Learn about the current state of the electric vehicle industry in Europe, plus carmakers’ plans and the outlook for the region.

Last year kicked off a decade where electric vehicles (EVs) are expected to take over the roads, and even though the COVID-19 pandemic has taken center stage, the narrative around the electrification of the world seems to be gathering pace by the day.

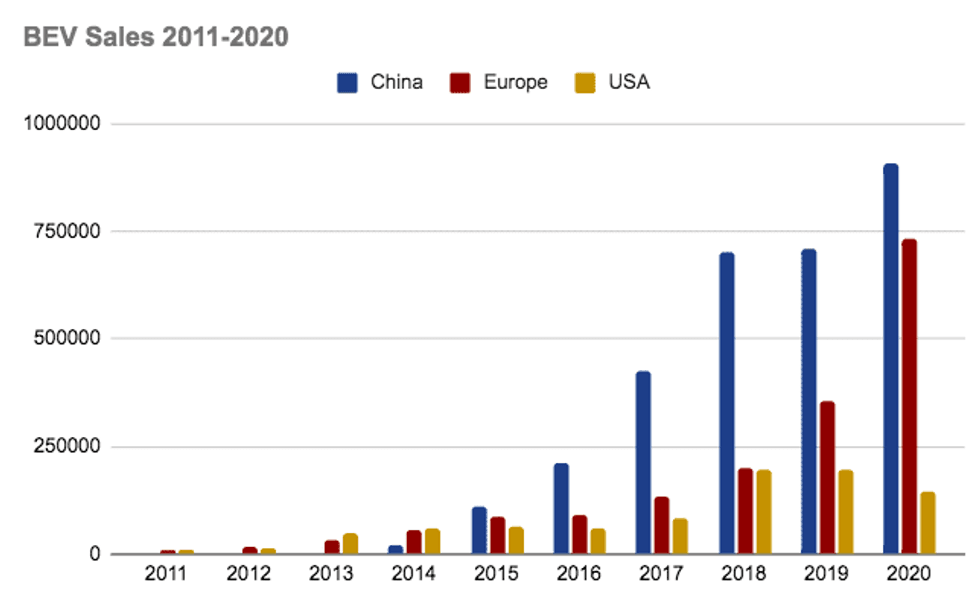

In 2020, Europe overtook China as the world’s biggest EV market, with the region aiming to have at least 30 million zero emission vehicles on its roads by 2030.

Here the Investing News Network looks at the current state of the EV industry in Europe, as well as carmakers’ plans and the outlook for EV activities in the region.

Electric vehicles in Europe

2020 was a stellar year for the registration of EVs in Europe, supported in part by legislation that took effect last year. The region is now requiring that the average carbon dioxide output of new cars across a manufacturer’s fleet be reduced to 95 grams of CO2 per kilometer.

“Each OEM has its own emission target based on the average weight of its cars (and only the 95 percent least-polluting cars count), and there are several flexibilities to help OEMs meet their targets — such as super credits, eco-innovation credits, manufacturing pooling,” Charles Lester of Rho Motion explained to the Investing News Network (INN). “The penalty for not meeting the target is set at 95 euros for each gram per kilometer of the target exceeded per car registered.”

Despite the COVID-19 pandemic, which pushed economies to close down and brought uncertainty to the world, these plans continued their course.

“Governments and automakers stood by them despite the challenges of the pandemic, which helped spur on EV growth despite an overall market decline,” Luke Gear of IDTechEx told INN. “EVs were also included in COVID-19 stimulus packages in Europe, whereas internal combustion engines were left out — in stark contrast to the aftermath of the 2008 economic crisis.”

Until 2020, very few OEMs took electrification seriously, delaying their plans due to several factors, JATO’s Felipe Munoz commented to INN.

“However, the regulation is forcing them to do this, because if they don’t they will be forced to pay a lot of penalties,” he said. “Governments around the region, especially the French government, the German and the British one, are all almost forcing their local OEMs to start producing EVs in order to avoid future problems in terms of labor or in terms of reducing costs.”

Not all EVs are created equal — there are battery electric vehicles (BEVs), hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs).

According to Rho Motion, in 2020, PHEVs accounted for 46 percent of total EVs sold in the EU, the European Free Trade Association (EFTA) and the UK. In the opening two months of 2021, PHEVs accounted for 56 percent of EVs sold in the same regions.

Further, it’s worth noting that in 2020 Europe outsold China as the biggest market for pure electric cars.

Chart via JATO.

“This is remarkable considering the pandemic,” Munoz said. “But it is mostly explained by some measures that the Chinese government implemented regarding the incentives, as some incentives were not available anymore in China, which impacted demand.”

Last year, automakers overall saw the need to increase the number of EV models they are offering to customers in an effort to increase their sales, said Srinath Rengarajan, global head of automotive research at Oliver Wyman. “We’re at the beginning of this, pretty much, because not only has there been an explosive increase in the last year, but looking at what announcements have come from various automakers, it looks like there’s going to be about 600 new models coming out in next five years globally from different car makers,” he told INN.

Consumers’ readiness to buy and switch to EVs is increasing as well, which has also contributed to increased demand.

Carmakers in Europe going electric

While in 2019 it was US-based Tesla (NASDAQ:TSLA) that took the main spot in Europe, 2020 was the year Volkswagen (VW) (OTC Pink:VLKAF,FWB:VOW) secured the leading seat in the region.

“Last year, it was VW because finally we saw a car for the ‘masses,’ although it’s still quite expensive,” Munoz said, referring to the company’s ID.3 model. “What we are seeing now is less expensive EVs out there, and Volkswagen, which is the biggest carmaker in Europe, finally introduced one of these models, and you can buy it right now.”

By 2025, VW plans to build and sell up to 3 million all-electric cars per year, aiming to have over 80 new electric models, including 50 purely electric-powered vehicles by then.

But Volkswagen was not the only player making moves in the EV space last year.

“PSA also launched two key cars, which are the Peugeot 208 electric and the open Corsa electric, which are two very popular cars that now you can buy electric — that’s a big step,” Munoz said.

Stellantis (NYSE:STLA), the world’s fourth largest carmaker, formed after the merger of Fiat Chrysler and PSA, has pledged to have fully electric or hybrid versions of all of its vehicles available in Europe by 2025. Renault (OTC Pink:RNSDF,EPA:RNO) will have a range of eight EVs and 12 electrified vehicles by 2022.

For its part, BMW (ETR:BMW) has said around 90 percent of its market categories will have fully electric models available by 2023, and back in 2019, Daimler (OTC Pink:DDAIF,ETR:DAI) said it expected plug-in hybrids or all-electric vehicles to make up more than 50 percent of its car sales by 2030.

Other traditional carmakers around the world, from Ford (NYSE:F) to Nissan (OTC Pink:NSANF,TSE:7201), also have plans to go electric to meet expected demand and hit targets set to reduce emissions.

Government push for electric vehicles

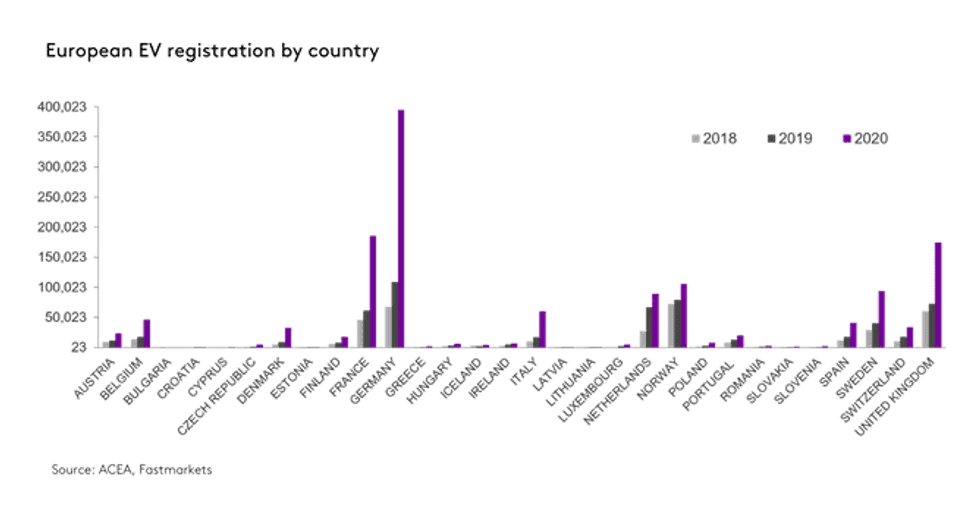

Currently, Europe’s key driver for EV adoption has been subsidies. Last year, many regions increased the maximum subsidy available as part of COVID-19 relief packages, including Germany and France.

Chart via Fastmarkets.

“Subsidies will continue to be (key) until the cost of production of EVs reduces and this can be reflected in the price for consumers,” Rho Motion’s Lester said. “The increased subsidies and incentives as part of economic stimulus packages will continue to be felt this year, and there will likely be a push towards the end of the year as OEMs push to meet emission targets again.”

For Gear, purchase subsidies and tax credits are needed, particularly in the early market stage, but as adoption grows emissions regulation for automakers will become the more important policy, as Europe is demonstrating. “Moving from carrot (purchase subsidies for consumers) to stick (fines to automakers for exceeding emissions quotas), are very effective to spur automakers to accelerate development and to release new models and to devise targets of their own — plus it doesn’t require a large upfront pot of public funding,” he commented.

JATO’s Munoz agreed, saying that right now incentives are not are not only fine, but also necessary.

“But in the long term this cannot be the case, because sooner or later the OEMs will need to make money selling these cars,” he added.

What’s hindering EV adoption right now

For Munoz, a main factor to consider when looking at EV adoption rates is culture, as consumers in Europe have always driven petrol or diesel cars and changing this will require time.

“Even if consumers are driving a few miles a day, there’s still this range anxiety,” he said. “This is one of the reasons why we are seeing more and more cars with longer and longer ranges.”

In addition, infrastructure is needed, which won’t be easy to scale up to meet the demand for electricity from EVs. There were around 300,000 public EV charging points in the EU, EFTA and the UK in 2020, with Rho Motion estimating this to rise to around 1.7 million 2021. This is expected to cost around $26 billion between 2021 and 2025.

For Rengarajan, the infrastructure problem was a bit of chicken and egg at the beginning, when there was always the question of who was going to do it, with everyone waiting and watching.

“But what we have seen in the last year is that OEMs have increasingly understood that they will be able to sell EVs … then there has to be some moves on the EV charging infrastructure side,” he said. “So some of these companies are already getting into collaborations with each other, building up consortia on one hand, but also increasingly with the energy companies, be it from the oil space or from the utility space.”

Meanwhile, Gear said it still comes down to upfront price and consumer awareness.

“Even though total cost of ownership is starting to look very attractive (depending on the model and market) when analysts run the numbers, average consumers look at upfront price as a deciding factor,” he said. “When automakers are regularly releasing models at a sub $25,000 price point with a 200+ mile vehicle range (WLTP), this is when the market will move to the next level.”

The European EV supply chain

When looking at the EV market, one area to keep an eye on is battery supply chains, which are concentrated in Asia and China, with Europe being reliant on importing battery cells.

“As yet, the supply chain for EV production at the cell but also at other levels is largely sourced offshore, which leaves the supply chain slightly more vulnerable than if components could be sourced domestically,” Lester said. “But as we’ve seen, this issue is being addressed.”

Europe is set for considerable investment into cell production, with around 200 GWh of capacity announced in 2020 alone due to come online over the next four to five years, Gear explained.

“However, investment is needed across all segments of the supply chain, but we’re not seeing this in areas such as cathode production or material extraction, which could be problematic as demand grows.”

Looking at the positive side, in Europe there’s a lot of money available, especially for Important Projects of Common European Interest, which are supported by the European Commission, Rengarajan said.

“There’s 6.1 billion euros, which has been made available for these projects, the total investment required exceeding 60 billion euros, so the industry is also putting its money into promoting the battery supply chain overall,” he said.

However, the expert also pointed out some challenges in the EV supply chain in Europe.

“Some of them are natural, for example, raw materials are where they are. If you don’t have some raw materials in Europe, then you don’t have them, you have to import them,” he said.

“You need other mechanisms to counter those kinds of challenges, like entering into offtake agreements or getting into collaborations with mining companies which have mines producing these materials, and then ensuring that you sign up the supplies so that you don’t have a shortfall. Vertical integration could naturally also be a solution for some players.”

For Rengarajan, sustainability is also an area where European players can differentiate themselves from other regions, with recycling also becoming crucial in the coming decades.

“In 10 years from now, there will be enough batteries going into the recycling sector, from which a good portion of materials can be salvaged and reused even for next-generation batteries,” he said. “So that would reduce the dependence on importing raw materials, which are not available in Europe.”

Outlook for EVs in Europe

As mentioned above, China’s change in regulations has helped Europe take a top place in the EV race, but if the Asian country brings back its incentives, could that threaten Europe’s leading position?

For Munoz, if estimates are based on what has been happening during January and February, it could be said that no one can beat Europe because demand is growing very fast.

“But in China, everything is big, everything is massive, and you never know,” he said. “One of the differences between China and the rest of the world is that the development of EVs and their technology is an essential part of the economic plan for the whole country in the coming years.”

For the expert, if China wants to finally expand its automotive industry globally, the way it has to do it is through its electric cars.

“They have something that Europeans and Americans don’t, which is they’re very flexible in regulation and have very low labor costs,” he said. “So these can make a difference in the EV market, especially when these cars are still very expensive.”

With the industry having a lot of momentum with VW, Volvo (STO:VOLV-A,STO:VOLV-B), Ford, Kia (KRX:000270) and Jaguar all ramping up their electrification plans and/or investments and targets in the first few months of this year alone, Gear expects growth in the region to continue in 2021.

“Europe’s new emissions regulation is now fully in force (2020 was an easier transitional year), so even more BEVs, PHEVs and HEV sales will be needed for automakers to avoid fines in Europe,” he said.

In 2020, Europe, including the EU, the UK and EFTA, more than doubled yearly plug-in cars sales from 559,000 in 2019 to over 1,364,000 in 2020, according to IDTechEx data. In 2021, the firm predicts further growth of at least 20 percent — around 1.5 million plug-in car sales.

“We expect HEVs (non-plug-in, high-voltage hybrids) will surge in the short term as automakers use them as a stepping stone to meet emissions targets while they develop BEVs, and try and recoup some of their investment into the technology before internal combustion bans come into force from the 2030s,” Gear said. “BEVs are the endgame in the long term.”

Looking forward to 2021, lots of subsidies are still in place, which will continue to drive EV demand, and emission targets will be tighter.

“That’s because in 2021, 100 percent of cars produced will count towards OEMs’ targets, rather than the 95 percent least polluting, and super credits will be reduced,” Lester said.

Additionally, the negative impact of COVID-19 on 2020 internal combustion engine sales, compared to the relative positive impact on EV sales, aided the OEMs in meeting the 2020 target. “If the total vehicle market recovers in 2021, it will become harder for each OEM to reach its emission target,” he added.

In 2020, there were about 1.3 million EVs sold, with industry estimates showing that about 2 million vehicles could realistically be sold this year, according to Oliver Wyman’s Rengarajan.

“Of course, there are some uncertainties here because you have a huge chip shortage going on, which at least affects the vehicle production in the first half of the year,” he said. “But automakers will try to make it up in the second half of the year.”

One trend that could be a game changer for the region in 2021 is the introduction of electric SUVs.

“SUVs have been the driver of growth in terms of volume and profits for the last, let’s say 10 years, and consumers around the world are crazy about them, (but) one of the issues that the EV market has been having is the lack of SUVs in the lineup,” Munoz said.

“This is due to change this year, and I think when more affordable and appealing electric SUVs hit the market, we will even see stronger growth rates for this industry.”

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.