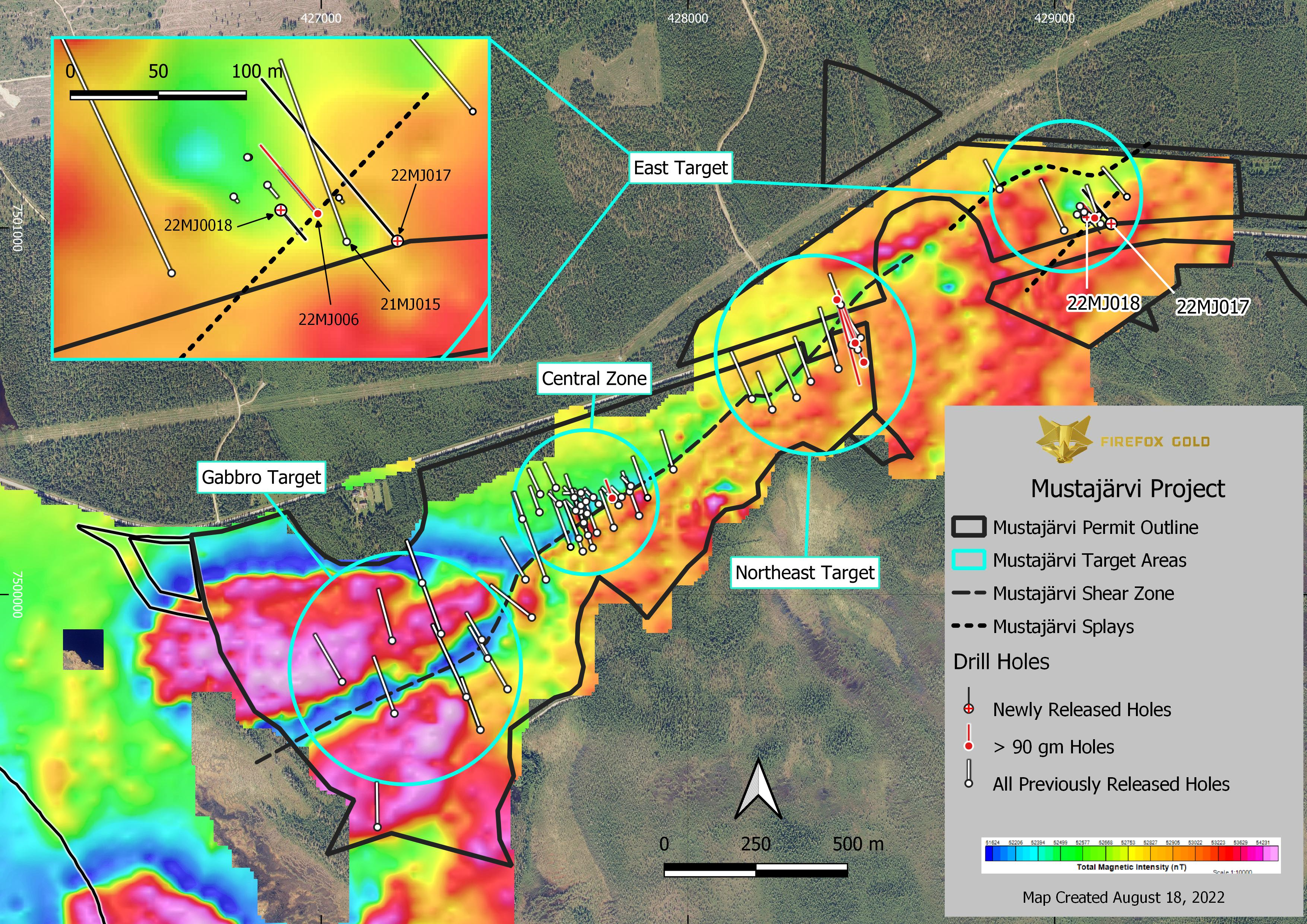

FireFox Gold Corp. (TSXV:FFOX)(OTCQB:FFOXF) ("FireFox" or the "Company") is pleased to report the final results from its 2021 - 2022 drilling program at the Company's 100%-held Mustajärvi Gold Project in Lapland, Finland. The last two core holes (22MJ017 and 22MJ018) tested the East Target (see Figure 1), which hosts the best drill hole to date from the project: 13.85 metres averaging 14.39 gt gold in 22MJ006 (see Company news release dated July 13, 2022). Both of these drill holes encountered significant gold mineralization, sometimes coming to surface beneath thin glacial sediments

Hole 22MJ018 returned multiple significant gold intervals starting near-surface and continuing to depths of approximately 80 metres, an extension of nearly 50 metres down-plunge from previous drilling at this location. The intercepts are summarized below, but in aggregate, the grade-thickness of gold mineralization in this hole is more than 110 gram-metres. FireFox has now drilled six holes into three different target areas at Mustajärvi with > 90 gram-metres of gold mineralization. These intercepts occur along more than 1.5km strike of the shear zone.

The strongest intercepts from both new holes are highlighted below, and additional details are provided in Table 1:

- 22MJ017: 1.0m at 9.42g/t Au from 70.7m depth;

- 22MJ018: 11.6m at 5.06 g/t Au from 10.3m depth, including

- 4.2m at 10.60 g/t Au from 17.7m depth;

- 22MJ018: 4.6m at 7.91 g/t Au from 77.2m depth, including

- 1.7m at 11.19 g/t Au from 77.20m depth.

"These results cap off a very successful program at Mustajärvi that has seen us drill many new gold intervals including three new +100 gram-metre holes," commented Carl Löfberg, President of FireFox Gold. "While our structural model holds up well in the East Target, the team has also noted some potentially important changes in host rock and alteration. The strike length of the system is impressive and each round of drilling yields high-grade gold intercepts. We are hard at work on the evolving interpretation of the results and planning for more drilling in the last quarter of the year."

Mustajärvi Project and Drill Program Details

The Mustajärvi Project lies along the highway between the cities of Kittilä and Sodankylä, approximately 17 kilometres east of Kittilä. The property straddles the Mustajärvi Shear Zone (MSZ), a major right-lateral shear zone that has associated second and third-order structures which further dissect the project into separate structural zones. The Sodankylä Group rocks, which are primarily to the north of the shear zone in the footwall, include metamorphosed sedimentary and volcaniclastic rocks. Geophysics and drilling have identified an extensive corridor of albite - sericite alteration in the footwall along more than two kilometres of the structure. The project remains at an early stage as FireFox and predecessor companies have drilled approximately 11,644 metres to date.

FireFox's structural model identified repetitive dilatant zones along the MSZ where vein swarms and higher-grade gold are concentrated. Three main areas of gold with significant mineralization have been identified along a 2.1-kilometre segment of the MSZ, namely the Central Zone, the Northeast Target, and the Eastern Target. The recently completed drill program at Mustajärvi included 23 diamond drill holes for a total of 4,624 metres between October and May, which included drilling at the Northeast Target and the recently reported drill tests at the Central Zone and Gabbro Target, but much of the focus was on the newly discovered East Target.

The final two drill holes of the campaign were collared in the East Target (see Figure 1) and returned significant gold intervals as shown in Table 1 and described below.

Table 1: Summary of Significant Drill Intercepts

Cut-off Grade 0.5 g/t Au

Drill Hole | From (m) | To (m) | Interval* (m) | Gold (g/t) | Grade - Thickness (gram - metres) |

22MJ018 | 10.3 | 21.9 | 11.6 | 5.06** | 58.7 |

including | 17.7 | 21.9 | 4.2 | 10.6 | |

including | 1.3 | 21.3** | |||

and including | 19 | 20 | 1.0 | 7.39 | |

and including | 20.9 | 21.9 | 1.0 | 8.42 | |

30.7 | 34 | 3.3 | 2.97 | 9.8 | |

including | 31.5 | 32.3 | 0.8 | 4.91 | |

and including | 33.2 | 34 | 0.8 | 8.57 | |

46.6 | 47.6 | 1.0 | 6.10 | 6.1 | |

62.7 | 63.7 | 1.0 | 0.89 | 0.90 | |

77.2 | 81.8 | 4.6 | 7.91 | 36.3 | |

including | 77.2 | 78.9 | 1.7 | 11.19** | |

22MJ017 | 70.7 | 71.7 | 1.0 | 9.42** | 9.42 |

| * Drilling is believed to be perpendicular to the dip of the mineralization, however true widths are not yet known and will be confirmed with additional drilling and geological modelling. ** Selected intervals were subjected to a 1,000gm screen fire assay designed to capture coarse gold | |||||

The East Target mineralization exhibits extensive albite - sericite alteration, as is typical along the MSZ, but iron oxide and iron carbonate veining is more common in this eastern part of Mustajärvi. Similar to previously reported holes from the East Target, the gold mineralization is associated with fractures and impregnation of partially oxidized pyrite along fractures, forming blebs, nests, disseminated and semi-massive mineralization within the host rock. The deeper mineralized intervals include the more typical quartz-carbonate-tourmaline-pyrite (QCTP) vein style of mineralization commonly seen at Mustajärvi.

Drill hole 22MJ018 was a twin hole designed to test for depth continuation of gold mineralization identified in drill hole 22MJ011, which was drilled to only 33 metres using a light hybrid drill rig. That hole intersected three significant gold intervals and ended in a 2-metre interval of semi-massive pyrite mineralization that assayed 5.11 g/t Au and was strongly enriched in silver (Ag), bismuth (Bi), tellurium (Te), selenium (Se), cobalt (Co), nickel (Ni), and tungsten (W) (see Company news Release dated July 13, 2022).

Drill hole 22MJ018 was collared in thin glacial sediments overlying intensely altered intermediate tuffites and intersected gold mineralization immediately beneath the glacial cover starting at 10.3 m down-hole. Like its predecessor 22MJ011, this hole returned several gold intervals in the top 35 metres, including 11.6 m averaging 5.06 g/t Au. The highest-grade intercept was 1.3 m at 21.3 g/t Au from 17.7 m depth. In addition, the hole successfully confirmed that gold mineralization continues past the depth of the previous hole by at least 46 metres. In fact, the upper 80 metres of the drill hole included a total of 16 assay intervals exceeding 1.0 g/t gold.

The near-surface high-grade gold mineralization is associated with strong enrichment of Co, Ni and Te. The hole intersected semi-massive and massive pyrite intervals that returned 8.1m averaging 0.17% Co from 13.8m depth and 2.3m averaging 0.37% Co from 17.7m depth, including 1.3m averaging 0.46% Co from 17.7m depth.

At approximately 85 metres depth, this drill hole encountered a zone of intensely altered ultramafic volcanic rocks. The ultramafic rocks were only weakly anomalous in gold, but a 4.6 metre interval just above the ultramafics averaged 7.91 g/t gold. This association of disseminated pyrite and fuchsite (a green mica containing elevated chromium) in ultramafic rocks with nearby gold is noted at a number of other gold occurrences in Lapland, as well as other greenstone belts around the world. FireFox geologists have now noted the altered ultramafic rocks in several of the holes in the East Target.

Drill hole 22MJ017 was collared 70 metres to the southeast from drill hole 22MJ018, also in thin glacial sediments (approximately 8.8 metres thick) and passed quickly into unaltered ultramafic volcanic rock. It was designed to test an interpreted magnetic low and possible splay in the MSZ. Drilling passed back into the intermediate tuffites, which are commonly albite-sericite altered and variably veined. One of the QCTP veins at approximately 70.7 metres downhole contained 9.42 g/t gold over 1.0 metre.

Deeper in the hole, faulting appears to increase, and the rock is commonly mylonitized. Thin units of mafic to ultramafic volcanics dominate the lithology below 125 metres depth, often cut by veins of various composition. There are multiple intervals of silica carbonate alteration with variable fuchsite, disseminated pyrite, and (rare) chalcopyrite. Once again, the abundant mylonite cutting chrome-altered mafic and ultramafic rocks appear to underly the gold mineralization in the East Target.

Table 2: Mustajärvi 2022 Collar Information(coordinates presented in EPSG:3067).

Drill Hole | Easting | Northing | Azimuth (°) | Plunge (°) | Final Depth (m) |

22MJ017 | 429154 | 7501012 | 320 | 45 | 169.6 |

22MJ018 | 429088 | 7501029 | 140 | 80 | 125.3 |

Methodology & Quality Assurance

The core was transported from the rig to the Company´s core storage facility in Sodankylä, where FireFox's exploration team conducted the geological and geotechnical logging and selected the assay intervals. Assay intervals were generally 1 metre but in some circumstances were modified according to lithological boundaries and other factors. FireFox geologists maintained chain of custody and sampling procedures according to best industry practice and with due attention to quality assurance and quality control, including sampling field duplicates and insertion of certified standard and blank samples.

FireFox team members transported the samples to an ALS sample prep lab in Sodankylä. The samples were sawed then crushed to -2 mm, split and pulverized into 1kg pulps, before being shipped to the ALS facility in Rosia Montana, Romania for gold by fire assay of 50 gm aliquots with AAS finish (method Au-AA24). Selected samples were assayed with a 1,000 gram Au-SCR24 method (screen fire assays). Other elements, altogether 48, were measured after four-acid digestion by ICP-AES and ICP-MS (method ME-MS61) at the ALS facility located in Loughrea, Ireland.

ALS Laboratories is a leading international provider of assay and analytical data to the mining industry. All ALS geochemical hub laboratories, including the Irish facility, are accredited to ISO/IEC 17025:2017 for specific analytical procedures. The Firefox QA/QC program consists of insertion of certificated standard material and blanks inserted by Firefox into the analytical batches did not show deviations from recommended values.

Patrick Highsmith, Certified Professional Geologist (AIPG CPG # 11702) and director of the Company, is a qualified person as defined by National Instrument 43-101. Mr. Highsmith has helped prepare, reviewed, and approved, the technical information in this news release.

Dr. Sven Hönig, Certified European Geologist (EFG EurGeol Title # 1789) and General Manager of Exploration for the Company, is a qualified person as defined by National Instrument 43-101. Dr. Hönig has supervised the field work reported herein and has helped to prepare and approves, the technical information in this news release.

About FireFox Gold Corp.

FireFox Gold Corp is listed on the TSX Venture Stock Exchange under the ticker symbol FFOX. FireFox also trades on the OTCQB Venture Market Exchange in the US under the ticker symbol FFOXF. The Company has been exploring for gold in Finland since 2017 where it holds a huge portfolio of prospective ground.

Finland is one of the top mining investment jurisdictions in the world as indicated by its multiple top-10 rankings in recent Fraser Institute Surveys of Mining Companies. Having a strong mining law and long mining tradition, Finland remains underexplored for gold. Recent exploration results in the country have highlighted its prospectivity, and FireFox is proud to have a Finland based CEO and technical team.

For more information, please refer to the Company's website and profile on the SEDAR website at www.sedar.com.

On behalf of the Board of Directors,

"Carl Löfberg"

Chief Executive Officer

CONTACT:

FireFox Gold Corp.

Email: info@firefoxgold.com

Telephone: +1 778-938-1994

Forward Looking Statements

The information herein contains forward looking statements that are subject to a number of known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those anticipated in our forward-looking statements. Factors that could cause such differences include changes in world commodity markets, equity markets, the extent of work stoppage and economic impacts that may result from the COVID 19 virus, costs and supply of materials relevant to the mining industry, change in government and changes to regulations affecting the mining industry.

Forward-looking statements in this release may include statements regarding: the intent to conduct additional drilling; the belief as to the location of the most prospective gold targets; the location of targets for future drill programs; and the current and future work program, including the extent and nature of exploration to be conducted in 2022. Although we believe the expectations reflected in our forward-looking statements are reasonable, results may vary.

The forward-looking statements contained herein represent the expectations of FireFox as of the date of dissemination and, accordingly, are subject to change after such date. Readers should not place undue importance on forward-looking statements and should not rely upon this information as of any other date. FireFox does not undertake to update this information at any particular time except as required in accordance with applicable laws.

SOURCE: FireFox Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/713424/FireFox-Gold-Reports-More-Shallow-High-Grade-Gold-from-the-East-Target-at-the-Mustajrvi-Project-Finland