February 28, 2024

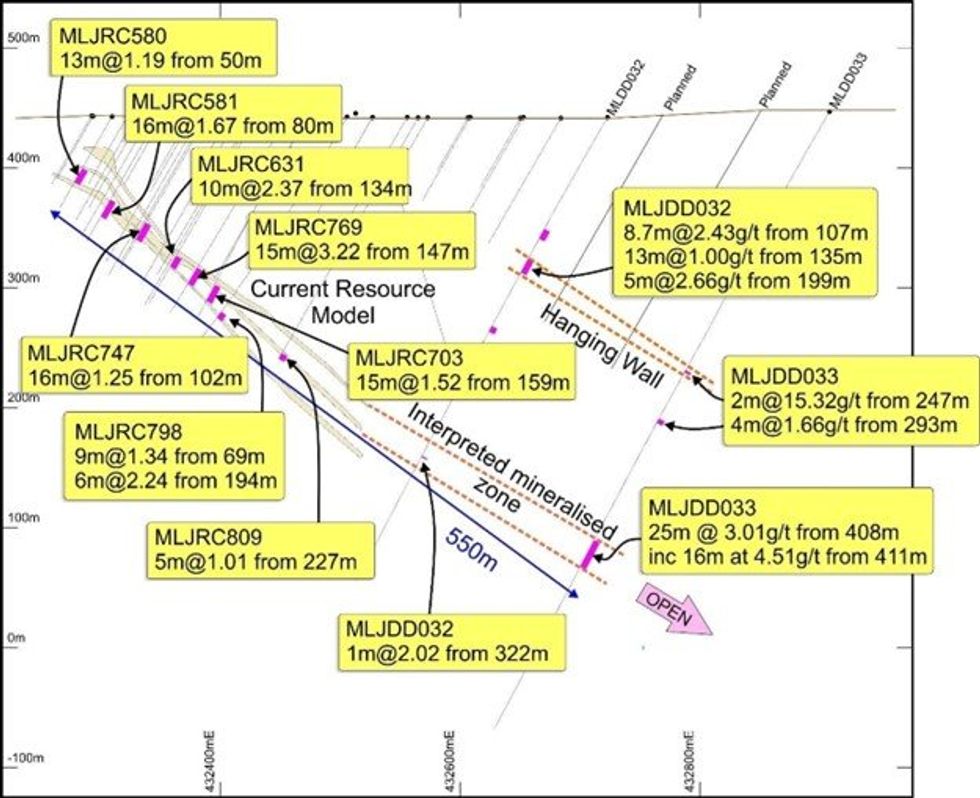

Magnetic Resources NL (Magnetic or the Company) is pleased to announce, after a significant intersection of 16m at 4.51g/t from 411m, which was a very large 200m step out below the current resource (Figure 4) six deeper holes were drilled to ascertain the depth continuity in other parts of the LJN4 Deposit. Some compelling intersections are outlined below.

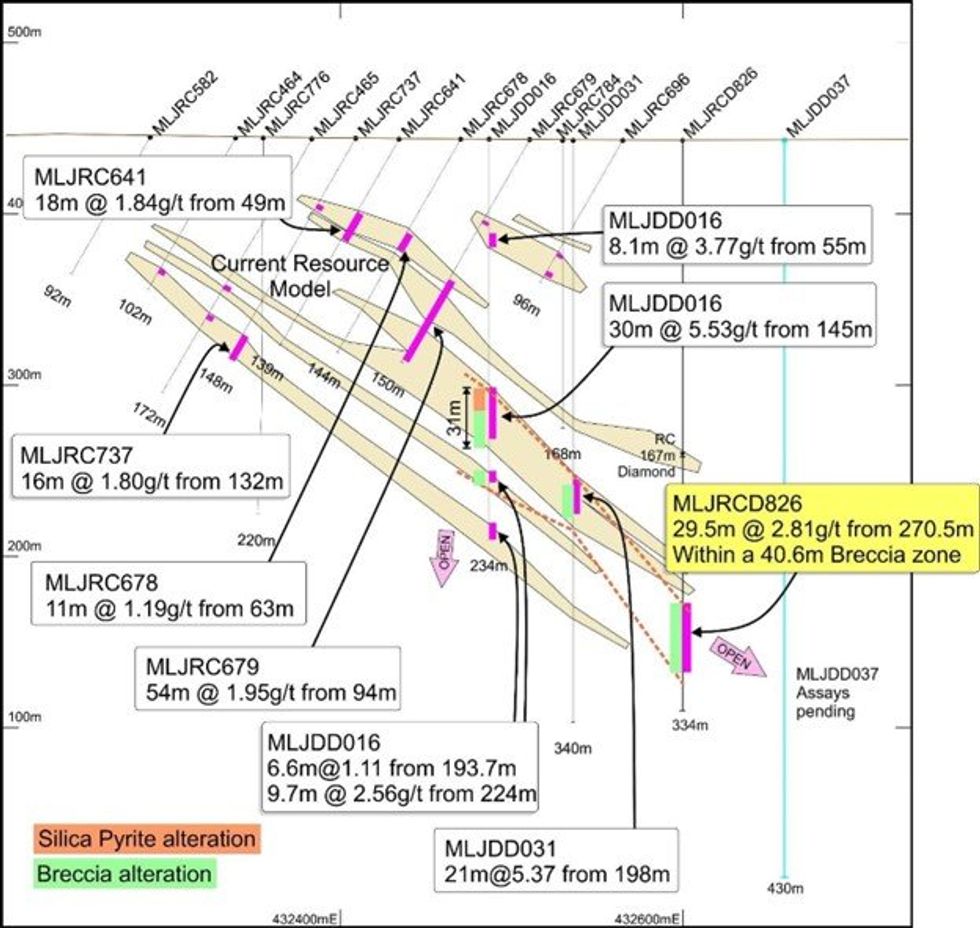

- MLRCD826 intersected 29.5m at 2.81 g/t from 270.5M within a 40.6m breccia zone, which is a 100m step out down dip from MLJDD031 which intersected 21m at 5.37g/t from 198m. also within breccia zone. MLRCD826 is still open down dip and MLJDD037 is a further 100m step out and results are pending for this recently completed hole (Figure 1).

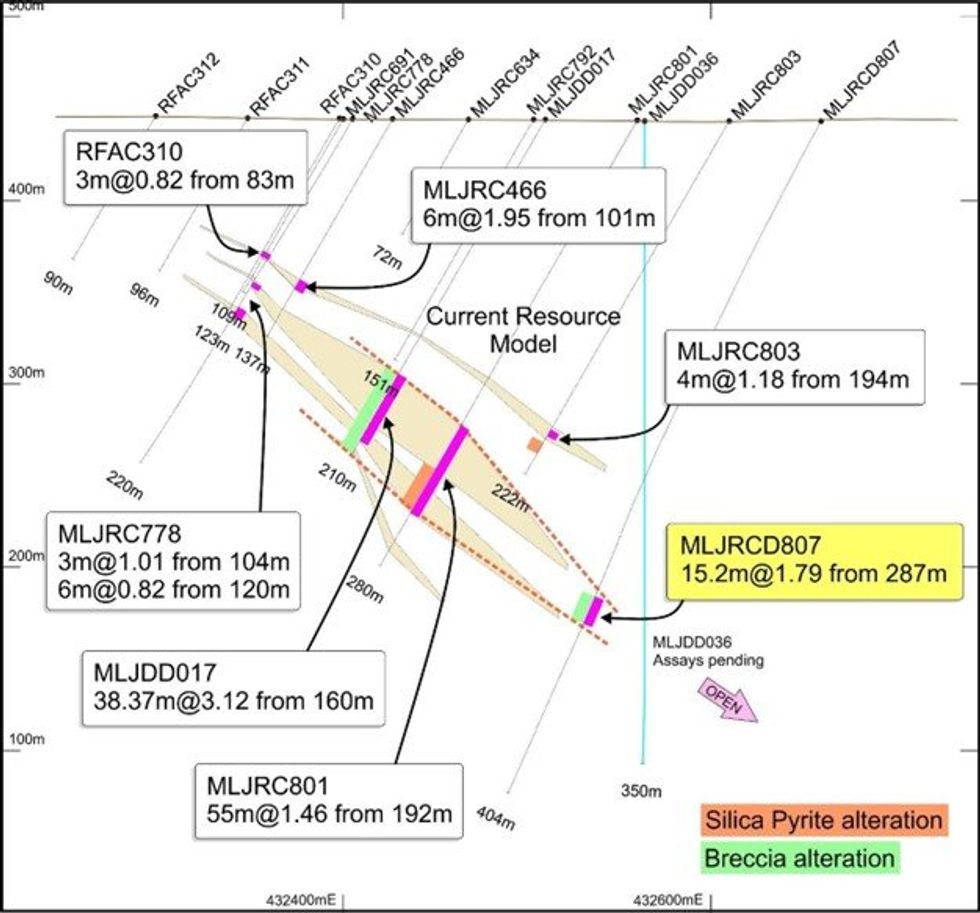

- MLJRCD807 is a southern extension of the main breccia zone described above and intersected 15.2m at 1.79g/t from 287m and is a 100m step out down dip from MLJRC801 which intersected 55m at 1.46g/t from 192m. Results are pending for MLJDD036 which is a further 50m step out from MLJRCD807 (Figure 2). This intersection in MLJCD807 is open to the south where MLJDD038 is now being drilled.

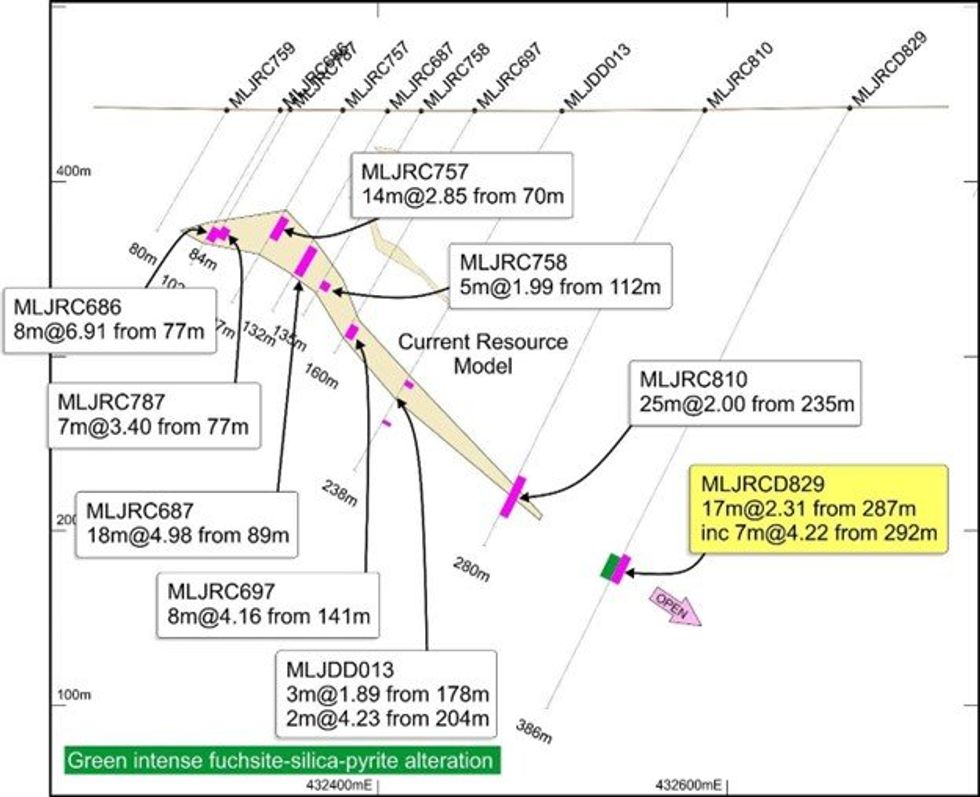

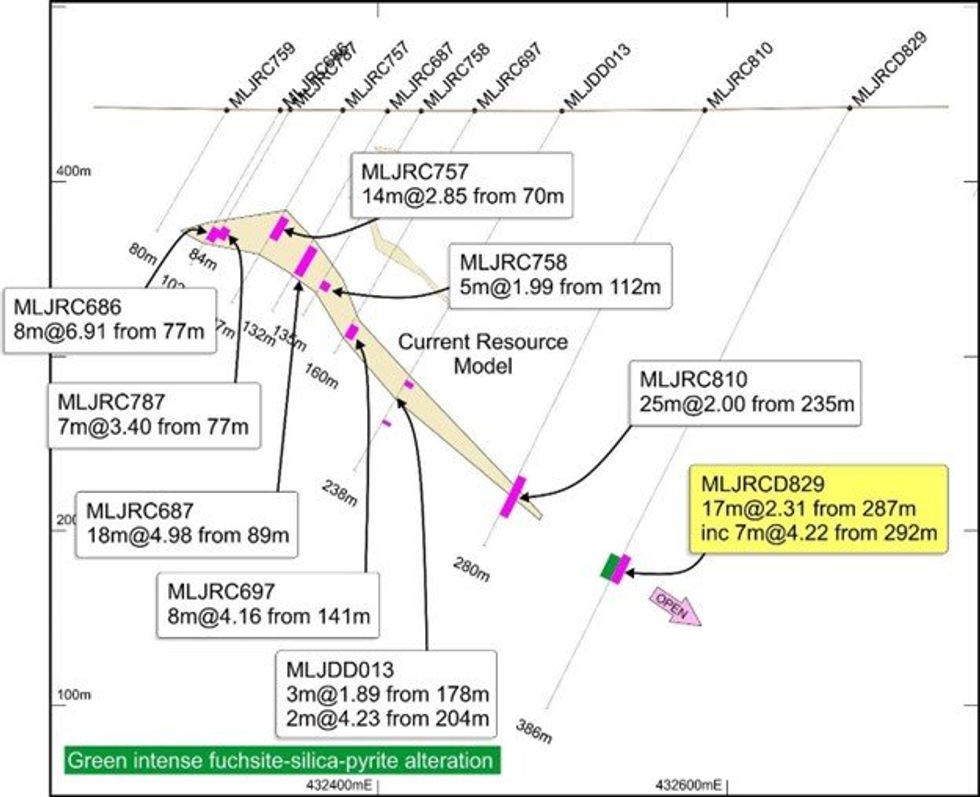

- In the northern part of LJN4 there is a strong green fuchsite-silica-pyrite alteration within the ultramafic. Both drill holes MLJRCD828 and 829 ended in thick zones of this distinctive green alteration as shown in Figure 7 (which highlights the zone in MLJRCD828). Both zones are strongly mineralised with an intersection of 16m at 2.44g/t from 272m in MLJRCD828 (Figure 5) and 17m at 2.31g/t from 287m in MLJRCD829 (Figure 4).

- It should be noted that the northern part of LJN4 is now continuous over 300m down dip as shown in Figures 4 and 5. The central part is continuous down dip to 550m (Figure 3) and the southern part is continuous down dip to 400m (Figure 1). Note in all areas the LJN4 deposit is still open down dip over a 700m strike length.

- As described previously there was a 107% increase in overall resource in our Laverton Project to 22.7Mt @1.69g/t totalling 1.24moz of gold at 0.5g/t cut off and LJN4 increased by 317% from 204,000oz to 852,000oz, which was announced on November 23 2023 (Table 1), a number of deeper step out holes have now been carried out to see whether the LJN4 resource appears to extend further at depth.

This structure and mineralisation is expected to continue at depth within the Chatterbox shear, which is a regional scale structure that controls many deposits along its length including LJN4, Apollo, Beasley Creek and Wallaby. A seismic survey Magnetic completed (ASX Release 15 February 2021) shows a depth extent of 1.5km.

The central part of the 700m long LJN4 deposit has been infill drilled with very promising results. Highlights of this drilling are shown in Table 4, Figures 1-5.

Click here for the full ASX Release

This article includes content from Magnetic Resources NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MAU:AU

The Conversation (0)

13 December 2023

Magnetic Resources NL

An Exciting Gold Development Play in Western Australia

An Exciting Gold Development Play in Western Australia Keep Reading...

6h

Peruvian Metals Closes Private Placement

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce the closing of its non-brokered private placement (the "Offering") previously announced on January 29, 2026. Pursuant to the Offering, the Company issued an aggregate of 10,000,000 units... Keep Reading...

8h

Blackrock Silver Commences 17,000 Metre Two-Phased Expansion Drill Programs at Tonopah West Project

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") announces the mobilization of drill rigs for two major resource expansion drill campaigns at the Tonopah West project ("Tonopah West") located along the Walker Lane Trend in Nye and Esmeralda... Keep Reading...

8h

American Eagle Reports Breakthrough Drilling at NAK, Encountering Continuous Mineralization over Previously Untested 1.7 km Trend, Including 901 m of 0.43% CuEq from Surface

Highlights: A broad zone of mineralization intersected within rocks of the Babine porphyry stock, previously interpreted to be barren; NAK mineralized system has significantly expanded. Prospective footprint effectively quadrupled, with porphyry Cu-Au-Mo mineralization now demonstrated... Keep Reading...

19h

How to Invest in Gold Royalty and Streaming Stocks

Gold royalty companies offer investors exposure to gold and silver with the benefits of diversification, lower risk and a steady income stream. Royalty companies operating in the resource sector will typically agree to provide funding for the exploration or development of a resource in exchange... Keep Reading...

19h

How Would a New BRICS Currency Affect the US Dollar?

The BRICS nations, originally composed of Brazil, Russia, India, China and South Africa, have had many discussions about establishing a new reserve currency backed by a basket of their respective currencies. The creation of a potentially gold-backed currency, known as the "Unit," as a US dollar... Keep Reading...

22h

Toronto to Host Global Mineral Sector for PDAC 2026, March 1 – 4

The Prospectors & Developers Association of Canada (PDAC) will bring together the mineral exploration and mining community in Toronto for its 94th annual Convention, taking place March 1 – 4, 2026, at the Metro Toronto Convention Centre (MTCC).As the World’s Premier Mineral Exploration & Mining... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00