- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

November 13, 2023

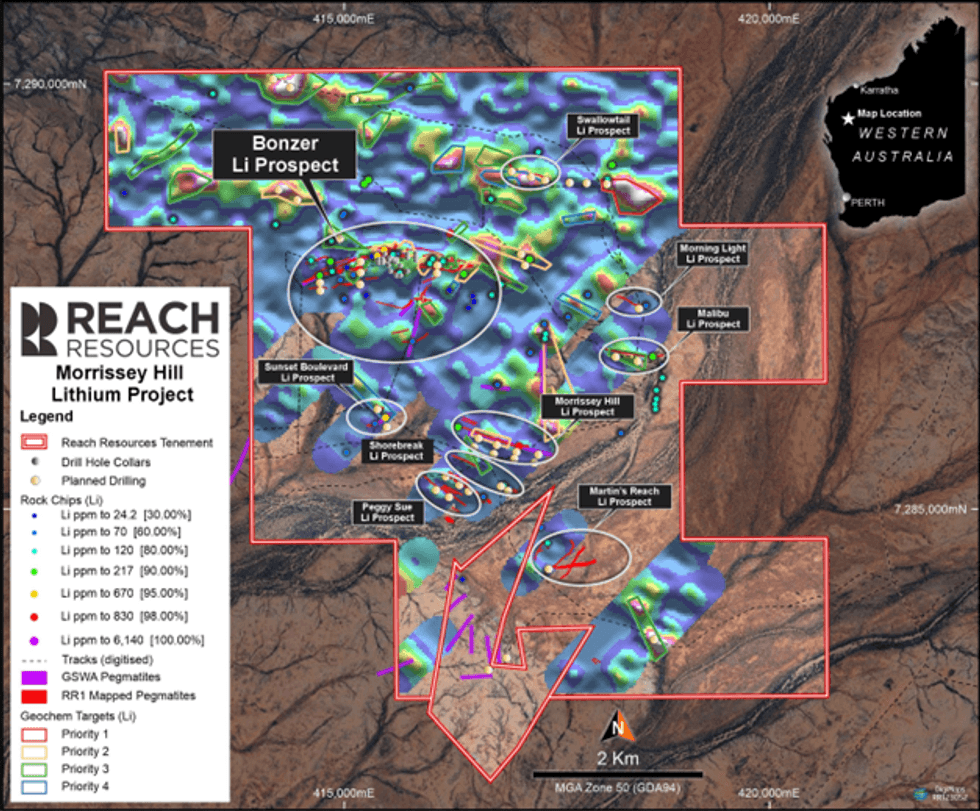

Reach Resources Limited (ASX: RR1 & RR1O) (“Reach” or “the Company”) is pleased to advise that Strike Drilling have today mobilised for commencement of the Phase 2 drilling program at the Company’s 100% owned Morrissey Hill Lithium Project.

HIGHLIGHTS

- Strike Drilling have been engaged and mobilised to site to undertake the Phase 2 exploration program at the Company’s Morrissey Hill Lithium Project, Yinnetharra WA

- The Phase 2 drilling campaign is anticipated to consist of up to 9,000m of RC drilling

- Phase 2 drilling will follow the plunge of the mineralisation at the Bonzer Prospect and test at least six other undrilled pegmatite targets

- Morrissey Hill is located adjacent to Delta Lithium’s (ASX: DLI) Malinda Lithium Project, Yinnetharra WA

Phase 2 drilling will follow up the anomalous results from the initial drill program at the Bonzer Prospect (Bonzer), focusing on drill targets along strike to both the east and west of the initial drilling at Bonzer. In addition, drilling will be conducted on additional new drill targets identified during previous field work, including new targets identified by Sugden Geoscience based upon analysis of the Company’s soil, rock chip and drill results.

The initial drill program consisted of approximately 4500m. Based on the results from the initial drilling program and the analysis completed by Sugden Geoscience, the Company is expanding its drilling program with Phase 2 to aggressively explore further targets within areas that have heritage clearance, aiming for up to 9,000m in total new drilling.

The Company’s CEO, Jeremy Bower said

“We see the initial drill program at Bonzer as a first step towards success at Morrisey Hill. The initial results have provided us with the encouragement to double our drilling metres in Phase 2 of the drilling program. We are a data driven team and we will work through this process methodically, with rigour and technical discipline. The data we have from exploration at Morrisey to date supports our contention that the project holds the potential to host high grade lithium, just like the Delta discovery next door. The Future is within Reach.”

Click here for the full ASX Release

This article includes content from Reach Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

RR1:AU

The Conversation (0)

03 May 2022

Reach Resources Limited

Sourcing the Critical Minerals of the Future

Sourcing the Critical Minerals of the Future Keep Reading...

13 May 2025

Murchison South Increases to 67koz Gold Across Two Pits

Reach Resources Limited (ASX: RR1 & RR1O) (“Reach” or “the Company”) is pleased to announce the completion of a new Mineral Resource Estimate (MRE) for the Pansy Pit deposit at its Murchison South Gold Project. The estimate, prepared by independent consultants Mining Plus, reported above a... Keep Reading...

28 July 2023

Quarterly Activities/Appendix 5B Cash Flow Report

Reach Resources Limited (ASX: RR1) (“Reach” or “the Company”) provides its activities report for the quarter ended 30 June 2023. HIGHLIGHTS High-Grade Lithium Results at Yinnetharra (15 May 2023) Lithium mineralisation confirmed with rock chip samples reporting highly encouraging assays of up to... Keep Reading...

18 May 2023

Outcropping Copper Gossan Delivers 33% Cu Assays At Morrissey Hill Project, Yinnetharra

Reach Resources Limited (ASX: RR1 & RR1O) (“Reach” or “the Company”) is pleased to announce that it has received high grade copper, gold and silver results up to 33% copper, 0.2g/t gold and 142g/t silver from its recently completed rock chip sampling program at the Company’s Morrissey Hill... Keep Reading...

14 May 2023

Reach Resources’ Strategic Position Between Two of WA’s Mining Heavyweights

Reach Resources’ (ASX:RR1) strategic position with its Morrissey Hill project has placed the critical mineral explorer on the radar of two of Western Australia’s mining giants Delta Lithium (ASX:DLI) and Minerals 260 (ASX:MI6), according to an article published in The West Australian.“While... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00