European Electric Metals Inc. (TSXV: EVX,OTC:EVXMF) (the "Company") is pleased to announce that it has entered into a mineral property purchase agreement dated November 28, 2025 (the "Purchase Agreement") with Storm Exploration Inc., a company listed on the TSX Venture Exchange, ("Storm") whereby the Company has agreed to acquire a number of mineral claims, patented claims and mining licence located in the Miminiska-Fort Hope greenstone belt in the Thunder Bay North Mining District, Ontario (the "Miminiska Gold Property" or the "Property").

To reflect this new direction, the Company also announces it will be changing its name to "Canadian Goldfields Discovery Corp." and will advise on timing of the name and symbol change prior to it occurring.

Highlights of the Miminiska Gold Property:

- While 85% of identified strike length is largely untested by drilling, multiple high grade gold drill intersections have been reported.

- Notable historic drill intercepts include 20.84m at 5.75 g/t Au, 3.96m at 13.45 g/t Au and 11.18m at 4.49 g/t Au (true widths are unknown).*

- Gold mineralization primarily hosted within Algoma-type Banded Iron Formations (BIF)

- Recent ground geophysical surveys identified several targets within the Miminiska prospect that have not yet been drill tested and that are similar in response to the known zones of high-grade gold mineralization.

- Potentially analogous deposit type is Orla Mining Ltd.'s Musselwhite Mine located approximately 150 km north-east of the Miminiska Property.

About the Miminiska Gold Property

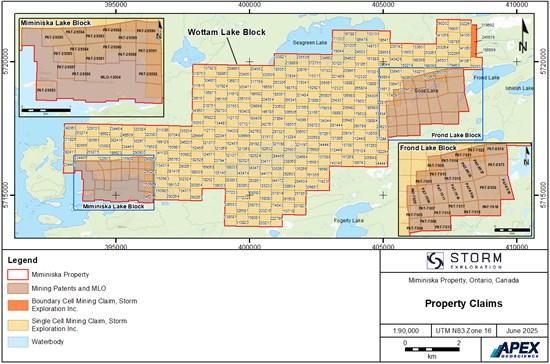

The Miminiska Gold Property is located approximately 350 kilometres (km) north of the city of Thunder Bay, 115 km east of the town of Pickle Lake, and approximately 40 km west of Fort Hope, Ontario. The property comprises 278 unpatented mining claims, 43 mining patents and 1 mining licence of occupation ("MLO"), covering a total area of 6,366.4 hectares (ha), distributed over three contiguous blocks named Miminiska Lake, Wottam Lake, and Frond Lake.

The Property is located within Eabametoong First Nation ("EFN") territory. There is a current (updated in 2025) Exploration Agreement in place with the EFN, which establishes a framework for ongoing cooperation and consultation and provides opportunities for the community to participate in the project through employment, training and business development.

Geology and Mineralization:

The Property lies within the Miminiska - Fort Hope greenstone belt, approximately 150 km southeast of Orla Mining Ltd.'s Musselwhite Gold Mine. The Property is within the Uchi Subprovince, an east-trending, predominantly metavolcanic-metasedimentary belt in the Superior Province of the Canadian Shield. The Uchi Subprovince forms part of the North Caribou Terrane that hosts the prolific Red Lake Gold Mines, Musselwhite Gold Mine, and past gold producers (all off-Property), notably the Pickle Crow Mine located approximately 115 km west of the Property.

The Property is underlain predominantly by very well laminated locally turbiditic appearing units of interbedded wacke, quarzitic wacke and slate/argillite. Mafic volcanic units observed in the northeastern portion of the Property are massive to amygdaloidal in texture and are commonly strongly amphibole and biotite altered due to regional metamorphism.

All the rock units found on the Property are Early Precambrian in age, with the exception of a few north-trending diabase dykes of Middle Precambrian age. Quaternary deposits of glacial till, and glaciolacustrine and glaciofluvial sand and esker gravels now cover much of the bedrock. A major unit of banded oxide facies iron formation trends east-west across the northern portion of the Property based on the limited geological mapping and magnetic surveys.

Gold mineralization on the Property is primarily associated with banded iron formations and east-west striking shear zones over a length of 14 km across the Property.

Figure 1. Location of the Miminiska Property

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11964/276531_a1d4ba69f4514bd7_001full.jpg

Historic Exploration:

Exploration at the Property dates back to the early 1930s and 1940s, when the Miminiska, Frond, and Wottam Lake prospects were discovered.

Modern exploration at the Property began in the 1960s. Since that time, there has been intermittent drilling of the property with 237 diamond drill holes completed totalling 28,265m primarily in the Frond Lake and Miminiska Lake blocks. The last significant sized drill program (47 NQ-sized diamond drill holes totalling 9,249m) was conducted from 2003-2005. It was during this program that notable intercepts such as 20.84m at 5.75 g/t Au and 11.18m at 4.49 g/t Au were drilled.*

In recent years (since 2021), a Light Detection and Ranging (LiDAR) survey, an airborne magnetic geophysical survey, a ground magnetic and electromagnetic (EM) geophysical survey, and a small 659.2m diamond drilling program have been completed.

Results from the LiDAR survey were used to identify geological outcrops and structures of interest, detect alteration and mineralization patterns, and produce a high-resolution digital elevation model of the Property. The airborne magnetic survey covered the entire Property and delineated several significant northeast trending structures. The ground magnetic and EM survey covered the Miminiska Lake block located on the southwest portion of the Property and targeted the extensively faulted and folded banded iron formation (BIF) in that area. The ground geophysical surveys identified several targets within the Miminiska prospect that have not yet been tested with drilling and that are similar in response to the known zones of high-grade gold mineralization. The EM survey delineated the BIF of the Miminiska prospect and provided information on the structural setting of the Property.

The 2 diamond drillholes totalling 659.2 m drilled at the Miminiska prospect adjacent to Miminiska Lake in 2022 laterally extended known high-grade mineralization in the folded iron formation by 130m.

Initial Exploration Plans:

Following closing, initial exploration planned by the Company is anticipated to include step out and exploration drilling at the Miminiska prospect, located on the southwest portion of the Property, and Frond Lake prospect, located on the southeast portion of the Property. At the Miminiska prospect, step out drilling is anticipated to take place along strike of the central limb of the folded iron formation, with exploration drill testing of the north and south limbs of the BIF. Since most anomalous gold values are associated with quartz veins within oxide iron formation, the Company plans to utilize the 2022 geophysical data to locate structural breaks proximal to strong magnetic anomalies and subsequently use these specific locations to define drill targets for future exploration. Step out drilling at Frond Lake is planned to extend historical drilling to the west.

Initial regional work planned includes a VTEM survey over the entire Property to map conductive units to increase the geological understanding of the Property and to assist in Phase 2 drill targeting. Ground follow up exploration, including geological mapping, prospecting, and rock sampling of exposed outcrops, will be conducted over geophysical anomalies with priority given to anomalies that coincide with interpreted BIF horizons and that are associated with structural complexities and/or near historical occurrences.

The estimated cost of the anticipated 2,000m Phase 1 drilling and exploration program for the Property totals approximately CAD$1,900,000.

CEO Appointment:

The Company is also pleased to announce the appointment of current Chairman and Director, Mr. John Booth as Chief Executive Officer.

Mr. Booth has more than 25 years' experience in the international capital markets as an investment banker, fund manager, lawyer and senior executive working for firms including Merrill Lynch International, ICAP, CEDEF, ABN AMRO Bank NV, CIBC, the World Bank, Climate Change Capital and Conservation Finance International. He brings more than 25 years experience as a non-executive chair and director of multiple public companies involved in natural resources, finance and technology.

Mr. Booth is Chairman of Laramide Resources, Lead Independent Director at Cerro De Pasco Resources and former Director and Audit Committee Chairman of Maya Gold & Silver (now Aya Gold & Silver), Chairman . Since 2023, he has been a guest lecturer in the MBA program at the University of Oxford, and for the past five years, in the MSc Program at Kings College, University of London where he focuses on environmental and social governance (ESG).

Mr. Booth holds a BSc (Hons) in Biology and Environmental Science, LLB, JD and LLM, and is a licensed attorney in New York, Ontario and Washington, DC.

Mr. Fred Tejada, P.Geo, has resigned as Chief Executive Officer of the Company, but will continue as an active contributor to the Company via his ongoing role as a Director.

Terms of Agreement:

Under the terms of the Purchase Agreement, the Company has agreed to agree to acquire Storm's interest in the Miminiska Property and, in consideration of which, the Company has agreed to:

(a) make cash payments to Storm totaling $3,525,000 as follows:

(i) $200,000 as a non-refundable deposit (the "Deposit") to be paid on the later of execution of the Purchase Agreement and confirmation from the TSX Venture Exchange;

(ii) $1,800,000 (the "Closing Cash Payment") to be paid on the date of closing (the "Closing Date");

(iii) $1,000,000 to be paid on or before three months after the Closing Date;

(iv) $525,000 to be paid on or before nine months after the Closing Date.

(b) issue to Storm $2,287,000 in common shares of the Company as follows:

(i) $1,500,000 common shares of the Company (the "First Consideration Shares") on the Closing Date;

(ii) $787,500 common shares of the Company (the "Second Consideration Shares" and together with the First Consideration Shares, the "Consideration Shares") on or before nine months after the Closing Date.

The First Consideration Shares will be issued at $0.20 per share, being a total of 7,500,000 common shares of the Company. The Second Consideration Shares will be issued at the 30-day volume-weighted average price on the date that is five business days prior to the issuance date of the Second Consideration Shares, subject to a minimum price equal to the "Discounted Market Price" as such term is defined under the policies of the Exchange.

The Consideration Shares will be subject to restrictions on resale for a period of four months after the date of issue. In addition to the foregoing restriction period, the First Consideration Shares will be subject to the following voluntary resale restrictions: (i) 25% of the First Consideration Shares will be subject to restrictions on resale until four months after the Closing Date, (ii) 25% of the First Consideration Shares will be subject to restrictions on resale until eight months after the Closing Date; (iii) 25% of the First Consideration Shares will be subject to restrictions on resale until twelve months after the closing date; and (iv) the final 25% of the First Consideration Shares will be subject to restrictions on resale until sixteen months after the Closing Date.

A significant portion of the Closing Cash Payment will be used to exercise Storm's option on the Property from Landore Resources Canada Inc. ("Landore") Upon exercise of the option, Landore will retain a 2% net smelter royalty (the "Landore Royalty"), of which 50% may be repurchased with a one time payment of C$1,000,000. In addition to the Landore Royalty, the Property is also subject to a historical royalty equal to 2% of the net value of the metals on certain mineral claims and a 2% net carrying interest on certain other mineral claims.

Prior to closing, the Company anticipates entering into a revised Exploration Agreement with the Eabametoong First Nation on substantially similar terms as the existing Exploration Agreement, but excluding mineral claims and licenses to be retained by Storm.

Neither the Company nor Storm will pay a finders fee in connection with the Transaction. The Company and its insiders do not have any relationship with Storm, its assets and the non-arm's length parties of Storm. The Transaction is not a non-arm's length transaction.

The Transaction is subject to approval of the TSX Venture Exchange and such other customary conditions set forth in the Purchase Agreement.

The common shares of the Company will remain halted pursuant to section 5.6 of Policy 5.3 of the TSX Venture Exchange.

Private Placement Financing

In connection with the Transaction, the Company plans to carry out a private placement financing of $7,000,000 (the "Offering"). The Offering will consist of 27,500,000 common shares of the Company at $0.20 per share for gross proceeds of $5,500,000 (the "HD Offering") and 6,818,181 flow-through common shares ("FT Shares") at a price of $0.22 per FT Share for gross proceeds of up to $1,500,000 (the "FT Offering").

The securities issued under the HD Offering and the FT Offering will be subject to restrictions on resale for a period of four months from the date of issue. The Company may pay finder's fees in accordance with the policies of the TSX Venture Exchange.

The proceeds of the Offering will be used to satisfy the Closing Payment, exploration and drill programs on the Miminiska Property and general working capital purposes.

Qualified Person

The scientific and technical information in this news release was reviewed and approved by Fred Tejada, P.Geo., a Qualified Person, as defined by NI 43-101. Mr. Tejada is a director of the Company and is not independent under NI 43-101.

Historical assay information contained from the Technical Report of the Miminiska Lake Project dated April 28, 2025 prepared by B.J. McKay, P. Geo.

Additional Information

John Booth

Chief Executive Officer

European Electric Metals Inc.

Phone: (604) 802-4447

Email: info@europeanelectricmetals.com

Forward-Looking Statements

Information set forth in this news release contains forward-looking statements that are based on assumptions as of the date of this news release. These statements reflect management's current estimates, beliefs, intentions and expectations. They are not guarantees of future performance. The Company cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by many material factors, many of which are beyond their respective control. Such factors include, among other things: risks and uncertainties relating to the Company's limited operating history. In particular, closing of the acquisition of the Miminiska Gold Property remains subject to a number of conditions, including, completion of the Offering, entering into new exploration agreements with the Eabametoong First Nation covering solely the Miminiska Gold Property and the acceptance of the TSX Venture Exchange. In addition, the Company's planned exploration program for the Miminiska Gold Property is subject to change. There is no assurance that the Miminiska Gold Property acquisition will be completed as contemplated, or at all. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, the Company does not undertake to publicly update or revise forward looking information.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276531