Overview

Sprott Asset Management CEO John Ciampaglia has called 2022 a “Dawn of a New Nuclear Renaissance” as governments worldwide strive to reduce emissions and realize they won’t likely meet their targets with wind and solar power alone. Nuclear energy currently supplies 10 percent of the world’s electricity, and as more nuclear power plants remain in operation and new ones come online, demand for uranium, a crucial element used to produce nuclear energy, will continue to rise.

In fact, in Q3 2022, uranium price reached a yearly high of US$52.27, a US$10 increase from January 2022. Based on the projected demand increase and a dwindling supply, some analysts anticipate the spot price for uranium to double to US107.70 by 2030. Investors can capitalize on this potential growth through commodity investing, energy ETFs or stocks of miners targeting uranium. When investing in a miner, investors benefit from both market trends and the company’s growth and successes.

ValOre Metals (TSX:VO) is a Canadian exploration mining company focusing on high-quality metals and projects. Angilak, the company’s flagship uranium asset located in Nunavut, Canada, covers 59,583 hectares and has district-scale potential for uranium along with precious and base metals. The company is also exploring its Brazilian project targeting PGEs and gold.

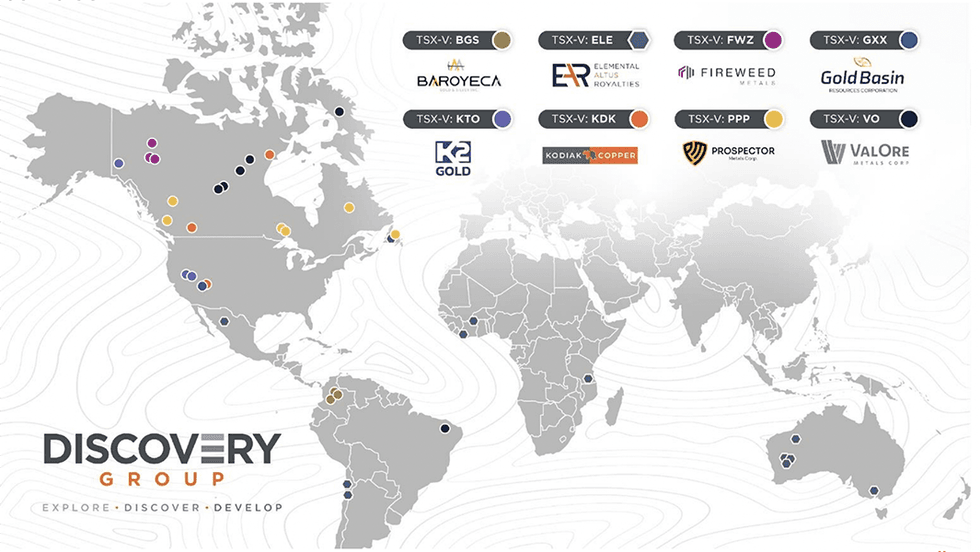

ValOre is a member of the Discovery Group, an alliance of nine publicly traded companies with a track record of successfully increasing shareholder value, often through tactful exits via mergers and acquisitions. An experienced management team leads the company toward its goal of improving shareholder value at every opportunity.

Discovery Group’s track record of value creation includes over US$2.4 billion through mergers and acquisitions since 2016. The company’s track record includes Great Bear acquired by Kinross Gold for US$1.8 billion, Kaminak Gold acquired by Gold Corp for US$520 million and Northern Empire acquired by Coeur Mining for US$117 million. ValOre’s directors were involved in many of Discovery Group’s successes, including the Kaminak and Northern Empire acquisitions.

ValOre’s Angilak project has significant upside potential due to its land area and deposits. The area represents Canada’s highest grade uranium resource outside Saskatchewan and one of the highest grade uranium resources on a global basis, according to ValOre VP of exploration Colin Smith.

ValOre Metals is also exploring its Pedra Branca PGE project in northeastern Brazil. As another district-scale mining project, the asset covers 56,852 hectares with multiple PGE and gold deposits. Ownership of the asset gives ValOre control of an entire PGE belt. The company has three additional projects for future exploration: Hatchet Lake, Baffin Gold and Genesis.

An experienced management team leads ValOre towards creating shareholder value as it continues to explore its significant assets. The team’s expertise includes mineral exploration, corporate administration, and international finance. Combined with added support from the Discovery Group, ValOre is poised to continually increase shareholder value through the exploration of its district-scale assets.

Company Highlights

- ValOre Metals is a Canadian exploration mining company focusing on district-scale, high-grade assets with uranium, PGE and gold deposits.

- The company is a member of the Discovery Group, an alliance of publicly traded companies striving to improve shareholder value through mergers and acquisitions.

- The Discovery Group has a track record of successful mergers and acquisitions that directly increase shareholder value. ValOre’s management team was involved in many of the Discovery Group’s notable transactions.

- The Angilak uranium project in Canada includes one of the highest-grade uranium deposits on a global scale. In addition, the project includes multiple notable uranium deposits, many of which reach the surface for straightforward extraction.

- ValOre’s Pedra Branca PGE-gold project in Brazil represents another district-scale opportunity and gives the company complete control over an entire PGE belt.

- An experienced management team with expertise in all aspects of the mining industry leads the company toward its goal of improving shareholder value.

Get access to more exclusive Uranium Investing Stock profiles here