August 16, 2023

Eclipse Metals Ltd (Eclipse or the Company) (ASX: EPM) is pleased to announce assay results for bulk samples of mineralised waste material from the Ivigtût cryolite mine within its 100% owned multi-commodity project in SW Greenland.

- Potentially valuable polymetallic mineralisation identified in waste rock from the historic Ivigtût cryolite mine.

- The large volume of mineralised waste material could be processed to create concentrates containing silver, zinc, gallium, copper, lead and gold.

- Eclipse is conducting metallurgical test-work to identify processes to produce a saleable concentrate.

- Eclipse is considering a Ground Penetrating Radar (GPR) survey to determine the overall volume of mineralised waste material at Ivigtût.

- The project boasts the potential for an early restart, with the advantage of requiring a low initial capital investment.

Executive Chairman Carl Popal commented:

"We're excited by the potential of the Ivigtût cryolite mine's mineralised waste dump. Our recent findings point to valuable polymetallic material that can be quickly leveraged. Our ongoing efforts include rigorous metallurgical test-work aimed at identifying the most effective processes to produce market-ready concentrates. The convenience of readily processable minerals, along with the advantage of existing infrastructure, positions us for an early restart, underpinned by a low initial capital investment.”

Metallurgical test-work has been initiated to evaluate potential for producing a saleable mineral concentrate on site. This concentrate could be readily shipped with minimal additional infrastructure to provide an early cashflow. The mineralised waste was produced during the extraction of 3.8 million tonnes of high grade cryolite from the 60m deep Ivigtût open pit mine over a period of 120 years (Reference: Greenland Mineral Occurrence Map & Occurrence data sheet). Materials other than cryolite were not of interest to the historic mine operator and were discarded on extensive mine dumps (Figure 1).

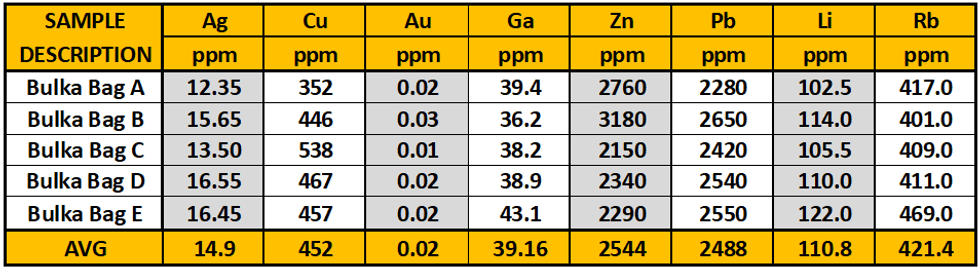

Five bulk samples collected by trenching of the mineralised waste dumps (refer to ASX Release dated 1 November 2022), were mixed and a sub-sampled crushed and ground for analysis by the ME-MS61 method, returned the following summary results.

Specimens from the waste dumps were observed to contain visible sulphide minerals, including galena (Pb sulphide), chalcopyrite (Cu sulphide), sphalerite (Zn sulphide) and pyrite (Fe oxide), as well as fluorite and the iron carbonate mineral siderite.

Gallium (Ga) is usually associated with zinc, silver (Ag) with lead (Pb) and gold (Au) with all sulphide minerals. The lithium (Li) content can likely be attributed to micas and the mineral cryolithionite, which has been identified at Ivigtût (refer to ASX Release dated 23 March 2022). The source of rubidium (Rb) is yet to be identified but is likely to be hosted by mica or feldspar.

Eclipse is considering a Ground Penetrating Radar (GPR) survey for the Ivigtût precinct to assess the potential volume of mineralised waste material. By calculating the size of the open pit and access tunnels and subtracting the cryolite that has been exported, it can be estimated that in the order of three (3) million tonnes of ROM waste was deposited in the dumps as well as for landfill purposes during a century of mining. There has been no comprehensive commercial assessment for other critical metals.

Click here for the full ASX Release

This article includes content from Eclipse Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EPM:AU

The Conversation (0)

25 March 2024

Eclipse Metals

Pursuing Multi-commodity Assets to Support Decarbonization

Pursuing Multi-commodity Assets to Support Decarbonization Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00