March 27, 2024

MTM Critical Metals (ASX:MTM) (MTM or the Company) is pleased to advise that it has completed the acquisition of Flash Metals Pty Ltd (Flash Metals). The closing of this transaction results in MTM securing exploration licenses in the West Arunta and Mukinbudin regions of Western Australia and the negotiation of the exclusive rights to Flash Joule Heating technology with Rice University.

Highlights:

- The all scrip 100% acquisition of Flash Metals Pty Ltd has been completed with allotment of securities following shareholder approval at a meeting on 14th March 2024.

- Control and management of tenements in the West Arunta and Mukinbudin areas of Western Australia has been secured which will enable Native Title and freehold land access to be progressed to enable in-field exploration planning to progress.

- Progress with Rice University to secure the Flash Joule Heating license agreement continues and has been assumed through the ownership of FJ Processing Pty Ltd, a wholly owned subsidiary of Flash Metals Pty Ltd.

- Tranche 2 of the Placement has been completed raising $3.4 million (before costs) resulting in the issue of approximately 42.6 million shares at $0.08 per share with one free attaching option (MTMO) for every two shares issued.

- Tranche 2 of the Convertible Note converted to equity with the allotment of approximately 10.7 million shares and 5.3 million options.

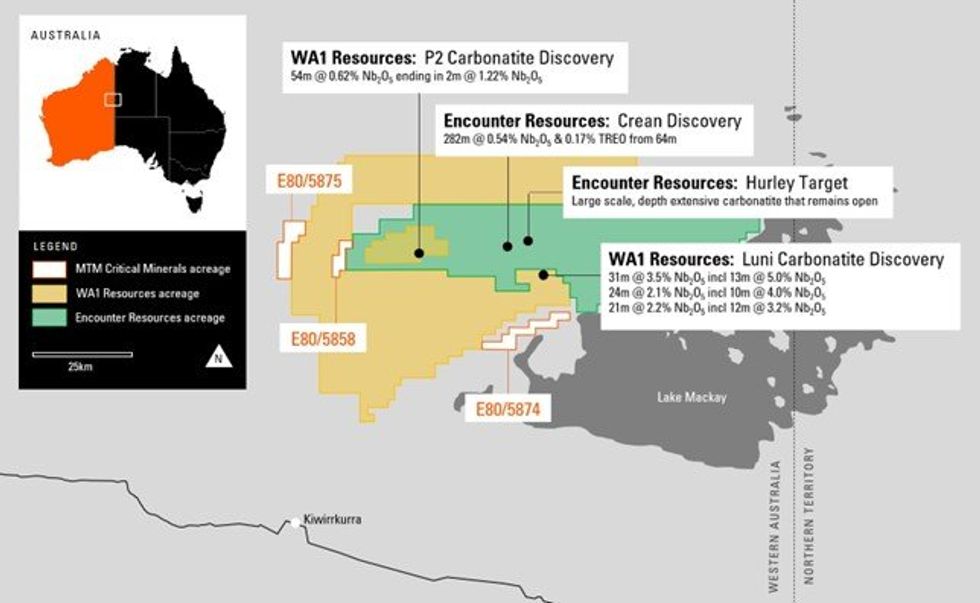

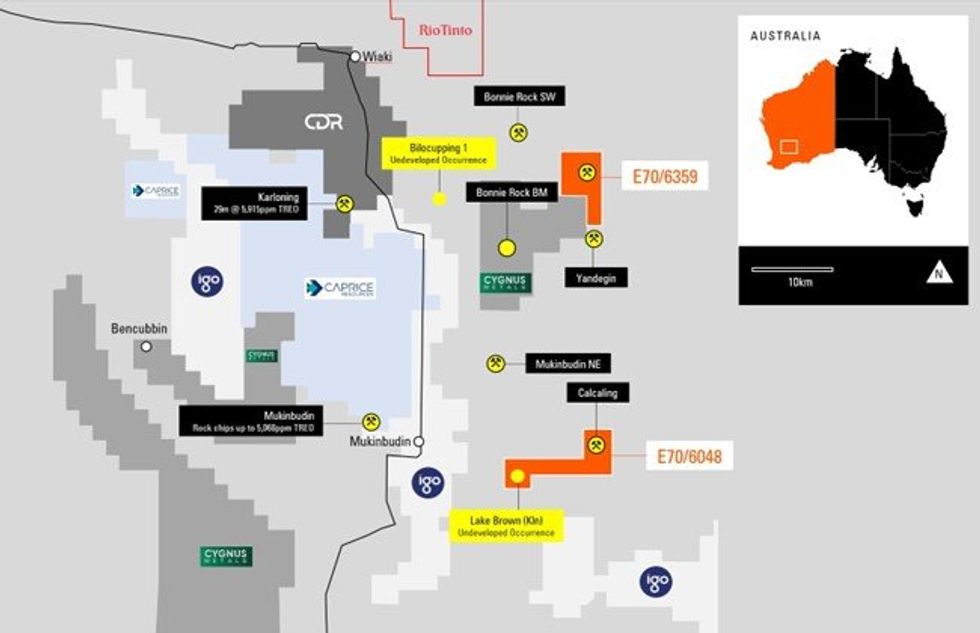

Completion of the Flash Metals acquisition sees control of three exploration licenses in the West Arunta area (E80/5858, E80/5754 and E80/5875) (Figure 1) and two tenements in the Mukinbudin area (E70/6048 & E70/6359) (Figure 2) transferred to MTM (together the WA REE Tenements).

MTM will assume the rights to the Flash Joule Heating licensing option which has been exercised by Flash Metals (refer ASX announcement dated 13 March 2024) and negotiations are under way to complete a licensing agreement with Rice University.

MTM Managing Director, Mr Lachlan Reynolds said “We are very pleased to have completed the Flash Metals acquisition which provides the Company with significant exploration and development opportunities through the acquisition of the REE focused exploration licenses in Western Australia.

“The new tenements in West Arunta provide us with an opportunity to discover new niobium-rare earth deposits in historically untested ground, right next door to some emerging mineralised carbonatite projects identified by both WA1 Resources and Encounter Resources. With the acquisition of Flash Metals now completed, we can progress the discussions with Native Title parties to enable us to access the tenements for in-field exploration .

“The Flash Joule Heating technology is complimentary to MTM’s exploration activities but also has the potential to be transformational at a bigger scale for the extraction of both precious and industrial metals.. We are very excited to be entering into a commercialisation partnership with Rice University and have closed the Flash Metals transaction at a time when the Flash Joule Heating prototype development has been well advanced by a Houston based engineering company under the stewardship of the Vendors of Flash Metals and KnightHawk Engineering.

The overwhelming support that we have received from existing and new shareholders who have participated in the Placement and the Convertible Note issue has been strong. The proceeds raised place MTM in a strong financial position to progress the mineral exploration and Flash Joule Heating technology development.”

Flash Metals Acquisition Consideration

With all conditions precedent having been satisfied, the all scrip consideration to acquire all of the ordinary shares in Flash Metals has been issued as follows:

a) 100 million fully paid ordinary shares in MTM (Shares) (Consideration Shares) issued to the shareholders of Flash Metals (the Vendors) (Note – 73,497,088 Shares are subject to six (6) month voluntary escrow);

b) 50 million quoted options with an exercise price of $0.25 and expiring 26 November 2024 (ASX:MTMO) issued to the Vendors (Quoted Consideration Options) (Note – 36748542 Options are subject to six (6) month voluntary escrow);

c) 37.5 million performance rights (Consideration Performance Rights) issued to Sandton Capital Pty Ltd (or its nominees), of which:

i. 12.5 million will vest and convert to Shares following the receipt of drilling results of >10m at >1,000ppm total rare earth oxide (TREO) and/or >0.5% Nb2O5 on the WA REE Tenements (Milestone 1);

ii. 12.5 million will vest and convert to Shares upon delineation of a JORC compliant inferred resource of >10MT at >1,000ppm TREO and/or >0.5% Nb2O5 on the WA REE Tenements (Milestone 2); and

iii. 12.5 million will vest and convert to Shares upon delineation of a JORC inferred resource of >20MT at >1,000 ppm TREO and/or >0.5% Nb2O5 on WA REE Tenements (Milestone 3); and

d) 15 million unquoted options to acquire Shares with an exercise price of $0.25 and an expiry date of 30 December 2026 (Unquoted Consideration Options) issued to Sandton Capital Pty Ltd (or its nominees), of which:

i. 5 million vest upon achieving Milestone 1;

ii. 5 million vest upon achieving Milestone 2; and

iii. 5 million vest upon achieving Milestone 3.

Nine (9) of the Vendors who have collectively been issued with 73,467,088 Consideration Shares and 36,733,544 Quoted Consideration Options have entered into six month voluntary escrow agreements with the Company.

Flash Metals owns all of the shares in FJ Processing Pty Ltd which holds the Flash Joule Heating technology licensing option and which has funded the initial development of the prototype of the Flash Joule Heating test module.

Click here for the full ASX Release

This article includes content from MTM Critical Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MTM:AU

The Conversation (0)

25 September 2023

MTM Critical Metals

Exploring Highly Prospective REE and Niobium Projects in Quebec and Western Australia

Exploring Highly Prospective REE and Niobium Projects in Quebec and Western Australia Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00