July 27, 2023

Eclipse Metals Ltd (Eclipse or the Company) (ASX: EPM | FSE: 9EU) ) is pleased to report its activities for the quarter ending 30 June 2023.

HIGHLIGHTS

IVIGTÛT AND GRØNNEDAL PROJECTS

- Sampling of deep diamond drillhole (Hole A) drilled into the centre of the historic Ivigtût mine in 1948 provides new insights into the polymetallic mineralisation.

- Hole A intersected a 12.7m upper zone of iron-zinc mineralisation and a 3.7m lower iron-zinc-copper zone, both accessible from Ivigtût's existing pit.

- Historic drill holes into these zones returned maximum assay values of 1.7% Cu, 18.2% Zn and 7.7% Pb.

- XRF analysis of the historic drill core has detected gold, silver, bismuth, tin and tungsten within the iron-zinc ± copper zones, warranting further investigation.

- Analysis also detected elevated niobium in the greisen body underlying the lower iron- zinc-copper zone. The greisen is known to be enriched in REE, niobium, tin, tantalum and tungsten. Further investigation is warranted.

- Encouraging mineralogical determinations from Grønnedal, with composite ferro- carbonate mineral containing elevated medium to heavy REE

- Grønnedal Pr+Nd account for 55% of the measured 4REE (La+Ce+Pr+Nd)

- Ongoing assessment of material found over a wide area in Grønnedal

- Eclipse completes scoping phase of Environmental and Social Impact Assessments for Ivigtût and submitted reports to Greenland’s Mineral Licence and Safety Authority (MLSA) to progress the Ivigtût project

- Completion of these are integral to applying to the MLSA for a Mining Licence

- Field Work Application approved by Greenland’s Mineral Licence and Safety Authority (MLSA).

- Collaboration with University of Delaware regional development study expected to assist with Eclipse’s Social Impact Assessment

- Working closely with the laboratory in Australia to analyse samples from Ivigtût and Grønnedal

IVIGTÛT (IVITTUUT) PROJECT– GREENLAND

Sampling of Historic Ivigtût Drill Core confirms Polymetallic Mineralisation

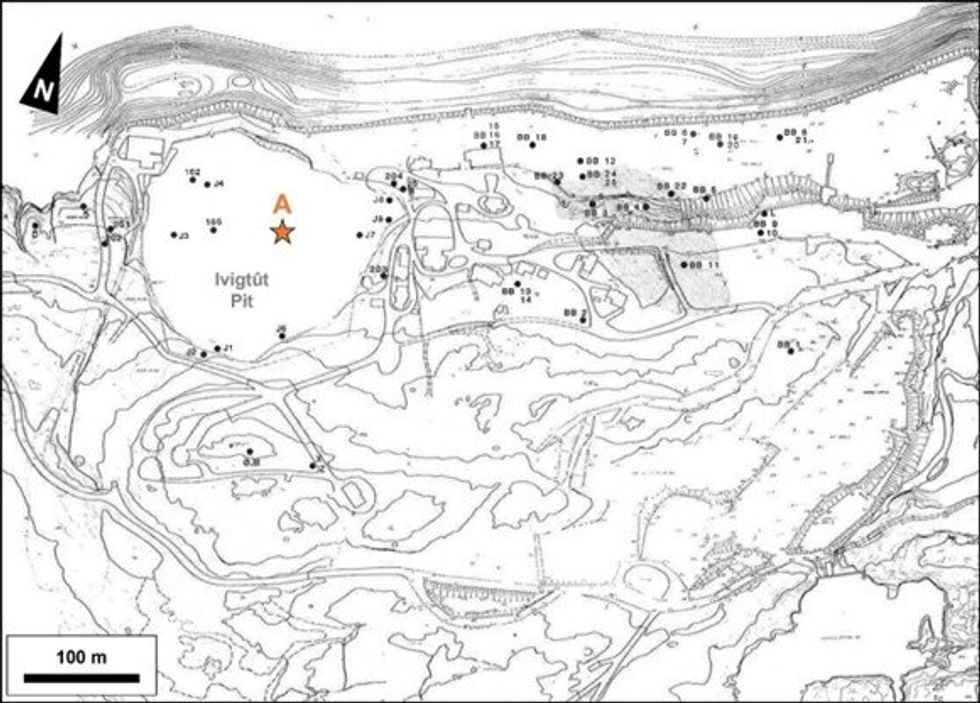

During the quarter, Eclipse gained access to historic drill core from Exploration Drillhole A (Hole A) (Figure 1), which was drilled vertically into the centre of the Ivigtût multi-commodity deposit in Greenland in 1948.

Examination of Hole A by Eclipse has served to visually corroborate reports of mineralisation remaining under the present Ivigtût pit floor (Bondam, 1991). The assessment has also served to substantiate significant grades of zinc in a previously identified southwest-dipping tabular body (Domain 2) located directly beneath Domain 1 of the mined cryolite-fluorite body (Figures 2 and 3) (ref ASX announcement dated 10th March 2021).

Spot measurements taken with a portable X-ray fluorescence analyser (pXRF) returned promising zinc and niobium results from certain downhole intervals of Hole A, along with highly anomalous spot values of lead, copper, gold, silver, bismuth, tin and tungsten (Figure 4). Whilst zinc (results ranging from 0.3% to 18.2% Zn), copper (0.04% to 1.7% Cu) and lead (0.05% to 7.7% Pb) are known from the historic Ivigtût drillhole assay data (ref ASX announcement dated 10th March 2021), the presence of niobium as well as gold, silver, bismuth, tin and tungsten warrants further investigation.

Click here for the full ASX Release

This article includes content from Eclipse Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EPM:AU

The Conversation (0)

25 March 2024

Eclipse Metals

Pursuing Multi-commodity Assets to Support Decarbonization

Pursuing Multi-commodity Assets to Support Decarbonization Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00