Investor Insight

NextSource Materials is an emerging leader in the global battery materials sector, backed by a world-class graphite resource and proven technology to produce high-performance anode material. With a focus on full vertical integration, the company is strategically positioned to supply critical materials essential to the global clean energy transition.

Overview

NextSource Materials (TSX:NEXT,OTCQB:NSRCF) is a Canadian-based battery materials development company focused on becoming a vertically integrated global supplier of critical minerals essential to the global clean energy transition. The company’s strategy spans the full value chain – from mining and upgrading high-quality flake graphite to producing advanced battery anode materials – positioning it as a key supplier to the rapidly growing electric vehicle (EV) and renewable energy storage markets.

NextSource’s core asset is the Molo graphite mine in Madagascar, one of the largest and highest-grade flake graphite deposits in the world. Commencing production in October 2024, the Molo mine has a resource base of more than 153 million tonnes and the exclusive source of NextSource’s trademarked SuperFlake® graphite.

Complementing the Molo graphite mine is the company’s downstream expansion through battery anode facilities (BAFs), which will convert its proprietary SuperFlake® graphite into spherical purified graphite (SPG) and coated SPG (CSPG), enabling direct supply to global battery and automotive manufacturers outside traditional Asian supply chains.

Global demand for flake graphite, valued at US$3.12 billion in 2024, is forecast to grow to US$5.48 billion by 2034, driven by a 6.1 percent CAGR. This growth is primarily fueled by the expansion of lithium-ion battery manufacturing for EVs and renewable energy systems, where graphite remains the dominant material used in battery anodes.

NextSource also owns the Green Giant vanadium project, an advanced-stage and strategically significant vanadium asset located near the Molo mine. With a large, sediment-hosted deposit suited for vanadium redox flow batteries (VRFBs), Green Giant provides additional exposure to the grid-scale energy storage market – a rapidly emerging segment of the clean energy landscape.

NextSource has assembled an impressive leadership team with a proven track record in mine operations and building shareholder value. With long-term offtake agreements in place, a scalable mine-to-anode business model, and strategic backing from Vision Blue Resources, led by former Xstrata CEO Sir Mick Davis, NextSource is positioned to deliver significant value as a secure and sustainable supplier of critical battery materials.

Company Highlights

- Molo Graphite Project: The Molo graphite project in Madagascar is among the world’s largest and highest-quality graphite resources and is the exclusive source of SuperFlake® graphite.

- First Commercial Shipments Completed: SuperFlake® shipments have been to multiple end-users and approved for high-demand applications for flake graphite, including battery anodes, refractory and graphite foils for fire retardants and consumer electronics.

- Long-term Offtake Agreements: One of the few graphite producers globally to secure long-term sales agreements with tier one partners, including a 20,000 tpa agreement with a leading Japanese trader that supplies intermediate anode material to the Japanese market, and a 35,000 tpa agreement with thyssenkrupp Materials Trading GmbH for SuperFlake® graphite concentrate.

- Mine Expansion Planned: With anticipated volume demands expected to quickly outgrow its Phase 1 volume capacity, NextSource updated its operational strategy to utilize Phase 1 for campaign production to focus on development of its Phase 2 mine expansion.

- Downstream Value-add Expansion: The company is executing a phased rollout of battery anode facilities to produce spherical purified graphite and coated SPG at commercial scale. These facilities will supply high-performance anode material directly to battery and automotive manufacturers outside traditional Asian supply chains.

- Strategic Shareholder Support: Vision Blue Resources, a battery materials investment fund led by former Xstrata CEO Sir Mick Davis, is NextSource’s corner-stone shareholder. Sir Mick Davis also serves as NextSource’s chairman, bringing decades of mine development and operational leadership to the company.

- Vanadium Exposure: NextSource also holds the Green Giant vanadium project in Madagascar, an advanced-stage NI 43-101 resource and one of the world’s largest known sedimentary vanadium (V2O5) deposits.

Key Projects

Molo Graphite Mine and Project

NextSource’s flagship Molo graphite project ranks as one of the largest-known and highest-quality flake graphite deposits in the world. The property spans more than 62.5 hectares, sits in the Tulear region of Southwestern Madagascar, and is located 11.5 kilometers east of the town of Fotadrevo. Phase 1 of the mine is currently in operation.

NextSource has superior flake size distribution and well above the global average. The Molo asset is relatively unique for having almost 50 percent premium-priced large and jumbo flake graphite and can achieve up to 97 percent carbon purity with simple flotation alone. Molo SuperFlake® has been verified by end-users and meets or exceeds all criteria for the top demand markets for flake graphite; anode material for lithium-ion batteries, refractories, graphite foils and graphene inks.

Project Highlights

Geological and Resource Overview:

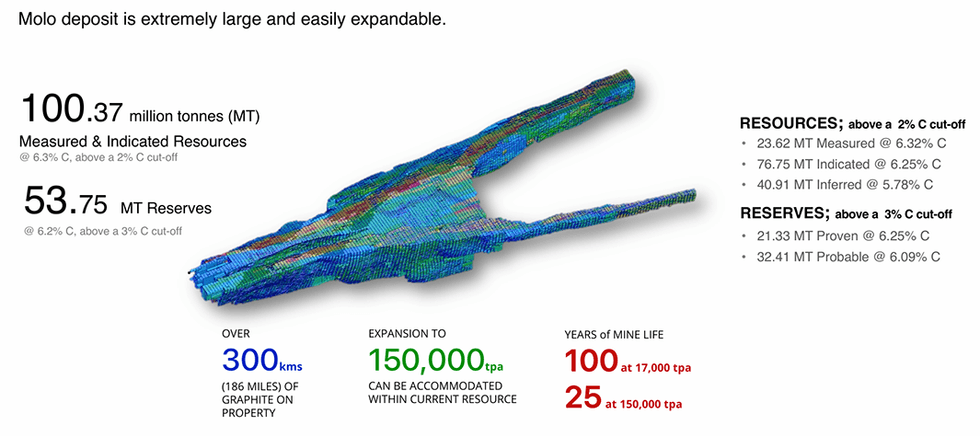

- Measured and indicated resources: 100.37 million tonnes (Mt) at 6.3 percent total graphitic carbon (C), based on a 2 percent C cut-off.

- Proven and probable reserves: 53.75 Mt at 6.2 percent C, based on a 3 percent C cut-off, including 21.33 Mt proven and 32.41 Mt probable.

- Over 300 km of continuous surface graphite mineralization has been delineated, enabling flexible, demand-driven production scale-up.

- The resource base supports more than 100 years of mine life at 17,000 tpa and 25+ years at 150,000 tpa production levels.

Operational Status:

- Phase 1 operations commenced production in October 2024, with the first commercial shipments of SuperFlake® graphite concentrate delivered to customers in Germany and the US in early 2025.

- In May 2025, NextSource transitioned Phase 1 to campaign production in order to preserve capital and prioritize the larger Phase 2 expansion, which is now the operational focus.

- Nameplate capacity for Phase 1 is 17,000 tpa, with modular Phase 2 plans targeting up to 150,000 tpa production capacity.

Strategic Sales Agreements:

- A 35,000 tpa SuperFlake® graphite offtake agreement with thyssenkrupp Materials Trading GmbH.

- A 20,000 tpa agreement with a leading Japanese trader that supplies anode material to major OEM supply chains (Tesla, Toyota).

Battery Anode Facilities

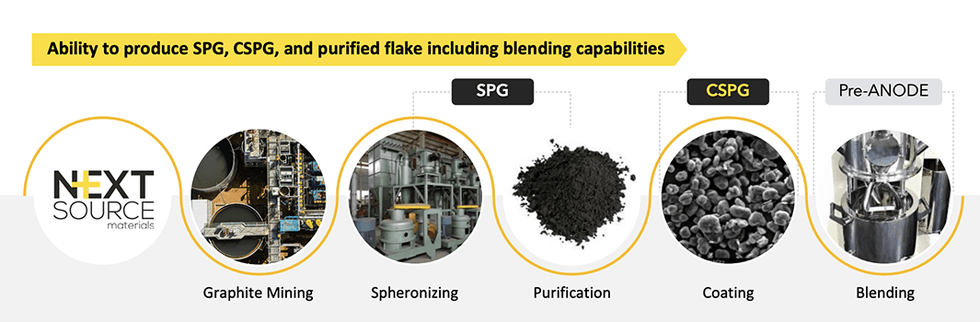

NextSource’s BAFs are value-added processing plants designed to convert smaller flake graphite into high-performance anode material, an essential component of lithium-ion batteries used in electric vehicles.

Project Highlights

Technology and Product Focus:

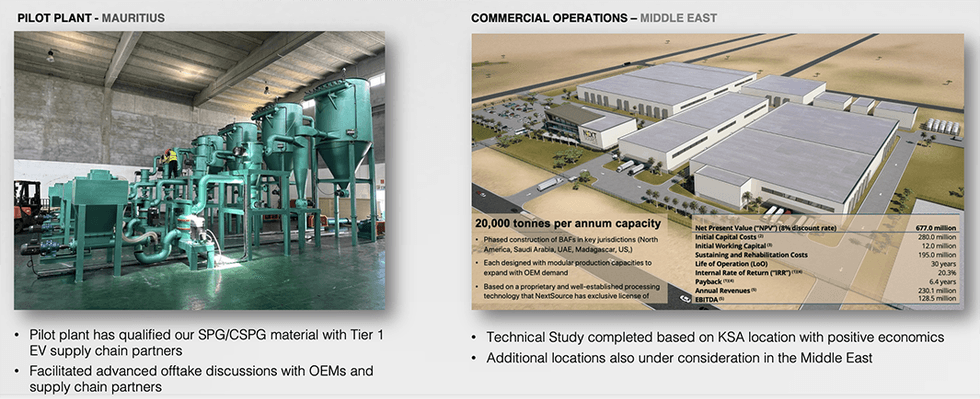

- Using a proprietary and proven processing technology, licensed exclusively by NextSource and currently supplying major OEMs, the BAFs will produce spherical purified graphite (SPG) and coated SPG (CSPG) through a process verified within, and currently being used by, the Tesla and Toyota supply chains.

- The CSPG production process involves micronizing flake graphite, shaping it into spheres (spheroidization), purifying it and applying a hard carbon coating to enhance durability and performance in battery applications.

Pilot to Commercial Progression:

- A pilot BAF in Mauritius successfully validated NextSource’s processing technology and facilitated advanced product qualification with Tier 1 EV and battery manufacturers.

- In 2025, the company redirected its BAF expansion focus from Mauritius to the Middle East, identifying Saudi Arabia and the UAE as ideal first locations due to favorable permitting, infrastructure, and access to global EV markets.

Strategic Plans and Economic Advantages:

- NextSource’s established technical process gives it a competitive advantage by significantly reducing the time and cost required for R&D and qualification phases.

- The modular BAF rollout strategy supports flexible scaling, with additional facilities planned for North America, Europe, and Asia to meet growing OEM demand.

- Feedstock will be sourced primarily from the Molo Mine, with provisions for qualified third-party graphite as needed.

Green Giant Vanadium Project

The Green Giant vanadium project is a 100-percent-owned, advanced-stage exploration asset located in south-central Madagascar, approximately 15 kilometers from the Molo Graphite Mine. It is one of the world’s largest known vanadium deposits and a potential future growth driver for NextSource.

Project Highlights

Resource Profile:

- NI 43-101 compliant resource of approximately 60 million tonnes, grading an average of 0.7 percent vanadium pentoxide at a 0.5 percent cut-off.

- The deposit is sediment-hosted, a rare geological profile seen in only about 5% of vanadium occurrences, and favorable for producing high-purity vanadium compounds.

Strategic Importance:

- Vanadium is a key material in vanadium redox flow batteries (VRFBs), which are emerging as a critical solution for long-duration grid-scale energy storage—a necessary component of the transition to renewable power.

- With increasing global focus on decarbonizing power systems, Green Giant provides long-term optionality in a growing adjacent market.

Development Status:

- Over US$20 million has been invested in exploration and development since acquisition in 2007.

- While currently on hold to maintain focus on graphite and anode material commercialization, the project remains a strategic asset for future energy storage market expansion.

Management Team

Hanré Rossouw - President and Chief Executive Officer, Director

Hanré Rossouw joins NextSource from his role as executive director and chief financial officer of Sasol Limited with extensive experience in the global natural resources industry over the last 25 years. A British and South African national, Rossouw has held senior positions in leading global mining and investment companies where his roles involved business development, M&A, capital markets, asset management and growth optimization.

Craig Scherba - Chief Development Officer, Director

Craig Scherba brings extensive operational and geologic experience, having discovered both the Molo and Green Giant deposits. He currently heads up development of NextSource’s downstream OEM offtake strategy and plans.

Jaco Crouse - Chief Financial Officer

Jaco Crouse brings over 20 years of experience in the global natural resources sector, with expertise in M&A, capital markets and financial strategy. He held senior positions at Glencore and Xstrata.

Brent Nykoliation - EVP, Strategy and Corporate Affairs

Brent Nykoliation joined the senior management team at NextSource Materials as vice-president in 2007 and leads strategy and corporate affairs for the company. In addition, he oversees all communications with graphite customers, institutional investors and analysts for the company.

He brings over 20 years of senior management experience, having held marketing and strategic development positions with several Fortune 500 corporations in Canada.

Dr. Tilo Hauke - EVP, Downstream Operations

Dr. Tilo Hauke leads the development of the company’s BAFs, focused on producing commercial-scale graphite anode material for lithium-ion batteries used in electric vehicles. He previously spent two decades at SGL Carbon SE, a global leader in carbon and graphite products, holding senior roles including SVP of Fuel Cell Components and Group VP of Technology and Innovation.

Danniel Stokes - VP, Special Projects

Daniel Stokes spearheads the project management aspects of the company, with significant experience across a diverse portfolio of projects in mining, infrastructure and nuclear industries.

Markus Reichardt - VP, Sustainability

Markus Reichardt is responsible for driving the company’s safety, health, environment, social, climate change and quality performance and initiatives. He has a 25-year track record in operational, senior corporate and advisory roles in the resources, agricultural and renewables sectors across the developing world.

Jean Luc Marquetoux - Country Manager

Jean Luc Marquetoux brings nearly three decades of experience in mining and project development in Madagascar and brings deep regional and governmental expertise in Madagascar.

Board of Directors

Sir Mick Davis - Chairman

Sir Mick Davis is the CEO of Vision Blue Resources and a highly successful mining executive accredited with building Xstrata plc into one of the largest mining companies in the world before its acquisition by Glencore plc.

Ian Pearce – Director

Ian Pearce is the former CEO of Xstrata Nickel, and was the former COO of Falconbridge Limited, which was acquired by Xstrata Plc in 2006. Xstrata Plc’s acquisition of Falconbridge was one of the largest mining takeovers globally and one of the largest takeover bids in Canadian history.

Brett Whalen — Director

Brett Whalen has over 20 years of investment banking and M&A expertise, spending over 16 of those years at Dundee Corporation. During his tenure at Dundee, Whalen was directly involved in completing approximately $2 billion in M&A deals and helped raise over $10 billion in capital for resource sector companies.

Christopher Kruba - Director

Christopher Kruba is vice-president and legal counsel to Nostrum Capital Corporation and several related corporations that are part of the Toldo Group.

Martina Buchhauser - Director

Martina Buchhauser is a globally recognized leader in the automotive industry, with deep expertise in sustainable mobility and the transition to low-carbon, responsible business practices. Her executive career includes senior roles in global procurement and supply chain management at General Motors, MAN, BMW, and most recently Volvo Cars.