October 27, 2025

Visually mineralised targets being drilled to build on existing resource

Jangada Mines Plc (AIM: JAN), a Brazil focused natural resource development company, is pleased to announce that its 15-hole 1,800m diamond drilling ("DD") programme has commenced at the 7,211-hectare Paranaíta Gold Project ("Paranaíta" or the "Project") located in Brazil's historically significant Alta Floresta-Juruena Gold Province.

Highlights:

- 3,100m of trenching completed - further highly visually mineralised veins identified

- 15-hole, 1,800m diamond drilling programme commenced

- Drilling to focus on high grade mineral sequences identified from trenching, topographic studies and extensive historic data

- Drilling campaign aiming to increase resource to 350,000 oz gold under JORC

- Significant potential for further resource growth with multiple additional targets already identified

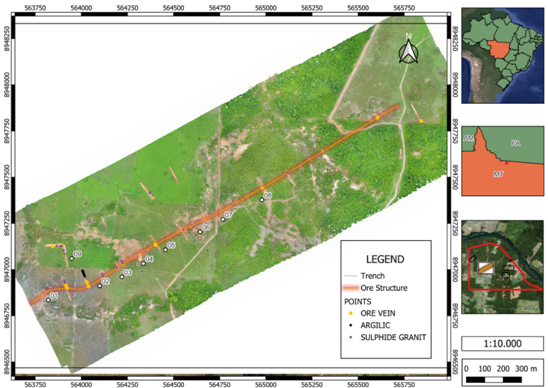

Following the completion of 3,100m of trenching, which yielded further highly visually mineralised veins, the analysis of existing data, and two topographic studies, a 10-week drill programme at Paranaíta has been designed primarily targeting the high-grade TP2 and TP3.2 (within TP3) targets. The first 8 drill holes of c.120m each will target the identified mineral sequence from trenches TR-02 to TR-08, where the mineralised vein was well identified over more than 700m and contained visible gold.

---

Figure 1: Drill holes on TP2

|

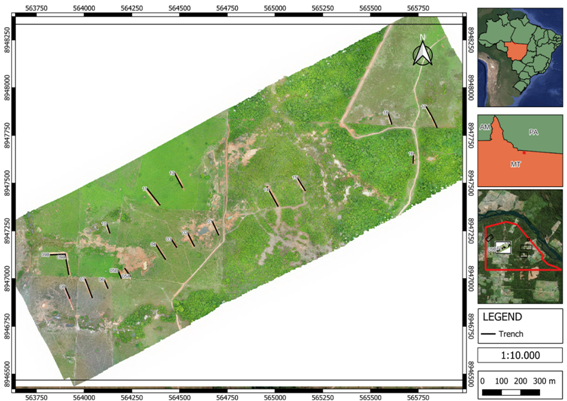

The remaining holes will target TP3.2 where the trenches TR-19 to TR-31 were executed with excellent results yielding well identified mafic dikes and disseminated granites. TR-18 identified a 2m thick vein (See Figure 2). The location of these is now being finalised and will depend on the chemical analysis results due in Q4.

|

Figure 2: 2m thick vein at TR18

The drill programme is focused on expanding the current resource from 210,000 oz Au @3.165 g/t to ~350,000 oz Au under the JORC code. The TP2 and TP3.2 zones have a resource of c.106,600 oz @ 16.65 g/t Au and c.34,600 oz @ 1.35 g/t Au respectively and are two of the six identified high priority targets along the 8km mineralised corridor. This corridor has 15+ high-grade gold occurrences and historical sampling up to 135 g/t Au.

Jangada CEO, Paulo Misk, said: "With trenching now complete and having confirmed further visually mineralised vein systems, we are pleased to announce the launch of our inaugural drill programme at the high-grade Paranaíta Gold Project. This 15-hole, 1,800-metre campaign will focus on two of the six identified high-grade, near-surface zones. Our immediate goal is to expand the current resource to approximately 350,000 ounces of gold. However, with multiple additional targets across the broader project area, we believe there is significant potential for further resource growth through continued exploration.

"In the current gold price environment, high-grade, shallow deposits are especially attractive, as they typically fall at the lower end of the capital cost curve and offer robust margins with strong value potential. We believe Paranaíta exemplifies these characteristics. Accordingly, we look forward to fast-tracking its development and that continued success will underpin a meaningful revaluation of Jangada."

Trench Locations TP2:

Qualified Person's Statement

The technical information in this announcement has been reviewed by Mr. Peter Heinrich Müller who is a member of the South African Council of Natural Scientific Professions (#114766). Mr. Müller is a senior professional geologist with +17 years of experience in the mining industry, which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he has undertaken to qualify as a Competent Person as defined in the 2012 edition of the JORC Code. Mr. Müller also meets the requirements of a competent person under the AIM Note for Mining, Oil and Gas Companies. Mr. Müller has no economic, financial or pecuniary interest in the Company, and he consents to the inclusion in this document of the matters based on his technical information in the form and context in which it appears.

ENDS

For further information please visit www.jangadamines.com or contact:

Jangada Mines plc | Brian McMaster (Chairman) | Tel: +44 (0)20 7317 6629 |

Strand Hanson Limited (Nominated & Financial Adviser) | Ritchie Balmer James Spinney David Asquith | Tel: +44 (0)20 7409 3494 |

Tavira Financial Ltd (Broker) | Jonathan Evans | Tel: +44 (0)20 7100 5100 |

Investor Relations | Hugo de Salis | hugo@lepanto.co.uk |

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulation (EU) No. 596/2014 as it forms part of United Kingdom domestic law by virtue of the European Union (Withdrawal) Act 2018, as amended by virtue of the Market Abuse (Amendment) (EU Exit) Regulations 2019.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.

The Conversation (0)

1h

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

6h

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

8h

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

8h

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

9h

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

19h

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00