June 16, 2022

Cross River Ventures Corp. (CSE: CRVC) (OTCQB: CSRVF) (FSE: C6R) (the "Company") is pleased to announce results from the Bear Head Zone maiden drill program at the McVicar Project, located 150km northeast of Red Lake Ontario. Highlights include:

- Discovery drill hole BH-02 intersected 0.5m of 41.1 g/t gold with visible gold in core at 153.75 m downhole (See Table 1 for complete results).

- Maiden 8-hole diamond drill program tested a new gold trend (the "Bear Head Zone") that was discovered in 2021 with surface samples grading up to 19.75 g/t Au (Press Release October 5, 2021).

- All 8 holes intercepted anomalous gold mineralization greater than 0.25 g/t Au (See Table 1).

- Planned follow-up work includes geophysics and step-out drill holes

In the summer of 2021, Cross River completed extensive targeted prospecting work on the McVicar Property located in the Archaean Lang Lake greenstone belt, which resulted in the discovery of a new surface gold trend, the "Bear Head Zone", which was drill tested by the company in winter 2022. The Bear Head Zone is a +700-meter long gold trend with surface samples returning up to 19.75 grams-per-tonne (g/t) gold over coincident LiDAR and magnetic features (Press Release October 5, 2021). No previous drilling has ever been completed at the Bear Head Zone target.

Figure 1 shows a map of drillhole locations at the Bear Head Zone.

Figure 1: Bear Head Zone drillholes and high-grade surface samples

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/7276/127988_f021b46cd4ce3a79_002full.jpg

Eight diamond drillholes tested the Bear Head Zone during the winter 2022 program, and all holes intercepted anomalous gold mineralization greater than 0.25 g/t Au. Drilling identified an altered and mineralized corridor >710 m long, open to the east and west along strike.

Notable Drilling Intercepts (>0.5 g/t Au) at Bear Head Zone include:

BH-02:

- 5.23 meters at 0.51 g/t gold from 72.37 m downhole

- including 1.0 meters at 1.17 g/t gold

- 1.0 meters at 0.61 g/t gold from 90.0 m downhole

- 1.2 meters at 0.74 g/t gold from 117.0 m downhole

- 0.5 meters at 0.70 g/t gold from 150.1 m downhole

- 0.5 meters at 41.1 g/t gold (with visible gold in core) from 153.75 m downhole

BH-03:

- 1.0 meters at 0.97 g/t gold from 22 m downhole

- 0.47 meters at 3.23 g/t gold from 43.36 m downhole

- 1.15 meters at 0.97 g/t gold from 47.85 m downhole

BH-04:

- 1.0 meters at 0.90 g/t gold from 125 m downhole

- 1.0 meters at 0.81 g/t gold from 155 m downhole

BH-08:

- 1.0 meters at 1.1 g/t gold from 133 m downhole

Discovery Drillhole: BH-02

Hole BH-02 intersected 0.5m of 41.1 g/t gold in a smoky grey quartz vein with visible gold, chalcopyrite, and pyrrhotite at 153.75m downhole (117m vertical depth). The quartz vein cross-cuts a locally sheared mafic metavolcanic succession, with a feldspar-porphyry dyke cutting host rocks proximal to the vein footwall. The gold interval is located near the east-west trending contact between volcano-sedimentary host rocks and a tonalite intrusive body. The contact area is characterized by damage zones and abundant shearing, various styles of alteration and veining, as well as feldspar porphyry dikes.

Figure 2: a) BH-02 smoky-grey quartz vein (41.1 g/t Au over 0.50m), b) visible gold, chalcopyrite and pyrrhotite in brecciated grey-black quartz

To view an enhanced version of Figure 2 (a and b), please visit:

https://orders.newsfilecorp.com/files/7276/127988_f021b46cd4ce3a79_003full.jpg

Geological mapping and 3-D modelling work indicates that this high-grade gold intercept projects to the surface along strike with the 19.75 g/t Au surface sample collected in 2021, as well as the 0.47m sample grading 3.23 g/t Au and 1.185% Cu from BH-03. (Figure 3).

Figure 3: Interpreted projection of high-grade intercepts from surface through BH-03 and BH-02

To view an enhanced version of Figure 3, please visit:

https://orders.newsfilecorp.com/files/7276/127988_crossriverfigure3.jpg

Additional smoky grey quartz +/- sulfide veins up to 20 cm wide were intercepted in BH-02 and all other Bear Head Zone drillholes, contributing to a broad, low-grade gold envelope as indicated by the assays. The presence of high-grade mineralization, with visible gold, within a broad low-grade mineralized envelope, is typical in environments where gold is concentrated in plunging chutes. Table 1 shows the significant gold intercepts (>0.25 g/t) in each drill hole.

Table 1: Significant Gold Intercepts >0.25 g/t

To view an enhanced version of Table 1, please visit:

https://orders.newsfilecorp.com/files/7276/127988_crossrivertable1.jpg

Drillhole Descriptions

BH-01 (Az: 180°, Dip: -50°)

BH-01 is the westernmost hole drilled at the Bear Head Zone and is designed to test an east-west trending quartz vein zone beneath the 1.415 g/t Au sample collected on surface in 2021. BH-01 cut 16 meters of overburden before intersecting chlorite-carbonate altered mafic metavolcanic rocks containing instances of moderate shearing with minor intervals of sericite-silica alteration, with up to 5% grey to white quartz veinlets. The best gold intercept occurs between 16-19 meters downhole and averages 0.356 g/t Au. Pyrite and pyrrhotite are present as fine disseminations and as a stringer veinlet network. At 78m, the hole intersected an intrusive tonalite body to EOH at 185.5m.

BH-02 (Az: 180°, Dip: -50°)

BH-02 was drilled 300m east of BH-01 and targeted an east-west oriented magnetic high feature located north of the quartz-veined topographic ridge system tested by BH-01. After 25 meters of overburden, the hole intersected an intensely sheared clastic sedimentary rock (argillite) that contains smokey quartz veins, disseminated pyrite and pyrrhotite. From 44 -163m downhole, chlorite-calcite altered mafic metavolcanic rocks were intersected, with locally strong shearing, and intermittent zones of moderate sericite and silica alteration. From 62-67m interbedded banded-iron-formations were noted, often with up to 8% banded pyrite and pyrrhotite. The mafic metavolcanic unit (72 to 155 meters downhole) contains narrow smoky grey and white quartz veinlets creating a broad low-grade gold halo (samples up to 1.17 g/t Au, 0.23% Cu over 1m), as well as a 0.5m meter sample with 41.1 g/t Au, where a 20cm (true width unknown) smoky quartz vein contains visible gold, chalcopyrite and pyrrhotite. At 163m the hole intersected tonalite intrusion to EOH at 206 meters.

BH-03 (Az: 180°, Dip: -50°)

BH-03 was drilled 100m east of BH-02 and targeted the quartz-veined ridge topographic high, specifically below the 19.75 g/t Au sample collected in 2021. After 15 meters of overburden the hole intersected chlorite altered mafic metavolcanic rocks to 117 meters downhole. The metavolcanic rocks are moderately sheared (locally) and contain smoky-grey and white quartz veins, quartz breccia, and sulfide stringers with sericite halos. From 20m to 105m downhole, a low-grade gold envelope is present (similar to BH-02). The highest grade sample was taken from a moderately veined interval with foliation-hosted pyrite, pyrrhotite and chalcopyrite, grading 3.23 g/t Au and 1.185% Cu over 0.47m. From 117m to 192m (EOH), the tonalite intrusion was intersected and intermittently cut by fine-grained mafic dykes.

BH-04 (Az: 180°, Dip: -50°)

BH-04 was drilled 100m east of BH-03 and targeted a quartz-vein topographic high ridge with a coincident magnetic anomaly (high). Below 28 meters of overburden the hole cut interbedded clastic metasedimentary rocks (argillite), mafic metavolcanic rocks, and banded iron-formations (locally enriched in arsenopyrite and pyrite) to 97m depth. From 97m to 181m, mafic metavolcanic rocks are present cut locally by fine-grained mafic intrusions (dykes). The mafic metavolcanic rocks are cut by 2-3% smoky-grey to white quartz veinlets which ran up to 0.895 g/t Au & 0.243% Cu over 1m. From 181m to 290m (EOH) the hole intersected tonalite intrusion cut by mafic dykes.

BH-05 (Az: 0°, Dip: -50°)

BH-05 was drilled toward the north and cut a topographic/magnetic low situated between the Bear Head Zone surface exposure and the Chellow Vein (600m to the north). After 26 meters of overburden, the hole intersected sheared argillite to 224m depth. The argillite is locally pyrite +/- pyrrhotite bearing in foliation parallel layering with occasional course arsenopyrite. From 224m to EOH at 449m, the hole intersected foliated chlorite-calcite altered mafic metavolcanic rocks (local argillite interbeds) with narrow zones of sulfides, and minor quartz-carbonate veining. The highest grade gold sample occurred at 63.4m in the sheared argillite, with 0.256 g/t Au, 32.6 g/t Ag, 0.483% Zn, and 0.476% As over 0.5m.

BH-06 (Az: 180°, dip: -50)

BH-06 was drilled 100m east of BH-04 and targeted a quartz-veined topographic high ridge system and coincident magnetic high anomaly. After 20 meters of overburden the hole cut the sheared argillite unit down to 59m, followed by banded iron formation interbedded with mafic metavolcanic rocks down to 67m downhole. From 67-165m, chlorite altered mafic metavolcanic rocks were cut by sparse intermediate to mafic dykes, and local zone of sericite + silica alteration. The mafic metavolcanic unit contains 2-5% smoky-grey to white quartz veins, with increasing sulfide abundance (pyrite + pyrrhotite + chalcopyrite) moving downhole, grading up to 0.42 g/t Au over 2m, and up to 0.16% Cu over 1m. From 165m to 225m the tonalite intrusion was intersected and intermittently cut by fine-grained mafic dykes.

BH-07 (Az: 0°, Dip: -50°)

BH-07 was drilled towards the north to test the topographic/ magnetic low situated between the Bear Head Zone surface exposure and the Chellow Vein (600m to the north). After 21 meters of overburden, the hole intersected the same lithologic sequence as BH-05, with strongly sheared argillite down to 234m, followed by chlorite-altered mafic metavolcanic rocks down to EOH at 489m. Within the mafic metavolcanic unit from 454-488m downhole, quartz + carbonate breccia veins up to 50cm wide with trace chalcopyrite, pyrrhotite and pyrite were intersected. The highest grade gold sample occurred at 429m downhole in the mafic metavolcanic rocks, with 0.267g/t Au over 2m.

BH-08 (Az: 180°, dip: -50)

BH-08 is the easternmost hole drilled at the Bear Head Zone and is designed to test an east-west trending quartz veined topographic ridge system. BH-08 cut 12 meters of overburden before intersecting sheared argillite containing local concentrations of banded sulfides (pyrite, pyrrhotite, and arsenopyrite), with samples in this unit grading up to 0.328% Zn and 0.471% As over 1m. At 74m, the hole intersected mafic metavolcanic rocks, cut by narrow smoky grey-white quartz veinlets and trace sulfides which ran up to 1.1 g/t Au over 1m, and 0.403% Cu and 0.269 g/t over 0.51m. From 185-245m (EOH) the hole intersected tonalite intrusion cut by minor mafic dykes.

Geologic Setting

The geology and mineralization encountered in the drill program are similar to that described at the historic Golden Patricia Mine, located along strike 30km to the SE along the Bear Head Fault Zone. The Golden Patricia Mine produced 619,796 oz at 15.2 g/t Aui, and is hosted in a continuous 40 cm wide smoky quartz vein with visible gold, pyrrhotite, chalcopyrite. Like the Bear Head Zone (McVicar Project), veining at Golden Patricia is also hosted in mafic metavolcanic rocks with feldspar porphyry intrusions, iron formations, and shearing. The Golden Patricia shear zone is interpreted as a splay of the Bear Head Fault.v

Cross River CEO, Alex Klenman stated: "We are pleased with the results of the company's initial drill test on the Bear Head trend. The Cross River technical team identified this area as a priority target for gold mineralization and drilling has now confirmed discovery in this highly prospective zone. We look forward to next steps on the large prospective McVicar property and to follow up drilling at Bear Head. We're also eager to see the results from drilling at the Altered Zone and anticipate receiving those sometime over the next few weeks."

"The discovery of high grade gold during the company's initial drill test at the Bear Head Zone represents a significant step forward for Cross River," said Dan MacNeil, P.Geo, of the Cross River Technical Team. "The Bear Head Zone is on trend with the Golden Patricia Mine, which produced more than half a million ounces of gold at an average grade of 15 grams per ton. The McVicar project is a flagship gold endowed exploration asset, and the presence of high grade gold increases our confidence in the potential of the project," continued Mr. MacNeil.

In addition to drill testing the Bear Head Zone during the winter 2022 drill program, 6 holes were drilled at the Altered Zone target to test strike and plunge continuity of known mineralization. Assays are pending and will be released once received, reviewed, and verified by the technical team.

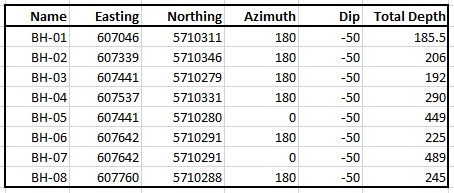

Table 2: Bear Head Zone Collars

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/7276/127988_f021b46cd4ce3a79_009full.jpg

About The Bear Head Trend

The Bear Head Trend was discovered in summer 2021 by Cross River Ventures field crews. The target is defined by a +700m strike of high-grade surface samples (up to 19.75 g/t Au - see News Release October 5th, 2021) following a prominent WNW trending topographic ridge system with mapped iron formation, sheared mafic meta-volcanics, and mineralized quartz veins. The Bear Head zone is located 600 meters south of the historic Chellow Vein near the southern contact between mafic volcanics and granite along the Bear Head Fault Zone. Drillholes were positioned to target the mineralized ridge system and coincident magnetic anomaly, as well as the topographic low situated between the Bear Head Trend and the Chellow Vein.

The Bear Head Trend is a previously undrilled high-grade gold corridor that is nested within a WNW trending multi-km braided damage zone structure. This geological environment is considered prospective for Archean greenstone gold deposits and contains favorable structural and lithological sites for gold deposition.

About The Altered Zone

The Altered Zone is a complex zone of deformation and intense alteration composed of sheared mafic volcanics, abundant green mica, intermediate intrusive rocks, massive to semi-massive quartz, and a quartz-carbonate-sericite schist.

New geologic modelling by Cross River in 2021 utilizes historic drilling data and suggests that the high-grade gold bearing structure continues at depth, coincident with lithologic breaks and a broader damage zone corridor characterized by an intense hydrothermal alteration overprint. The gold bearing structure at the Altered Zone is open in all directions. 2022 drillholes were positioned to target down-plunge extensions of known mineralization based on 3D modelling, as well as track the continuity of the structure to the south.

About the McVicar Project

Cross River's McVicar gold project is situated in the Superior Province of northern Ontario, Canada. The greenstone belts within the Superior Province contain some of the largest economic gold deposits in the world. McVicar encompasses the geologically significant structural components of the Lang Lake greenstone belt, an underexplored belt located approximately 40 km north of the historic Golden Patricia Mine (619,796 oz at 15.2 g/t Au)*.

The McVicar Gold Project is a district-scale (approximately 12,000 hectares) gold exploration project that contains gold prospective structure and host rocks that transect the entire Lang Lake greenstone belt, located in the Patricia Mining Division, approximately 150 km east of Red Lake, and 80 km west of Pickle Lake, in NW Ontario, Canada.

The property covers all the major fertile structural and lithostratigraphic elements of the greenstone belt, which is bound to the south by the major NW trending Bear Head Fault zone (within which the historic Golden Patricia Mine is situated).

Historic drilling at McVicar Lake in the Altered and North Flexure Zones include:

- 6.46 g/t Au over 10.09 m including 29.86 g/t Au over 1.86 metersii

- 5.5 g/t Au over 3.6 m including 12.2 g/t Au over 0.98 metersiii

The McVicar property also host the Chellow Vein zone, which is a narrow quartz vein that consists of smoky grey to white quartz mineralized with minor pyrite and visible gold. The vein system yielded high grade gold at surface including grab samplesiv that assayed 827.4 g/t Au and 578.1 g/t Auv.

Figure 4: McVicar Gold Project, location of nearby deposits and historical mines, NW Ontario

To view an enhanced version of Figure 4, please visit:

https://orders.newsfilecorp.com/files/7276/127988_f021b46cd4ce3a79_010full.jpg

Quality Assessment, Quality Control Protocols

Cross River has deployed an industry-standard quality-assurance/quality-control program during the 2022 drill program. This included the insertion of a sequence of standards, blanks, and duplicates into the sample string every tenth sample, in addition to industry standard chain of custody protocols for the samples. Core cutting was completed in Thunder Bay and samples were taken to ALS Global for multi-element analysis in addition to fire-assay of gold using analytical codes ME-MS61 and Au-ICP22. Overlimit analyses of gold (>10 g/t Au) was performed using Au-GRAV22.

Qualified Person

Daniel MacNeil, P.Geo., M.Sc., a Qualified Person as defined under National Instrument 43-101, reviewed, and approved the technical content disclosed in this press release. Historical assay results contained in this press release were not verified by the Company. However, the historical reports referenced were authored by experienced geoscientists and copies of laboratory assay sheets were commonly inserted in the reports.

About Cross River Ventures

Cross River is a gold exploration company focused on the development of top tier exploration properties located in emerging Greenstone Districts of NW Ontario, Canada. The Company controls a 28,000-ha, multiple project portfolio with highly prospective ground in and among prolific, gold bearing greenstone belts. Cross River's common shares trade in Canada under the symbol "CRVC" on the CSE, and in the US under the symbol "CSRVF" on the OTCQB. Please visit www.crossriverventures.com for more information.

On behalf of the Board of Directors of

CROSS RIVER VENTURES CORP.

Alex Klenman

CEO

604-227-6610

aklenman@crossriverventures.com

www.crossriverventures.com

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statement or other reports and filings with the Canadian Securities Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements, except as required by applicable laws.

____________________________________________

i https://thediggings.com/mines/usgs10255075

*https://www.geologyontario.mndm.gov.on.ca/mndmfiles/mdi/data/records/MDI52O06SE00005.html

ii McKay D.B, 2004. Report on the 2003 Overburden Stripping, Geologic Mapping and Sampling Program conducted on the McVicar Lake Property: Continuum Resources Ltd and Prospector Consolidated Resources Inc. www.geologyontario.mndm.gov.on.ca/mndmfiles/afri/data/imaging/52O11SW2003/52O11SW2003.pdf

iii McKay D.B, 2004. Report on the 2003 Overburden Stripping, Geologic Mapping and Sampling Program conducted on the McVicar Lake Property: Continuum Resources Ltd and Prospector Consolidated Resources Inc. www.geologyontario.mndm.gov.on.ca/mndmfiles/afri/data/imaging/52O11SW2003/52O11SW2003.pdf

iv Grab samples are selective by nature and may not represent the true grade or style of mineralization across the property. Dr. Rob Carpenter, P.Geo., Ph.D., a Qualified Person as defined under National Instrument 43-101, reviewed, and approved the technical content disclosed in this press release. Historical assay results contained in this press release were not verified by the Company. However, the historical reports referenced were authored by experienced geoscientists and copies of laboratory assay sheets were commonly inserted in the reports.

v Waldie C.J. Report of Diamond Drilling McVicar Lake Area Patricia Mining Division: BHP Minerals Canada Ltd.

v https://www.geologyontario.mndm.gov.on.ca/mndmfiles/mdi/data/records/MDI52O06SE00005.html

The Conversation (0)

25 March 2021

Cross River Ventures

District-Scale Potential in Northwest Ontario

District-Scale Potential in Northwest Ontario Keep Reading...

19h

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

09 February

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

09 February

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

09 February

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

09 February

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

09 February

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00