Empress Royalty Corp. (TSXV:EMPR)( OTCQB:EMPYF) ("Empress" or the "Company") is pleased to announce that pre-production has commenced at the Manica Gold Mine ("Manica" or the "Mine"). The Company owns a 3.375% royalty on Manica, which is located in Mozambique and operated by Mutapa Mining & Processing LDA ("MMP

"Congratulations to the team at MMP for their hard work and dedication in taking Manica from a development stage project into a producing mine," stated Alexandra Woodyer Sherron, CEO and President of Empress Royalty. "The Manica Gold Mine is our second development asset reaching pre-production and demonstrates our team's ability to make strategic investments that create significant returns and value for our shareholders."

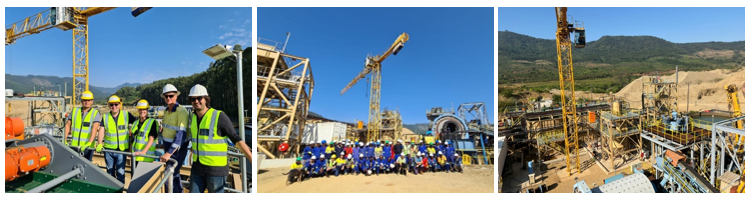

Figure 1 to 3. Empress Management Site Visit to Manica Gold Mine

ABOUT Empress Royalty Corp.

Empress is a global royalty and streaming creation company providing investors with a diversified portfolio of gold and silver investments. Since listing in December 2020, Empress has built a portfolio of 17 precious metal investments and is actively investing in mining companies with development and production stage projects who require additional non-dilutive capital. The Company has strategic partnerships with Endeavour Financial and Terra Capital which allow Empress to not only access global investment opportunities but also bring unique mining finance expertise, deal structuring and access to capital markets. Empress is looking forward to continuously creating value for its shareholders through the proven royalty and streaming models.

ON BEHALF OF Empress Royalty Corp.

Per: Alexandra Woodyer Sherron, CEO and President

For further information, please visit our website at www.empressroyalty.com or contact Kaitlin Taylor, Investor Communications, by email at info@empressroyalty.com or by phone at +1.604.331.2080.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Certain information contained herein constitutes forward-looking information or statements under applicable securities legislation and rules. All statements, other than statements of historical fact, are forward-looking statements. Forward-looking statements are frequently identified by such words as may, will, plan, expect, anticipate, estimate, intend, indicate, scheduled, target, goal, potential, subject, efforts, option and similar words, or the negative connotations thereof, referring to future events and results. Forward looking statements in this press release include, but are not limited to, statements related to the implementation of Empress' investment game plan and the anticipated returns on its investments. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Empress to be materially different from those expressed or implied by such forward-looking statements, including, but not limited to the risks and uncertainties identified in Empress' most recent Annual Information Form filed on the Company's profile on SEDAR at www.sedar.com. Although management of Empress has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate. Readers should not place undue reliance on forward-looking statements. Empress will not update any forward-looking statements except as required by applicable securities laws. Empress caution readers not to place undue reliance on these forward-looking statements and it does not undertake any obligation to revise and disseminate forward-looking statements to reflect events or circumstances after the date hereof, or to reflect the occurrence of or non-occurrence of any events.

SOURCE: Empress Royalty Corp.

View source version on accesswire.com:

https://www.accesswire.com/704800/Empress-Royalty-Announces-Pre-Production-at-Manica-Gold-Mine