September 20, 2023

Balkan Mining and Minerals Ltd (ASX: BMM; “BMM” or “the Company”) is pleased to announce the commencement of the Company’s phase 1 drill program at the Gorge Lithium Project located in Ontario, Canada (the "Gorge Lithium Project" or the "Project").

Highlights

- Diamond drill program underway at Gorge Lithium Project

- The Gorge drilling campaign has been designed to systematically test the vertical plunge extensions along prospective pegmatite strikes at the Koshman and Nelson occurrences

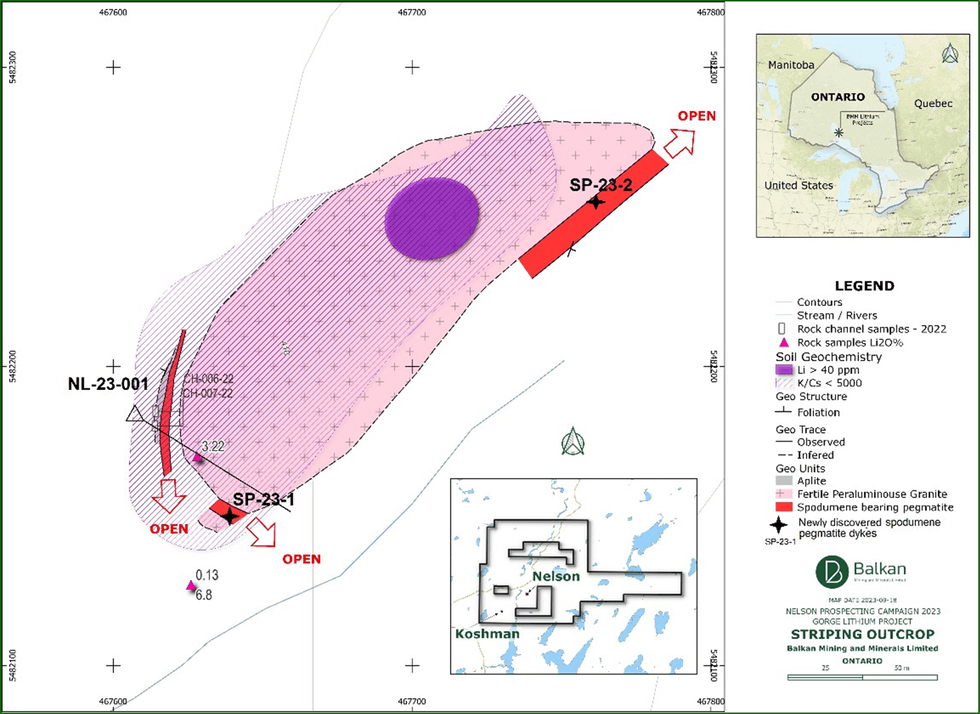

- Clearing at the Nelson spodumene pegmatite occurrence has resulted in the identification of two additional pegmatite targets along strike extending over 200m - targets remain open along strike

The ongoing drilling program will be the first sub-surface testing for lithium mineralisation at the Gorge Lithium Project where previous channel sampling results confirmed high grade lithium mineralisation at the surface, including 1.8m @ 3.75% Li2O. (see ASX Announcement dated 16 December 2022).

The 12-hole drill program has been designed to provide a better understanding of the lithium mineralisation in the shallow subsurface and to test the vertical plunge extensions along pegmatite strikes.

In parallel to clearing the access trail and setting up drill pads, the Company has been mechanically stripping at the Nelson spodumene pegmatite. Surface stripping has revealed two additional unmapped pegmatite targets located 25m southeast and 150m northwest from the Nelson discovery outcrop which demonstrates the rich endowment of pegmatites in this region and highlights the exploration potential of the Project. Detail mapping of newly discovered pegmatites is under way.

Click here for the full ASX Release

This article includes content from Balkan Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BMM:AU

The Conversation (0)

05 September 2021

Bayan Mining and Minerals

Mining Critical Minerals from the Balkan Region

Mining Critical Minerals from the Balkan Region Keep Reading...

19 January 2025

Further Exploration Targets Identified at Bayan Springs

Bayan Mining and Minerals (BMM:AU) has announced Further Exploration Targets Identified at Bayan SpringsDownload the PDF here. Keep Reading...

31 October 2024

Quarterly Activities/Appendix 5B Cash Flow Report

Balkan Mining and Minerals (BMM:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00