- WORLD EDITIONAustraliaNorth AmericaWorld

March 27, 2023

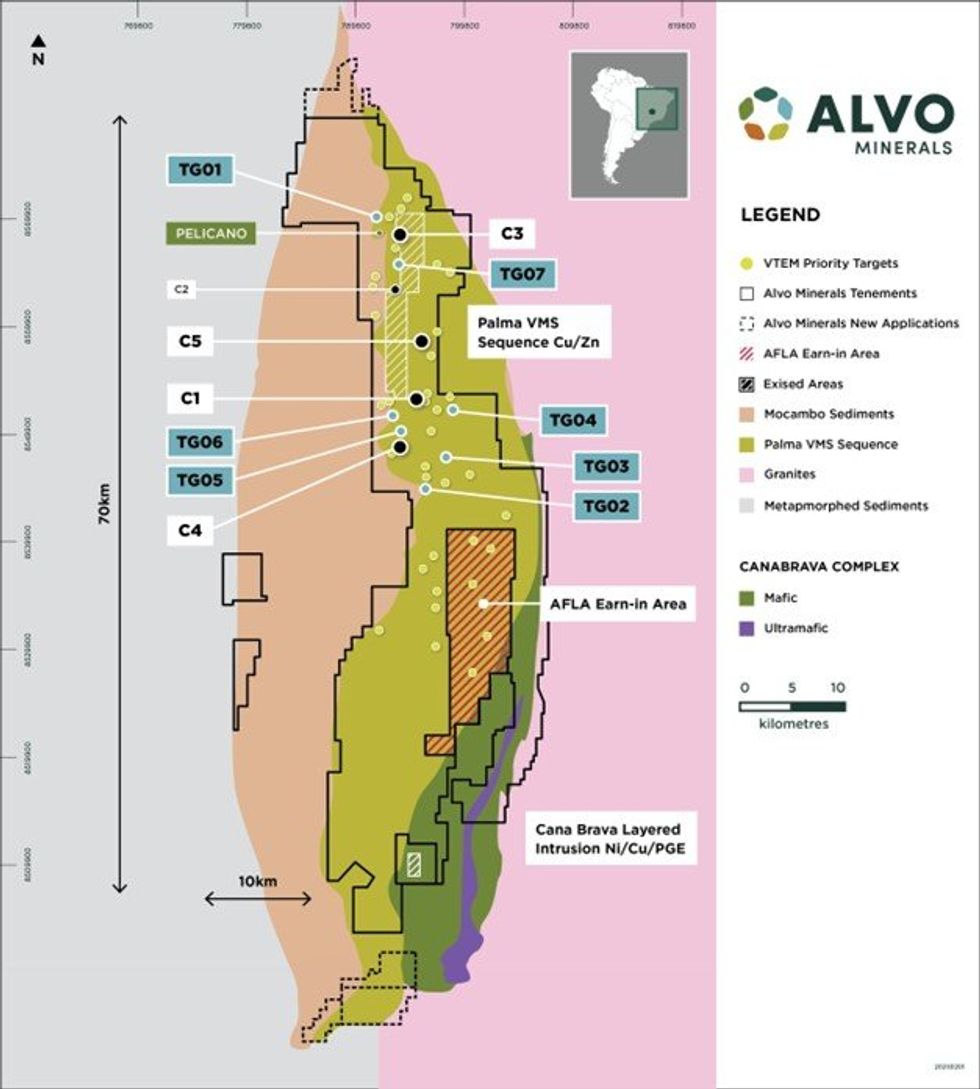

Alvo Minerals Limited (ASX: ALV) (“Alvo” or the “Company”) is pleased to announce the signing of a binding agreement to earn-in to the highly prospective Alfa Project (“Afla”), consolidating the broader Palma Volcanogenic Massive Sulphide (VMS) belt. The Afla Project is located adjacent to Alvo’s Palma Project and covers a strategic southern portion of the target host rocks of the VMS sequence.

HIGHLIGHTS

- Binding agreement to earn-in to the Afla Cu/Zn Project, consolidating the southern portion of the highly prospective Palma VMS belt

- The Afla Project was partially covered by a VTEM survey, and multiple conductors have been identified which appear similar to conductors that host significant VMS mineralisation at Palma

- The Brazilian Geological Survey (CPRM) conducted regional stream sediment sampling and soils sampling across the area highlighting several highly anomalous prospects

- Earn-in transaction has no upfront cash payments and will utilise Alvo’s existing exploration team to deliver the 1,000m of diamond drilling within 18 months of the agreement to earn the initial 60% of the project

- Ability to earn up to 100% of the project dependant on additional exploration and contract milestones

Alvo has the team, the tools and expertise to conduct a cost-effective exploration program across the Afla Project.

Rob Smakman, Alvo’s Managing Director commented on the Afla Project:

"We have secured the Afla Project due to its prospectivity and strategic location. It’s a significant area that increases our control over the VMS district, an enviable land package for a junior anywhere in the world and we are confident that integrating exploration at Afla with our existing CY2023 plans will be seamless. Field work on the ground will start immediately, focussed on the already identified targets. We will continue our systematic approach to prioritisation of the multiple greenfields targets to the point of being drill-ready.

“We have built an expert in-house team that is motivated and focussed on making new discoveries. We have leading edge in-house exploration tools available and continue to enhance our knowledge of the typical type and style of mineralisation in the district. We are really excited that we will be integrating the Afla Project into our exploration plans.”

Afla Cu/Zn Project

Alvo has signed a binding deal with AFLA INVESTIMENTOS E PARTICIPAÇÕES LTDA, (“Afla Investimentos”) a Brazilian company with interests in gold and limestone mining, agriculture, and real estate. The Afla Project includes 5 granted exploration licenses covering a total area of 9,758Ha (98km2), located adjacent to both Alvo’s Palma VMS Project and Alvo’s Ni/Cu/PGE Project at Cana Brava (see Figure 1). The Project is considered predominantly prospective for VMS style (Cu, Zn, Pb, Ag, Au) mineralisation.

Prior to Afla Investimentos taking control of the project in 2018, the area was explored by the Brazilian subsidiary of BHP (Colorado Exploration circa 1980’s), Glencore (early 2000’s) and Nexa in 2008. No historical data from these companies is currently available, however a recent due diligence field visit noted historical drill-core believed to be from when BHP was exploring the area.

Alvo is pursuing the historical information which may exist in the Mines Department, however there is no guarantee that this information will be available.

The Geological survey of Brazil (CPRM) completed a regional Stream Sediment survey which covered the Afla Project ground and indicated anomalous catchments of Cu, Zn and Pb. The CPRM also completed several soil sampling and mapping traverses also confirming anomalous Cu and Zn.

In 2008, Votorantim Exploration (now Nexa) flew a VTEM survey covering most of the Afla ground. This is the same survey that covers much of the Palma project and the source of multiple conductive targets currently being followed up by the Alvo exploration team. Alvo’s consultants have highlighted 5 individual conductors on the Afla ground that warrant follow up (see Figure 1).

The work by the CPRM and the VTEM survey is a great starting point for Alvo’s exploration strategy.

Integrating Afla into the Palma Regional Exploration Strategy

Alvo is undertaking an extensive regional exploration program across the Palma project which covers over 780km2 (including the Afla Project increases this tenure to ~875 km2) of contiguous and highly prospective ground in a known VMS district. The district has been largely unexplored for over 30 years since the first discovery in the 1970s and presents an extraordinary opportunity to make new discoveries by applying modern and systematic exploration techniques.

VMS deposits typically occur in clusters, where multiple deposits are located in similar geological districts. These districts can host a number of VMS deposits that range in size from less than 1Mt to exceeding 100Mt.

Exploration work is underway across multiple prospects with the aim of advancing prospects to drill-ready status. Field activities including geological mapping, soil sampling, Auger drilling (“Auger”), Induced Polarisation Surveys (“IP”) and Fixed Loop electromagnetic surveys (“FLEM”) are underway. These activities are being undertaken concurrently within the district on various prospects identified by the Company from historical work completed to date.

Importantly, the Company’s key equipment purchases allow for flexible, fast and efficient exploration which is significantly less expensive than typical contracted exploration as the only material expense is labour and maintenance.

The Afla project areas have been integrated into the Palma project plan and exploration will proceed across the new areas according to the current schedule in place. Alvo expects that the time required to complete the earn- in is sufficient assuming the first pass exploration is successful.

Click here for the full ASX Release

This article includes content from Alvo Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ALV:AU

The Conversation (0)

08 August 2022

Alvo Minerals

District-Scale Copper-Zinc VMS Project in Brazil

District-Scale Copper-Zinc VMS Project in Brazil Keep Reading...

20h

Nine Mile Metals Intersects 44 Meters of Copper Mineralization and Provides Drill Program Update

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to provide the details of drill hole WD-25-05 in addition to a summary of the 2025 drill program completed in December at the Wedge Project.Drillhole WD-25-05:DDH WD-25-05 collared... Keep Reading...

09 February

Rio Tinto and Glencore Walk Away from Mega-Merger, but Mining M&A Marches On

The collapse of merger talks between Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) and Glencore (LSE:GLEN,OTCPL:GLCNF) has ended what would have been the mining industry’s largest-ever deal.The two companies confirmed last week that discussions over a potential US$260 billion combination have been... Keep Reading...

06 February

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data shows that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00