Crude Oil Production to Rise Through 2020, Reducing Net Petroleum Imports

The US Energy Information Administration reported that in its recently released Annual Energy Outlook 2015 (AEO 2015), it noted the EIA expects US crude oil production to rise through 2020 as oil prices recover, reducing net petroleum imports.

The US Energy Information Administration reported that in its recently released Annual Energy Outlook 2015 (AEO 2015), it noted the EIA expects US crude oil production to rise through 2020 as oil prices recover, reducing net petroleum imports.

As quoted in the market news:

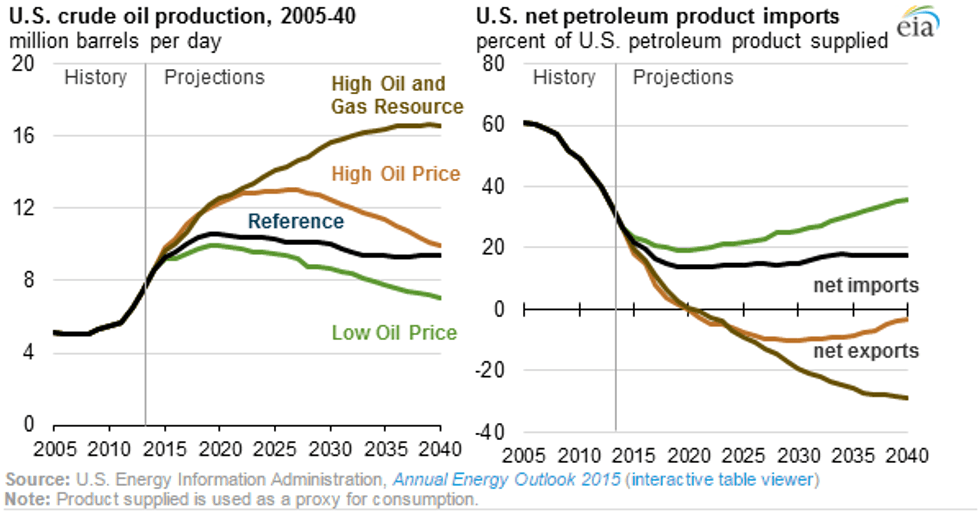

AEO 2015 explores the effects of domestic crude oil production under various assumptions about world oil prices and domestic resource availability.

In all AEO2015 scenarios, the United States remains a net importer of crude oil (despite increased domestic production) and a net exporter of petroleum products. As always with EIA base-case outlooks, AEO2015 assumes no changes in current laws and regulations. Thus, all cases in the AEO2015 assume that current restrictions on U.S. crude oil exports remain in place.

Increasing levels of domestic crude oil production through 2020 have two effects: lower crude oil imports and higher throughput at U.S. refineries. Higher refinery throughput increases production and net exports of refined petroleum products like motor gasoline and diesel fuel.

Together, lower crude oil imports and higher product exports reduce net imports of petroleum and other liquids, which in 2013 provided 33 percent of total U.S. consumption (product supplied). In the AEO2015 Reference case, this percentage falls to 14 percent in 2020, when domestic crude oil production reaches 10.6 million barrels per day. Domestic crude oil production then begins to decline, and the net import share of product supplied increases to 17 percent by 2040.

Click here to read the full US Energy Information Administration report.