- WORLD EDITIONAustraliaNorth AmericaWorld

3 Biggest US Silver Miners in 2026

Top 5 Canadian Cobalt Stocks (Updated January 2026)

Overview

Silver North Resources (TSXV:SNAG,OTCQB:TARSF) has made significant new silver discoveries in the famous Keno Hill Silver District of the Yukon in Canada. This includes Silver North’s Haldane Project, where high-grade silver has been identified in drilling at two target areas. The company also holds the Tim silver property in southern Yukon, where partner-funded exploration has identified high-grade silver mineralization just 19 kilometers from the Silvertip mine.

Silver North is ideally positioned to further prove out and expand these discoveries, at the stage of the mining development curve traditionally associated with the largest value increases for shareholders.

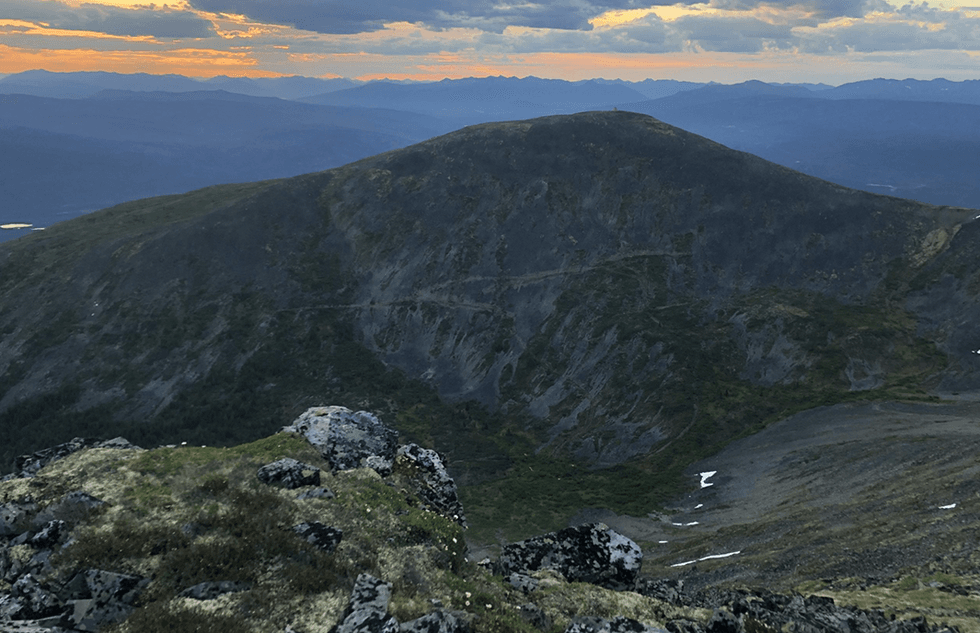

Silver North’s Haldane Property is located within the Keno Hill mining district, a premier silver-producing region in North America.

Silver North’s Haldane Property is located within the Keno Hill mining district, a premier silver-producing region in North America.

Beyond jewelry and cutleries, silver has a wide range of industrial applications, present in nearly all electronic devices and appliances, and plays an important role in global electrification.

Silver is critical to the green economy due to its diverse applications in the automotive, green energy, technology and medical fields. The average internal combustion engine vehicle contains 15 to 28 grams of silver per vehicle. However, hybrid and battery electric vehicles (EV) use as much as 50 grams of silver per vehicle. As EV adoption grows, predictions are that battery EV demand will increase 50 percent by 2040.

As the world shifts towards renewable energy, the solar energy sector heavily depends on silver to produce photovoltaic cells used in solar panels. These cells convert sunlight into electricity, and silver's exceptional conductivity ensures efficient energy movement. With no end in sight to the growth of solar energy generation, silver use could grow 85 percent in 10 years.

Silver’s electrical conductivity also makes it a metal of choice in the technology industry, where it is used in various electronic devices, including smartphones, tablets and computers.

Infrastructure rollouts, such as 5G wireless technology, result in a steady demand growth for silver - and as these devices become more complex, the amount of silver required increases.

As the demand for electric vehicles, solar panels and advanced technology continues to soar, the need for silver will drive the growth of the silver exploration and mining sector, rewarding explorers and developers like Silver North.

With more and more end-product producers seeking to lock up their supply chains, the potential scope of firms looking to invest in and own silver development projects is also expanding. Silver North’s proven expertise in exploration and discovery will be an even more valuable component of the silver commodity chain in the coming years.

Silver North has a diverse team of experts that builds confidence in the company’s ability to produce shareholder value in the areas of silver exploration and discoveries. Jason Weber, Craig Lindsay and Marc Blythe have direct experience selling discoveries to other mining companies. Weber and Rob Duncan have a combined 60 years of mineral exploration experience, creating a solid foundation of expertise. Mark Brown was the founder of Rare Element Resources (OTCQB:REEMF) that he and his team built into a $500-million company based on a rare earth element discovery. Experts in corporate management and accounting round out the management team.Company Highlights

- Silver North is a silver explorer focused on its wholly owned flagship Haldane Silver Project in Yukon. Haldane has recently seen some excellent high-grade silver intersections over potentially mineable widths.

- Coeur Mining is a meaningful partner providing its expertise and capital to the exploration of the Tim Silver Project, where high-grade silver mineralization has been located over an 800-meter strike length in trenching, including 468 g/t silver and 21.1 percent lead over 4 meters.

- Silver North is led by an experienced management team with asset exploration and sales expertise, and decades of experience in mineral exploration, corporate administration or corporate finance.

Get access to more exclusive Silver Investing Stock profiles here