Chibougamau Independent Mines Inc. (CBG-TSXV in Canada, CLL1-Frankfurt, Stuttgart, Berlin and Lang & Schwarz Stock Exchanges in Germany, CMAUF-OTC in the US), herein called Chibougamau, is pleased to update shareholders as regards recent drilling reported by TomaGold Corporation (LOT-TSXV, TOGOF-OTCPK) on the Berrigan property located west of the town of Chibougamau, under option from Chibougamau Independent Mines Inc. Updated option terms were published in a Chibougamau Independent press release dated September 30, 2025 accessible by clicking here.

Tomagold has published assay results for two drill holes TOM-25-015 and TOM-25-014 as follows:

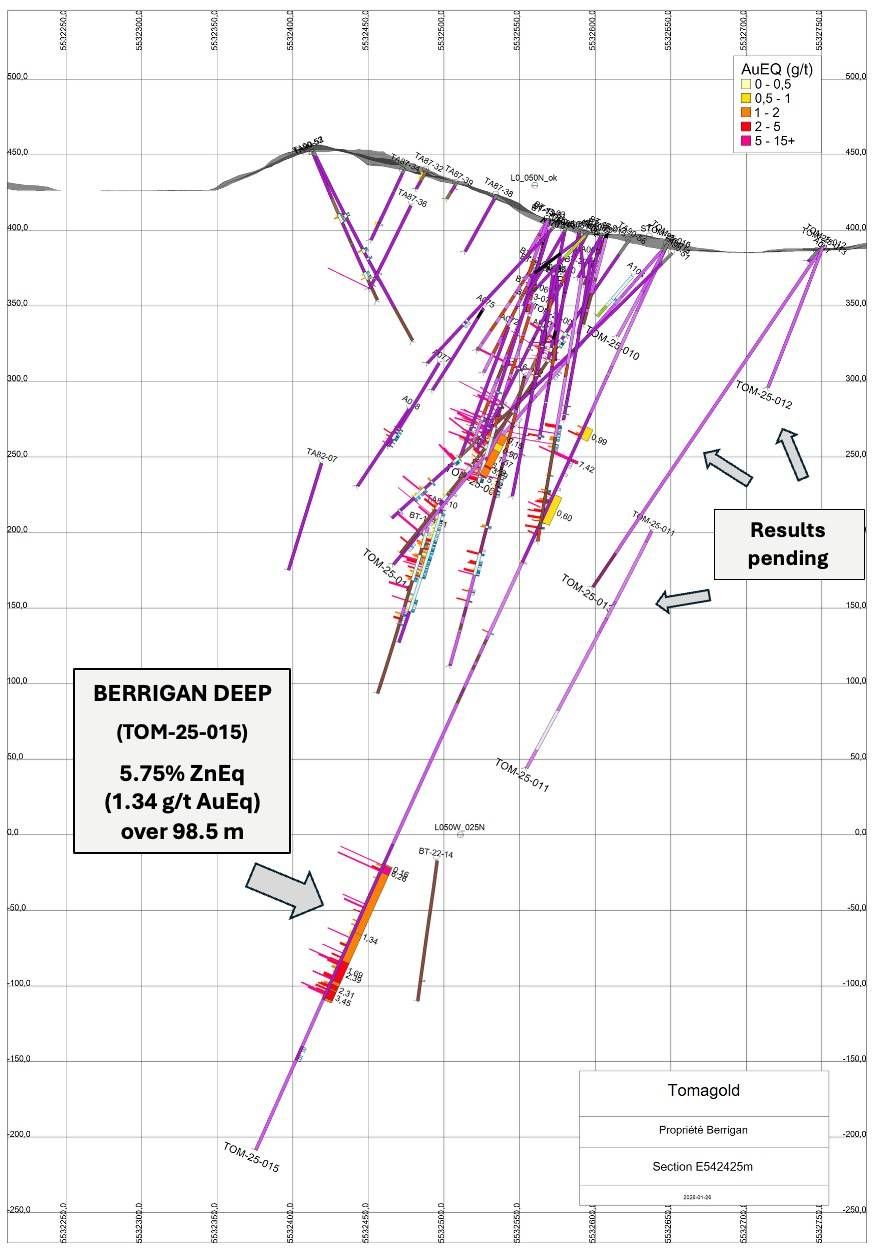

- Drill hole TOM-25-015 (from 451.20 m): 5.75% ZnEq (1.34 g/t AuEq) over 98.5 m

- Including: 26.67% ZnEq (6.26 g/t AuEq) over 4.90 m

- Including: 7.26% ZnEq (1.69 g/t AuEq) over 49.35 m

- Including: 10.26% ZnEq (2.39 g/t AuEq) over 14.60 m, 9.94% ZnEq (2.31 g/t AuEq) over 3.25 m, and 14.82% ZnEq (3.45 g/t AuEq) over 6.20 m

- Drill hole TOM-25-015 confirms the discovery of a new major semi-massive sulfide zone, named Berrigan Deep, which remains open at depth

- Drill hole TOM-25-014 (from 185 m): 28.69% ZnEq (6.73 g/t AuEq) over 2.10 m

For more details, shareholders may access the Tomagold press release by clicking here.

Tomagold states that "Drill hole TOM-25-015, grading 5.75% ZnEq (1.34 g/t AuEq) over 98.5 m, is truly transforming the Berrigan Mine project and highlights a new semi-massive sulfide zone that extends at depth beneath the known zones. This very encouraging result suggests the presence of a large mineralized system that remains open at depth."

The drill holes contain significant secondary silver and gold mineralization. The table below provides the breakdown of individual assays.

Results from drill holes TOM-025-014 and TOM-025-015: Berrigan Mine project

| Hole ID | From (m) | To (m) | Length (m) | ZnEq (%) | AuEq (g/t) | Au (g/t) | Ag (g/t) | Cu (ppm) | Zn (ppm) |

| TOM-25-014 | 185.00 | 187.10 | 2.10 | 28.69 | 6.73 | 4.94 | 56.44 | 545 | 45509 |

| 238.70 | 239.85 | 1.15 | 23.29 | 5.43 | 2.63 | 22.20 | 1590 | 104000 | |

| 251.20 | 252.60 | 1.40 | 41.79 | 9.80 | 7.44 | 37.30 | 552 | 80400 | |

| 405.30 | 406.70 | 1.40 | 14.99 | 3.48 | 1.13 | 13.15 | 655 | 92514 | |

| 423.30 | 426.30 | 3.00 | 2.34 | 0.54 | 0.07 | 5.45 | 493 | 15700 | |

| 451.50 | 457.50 | 6.00 | 1.34 | 0.31 | 0.08 | 3.45 | 77 | 7882 | |

| TOM-25-015 | 132.55 | 141.00 | 8.45 | 4.22 | 0.99 | 0.51 | 5.51 | 338 | 16610 |

| 155.70 | 157.70 | 2.00 | 31.75 | 7.42 | 4.66 | 26.90 | 684 | 102850 | |

| 182.10 | 202.20 | 20.10 | 2.55 | 0.60 | 0.36 | 3.20 | 265 | 7687 | |

| 451.20 | 549.70 | 98.50 | 5.75 | 1.34 | 0.82 | 3.21 | 386 | 19751 | |

| including | 452.20 | 457.10 | 4.90 | 26.67 | 6.26 | 4.69 | 18.80 | 2897 | 47876 |

| and including | 500.35 | 549.70 | 49.35 | 7.26 | 1.69 | 0.90 | 3.48 | 310 | 31250 |

| Including | 521.00 | 535.60 | 14.60 | 10.26 | 2.39 | 1.34 | 5.91 | 420 | 41158 |

| Including | 537.85 | 541.10 | 3.25 | 9.94 | 2.31 | 0.88 | 3.85 | 529 | 58200 |

| Including | 542.00 | 548.20 | 6.20 | 14.82 | 3.45 | 1.63 | 5.26 | 511 | 74276 |

Notes:

- The reported widths represent core lengths. True width is estimated to be approximately 80-85% of the core length, depending on the deviation angles.

- ZnEq and AuEq are calculated using the Company's standard parameters.

- AuEq calculation was based on US$4150/oz Au, $51.36/oz Ag, US$5.044/lb. Cu and $1.398/lb Zn. AuEq = Au g/t + (Ag g/t × 0.01237) + (Cu ppm × 0.000083) + (Zn ppm × 0.000023). The use of AuEq is to calculate cut-off grades for exploration purposes, and no adjustments were made for metal recovery. The Company is currently in the initial exploration phase, following historical drilling. At this stage, the Company does not have any metallurgical data and no comparative studies have been conducted, given the geological complexity of the ultramafic host rock. Furthermore, the Company is not aware of any deposits that may have similar geological characteristics.

- ZnEq calculation was based on US$4047/oz Au, $50.22/oz Ag, US$4.796/lb. Cu and $1.390/lb Zn. ZnEq = Zn ppm + (Ag g/t × 527) + (Au g/t x 42466) + (Cu ppm × 3.45) / 10,000. The use of ZnEq is to calculate cut-off grades for exploration purposes, and no adjustments were made for metal recovery. The Company is currently in the initial exploration phase, following historical drilling. At this stage, the Company does not have any metallurgical data and no comparative studies have been conducted, given the geological complexity of the ultramafic host rock. Furthermore, the Company is not aware of any deposits that may have similar geological characteristics.

Drill Hole TOM-25-015: A Major Discovery at Depth

This press release was written by Jack Stoch, P. Geo., President and CEO of Chibougamau Independent Mines Inc. in his capacity as a Qualified Person (Q.P.) under NI 43-101.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

| We Seek Safe Harbour. | CUSIP Number 167101 203 LEI 529900GYUP9EBEF7U709 |

| For further information, contact: | |

| Jack Stoch, P.Geo., Acc.Dir. President & CEO Chibougamau Independent Mines Inc. 86, 14th Street Rouyn-Noranda, Quebec Canada J9X 2J1 | Tel.: 819.797.5242 Fax: 819.797.1470 info@chibougamaumines.com www.chibougamaumines.com |

Forward-Looking Statements

Except for historical information this News Release may contain certain "forward looking statements". These statements may involve a number of known and unknown risks and uncertainties and other factors that may cause the actual results, level of activity and performance to be materially different from the Companies expectations and projections. A more detailed discussion of the risks is available under "disclaimer" on the Company's website.

A map accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/2f2e13be-17d4-4c01-9b16-1957e866fc41