October 15, 2023

Further profitable life ahead for the Endeavor Silver-Zinc-Lead Mine

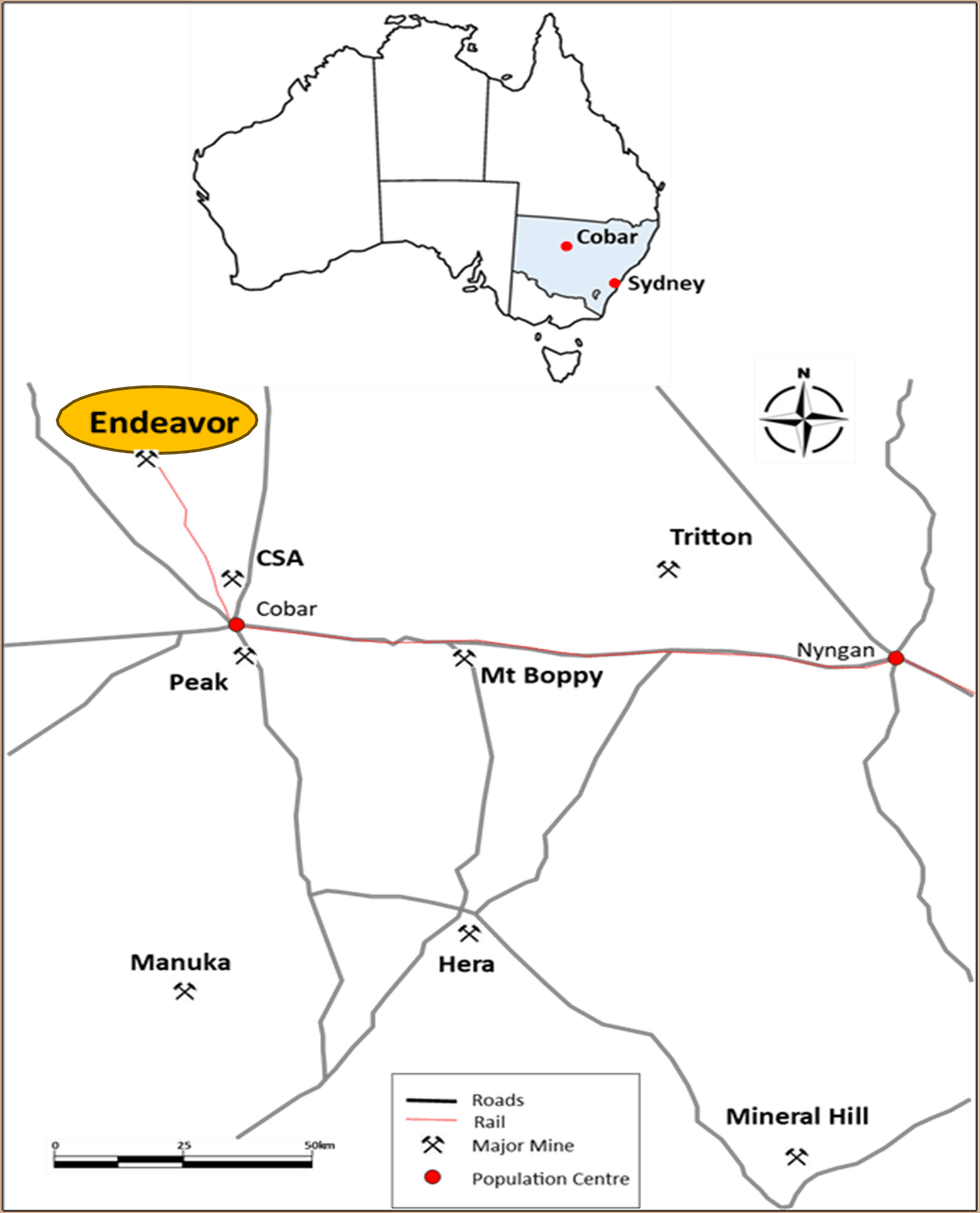

Polymetals Resources Ltd (ASX: POL) (Polymetals or the Company) is pleased to announce the outcomes of its Endeavor Mine Restart Study (MRS) which demonstrates strong technical and robust economic support to recommence Silver, Zinc and Lead concentrate production at the Mine.

HIGHLIGHTS1

- Updated Endeavor Mine Ore Reserve

- Initial 10-year mine life with significant growth potential

- LOM Free Cashflow of $323M, Pre-tax NPV8 of $201M and IRR of 91%

- Low Pre-Production Capex of $23.7M, Maximum cash drawdown of $37.8M

- Project Revenues of $1,412M (US$2,750/t Zn, US$2,200/t Pb & US$23/oz Ag)

- Project EBITDA of $400M at an average margin of 28.5% p.a.

- First Concentrate production targeted for H2 2024

Polymetals Executive Chairman Dave Sproule commented:

“The delivery of the Endeavor Mine Restart Study is the culmination of an immense body of work completed to a high level of confidence that can support a positive investment decision.

Bringing silver back into the revenue stream via our reset of the historic 100% silver streaming royalty has unlocked significant value at the Endeavor Mine.

The MRS shows a mining operation that makes swift payback of capital because of high operating margins and the restart nature of activity. We are well advanced in our negotiations to replace the Rehabilitation Bond2 which will complete Polymetals acquisition of the Project, as well as a finance facility to ensure coverage for peak negative cash drawdown.

I am buoyed by the growth potential inherent in the project, given the economic qualities of the mine outlined in the MRS, and the potential to expand the mineral resource of the project since the mine remains open to depth and there are many targets in the mining lease that remain untested.

In the past year, Polymetals share price appreciation ranks the Company in the top 5% of the 817 ASX listed Materials Companies during the period3 and the Board, and Management are proud and excited to move back to our roots as producers and to advance the exploration targets identified.

To unlock Endeavor’s embedded value, Polymetals is laser focussed on recommencement of mining.”

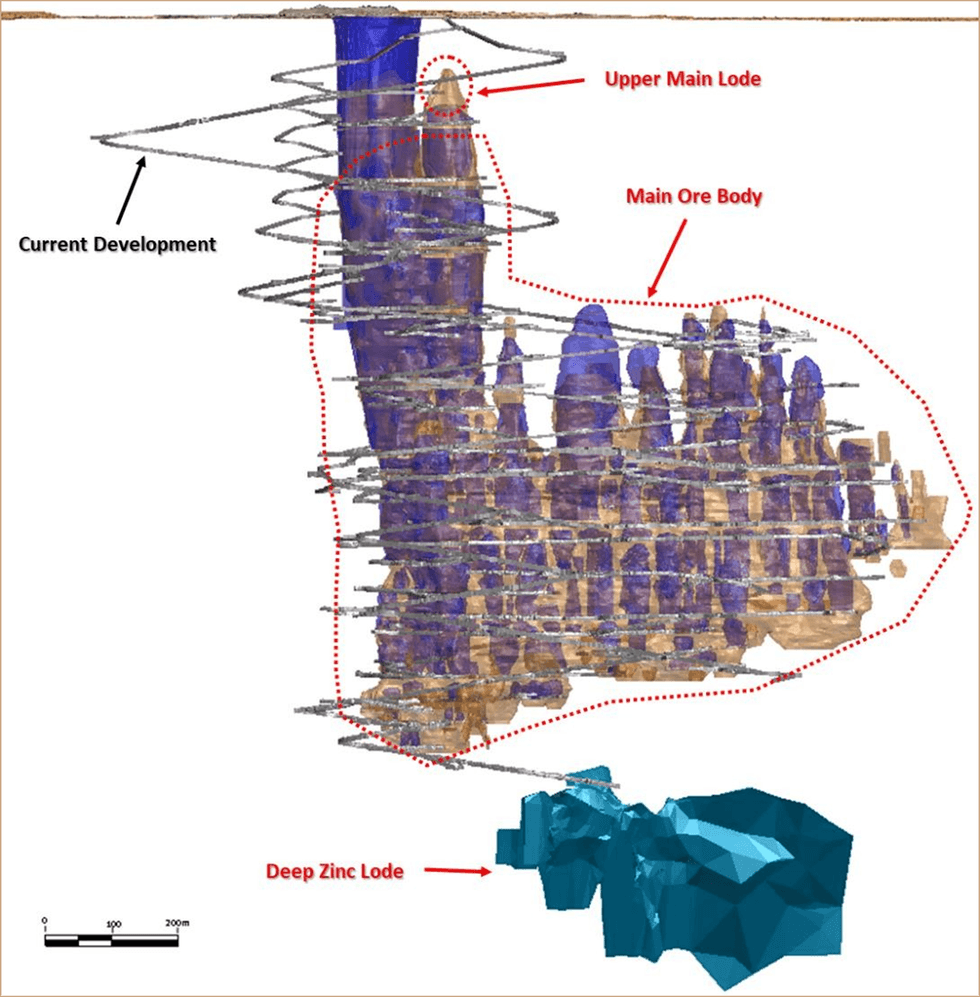

Mine Plan

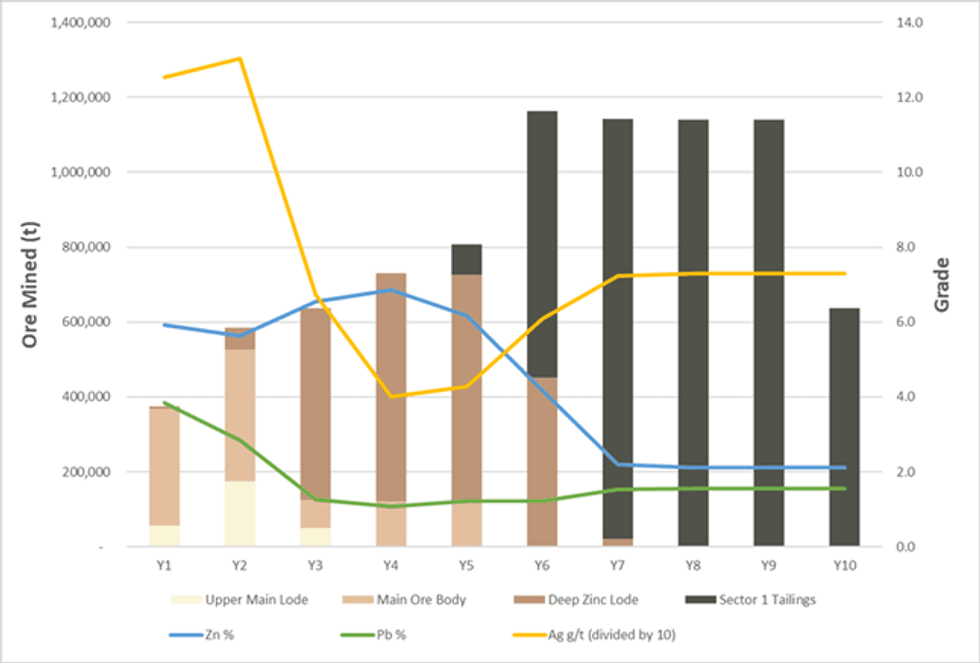

The Mine Restart Study is based on a mine plan and optimised mining schedule that includes initial mining from three zones in the underground mine (Figure 2) as well as the later retreatment of high-grade Sector 1 tailings that were produced during the early years of production which commenced in 1983. The project benefits from the ability to utilise the extensive existing high-quality and well maintained underground and surface infrastructure.4

The MRS has estimated total ore mined and processed of 8.4 Mt over an initial mine life of 10 years. Mining of underground ore extends from Years 1 to 6 and re-treatment of Sector 1 tailings commences in Year 5 (Figure 3). Underground mining is scheduled to commence within 8 months of a project restart decision with concentrate production 2 months thereafter.

The MRS has determined total material to be mined which includes Measured, Indicated and Inferred Mineral Resources. The production schedule (Table 2) contains 30% from the Inferred Mineral Resource category primarily from Tailings and Deep Zinc Lode. There is a low level of geological confidence associated with inferred mineral resources and there is no certainty that further exploration work will result in the determination of indicated mineral resources or that the production target will be realised.

The company notes that the project forecasts a positive financial performance and is therefore satisfied that the use of Inferred Resources in Production Target reporting and forecast financial information is not the determining factor in overall project viability and that it is reasonable to report the Life of Mine (LOM) Plan with Inferred Resources. It is to be noted that the Deep Zinc Lode contribution (one of 3 underground ore sources) only comes on stream in Year 3 and Tailings in Year 5. The Mine Plan includes capital for in-fill drilling with the objective of upgrading the resource confidence in these two areas.

Click here for the full ASX Release

This article includes content from Polymetals Resources Ltd, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00