Forward-looking statements in this news release relate to, among other things, the use of some of the newly acquired claims in connection with the tailings storage facility, and the transition with regard to the Chief Financial Officer role on September 1, 2025 . There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by Freeman, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation, continued availability of capital and changes in general economic, market and business conditions. The reader is urged to refer to the Company's reports, publicly available on SEDAR+ at www.sedarplus.ca for a more complete discussion of such risk factors and their potential effects. The Company does not undertake to update forward‐looking statements or forward‐looking information, except as required by law.

SOURCE Freeman Gold Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/August2025/26/c7174.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/August2025/26/c7174.html