April 21, 2022

Challenger Exploration (ASX: CEL) (“CEL” the “Company”) is pleased to announce results from drill holes GYDD-21-007 to GYDD-21-013, the next six drill holes at its 100% owned El Guayabo Gold-Copper Project in El Oro Province, Ecuador. The results follow the first seven drillholes which all recorded significant intersections including 257.8m at 1.4 g/t AuEq including 53.7m at 5.3 g/t AuEq(GYDD-21-008) and 309.8m at 0.7 g/t AuEq including 202.1 metres at 0.8 g/t AuEq (GYDD-21-006).

Highlights

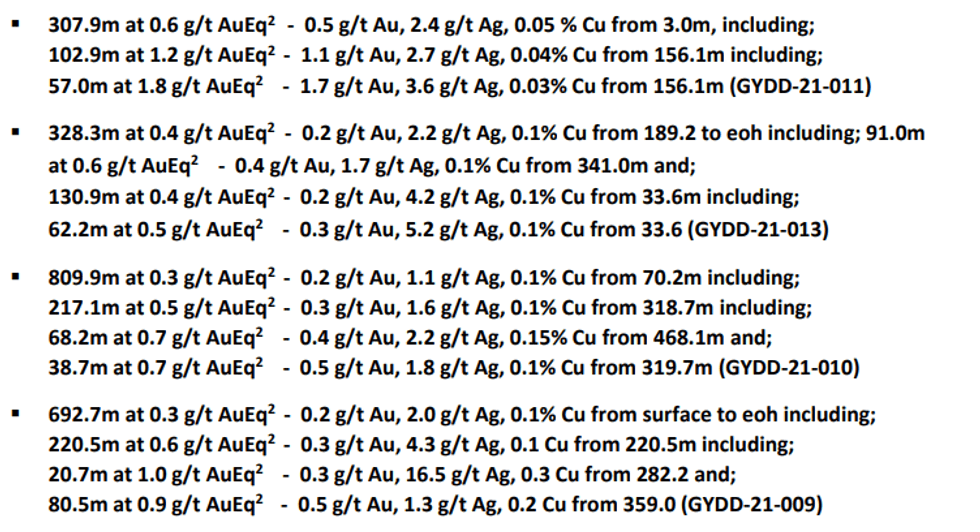

- Next six holes all intercept over 300 metres of mineralisation, confirming a major Au-Cu-Ag discovery spanning multiple zones. Results include (refer Table 1):

- Four holes ended in mineralisation, including GYDD-21-011 (307.9m at 0.6 g/t AuEq from surface) stopped at 310m due to drilling problems 300 metres above the main target.

- GYDD-21-010 extends the main discovery zone 400 metres to 1000 metres of strike and GYDD-21-011 indicates the mineralisation is 1000 metres wide at the centre of this main discovery zone.

- GYDD-21-009 and GYDD-21-013 tested two new gold in soil anomalies, undrilled by CEL and the discovery of strong mineralisation significantly expands the scale of the discovery.

Commenting on the results, CEL Managing Director, Mr Kris Knauer, said

“These results confirm we have made a major discovery, that will significantly exceed our early expectations. We have extended the main discovery zone to over 1km of strike and in the central part of this zone, the mineralisation is 1 kilometre wide and remains open in all directions. Drilling on the first two, of fifteen, targets away from the discovery zone intersected significant mineralisation. Intercepts of 700 metres of gold-copper-silver mineralisation, at the first anomaly and 300 metres in the second,show we have a major system with multiple centers of mineralisation."

Highlights

All six holes reported in this release intercepted at least 300 metres of mineralisation, with two holes intercepting over 600 metres of mineralisation and four of the six holes ending in mineralisation. The results include wide ore grade intercepts from drilling testing the first two of fifteen additional Au soil anomalies, separate from the initial discovery zone in CEL's 100% owned El Guayabo concession.

The drill results and distribution of the mineralisation corelate well with the underlying Au in soil anomalies. The soil anomalies are interpreted as defining the surface outcrop of mineralised intrusive breccia bodies which are sub-vertical, at least 300 metres wide and oriented parallel to the main regional north-east structural control.

Highlights include, drillhole GYDD-21-011 which was designed as test 300 metres downdip of GYDD21-001 (784.3m at 0.4 g/t AuEq including 380.5m at 0.5 g/t AuEq) on the main discovery zone. This hole intersected 307.9m at 0.6 g/t AuEq from surface, including 102.9 metres at 1.2 g/t AuEq some 300 metres above the prognosed target. It confirms that, in this location, the main discovery zone has a true width of 1000 metres (Figure 1). Drillhole GYDD-21-010 (809.9m at 0.3 g/t AuEq including 217.1m at 0.5 g/t AuEq) extends the main discovery zone by 400 metres to 1 kilometre of strike.

Highlights from the Company's initial drilling, targeting the first two of the fifteen separate Au soil anomalies, away from the initial discovery trend included:

- 692.7m at 0.3 g/t AuEq, including 220.5m at 0.6 g/t AuEq (GYDD-21-009) testing the 800 metre x 200 metre GY-B Au soil anomaly; and

- 328.3m at 0.4 g/t AuEq to the end of the hole, including 91.0m at 0.6 g/t AuEq plus 130.9m at 0.4 g/t AuEq including 62.2m at 0.5 g/t AuEq (GYDD-21-013) testing the 800 metre x 400 metre GY-C Au soil anomaly.

The results from the next six holes at CEL's 100% owned El Guayabo Project confirm the discovery of a significant intrusion hosted gold-copper-silver-molybdenum system with multiple centers of mineralisation, all of which have returned ore grade intercepts. The mineralisation has a similar scale and tenor to the Tier 1 Cangrejos Gold project located 5 kilometres along strike to north-east.

Mineralisation remains open in all directions with results for a further three holes at El Guayabo pending. An initial 18 hole drill program is underway, on CEL's adjoining Colorado V concession with results for the initial two holes pending. Given the exciting results returned to date, the Company intends to undertake a follow up drill program at El Guayabo immediately upon the completion of the current Colorado V drill program.

Click here for the full ASX Release

This article includes content from Challenger Exploration, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CEL:AU

The Conversation (0)

14 February 2022

Challenger Exploration

Gold and Copper Exploration Across Known and Untapped Sources

Gold and Copper Exploration Across Known and Untapped Sources Keep Reading...

9h

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

21h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

22h

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

22h

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

23h

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

23h

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00