Investing in Graphene Companies

What Was the Highest Price for Silver?

What Was the Highest Price for Gold?

4 Platinum Uses for Investors to Know

Could the Silver Price Really Hit $100 per Ounce?

Overview

With a combination of climate change worries and energy security constraints afflicting the many nations of Europe, the European Union is looking to accelerate its already substantial green commitments. The EU’s Green Deal, which outlines the pathway to energy transition, is ambitiously aiming to become the first climate-neutral continent by 2050.

In addition to a commitment to spend at least €1 trillion on climate initiatives by 2030, the Green Deal also stipulates measures such as CO2 targets and includes a Strategy for Sustainable and Smart Mobility which calls for a 90 percent reduction in emissions from vehicles. In order to meet such an ambitious goal, 30 million zero-emission vehicles will need to be on the roads by 2030.

The Green Deal is turbocharging an already buoyant industry with electric vehicles gaining momentum around the world. The EV market now accounts for 29 percent of all passenger car sales in Europe in 2021, surpassing diesel vehicle sales. Analysts further predict that a quarter of new car sales would be electric in 2025.

However, to sustain this growth and satisfy its aggressive targets the European Union knows it needs more lithium, which was added to its critical raw materials list in 2020. The EU aims to develop a sustainable battery supply chain that covers the battery industry’s entire life cycle from sourcing raw materials to end-of-life recycling.

Yet, an official study reveals local production of lithium concentrates, which are essential for batteries that power EVs, is insignificant at 110 tonnes across the continent. So, how is the EU going to reach its goal of a sustainable supply chain? It comes down to having development-ready projects to create a local supply chain.

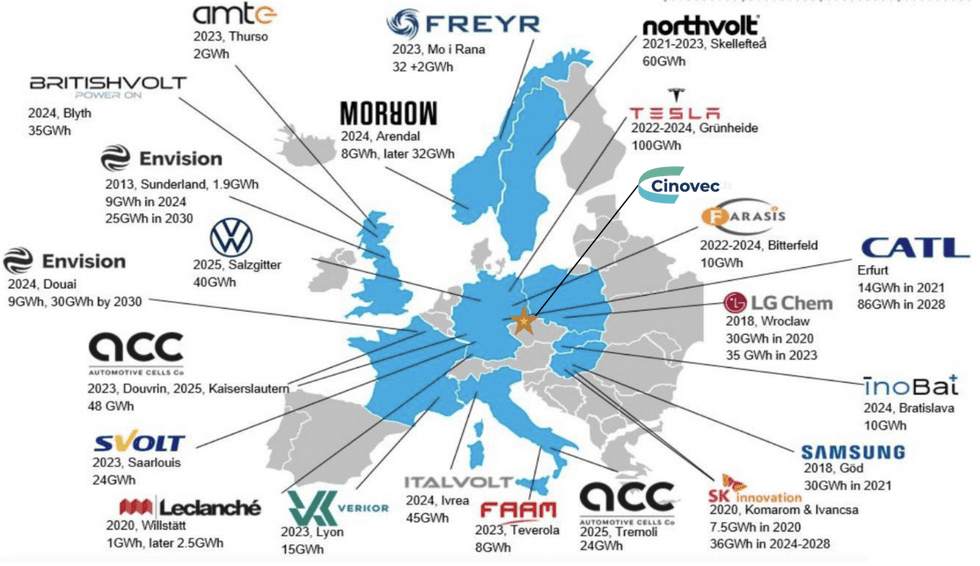

European Metals (ASX:EMH, AIM:EMH, NASDAQ:ERPNF), which is developing the Cinovec project, the largest hard rock lithium deposit in Europe. Cinovec is not only the largest deposit, it's bigger than every other hard rock lithium deposit in the European Union combined. It also possesses one of the largest undeveloped tin resources in the world.

European Metals is not only blessed with scale, but it also sits in an attractive neighborhood. The Cinovec project is located on the Czech Republic’s border with Germany, placing it centrally amongst Europe’s biggest battery and EV manufacturers – all of which are looking to secure a greater supply of lithium, which is critical to ongoing production.

European Metals’ Czech Republic location affords the company access to a number of key networks within the stable political system. Three organisations are already playing an important role in the project’s development:

- CEZ Group in the Czech Republic’s 70 percent state-owned power company which is also the largest utility and biggest public company in Central and Eastern Europe. The company is increasingly looking to transition away from gas and coal, leading the charge to build a lithium-ion battery industry within the country. CEZ is a key financial partner, having invested €29 million at the project level to date.

- European Metals holds a collaborative agreement with the European Institute of Innovation and Technology, a body of the European Union which provides support for offtake, financing, construction, and commercialisation. The organisation is the primary facilitator of the European Battery Alliance and is aiming to secure raw materials for the European battery market overall.

- SMS Group is European Metals’ lead engineering consultant. SMS is a German-owned company widely regarded as specialists in plant construction and engineering technology. The group is increasingly expanding its expertise in projects that involve critical metals. For European Metals, SMS is responsible for creating full process integration, taking raw materials from ore to battery-grade lithium. Importantly, SMS has agreed to provide process and product specification guarantees, further increasing confidence in the Cinovec operations.

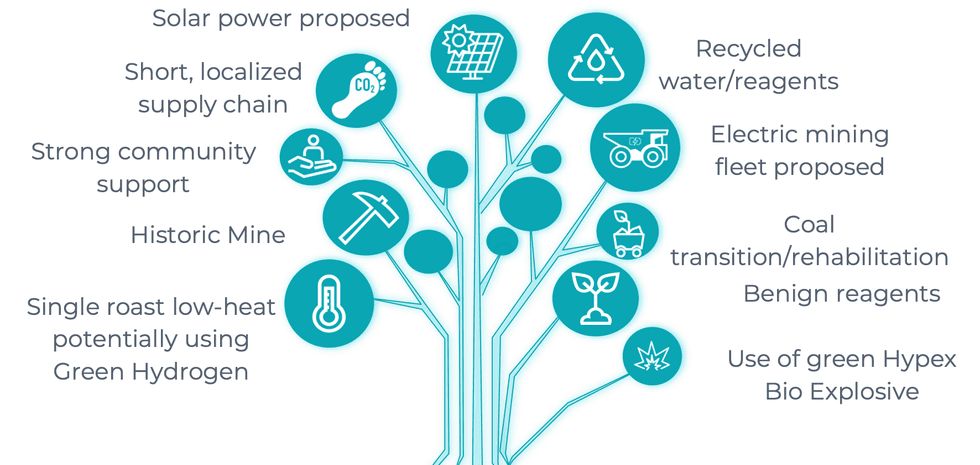

European Metals has maintained an excellent ESG profile throughout the development of Cinovec. The project is located in a historic mining district with strong community support, the existing underground workings ensure minimal disruption of the landscape and recycled water/reagents all contribute to a positive profile. Additionally, integrating solar power and an electric mining fleet has been proposed to further reduce the environmental impact of the operation.

Executive chairman Keith Coughlan discusses the importance of ESG in a recent interview, “It’s a positive to tick all the ESG boxes, which we have. But it means not all projects are alike. If you kick that down to the next stage, the people who buy our lithium and put it into their electric vehicles, when they’re assessed on their CO2 footprint for that vehicle — it goes all the way down the supply chain,”

“That’s another reason why the EU wants to develop its own resources. The CO2 impact of shipping long distances increases the emissions of that end product, that end vehicle. Nobody can operate in isolation anymore, it’s the whole supply chain that’s interrogated. We don’t want to cause more problems than we solve,” added Coughlan.

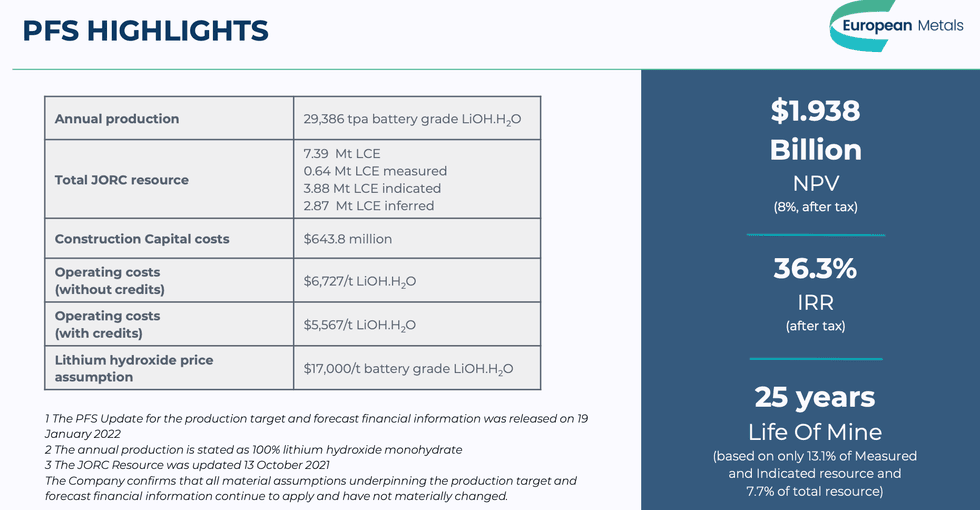

European Metals recently announced an updated Prefeasibility Study for 2022 that revealed a 74.9 percent increase in post-tax NPV from US$1.10 billion to US$1.94 billion, alongside a 16 percent increase in production to 29,386 tpa from 25,267 tpa.

The NPV is based on a very conservative lithium price of US$17,000 per tonne, while current pricing is soaring to all-time highs and lithium hydroxide forecasted to rise to US$18,940 in 2023.

A strong, experienced management team is at the helm and guiding the company towards production executive chairman Keith Coughlan has 30 years of experience in funds management and stockbroking. Executive director Richard Pavlik brings another 30 years of experience working in the Czech mining industry and has a master’s degree in mining engineering. Kiran Morzaria, non-executive director, has both management and engineering experience within the mining industry. Lincoln Bloomfield, non-executive director, is a former US ambassador who specialises in foreign policy and international security, providing directly applicable experience working with governments and companies in the private sector. The Company’s board is also flanked by a number of impressive geological, metallurgical and corporate consultants, further improving European Metal’s impressive credentials.

Company Highlights

- European Metals is currently developing its Cinovec asset, which is the largest hard rock lithium deposit in Europe

- The company has forged partnerships with three organisations that each provide an important specialty to the project: CEZ Group is seeking to advance the lithium-ion battery industry within the Czech Republic, the European Institute of Innovation and Technology is supporting overall development and offtake, and SMS Group is engineering a processing facility

- European Metals is dedicated to maintaining a positive ESG profile which not only attracts significant interest from potential financiers and offtake partners but also ensures the project is not doing more harm than good

- The company’s recent 2022 PFS update indicated a 16 percent tpa increase and a 74.9 percent increased NPV8 (post-tax), reaching an impressive US$1.938 billion

- The company’s management team has decades of experience in corporate administration, mining engineering and foreign policy, which builds confidence in the project

Get access to more exclusive Resource Investing Stock profiles here