What Was the Highest Price for Gold?

4 Platinum Uses for Investors to Know

USD/JPY Rate Check Helps Boost Gold Above US$5,000

Is Now a Good Time to Buy Bitcoin?

Top 5 Canadian Cobalt Stocks (Updated January 2026)

Top 5 Australian Government News Stories of 2025

Company Highlights

- First-mover status as an international gold explorer in Japan

- 30 gold exploration projects in the safe and stable jurisdiction of Japan

- Projects host over 40 past-producing mines with high-grade gold mineralization

- Country-wide alliance in Japan with the Barrick Gold Corporation

- Newmont Corporation as a significant shareholder

- Management team with extensive local knowledge

Overview

Japan Gold (TSXV:JG) is a gold exploration company with a vast portfolio of 30 gold projects across the island nation of Japan. Japan Gold's leadership team has long recognized the potential for gold exploration in Japan. When the Japan Mining Act was amended in 2012 for the first time, allowing foreign mineral companies the ability to hold exploration and mining permits, Japan Gold was the first foreign mineral exploration company to seize this opportunity.

Japan Gold is the only foreign mineral exploration company to focus solely on gold exploration in the country and has gathered a large portfolio of projects that collectively host over 40 past-producing gold mines and workings which were all shut down during World War II due to a government moratorium on gold mining.

During February 2020, Japan Gold announced a country-wide alliance with Barrick Gold Corporation to jointly explore, develop and mine certain gold mineral properties and mining projects in Japan. The Japan Gold-Barrick alliance includes 28 out of 30 projects currently held by Japan Gold.

Japan Gold will continue to advance the Ikutahara Project in Hokkaido and the Ohra-Takamine Project in Kyushu independently guided by the Japan Gold/Newmont Technical Committee. Newmont Corporation has a joint venture right of first refusal on these two projects.

As a first-mover in the country, Japan Gold has also taken the opportunity to establish strong relationships with local universities and industry specialists, incorporating some of these—such as Mitsuhiko Yamada and Takashi Kuriyama—into its management team and board of directors. This first-mover position has also made the company a key resource for other organizations looking to partake in gold exploration in the region.

Japan Gold is led by an exceptional management team with extensive local knowledge and relationships. This team is supported by a knowledgeable board of directors and advisors. As Japan Gold is a spinoff of Southern Arc Minerals Inc (TSXV:SA)—a company that shares many of the same directors—26 percent of the company is held by its predecessor, giving the company a unique share structure.

Over the course of the next 12 months, Japan Gold plans to complete large scale, regional programs under the Japan Gold-Barrick alliance which is expected to include geochemical (BLEG) stream sediment analysis and geophysical analysis over the 28 projects included in the alliance. These programs are guided by the Japan Gold-Barrick Alliance Technical Committee.

In addition, the company plans to fully evaluate and drill permit three prospects on the two projects excluded from the Barrick alliance. Newmont has a joint venture right of first refusal on these two projects. Japan Gold plans to complete drill programs on at least two of these prospects over the next 12 months. These programs are guided by the Japan Gold/Newmont Technical Committee.

Mining in Japan

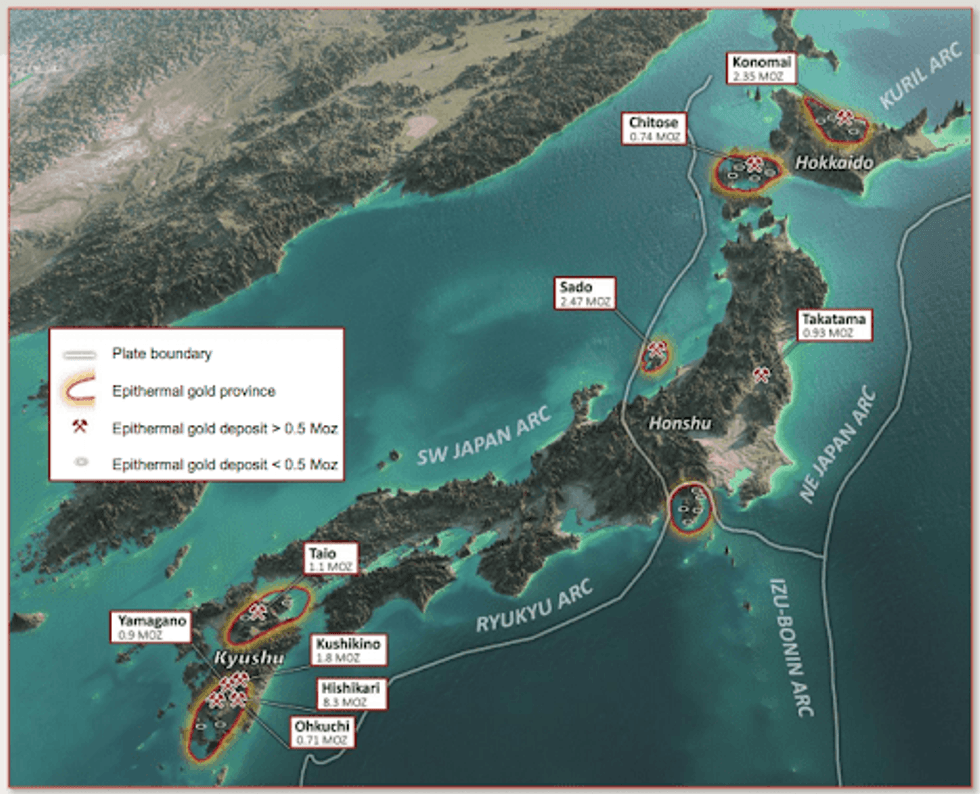

As a safe and stable jurisdiction, Japan hosts 76 known past producing gold mines, including five gold deposits greater than one million ounces.

All of Japan's gold mines were shut down in 1943 as part of a moratorium that was implemented by the government in light of World War II. Following that, there was a short period of small-scale production in the 1960s and 1970s and since then, production has been limited to a handful of mines including the Hishikari mine, which still produces today and is one of the world's highest-grade gold mines. The Hishikari mine has produced over 7.8 million ounces of gold between 1985-2019 at an average grade of 30-40 g/t gold.

Mining in Japan

Understanding the potential for gold exploration in the island nation, Japan Gold has entered the country as a first mover, collaborating with local companies and universities while engaging with local directors and advisors.

Get access to more exclusive Gold Investing Stock profiles here