- WORLD EDITIONAustraliaNorth AmericaWorld

May 11, 2025

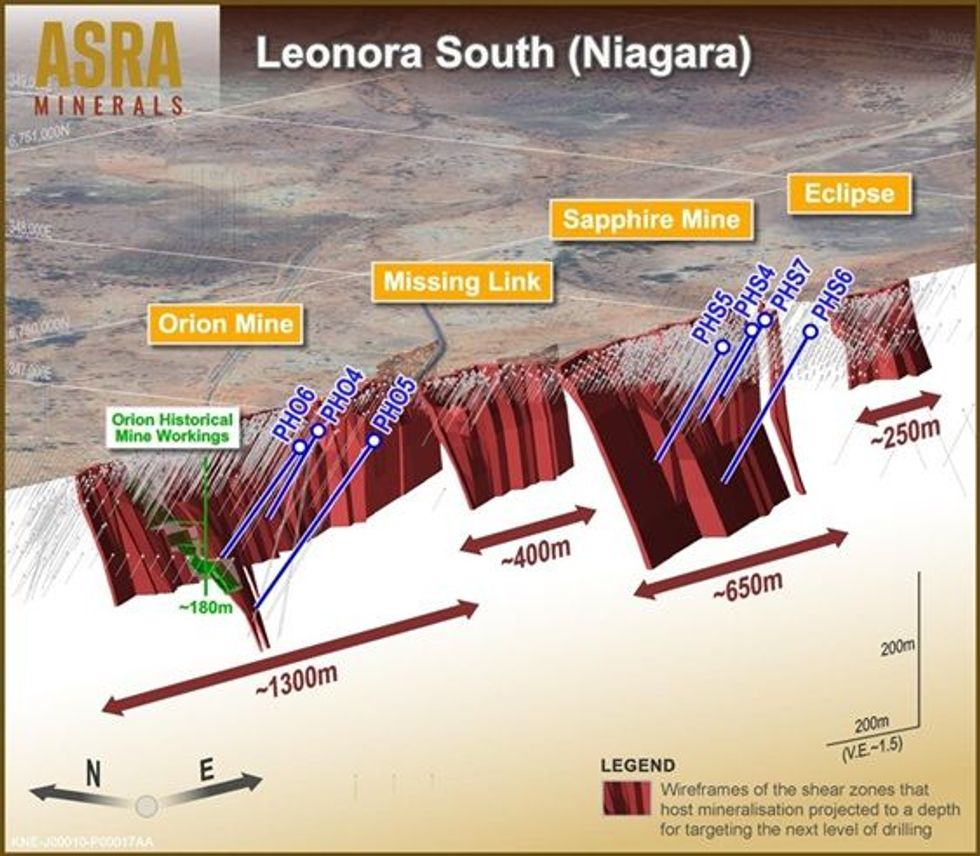

Asra Minerals Limited (ASX: ASR; “Asra” or “the Company”) is pleased to announce the commencement of a significant exploration program at its Leonora South Gold Project, located 60km south of Leonora. This program targets the down-dip extensions of the known high- grade gold mineralisation at the Orion and Sapphire deposits (see Figure 1).

Highlights

- Initial 1,300m drilling program at its Leonora South Gold Project targeting down-dip extensions of the high-grade Orion and Sapphire deposits.

- The first stage program comprises ~1,000m Reverse Circulation (RC) drilling and ~300m of Diamond Tail drilling for a total of 6 holes.

- Program follows up on significant gold intersections achieved in October 2024, which confirmed high-grade mineralisation 30 metres below existing drilling.

- The 3-4 week drilling program anticipates initial assay results within 6-8 weeks, providing timely updates on the potential for resource growth.

- Key drilling contractors secured with an optional drill-for-equity agreement in place to optimise capital management and support exploration objectives.

The initial phase of drilling comprises approximately 1,000m Reverse Circulation (RC) drilling and 300m of Diamond Tail drilling. The program will involve drilling three holes at Sapphire and Orion, respectively. The primary objective is to confirm the continuity of mineralisation at depth and evaluate the potential for resource expansion.

Asra Minerals Chief Executive Officer, Paul Stephen:

“We are excited to kick off this drilling campaign at Leonora South, which represents a focused effort to unlock the deeper potential of the high-grade gold we’ve already identified at Orion and Sapphire. The insights gained from our recent aeromagnetic review, coupled with the encouraging results from last year’s drilling, give us strong confidence in the potential to significantly expand our resource at Leonora South. We look forward to providing the market with updates as the program progresses.”

Challenge Drilling and Terra Drilling have been engaged to complete the program. A drill-for- equity facility has been agreed, whereby Asra has the option, at its election, to issue up to A$250,000 in Asra ordinary shares to the contractors for services provided at an issue price of $0.002 each and the issue of the shares will be subject to shareholder approval.

The respective agreements provide significant operational support for the drilling program and offer Asra enhanced capital management flexibility, ensuring resources are strategically allocated for current and future exploration activities.

This campaign is underpinned by a recent reinterpretation of aeromagnetic data, which refined targeting across Asra’s Leonora Gold Projects1. The first round of drilling at Leonora South will focus on the highest-ranking targets identified in this process, aiming to build upon previous successful drilling. This included a three-hole diamond drill program completed in October 20242 that intersected the presence of strong gold grades approximately 30m below previously drilled zones at Sapphire and Orion. Drilling to date has not extended below 80m vertical.

This initial program is expected to take 3-4 weeks, with the first assays anticipated 6-8 weeks following program completion. Subsequent to this program, Asra intends to commence exploration activities at its Gladstone prospect, targeting newly identified, high-priority areas.

Click here for the full ASX Release

This article includes content from Asra Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

11h

Fabi Lara: What to Do When Commodities Prices Go Parabolic

Speaking against a backdrop of record-high gold and silver prices, Fabi Lara, creator of the Next Big Rush, delivered a timely reality check at this year’s Vancouver Resource Investment Conference. Addressing a packed room that included a noticeable influx of first-time attendees, she urged... Keep Reading...

11h

Joe Cavatoni: Gold Price Drop — Why it Happened, What's Next

Joe Cavatoni, senior market strategist, Americas, at the World Gold Council, breaks down gold's record-setting run past US$5,500 per ounce as well as its correction. "At the end of this, you're looking at a lot of people who were pushing the price higher — speculative in nature — pulling back... Keep Reading...

18h

Gold-Copper Consolidation Continues as Eldorado Moves to Acquire Foran

Eldorado Gold (TSX:ELD,NYSE:EGO) and Foran Mining (TSX:FOM,OTCQX:FMCXF) have agreed to combine in a share-based transaction that will create a larger, diversified gold and copper producer with two major development projects that are set to enter production in 2026.Following completion under a... Keep Reading...

20h

Stellar AfricaGold Intersects Multiple Gold-Bearing Zones and Confirms Structural Controls at Tichka Est, Morocco - Drilling Resumed on January 30, 2026

(TheNewswire) Vancouver, BC TheNewswire - February 3rd, 2026 Stellar AfricaGold Inc. ("Stellar" or the "Company") (TSX-V: SPX | FSE: 6YP | TGAT: 6YP) is pleased to report additional assay results and an updated interpretation from its ongoing diamond drilling program at the Tichka Est Gold... Keep Reading...

02 February

Gold and Silver Prices Take a U-Turn on Trump's Fed Chair Nomination

Gold and silver prices have experienced one of their most savage corrections in decades. After hitting a record high of close to US$5,600 per ounce in the last week of January, the price of gold took a dramatic U-turn on January 30, dropping as low as US$4,400 in early morning trading on Monday... Keep Reading...

02 February

Bold Ventures Kicks Off 2026 with Diamond Drilling Program at Burchell Base and Precious Metals Project

Bold Ventures (TSXV:BOL) has launched a diamond drilling program at its Burchell base and precious metals property in Ontario, President and COO Bruce MacLachlan told the Investing News Network.“We just started drilling a couple of weeks ago, and we’ll be drilling for a while,” MacLachlan said,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00