June 19, 2023

Queensland Pacific Metals Limited (ASX:QPM) (“QPM” or “the Company”) is pleased to announce that 4N HPA has been successfully produced from the Lava Blue Demonstration Plant, located at QUT Redlands, Queensland.

Highlights

- Lava Blue’s Demonstration Plant successfully commissioned late May / early June.

- Kilogram batches of better than 99.99% (“4N”) High Purity Alumina (“HPA”) have been produced from aluminium hydroxide feed source.

- Total production of 60kg is being targeted for production for customer evaluation.

- Production of 4N HPA from the Demonstration Plant is a major technical milestone in the pathway towards commercial production.

- Product produced from the Demonstration Plant is critical for QPM’s offtake marketing efforts and will be provided to potential customers.

Demonstration Plant

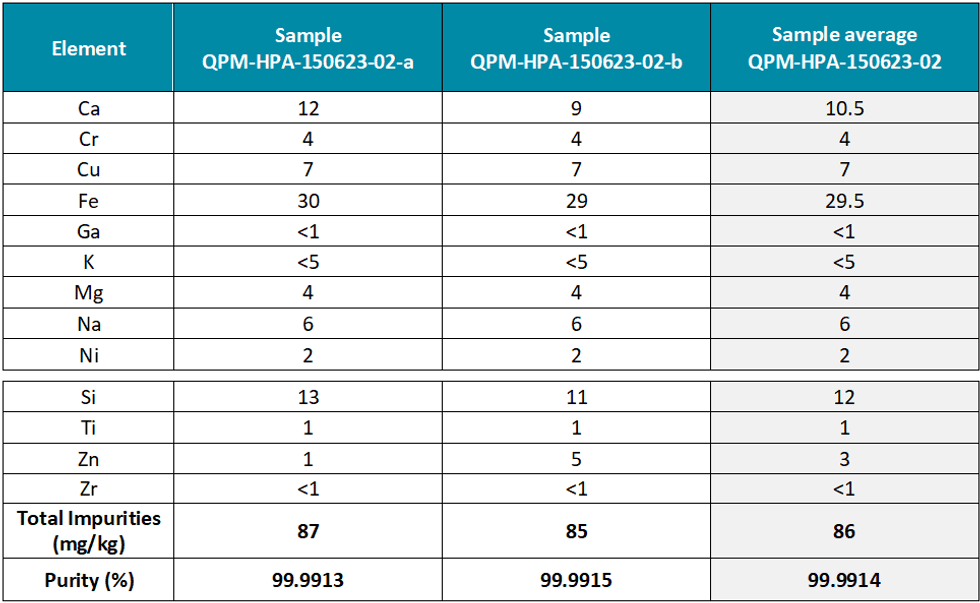

As with the TECH Project, QPM and Lava Blue procured aluminium hydroxide as a feed source for the Demonstration Plant. Production from Lava Blue’ HPA demonstration facility in Brisbane has begun to ramp up and kilogram scale samples produced during commissioning are achieving better than 4N purity despite progressively diminishing contamination from commissioning new kilns. The results of a composite sample, produced June 15, and tested for purity in the QUT laboratory that is dedicated to the Lava Blue HPA project, are tabulated below.

Duplicates of the sample were tested and both the primary results of each test and the average of the test are displayed. While the results demonstrate greater than 99.99% purity is being achieved, higher than desirable iron, silicon and calcium contamination levels have been detected and are attributed to ‘curing” of new kiln internals.

Both QPM and Lava Blue are excited to have achieved 4N HPA during the commissioning phase of this project. Lava Blue will continue to operate the Demonstration Plant with a target of producing 60 kg of 4N HPA. The operation of the Demonstration Plant is also providing valuable technical information for the design of commercial scale plant.

QPM is also seeking to actively engage with potential HPA customers. It has recently appointed an in-house Technical Marketing Manager who will drive these efforts in cnjnn with external HPA marketing experts. The samples from the Demonstration Plant will be critical to customer engagement.

Click here for the full ASX Release

This article includes content from Queensland Pacific Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

QPM:AU

Sign up to get your FREE

Queensland Pacific Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

20 April 2022

Queensland Pacific Metals

Developing a Sustainable and High-Purity Battery Materials Refinery Project

Developing a Sustainable and High-Purity Battery Materials Refinery Project Keep Reading...

Keep reading...Show less

25 February

Oregon: America’s Premier Domestic Nickel Opportunity

The global race for critical minerals has begun. As the US stares down a future of massive industrial shifts, the strategy is clear: secure the supply chain or get left behind. Demand for nickel is hitting overdrive, fueled by its role in electric vehicle (EV) batteries, high-strength stainless... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Sign up to get your FREE

Queensland Pacific Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00