September 25, 2023

Firetail Resources Limited ("Firetail" or "the Company") (ASX: FTL) is pleased to provide an update on future works planned for the Picha Copper Project (“Picha) in Peru.

Highlights:

- Maiden diamond drilling (“DD”) program to commence at Picha in the first week of October 2023.

- Exploration camp installation at Picha is nearing completion.

- Drilling contract signed and equipment mobilised to site, with drill rig expected on site at the end of this month.

- Drilling platforms are well advanced with several drill pads and access tracks completed.

Executive Chairman, Brett Grosvenor, commented:

"We are very pleased with the progress made at the Picha Copper Project in Peru.

“The local team in Peru is on target to commence drilling in the first week of October and their approach to the preparation has been extremely thorough. Picha has undergone a substantial exploration program in the past 18 months to identify a significant number of targets, and the team has done an excellent job to advance these targets to the drilling stage.

“The excitement is building within the Firetail team and we are confident that the targets identified have potential to position the project for a significant discovery in the coming months.

“We look forward to the commencement of drilling in the next two weeks.”

Transaction Completed

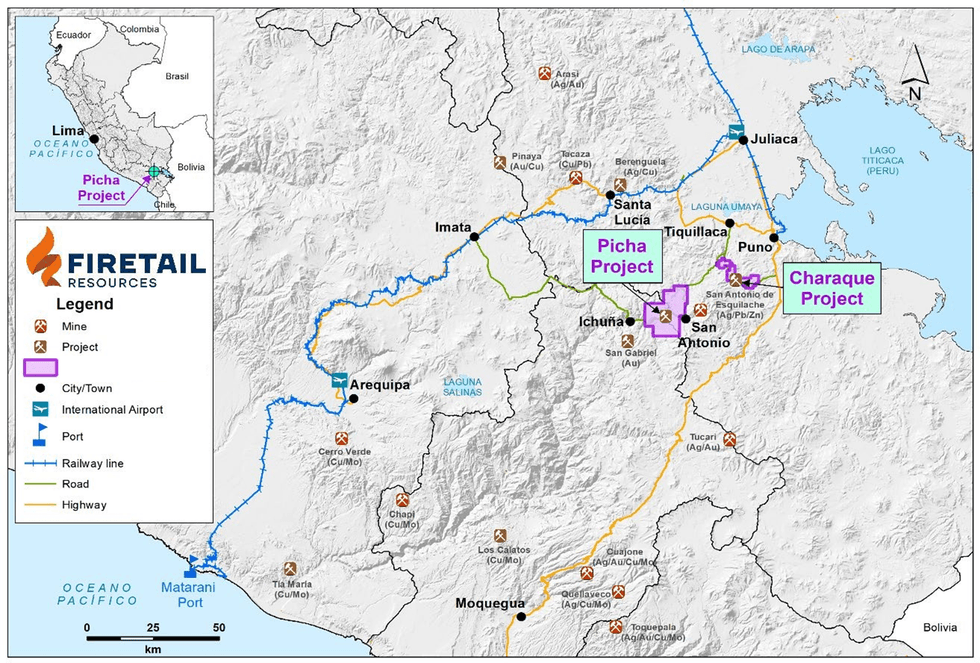

On 21 August 2023, shareholders of Firetail voted to approve the issue of shares and performance rights relating to Firetail’s acquisition of up to an 80% interest in Valor Resources Limited’s (“Valor”) (ASX:VAL) Picha Copper Project and Charaque Copper Project in southern Peru1.

Under the acquisition agreement, Firetail acquired up to 80% of the issued share capital of Kiwanda S.A.C. (Kiwanda) which holds the mining concessions that make up the Picha and Charaque Projects.

The transaction was completed on 6 September 20232 and has resulted in Firetail inheriting Valor’s experienced in-country management and technical team as well as an Earn-in Agreement with leading global gold and copper producer Barrick Gold Corporation covering the Charaque Project3.

Approvals and Drill Planning

Final regulatory approval was received by Valor4 and announced on 4 August 2023. Receipt of the Autorización de Inicio (Permission to Begin Drilling) from the Peruvian Ministry of Energy and Mines (“MEM”) is a key milestone for the Picha Copper Project, and allows the Company to commence the maiden drilling program within the approved “Effective Area”.

The drilling permit allows drilling of up to 120 holes at Picha, comprising of up to 40 drill platforms with three holes planned per platform. A maiden diamond drilling program of around 5,000m is proposed to test four targets within the Effective Area – Cobremani, Cumbre Coya, Maricate and Fundicion (see Figure 3 below).

Firetail has selected a well-regarded local drilling contractor to undertake the maiden drilling program.

Camp installation has progressed according to plan and completion works are now underway on the final fittings.

Click here for the full ASX Release

This article includes content from Firetail Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

FTL:AU

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00