December 11, 2024

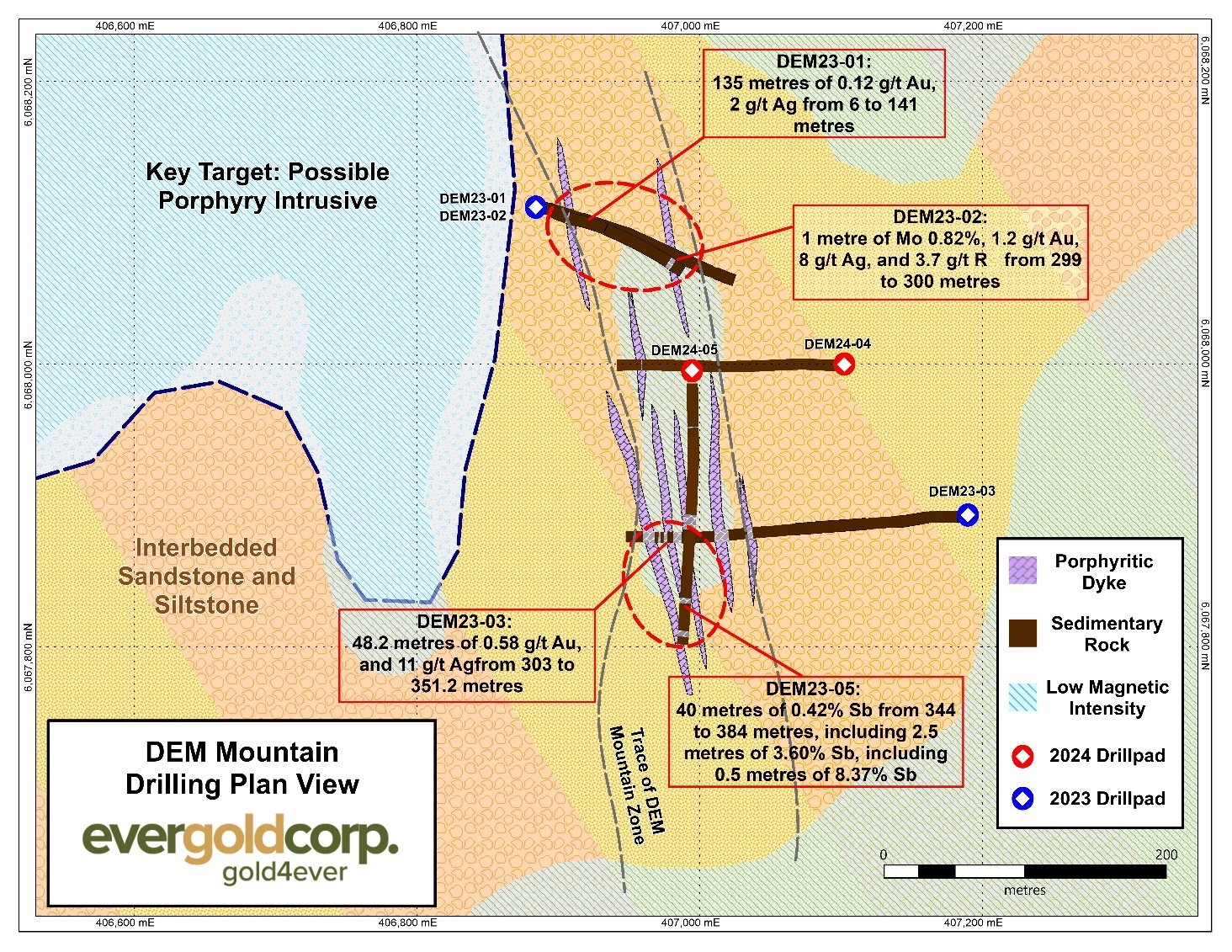

Evergold Corp. (TSX-V: EVER, WKN: A2PTHZ) (“Evergold” or the “Company”) is pleased to report assay results for two core holes (DEM24-04 and DEM24-05) completed on the DEM Mountain Zone near Fort St. James, B.C. in early October this year, in follow up to highly encouraging results from an initial 3-hole drill program (DEM23-01,02,03), carried out in fall 2023 (see news, January 15, 2024). The DEM Mountain Zone consists of a polymetallic sulphide-bearing vein and vein-breccia and related alteration system hosted within what is interpreted to be a zone of hornfels developed around an intrusive centre (see figures, below). The latest results, combined with those of the fall 2023 program, demonstrate a broad zone endowed locally with elevated precious and high-value critical elements, each locally exhibiting high grades at the level of individual half to two metre lengths in core samples, or consecutive samples, including values to highs of 8.37% antimony (DEM24-05), 29.5 g/t gold (DEM23-03), 182 g/t silver (DEM23-03), 0.12% cobalt (DEM23-03), 42 g/t tellurium (DEM23-03), 0.83% molybdenum (DEM23-02), 3.7 g/t rhenium (DEM23-02), and 0.32% tungsten (DEM23-01). In general, all of the higher-grade intervals are associated with, or encompassed by, an envelope of anomalous pathfinder elements and gold and silver. For example, an estimated true width 48 metres of 0.58 g/t gold and 11 g/t silver in DEM23-03, and 135 metres of 0.12 g/t Au from surface in DEM23-01.

Highlights, DEM Mountain Zone (Note: Drill results from 2023 core holes DEM23-01 and DEM23-02, which collared in the anomalous zone, coupled with gridded soil sample results, suggest that the DEM Mountain Zone approaches surface. Antimony is presently valued at approximately $US33,000 per tonne, or roughly 3.5 times the value of copper. See comments below.)

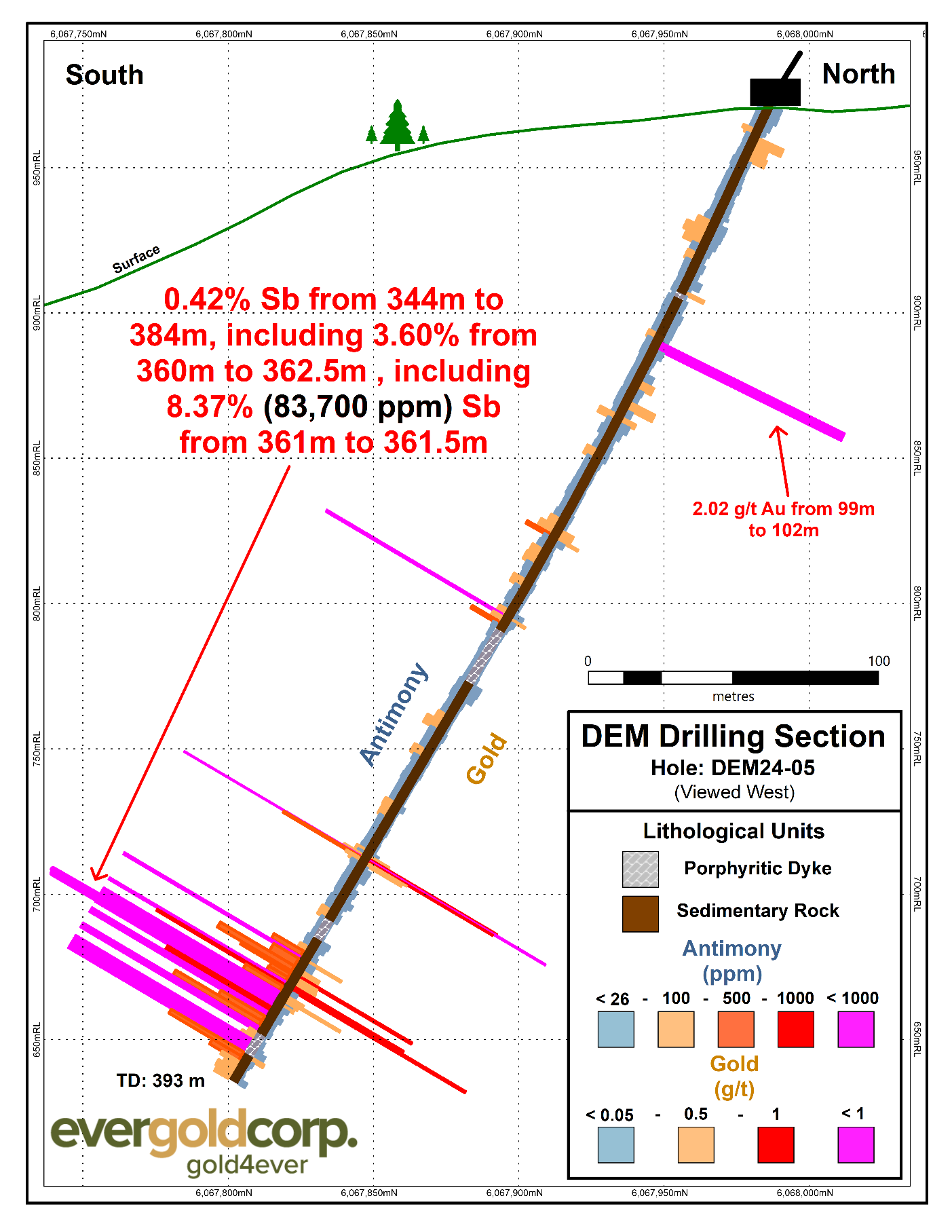

- High-grade antimony: The DEM Mountain Zone delivers the highest grades of antimony seen in actual drilling from any Canadian mineral prospect in recent years. This includes individual core assay highs to 8.37% antimony over 0.50 metre within 40 metres of 0.42% antimony in DEM24-05, including 3.60% antimony over 2.5 metres (see core photos, below). Note: the industry generally considers “substantially elevated” grades of antimony mineralization as containing greater than 0.40% antimony and cut-offs for extraction purposes may be as low as 0.1% antimony.

- High-grade antimony with elevated silver, and some gold: 1.67% antimony (not previously reported) with 182 g/t silver and 2.89 g/t gold over half a metre in DEM23-03 (core photos, below).

- High-grade gold, with some antimony, cobalt and high-grade tellurium: 29.5 g/t gold and 22 g/t silver with 0.09% antimony, 0.12% cobalt, and 41.5 g/t tellurium over half a metre in DEM23-03 (core photos, below).

- A broad zone: The DEM Mountain Zone, as defined by visible alteration and the persistence, sample-to-sample within the zone of highly elevated values of its various defining elements - particularly manganese and arsenic - is broad in the two directions Evergold has intersected it from to date – i.e. an estimated 48 metres true width from 303 to 351.2 metres in west azimuth hole DEM23-03, and an estimated 40 metres (true width unknown) from 344 to 384 metres in south drilling hole DEM24-05.

- Rich in high-value elements: The DEM Mountain Zone carries an impressive array of high-value elements: system pathfinder elements manganese and arsenic; precious metals gold and silver; and critical mineral elements antimony, zinc, copper, cobalt, tellurium, molybdenum, rhenium and tungsten.

- Local higher-to-high grades of all the above elements: The foregoing elements have been shown to be strongly elevated to high-grade at the level of individual samples or consecutive samples, including antimony to sample highs of 3.6% Sb over 2.5 metres including 8.4% Sb over half a metre in DEM24-05, tellurium to highs of 42.0 g/t Te over half a metre in DEM23-03, cobalt to sample highs of 0.12% over half a metre in DEM23-03, molybdenum to highs of 0.82% Mo over 1 metre in DEM23-02, rhenium to highs of 3.7 g/t Re over 1 metre in DEM23-02, and tungsten to highs of 0.32% W over 1 metre in DEM23-01.

“Antimony has emerged as a focus for speculative interest this year, because of its outsize role in various technology and military applications, and supply shortages precipitated by China’s banning of exports, including those to the U.S. just last week,” said Kevin Keough, President and CEO. “A number of junior explorers have been attempting to capitalize on this interest by touting property acquisitions and high values of antimony in grab samples. However, our results are, to the best of our knowledge, the only antimony-rich drill results delivered year-to-date in Canada. At the DEM Mountain Zone we have drilled genuinely high-grade antimony over metre+ widths within much larger envelopes, with associated gold and silver credits – and locally, high-grade gold and a number of other high-value elements – all of them in the same system, though not always in the same samples. I am therefore confident that, as the drill density is brought up within this system, and exploration expands beyond the relatively small magnetic low associated with the DEM Mountain Zone into areas below and adjacent to these early intersections, including the large magnetic lows adjacent to the west, we will see the DEM project evolve in a direction that rewards shareholders.”

Discussion of Drill Results (refer to figures and photos below)

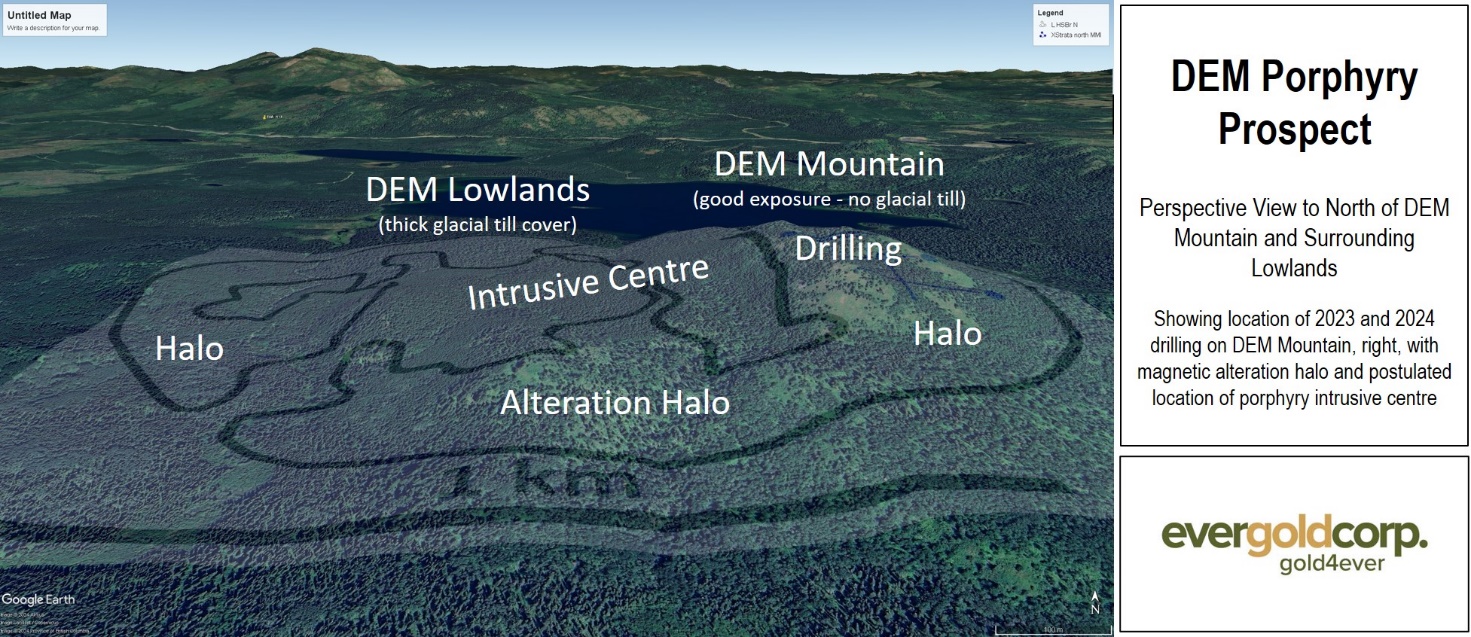

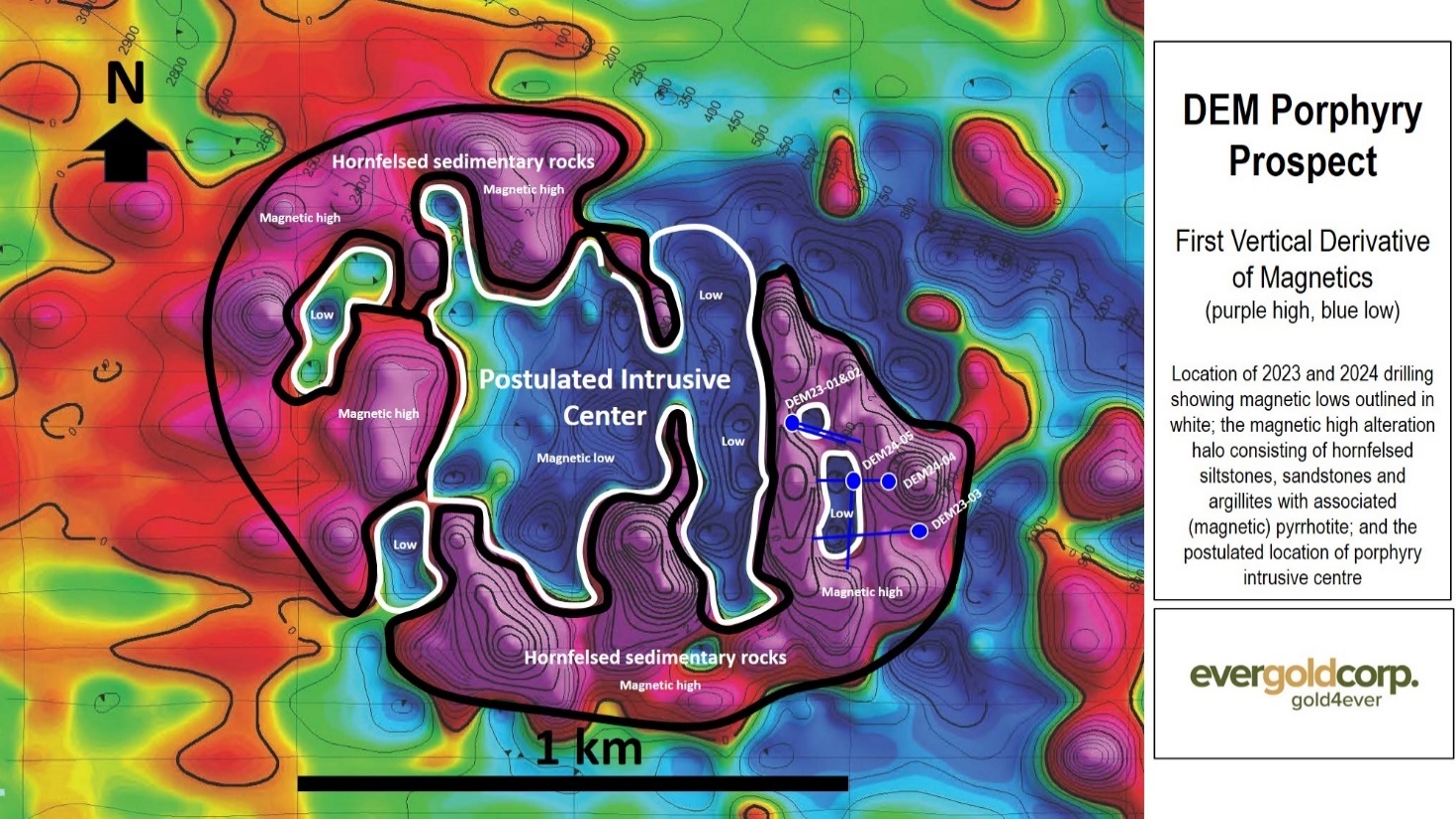

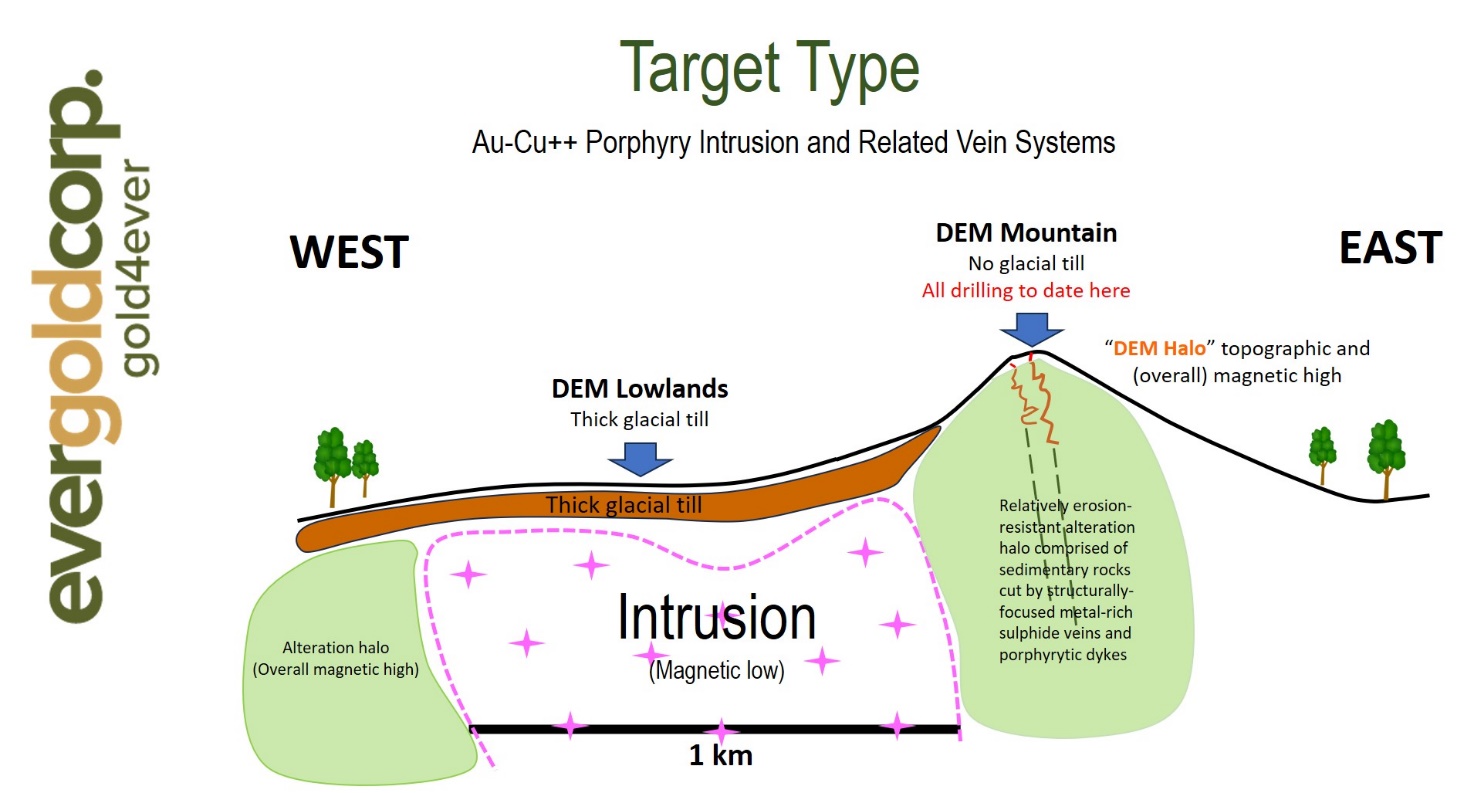

Drilling to date (three holes for 947 metres in 2023, and two holes for 654 metres in 2024) at the DEM prospect has focused only on that small part of the 4 km2 DEM prospect area that underlies the topographic and (overall) magnetic highs of DEM Mountain. DEM Mountain is surrounded by the generally much lower elevations of the DEM Lowlands (see Figures 1 and 4 below, and DEM Mountain fly-over videos on Evergold’s home page at www.evergoldcorp.ca) which include several low-relief knolls trending off from DEM Mountain to the west, coincident with a roughly donut-shaped arc of underlying magnetically positive anomalies. DEM Mountain and these knolls are now interpreted to be part of the topographically higher elevation, relatively well exposed hornfelsed and (generally) magnetically positive alteration halo possibly surrounding a topographically lower and glacial till-covered intrusion, or intrusions, principally underlying the DEM Lowlands, and identified in part by magnetic lows; the lows also exhibit locally high IP chargeability and low resistivity.

DEM24-05 was drilled due south (azimuth 180 degrees) at an inclination of minus 65 degrees to a downhole depth of 393 metres, from a pad located 100 metres due west of DEM24-04. The hole was designed to target the broad mineralized volume intercepted between 303 and 351.2 metres in DEM23-03. At 230 metres downhole the hole came in above the zone intersected in DEM23-03, approached to within several tens of metres of it, before intersecting a deeper zone of strongly elevated manganese and antimony to the south, between 344 and 384 metres downhole. Within that zone, exceptional highs of 3.6% Sb over 2.5 metres were achieved between 360 and 362.5 metres.

DEM24-04 was drilled due west (azimuth 270 degrees) at an inclination of minus 50 degrees to a downhole depth of 261 metres from a pad located 100 metres north and 100 metres west of the site of DEM23-03, and roughly 100 metres south and 200 metres east of the collars for DEM23-01 and DEM23-02. This relatively shallow angle hole was designed to undercut a strong north-south trending soil geochemical anomaly which, further to the northwest at the site of last season’s DEM23-01 & 02, delivered a long intercept from surface of anomalous gold - i.e. 135 metres of 0.12 g/t Au and 2 g/t Ag from 6 to 141 metres, including a higher-grade interval running 0.32% tungsten with 155 g/t silver and 5 ppm tellurium, from 131 to 132 metres. However, only disappointingly low silver and gold values were returned from DEM24-04. We speculate that this part of the DEM Mountain Zone may be slightly deeper in this area, and perhaps trending more toward the north-northeast.

Mineralization of the DEM Mountain Zone

The DEM Mountain Zone consists of variably calcareous fine-grained sedimentary rocks, principally interbedded sandstone and siltstone, cut locally by north-trending metre-scale porphyritic dykes, with the host rocks cut by variably sulphide-bearing veinlets and veins, very locally of semi-massive to massive character, and commonly associated with disseminated sulphides. Sulphide minerals observed in core include arsenopyrite, pyrite, pyrrhotite, stibnite, sphalerite, galena, chalcopyrite, and molybdenite. Sulphosalts are also observed locally. High-grade precious metals, antimony, and tellurium, along with attendant cobalt, zinc, and lead values are localized to the best developed parts of the vein systems, particularly the massive sulphide sections, whereas the molybdenum, although present at elevated levels generally throughout the vein system, achieves high grades within a single narrow porphyritic intrusive (dyke) intercepted from 299 to 301 metres in DEM23-02, where it is accompanied by high-grade rhenium as well as gold, silver and the suite of elements characterizing other parts of the DEM mineralizing system. Very speculatively, the dyke may represent an apophysis from a larger body of porphyry-style mineralization nearby, although most dykes intercepted in the drilling appear to be unmineralized.

About Antimony

One of antimony’s primary uses (accounting for about 50% of consumption) is in the form of antimony trioxide in flame retardants for plastics, rubber, textiles, paper and paints, whereas antimony trisulfide is used in the production of explosives, pigments and antimony salts. It can also be used for producing semiconductors, infrared detectors and diodes. Because of its relative inflexibility, it is usually mixed into alloys for further applications in the manufacture of lead storage batteries, solder, sheet and pipe metal, bearings, castings etc. The latest new technology to utilize the metal is antimony molten salt batteries for mass storage. However, the relatively new use of antimony in the form of sodium antimonate as a clarifying agent in photovoltaic (PV) glass, which improves the efficiency of solar panels, is expected to surpass its use in flame-retardants in the very near future.

According to the United States Geological Survey, total global antimony mine production in 2023 was approximately 83,000 tonnes, with China producing more than 40,000 tonnes, or 48% of the total, followed by Tajikistan at 21,000 tonnes (26%), Turkey at 6,000 tonnes (7.2%), Myanmar at 4,600 tonnes (5.5%), Russia at 4,300 tonnes (5.2%), Bolivia at 3,000 tonnes (3.6%), and Australia at 2,300 tonnes (2.8%), with various other countries making up the remainder. China’s mine production has fallen significantly in recent years due to depleting mine reserves, problems with maintaining product quality, and tighter environmental protection regulations. On September 15 this year, China implemented export restrictions on antimony and related products including ore, ingots, oxides, chemicals and smelting and separation technology. This was followed, on December 3, 2024, by an outright banning of all exports of antimony to the U.S.. Elsewhere, internal conflict in Myanmar has led to limited and unreliable supplies coming out of southeast Asia, and Russian supplies to the West have been eliminated due to sanctions imposed following their invasion of Ukraine. These negative supply shocks drive home the importance of securing reliable sources of antimony, and other critical elements.

In consequence of the reduction in supplies, antimony prices have soared in 2024 from around $US12,000 a tonne at the beginning of the year, to $US33,000 presently, or almost 4 times the current value of copper per tonne.

In recognition of the importance of antimony to a wide range of industrial and military applications, the high degree of control exerted over world production by a limited number of authoritarian states, and the decline of supplies from those states, antimony has become one of the few metals to be registered as critical in the rankings of all countries in the West: i.e. the US, EU, Canada, Japan, UK and Australia.

Table 1 – Significant Assay Results for Diamond Core Holes DEM24-04 and 05. Note: Both DEM24-04 and 05 were sampled top to bottom. All widths reported are drilled core lengths. Due to the low density of drilling to date, true widths for the intercepts in both DEM24-04 and 05 cannot presently be determined. However, data gathered from 2023 drill hole DEM23-03 suggests zone width may approximate 50 metres, although this estimate may change with the acquisition of additional data. Core diameter is 47.6 mm (NQ). Manganese and arsenic values have been determined to be the key indicators of system presence.

| 2024 Hole ID | From (m) | To (m) | Width (m) | Au (g/t)1 | Ag (g/t)2 | Sb (%)1 |

| DEM23-04 (fully sampled) – no significant assays (hole drilled above the zone?) | ||||||

| DEM23-05 (fully sampled) – strong intercept | ||||||

| 303.00 | 306.00 | 3.00 | 0.70 | 14 | 0.03 | |

| Including | 303.50 | 304.00 | 0.50 | 2.19 | 50 | 0.11 |

| Zone intercept – first occurrence of high-grade antimony to last | 344.00 | 384.00 | 40.00 | 0.10 | 2 | 0.42 |

| Including | 344.00 | 345.00 | 1.00 | 0.18 | 7 | 0.74 |

| And Including | 350.00 | 351.00 | 1.00 | 0.63 | 3 | 0.03 |

| And Including | 354.00 | 356.00 | 2.00 | 0.80 | 10 | 0.09 |

| Including | 355.00 | 356.00 | 1.00 | 0.98 | 17 | 0.07 |

| And Including | 358.00 | 364.00 | 6.00 | 0.10 | 2 | 1.63 |

| Including | 360.00 | 362.50 | 2.50 | 0.06 | 1 | 3.60 |

| Including | 361.00 | 361.50 | 0.50 | 0.04 | 2 | 8.37 |

| And Including | 366.00 | 368.00 | 2.00 | 0.06 | 2 | 0.37 |

| And Including | 372.00 | 374.15 | 2.15 | 0.04 | 1 | 0.52 |

| And Including | 377.00 | 382.40 | 5.40 | 0.03 | 1 | 0.67 |

| Including | 379.00 | 380.00 | 1.00 | 0.03 | 1 | 2.42 |

Notes: 1. Values rounded to two decimals. 2. Values rounded to no decimals.

Figure 1 - DEM prospect perspective view of terrain looking north, showing postulated central intrusion, its encompassing alteration halo, and the location of drilling to date on the heights of DEM Mountain

Figure 2 - DEM prospect showing the postulated central intrusion, its encompassing alteration halo, and the location of drilling to date, on the first vertical derivative magnetics

Figure 3 - DEM prospect schematic section view looking north, showing the postulated central intrusion or intrusions(?), with encompassing hornfels and/or alteration halo, and the location of drilling to date on the heights of DEM Mountain

Figure 4: DEM drilling on geology showing the targeted local magnetic low on the heights of DEM Mountain, and the considerably larger magnetic low immediately adjacent to the west

Figure 5 – Drillhole DEM24-05 section, viewed west

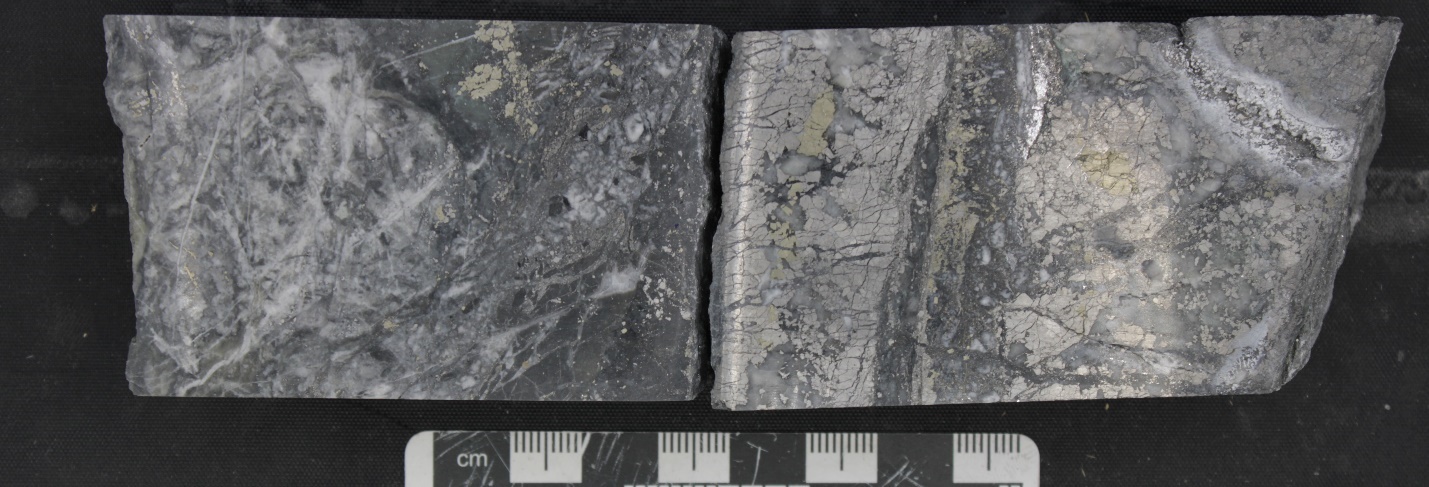

Photos 1 to 3 below: Core samples of antimony-rich vein-breccia showing darker grey, angular fragments of fine-grained sedimentary rock surrounded by paler grey stibnite (antimony sulphide) and white to very pale grey quartz-carbonate veining exhibiting drusy textures and local open space. The mineralization is significant, with abundant stibnite as breccia infill as well as clots and patches marginal to veins. Minor pyrite is also visible as clots within the host rock. The quartz-carbonate veins crosscut the sulphide vein breccia, suggesting that a multiphase high-level hydrothermal event occurred along an active structure - this combination was also evident in the better-mineralized intervals intersected in the 2023 drilling at Dem Mountain (see photos 4 and 5).

Photo 1: Antimony-rich core, 361 metres, DEM24-05

Photo 2: Antimony-rich core, 360.5 metres, DEM24-05

Photo 3: Antimony-rich core, 361 metres, DEM24-05

Photo 4 - High-grade gold (29.5 g/t), cobalt (0.11%), tellurium (42 g/t), with silver (22 g/t) and copper (0.19%) 340-340.50 metres, DEM23-03

Photo 5 - High-grade molybdenum (0.82%) with strong gold (1.2 g/t), silver (8 g/t), rhenium (3.66 g/t), 299 to 300 metres, DEM23-02

About the DEM Project

The 12,728-hectare DEM property is ideally located in moderate terrain only 40 kms northwest of Fort St. James in central B.C.. The project area lies toward the south end of the Nation Lakes porphyry camp and within the Quesnel terrane, the latter of which hosts large deposits and long-life mines including the Mount Milligan mine (50 kms to the northeast of DEM) and Lorraine deposit and, farther south, the Mt. Polley, Afton, Copper Mountain, and Brenda mines, in addition to the Highland Valley mines and deposits.

Located central to the DEM property is the DEM prospect, a roughly 4km2 target area defined by alteration and mineralogy suggestive of the presence of a porphyry system, by a multi-element soil geochemical signature, by compelling high-relief magnetic, IP-chargeability and CSAMT resistivity anomalies, and by the presence of nearby regional scale structures. Extensive logging in the area and associated forest service roads provide drive-on access directly to the DEM prospect.

A reconnaissance drill program (3 holes for 947 metres) carried out in October and November 2023 returned narrow intercepts of high-grade gold, silver and strategic metals (molybdenum, cobalt, tungsten, tellurium, rhenium) encompassed by a broad low-grade envelope, localized to a magnetic low within the high elevations of DEM Mountain (see news, January 15, 2024). Each of the three holes intercepted variably calcareous fine-grained sedimentary rocks cut locally by metre-scale porphyritic dykes, with the host rocks, and locally the dykes, cross-cut over core lengths of up to 50 metres by sulphide-bearing veinlets and veins, locally of semi-massive to massive character, along with associated disseminated sulphides. These intervals were also encompassed by broader halos of lower-intensity disseminated and sulphide-bearing veinlets and veins. Sulphide minerals observed in core included abundant disseminated and vein-hosted arsenopyrite, pyrite, and pyrrhotite, with lesser but significant sphalerite, galena, chalcopyrite, and molybdenite. Sulphosalts were also commonly observed.

Further details on the DEM prospect may be found on the Company’s website at www.evergoldcorp.ca/projects/dem-property/ and in a NI 43-101 technical report dated August 30, 2023, posted thereon and on the Company’s issuer profile at SEDAR+.

Qualified Person

Charles J. Greig, M.Sc., P.Geo., the Company’s Chief Exploration Officer and a Qualified Person as defined by NI 43-101, has reviewed and approved the technical information in this news release.

QA/QC

The company has a robust quality assurance/quality control program that includes the insertion of blanks, standards and duplicates. Samples of drill core are cut by a diamond-blade rock saw, with half of the cut core placed in individually sealed polyurethane bags and half placed back in the original core box for permanent storage. With the rare exception, sample lengths generally vary from a minimum 0.5-metre interval to a maximum 3.0-metre interval, with an average of 0.5 to 1.0 metres in heavily mineralized sections of core, where precise identification of the mineralogical source of metal values is important. Drill core samples are shipped by truck in sealed woven plastic bags to the ALS sample preparation facility in Langley, BC, and thereafter taken by ALS to their North Vancouver analytical laboratory. ALS operates according to the guidelines set out in International Organization for Standardization/International Electrotechnical Commission Guide 25. Gold is determined by fire assay fusion of a 50-gram subsample with atomic absorption spectroscopy (AAS). Samples that return values greater than 10 parts per million gold from fire assay and AAS (atomic absorption spectroscopy) are determined by using fire assay and a gravimetric finish. Various metals including silver, gold, copper, lead, antimony and zinc are analyzed by inductively coupled plasma (ICP) atomic emission spectroscopy, following multi-acid digestion. The elements copper, lead, antimony and zinc are determined by ore-grade assay for samples that return values greater than 10,000 ppm by ICP analysis. Silver is determined by ore-grade assay for samples that return greater than 100 ppm.

About Evergold

Evergold Corp. is a TSX-V listed mineral exploration company with projects in B.C. and Nevada. The Evergold team has a track record of success in the junior mining space, most recently the establishment of GT Gold Corp. in 2016 and the discovery of the Saddle South epithermal vein and Saddle North porphyry copper-gold deposits near Iskut B.C., sold to Newmont in 2021 for a fully diluted value of $456 million, representing a 1,136% (12.4 X) return on exploration outlays of $36.9 million.

For additional information, please contact:

Kevin M. Keough

President and CEO

Tel: (613) 622-1916

kevin.keough@evergoldcorp.ca

www.evergoldcorp.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Statement Regarding Forward-Looking Information

This news release includes certain “forward-looking statements” which are not comprised of historical facts. Forward- looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to failure to identify mineral resources, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate First Nations, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company’s public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

EVER:CA

The Conversation (0)

04 February

Australia Set to Join Global Critical Minerals Alliance Meeting

Australia is taking part in a ministerial meeting aimed at exploring a strategic critical minerals alliance alongside the US, Europe, the UK, Japan and New Zealand.According to media reports, the talks were convened by US Secretary of State Marco Rubio and are scheduled for February 4. The... Keep Reading...

27 January

Quarterly Activities/Appendix 5B Cash Flow Report

American Rare Earths Limited (ARR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

21 January

Forge Encounters Coal Seam amid Rising Coal Prices and Completes Resin Injections at La Estrella, Colombia

Forge Resources Corp. (CSE: FRG) (OTCQB: FRGGF) (FSE: 5YZ) ("Forge" or the "Company") is pleased to provide an operational update from its fully permitted flagship La Estrella coal project, located in Santander, Colombia. Underground development activities continue to advance steadily, supported... Keep Reading...

23 December 2025

ERG's Gallium Deal Puts Kazakhstan on Track to Become World's Top 2 Producer

Kazakhstan could be set to emerge as a key player in critical minerals and low-carbon metals as Eurasian Resources Group (ERG) moves ahead with gallium and iron projects in the country. During President Kassym-Jomart Tokayev’s state visit to Japan, ERG signed a long-term agreement to supply... Keep Reading...

19 December 2025

Australia Joins Global Pact to Secure Critical Minerals Supply Chains

Australia signed a critical minerals declaration at the Pax Silica Summit, alongside six other countries.Present at the December 12 summit were Australia, the US, Korea, Japan, the UK, Singapore and Israel.“The Pax Silica Summit is a United States-led initiative on securing technology supply... Keep Reading...

16 December 2025

Rare Earths Oxide Produced from Halleck Creek Ore-Major Technical Breakthrough

American Rare Earths (ASX: ARR | OTCQX: ARRNF | ADR: AMRRY) (“ARR” or the “Company”) has successfully completed another critical stage in its mineral processing program by producing a mixed rare earths oxide (“MREO”) using the updated preliminary PFS mineral processing flowsheet. HighlightsRare... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00