- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

Overview

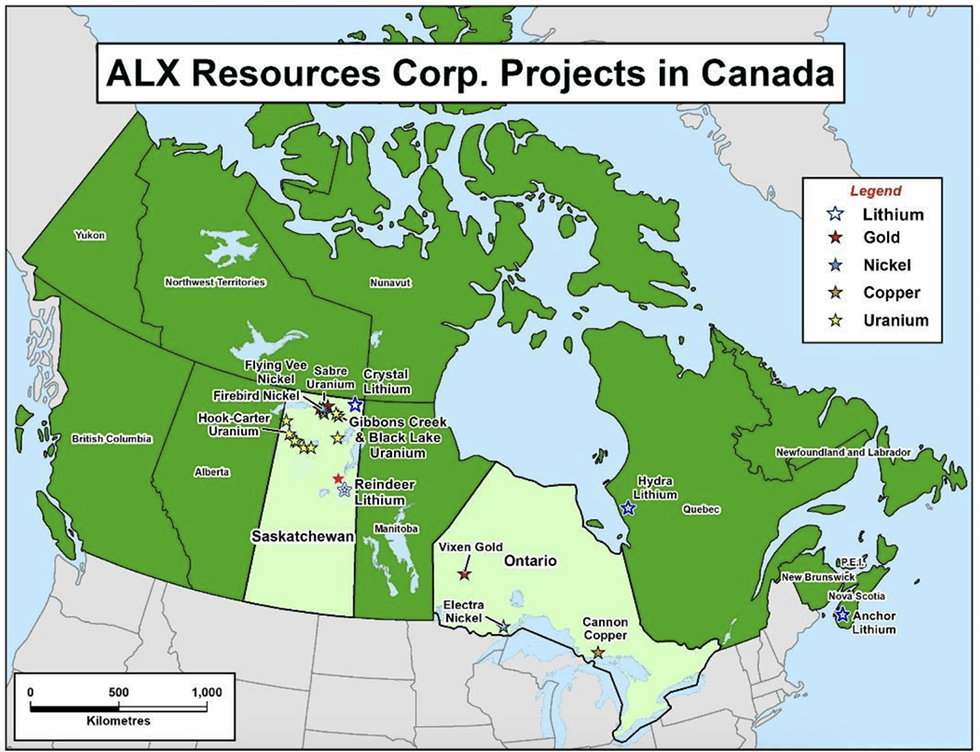

ALX Resources (TSXV:AL,FWB:6LLN,OTC:ALXEF) is dedicated to providing shareholders with multiple opportunities for discovery by exploring a portfolio of prospective mineral properties, which include uranium, lithium, nickel–copper–cobalt and gold.

Using the latest technologies, ALX plans and executes well-designed exploration programs and holds over 240,000 hectares of prospective properties in Saskatchewan, Quebec and Ontario, Canada.

Having operations in stable Canadian jurisdictions strategically positions ALX Resources in key exploration areas with strong potential for economic base metals deposits, producing gold mines and the richest uranium deposits in the world. This includes the Firebird nickel (formerly Falcon Nickel) and Flying Vee nickel-copper-cobalt projects, and the Sceptre gold project, all located in Northern Saskatchewan.

ALX is planning a 2024 summer exploration program at its Hydra Lithium Project in the James Bay region of Quebec, a joint venture with Forrestania Resources Ltd., which includes a prospecting and geological mapping program to locate pegmatite bodies in the field as a follow-up to ALX's 2023 exploration activities.

ALX also holds interests in several uranium exploration properties in Northern Saskatchewan, including the Gibbons Creek uranium project comprising eight claims covering 13,864 hectares. The company has completed its 2024 winter drilling program that consisted of five holes totaling 905.4 meters. Four of the five holes have uranium mineralization at or near the unconformity, based upon hand-held scintillometer readings on the drill core, downhole gamma probe results, and visual observation of uranium minerals. Analytical results are pending.

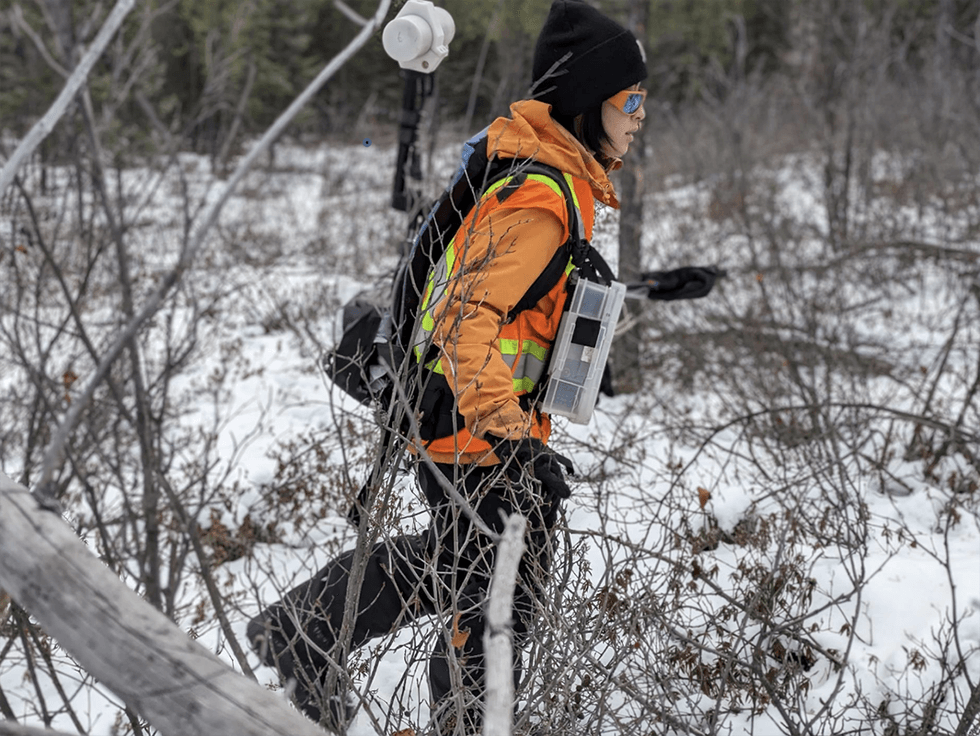

“Walking Mag” survey technique at the Gibbons Creek Uranium Project in 2023

ALX has a 20 percent interest in the Hook-Carter Uranium Project in which Denison Mines (NYSE:DNN) owns 80 percent. Denison has funded approximately $7 million in exploration to date. The property is subject to certain royalties held by underlying vendors. The 2023 Hook-Carter airborne Z-Axis Tipper electromagnetic survey successfully outlined historical conductors present at Hook-Carter and resolved new conductors in deeper terrain that were not identified by previous geophysical surveys.

The company also completed a surface prospecting program in October 2023 at its 100 percent-owned McKenzie Lake uranium project located in the southeastern Athabasca Basin area of northern Saskatchewan.

Along with ALX’s rich portfolio of diverse assets in world-renowned jurisdictions, identifying undervalued and underexplored assets is the company’s strong suit. As early adopters of new methods of exploration, the company embodies innovation with its willingness to utilize new geochemical and geophysical technologies. This includes artificial intelligence recognition methods and other emerging science-focused exploration tools.

ALX has a world-class management team led by chairman and CEO Warren Stanyer who has more than 27 years of experience in the mineral exploration industry, focused mostly on uranium exploration in Saskatchewan.

Get access to more exclusive Gold Investing Stock profiles here