Investor Insight

As FPX Nickel strengthens its position in the critical minerals space, it offers investors a compelling opportunity in the low-carbon energy transition, with the potential to be a low-cost, environmentally responsible nickel producer in a stable jurisdiction.

Overview

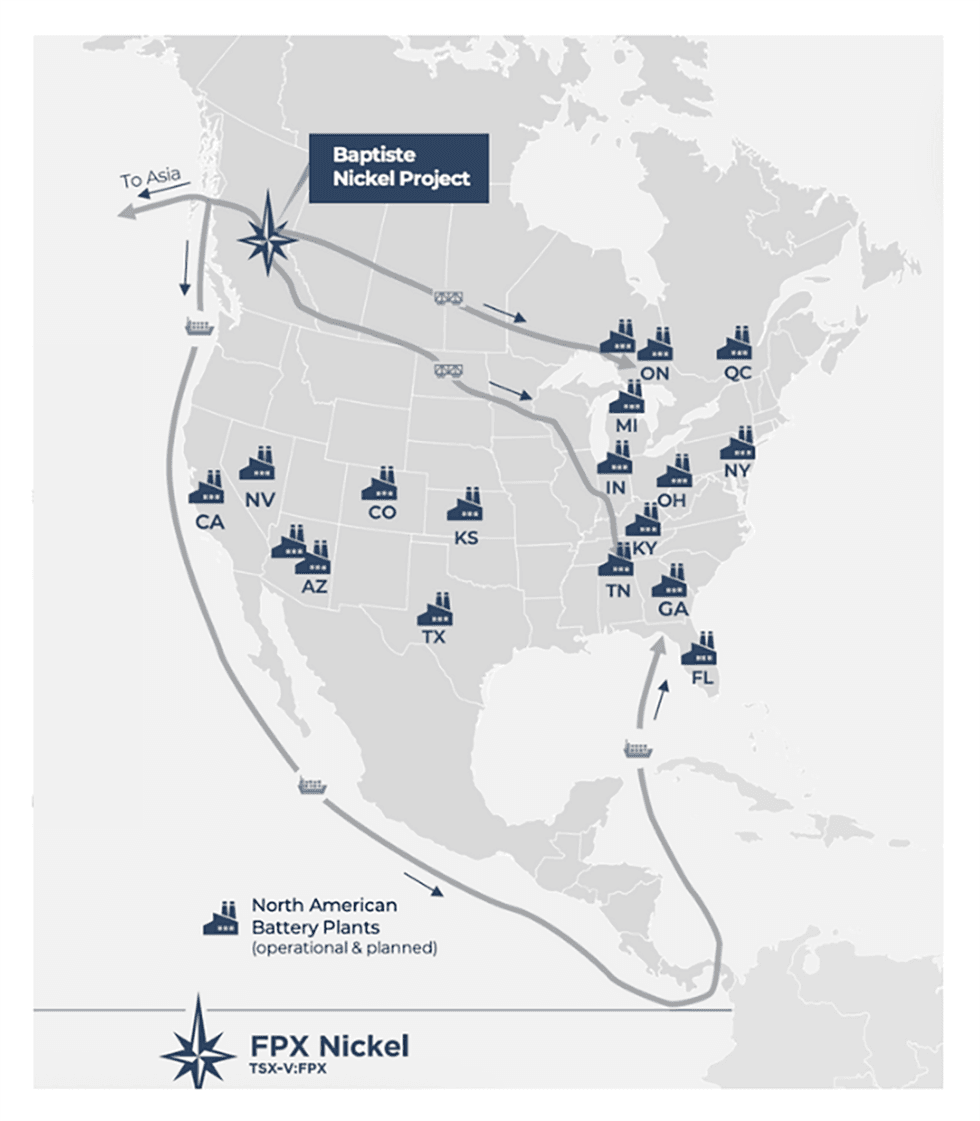

FPX Nickel (TSXV:FPX,OTCQX:FPOCF) is a Canadian developer of large-scale, low-carbon nickel projects designed to anchor a North American, fully integrated supply chain for stainless steel and electric vehicle batteries.

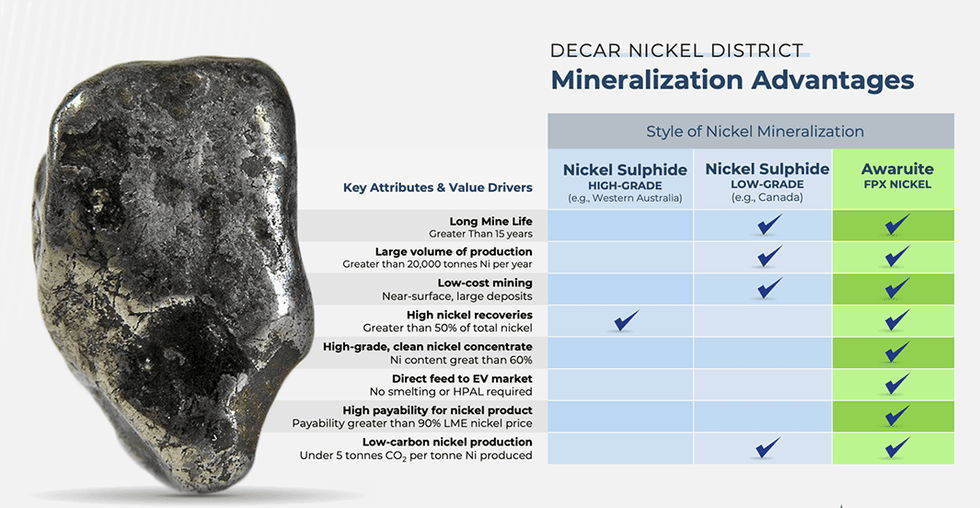

The company’s core asset, the Baptiste nickel project in British Columbia’s Decar Nickel District, is one of the largest undeveloped nickel resources in the world and features a unique form of naturally occurring awaruite (Ni₃Fe) mineralization. This sulphur-free, magnetic nickel-iron alloy enables a simple, low-cost and low-emission flowsheet that produces approximately 60 percent nickel concentrate capable of bypassing smelters and feeding directly into downstream markets.

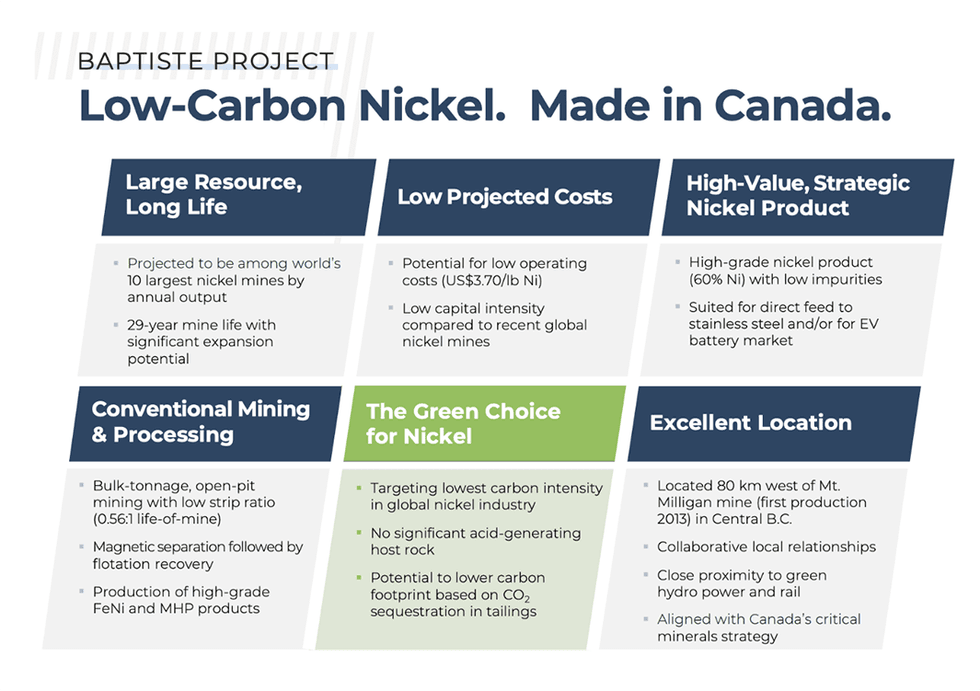

FPX’s 2023 preliminary feasibility study confirms Baptiste’s Tier-1 scale and robust economics, positioning it among the most competitive greenfield nickel developments globally. With its lowest-decile carbon intensity and access to clean BC hydro power, Baptiste offers the dual appeal of strong financial returns and ESG leadership in the nickel sector.

The company is also advancing a growing Canadian exploration pipeline through its strategic alliance with the Japan Organization for Metals and Energy Security (JOGMEC). In 2025, FPX and JOGMEC selected the Advocate nickel property in Newfoundland, as the first “designated project” under their Generative Alliance, and expanded the partnership at the Klow property in British Columbia, where FPX has signed an exploration agreement with the Takla Nation. These initiatives demonstrate FPX’s leadership in building a multi-jurisdictional, low-carbon nickel platform within stable, Tier-1 mining regions.

Backed by global strategic investors Sumitomo Metal Mining and Outokumpu, and supported by funding from Natural Resources Canada, FPX Nickel provides investors with exposure to a rare combination of scale, sustainability, and strategic relevance in the global shift toward cleaner industrial metals.

Company Highlights

- Flagship Asset: Baptiste Nickel Project (Decar Nickel District, B.C.), 2023 prefeasibility study completed.

- Strong Strategic Support: Outokumpu, Sumitomo Metal Mining and an undisclosed Canadian mining company each own 9.9 percent; management and insiders 18 percent.

- Partnerships and ESG: Exploration Agreement with Takla Nation for Klow Property; strong Indigenous engagement framework.

- Government Support: Funding from Natural Resources Canada to advance Baptiste.

Key Project

Decar Nickel District

FPX Nickel’s 100 percent-owned Decar Nickel District is located 90 km northwest of Fort St. James in central British Columbia. It is FPX Nickel’s flagship asset and home to the Baptiste nickel project – one of the largest undeveloped nickel deposits in the world. The district also includes the nearby Van target, providing long-term growth potential within the same 100-percent-owned property.

Baptiste Nickel Project

Baptiste is the cornerstone of FPX Nickel’s strategy to produce large volumes of clean, low-carbon nickel in Canada. The deposit contains a naturally occurring nickel-iron mineral called awaruite (Ni₃Fe), which allows for a simple, energy-efficient processing that eliminates the need for traditional smelting. The result is a high-grade nickel product with one of the lowest carbon footprints in the global industry.

A 2023 preliminary feasibility study (PFS) confirmed Baptiste as a Tier-1 development opportunity with robust economics and long-life production:

- After-tax NPV (8 percent) of US $2 billion

- After-tax IRR of 18.6 percent

- Mine life 29 years

- Average annual production of 59,000 tonnes nickel

- Cash cost (C1) of approximately US$3.70 per lb nickel

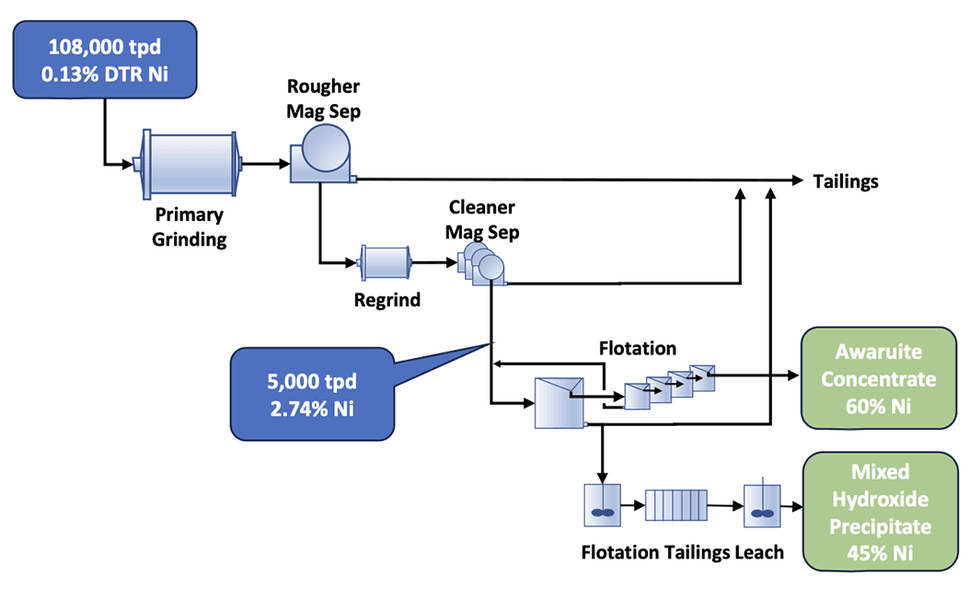

The PFS outlines a conventional open-pit mine and processing facility powered by British Columbia’s clean hydroelectric grid. Using magnetic separation and flotation, the operation would produce a ~60 percent nickel concentrate that can be sold directly to stainless-steel producers or refined into battery-grade nickel sulphate for the electric-vehicle market.

Van Target

Situated six kilometres north of Baptiste, the Van target hosts the same style of awaruite mineralization near surface and offers similar potential scale. Early drilling has intersected broad zones of nickel mineralization, reinforcing the district’s capacity to support multiple large deposits over time.

Downstream Integration and Refinery Study

In March 2025, FPX Nickel published the results of its Awaruite Refinery Scoping Study, outlining plans for North America’s largest nickel sulphate refinery. The proposed facility aims to produce 32,000 tonnes per year of battery-grade nickel sulphate, along with by-products including cobalt carbonate, copper cement, and ammonium sulphate.

Highlights of the study:

- Economics: After-tax NPV (8 percent) ~US$445 million; IRR ~20 percent; operating cost US$1,598/t Ni (US$0.06/lb on a by-product basis).

- Carbon Profile: 0.2 t CO₂/t Ni refined; cradle-to-gate 1.4 t CO₂/t Ni.

- Status: Standalone scoping study, not included in the 2023 PFS base case.

- Strategic Context: FPX also signed an MOU with JOGMEC and Prime Planet Energy & Solutions (Toyota–Panasonic JV) to evaluate integration of Baptiste feed into EV battery materials supply chains.

Pilot-Scale Success and Government Support

In early 2024, FPX completed pilot-scale hydrometallurgical testing, producing battery-grade nickel sulphate. The program, partially funded by Natural Resources Canada’s Critical Minerals R&D program, marked a key milestone in demonstrating the project’s readiness for commercialization and alignment with Canada’s strategic critical minerals priorities.

Exploration and Pipeline

Advocate Nickel Property (Newfoundland)

- Selected in Sept 2025 as the first “designated project” under the FPX–JOGMEC Generative Alliance.

- 86.25 sq km holding, 45 km of serpentinized ultramafic strike on the Baie Verte Peninsula.

- Three awaruite zones (Wolverine Pond, Birchy Lake, Birchy Lake North) with surface samples up to 0.14 percent DTR Ni.

- 2025 budget: C$450,000 to define drill targets. Joint venture interest ratio JOGMEC 60 percent / FPX 40 percent.

Klow Property (British Columbia)

- Exploration agreement with Takla Nation signed Oct 2025, establishing collaboration protocols for future exploration and development.

- JOGMEC earn-in amended to March 31 2027 (Option to 60 percent with C$1 million expenditure).

- 2025 surface program funded 100 percent by JOGMEC.

- Historic drilling (316 m @ 0.10 percent nickel-in-alloy) and 2024 DTR re-analysis confirm strong awaruite potential.

Management Team

Martin Turenne – President, CEO and Director

Martin Turenne is a seasoned executive with over 15 years in the commodities sector, including significant leadership experience in mining. His expertise spans strategic management, capital markets, financial reporting, and regulatory compliance. He previously served as CFO of First Point Minerals and held roles at KPMG LLP and Methanex Corporation. Turenne is a Chartered Professional Accountant (CPA) and a member of the Canadian Institute of Chartered Accountants.

Dan Apai - Vice President, Projects

Dan Apai has over 20 years of mining industry experience in civil engineering and engineering management over a diverse range of projects. As principal civil engineer for Fluor Canada, he led studies and detailed engineering works for numerous large-scale mining projects for clients including Teck, Newmont, BHP, First Quantum, Glencore, Josemaria Resources, and Newcrest. Apai's technical expertise includes site layout, earthworks, water management, linear facilities, and water supply systems – all elements that strongly influence the capital intensity, permitability, and operability of mining projects. Apai is a member of the Association of Professional Engineers of British Columbia and holds a Bachelor of Engineering from the University of Western Australia.

Tim Bekhuys – SVP, Sustainability and External Relations

Tim Bekhuys is a mining sustainability expert with 40+ years of experience in environmental permitting, community engagement, and ESG leadership. He was VP of sustainability at SSR Mining and held senior roles at New Gold, successfully advancing projects like the Blackwater gold project. He has served on the boards of AME BC, the Mining Association of BC, and the Mining Association of Canada.

Felicia de la Paz – CFO and Corporate Secretary

Felicia de la Paz is a CPA with deep expertise in corporate finance and systems implementation. She started her career at KPMG, rising to senior manager, before joining Equinox Gold as corporate controller, where she led post-acquisition financial integration. She later served as VP of finance at Vida Carbon and now advises public mining companies on financial and operational systems. She holds a Bachelor of Commerce (Honours) from UBC.

Dr. Peter M.D. Bradshaw – Chairman

Dr. Peter Bradshaw is a renowned geologist with over 45 years of global mineral exploration experience and a member of the Canadian Mining Hall of Fame. He has played key roles in several major discoveries, including the Porgera, Kidston, and Misima gold mines, and co-founded the UBC Mineral Deposit Research Unit. Bradshaw’s past roles include senior positions at Barringer Research, Placer Dome, and Orvana Minerals.

Peter Marshall – Director

Peter Marshall is a mining engineer with 30 years of experience in mine development. Formerly VP of project development at New Gold and SVP at Terrane Metals, he played key roles in major BC projects including the feasibility and early construction of the Mt. Milligan copper-gold mine and the Blackwater gold project.

Anne Currie – Director

Anne Currie is a leading expert in mining permitting and regulatory processes in Canada, with more than 30 years of private and public sector experience. She was BC’s chief gold commissioner and a senior partner at Environmental Resources Management. Currie has guided permitting for major projects including KSM, Brucejack, Kemess Underground, and Blackwater.

James S. Gilbert – Director

James Gilbert has over 30 years of experience in investment banking and corporate strategy, with two decades focused on mining and metals. He has held senior roles at Rothschild, Gerald Metals, and Minera S.A., and has deep expertise in M&A, project finance, off-take agreements, and strategic marketing. He was a director of AQM Copper, acquired by Teck in 2016.

Kim Baird – Director

Kim Baird is a strategic advisor with deep experience in Indigenous relations, governance, and treaty implementation. As former elected Chief of the Tsawwassen First Nation, she negotiated and implemented BC’s first urban treaty, securing land and resource governance for her community. She now advises governments, businesses, and Indigenous groups across Canada.

Rob Pease – Director

Rob Pease is a geologist with more than 30 years in exploration, mine development, and corporate leadership. He was CEO of Terrane Metals and a director of Richfield Ventures—both acquired for over C$500 million. He currently serves on the boards of Pure Gold Mining and Liberty Gold.

Andrew Osterloh – Director

Andrew Osterloh is a professional engineer with 25+ years in process engineering, plant metallurgy and project development. He is currently VP project engineering & construction at Skeena Gold & Silver.