Overview

The large-scale shift to carbon-pollution-free electricity and net-zero emissions is already underway. According to analysts and industry executives, the global electric vehicle market size will cross US$980 billion by 2028, at a CAGR of 24.5 percent between 2022 and 2028. With the worldwide lithium battery market expected to grow exponentially in the coming decade — with the potential to reach a record value of US$80 billion by 2026 — it’s clear there is significant potential and a lot of growth to come.

“And when you come into this growth period where year-on-year the volumes are getting significantly bigger in terms of orders from the battery industry, I think that has the potential to create a real bottleneck in terms of keeping supply up with demand,” said Andrew Miller, product director at Benchmark Mineral Intelligence, in an interview with INN.

But with limited production capacity available in the United States, more production will be required to facilitate the growing needs of the electric vehicle and stationary grid storage markets. It’s this perfect storm of conditions that has led Clayton Valley in Esmeralda County, Nevada to become a hotspot for lithium exploration and development in the US. This region uniquely hosts the only US-based lithium mine.

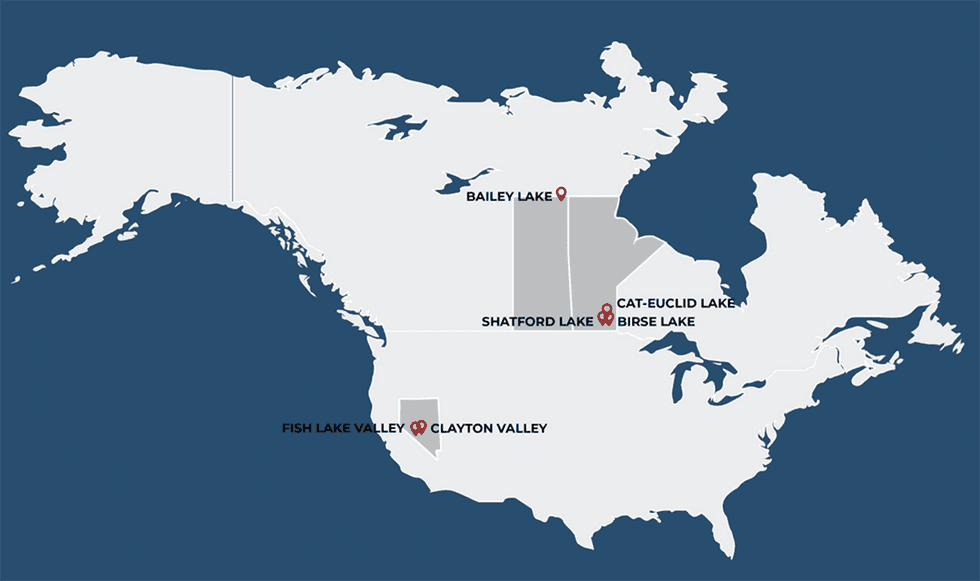

ACME Lithium (CSE:ACME, OTCQX:ACLHF) is a junior mineral exploration and development company focused on acquiring and developing a portfolio of exploration-stage, lithium-containing projects in Nevada, southeastern Manitoba, and northeastern Saskatchewan. The company’s management team is highly experienced with a strong history of success in building and financing resource companies around the world including the development of lithium-based projects.

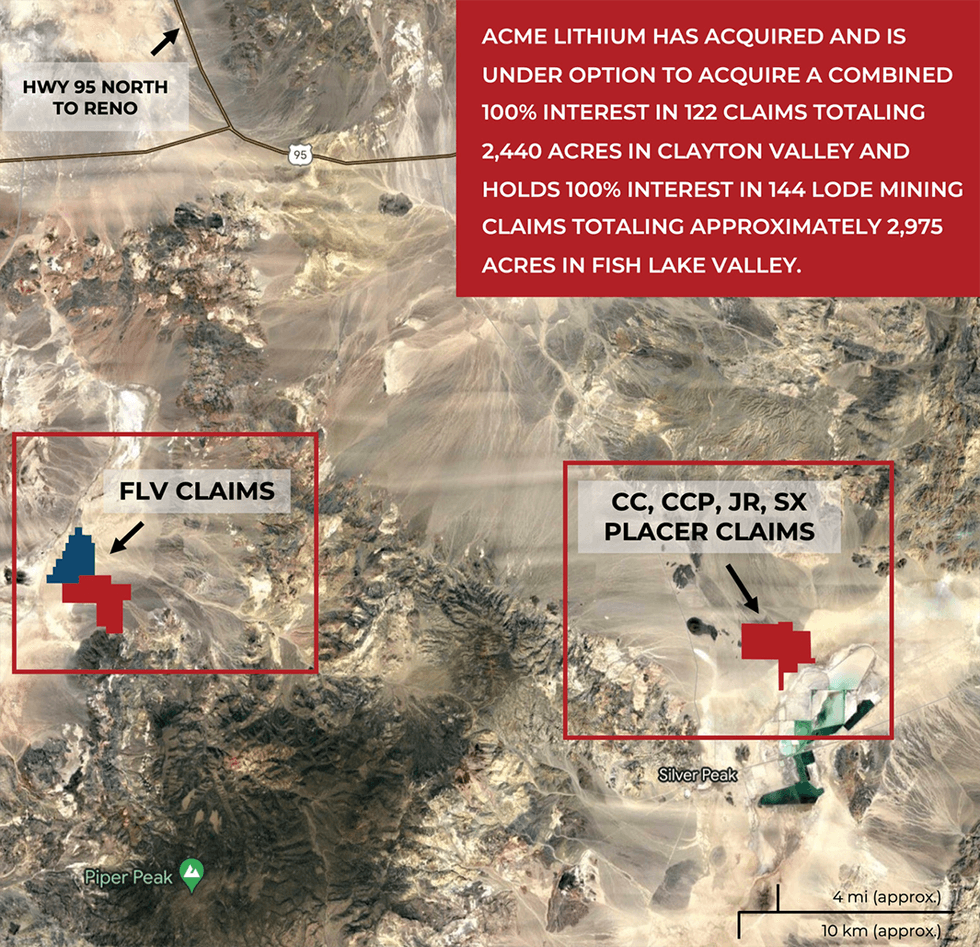

ACME Lithium operates its Clayton Valley and Fish Lake Valley projects in the mining-friendly Esmeralda County area in Nevada. The properties are strategically located near Albemarle Corporation’s Silver Peak Lithium mine. The Silver Peak lithium mine has continuously produced lithium since 1966, with concentrations as high as +1,000 parts per million (ppm) of lithium. Ford Motor Company, Toyota and Panasonic recently announced plans to buy lithium from Ioneer Ltd’s Rhyolite Ridge mining project in Nevada to produce electric vehicle (EV) batteries in the US. Ioneer’s Rhyolite Ridge project and mineral interests border ACME Lithium’s Fish Lake Valley project directly to the east.

ACME Lithium's projects are also located in an area with a developing battery supply chain, including Tesla’s Gigafactory, which sits only 200 miles away. Both of ACME Lithium’s Nevada properties have year-round access to expertise, infrastructure, rail and roads, power and water, including favorable weather conditions and logistics.

The Clayton Valley property has the potential to host lithium brine just like the Silver Peak Lithium mine in Clayton Valley. The company expects to use direct lithium extraction (DLE) technology to process lithium at Clayton Valley. It is a low-cost and sustainable technology that selectively removes pure lithium from brine water. As a more efficient process compared to traditional lithium extraction and with the development of relationships with companies that have DLE technology, it gives ACME Lithium a strong competitive advantage.

ACME’s Phase 2 drill program at its Clayton Valley Nevada lithium brine project covers a large diameter test well (TW-1) for completion of brine aquifer permeability testing and sampling. Launching in winter 2023, the drill program will also include up to three new exploration holes, DH-1A, DH-2 and DH-3, with objectives to examine deeper horizons through zonal isolated testing, assess stratigraphy, and the potential for continuity between the stratigraphic units encountered in DH-1.

The company strongly believes that its properties have the potential to produce lithium under simple metallurgical conditions based on preliminary indications.

The company’s leadership team has decades of experience in the mining, energy and finance sectors. ACME Lithium also boasts multiple notable industry figures, including Yiannis Tsitos, who has worked for the BHP Billiton group, William Feyerabend, who has direct experience in developing lithium projects, and Steve Hanson, who has been involved in multiple successful M&A transactions in the mining and resource sector, including exit strategies with major corporations.

In December 2022, the company received work permit from the government of Manitoba for its upcoming drill program at the Shatford Lake project. ACME plans to drill up to 5,000 meters prioritizing Shatford East, that is a 7-kilometer curvilinear feature on the claim block with multiple observations of pegmatites containing anomalous lithium.

ACME Lithium has an option and purchase agreements with Gem Oil Inc. to acquire a total of 41,694 hectares of project claims known as the Bailey Lake Pegmatite Discovery Area, located in the northeastern region of Saskatchewan. The two agreements comprised an option to purchase a 100 percent interest in a core block of 13 contiguous mineral claims encompassing 25,900 hectares (or 100 square miles) and a purchase of five additional contiguous claims comprised of 15,794 hectares (61 square miles).

In January 2023, ACME Lithium signed an agreement with Israel-based satellite technology company ASTERRA to utilize its synthetic aperture radar data analytics, patented algorithms and artificial intelligence to identify lithium-specific targets. ACME Lithium is the first in the United States to use ASTERRA's technology. The technology has already helped ACME Lithium identify high-grade lithium target at Fish Lake Valley, Nevada, with samples returning values of up to 1,325 ppm lithium.

Company Highlights

- Led by an experienced team, ACME Lithium (CSE:ACME, OTCQX: ACLHF) is a mineral exploration company focused on acquiring, exploring and developing battery metal projects in partnership with leading technology and commodity companies. ACME has acquired or is under option to acquire a 100-percent interest in projects located in Clayton Valley and Fish Lake Valley, Esmeralda County, Nevada, at Cat-Euclid, Birse, and Shatford Lakes in southeastern Manitoba, and at Bailey Lake in northeastern Saskatchewan.

- Both Clayton Valley and Fish Lake Valley projects have year-round access to expertise, infrastructure, rail and roads, power and water, including favorable weather conditions and logistics.

- The projects are strategically located near Albemarle Corporation’s lithium-producing Silver Peak mine with Clayton Valley potentially hosting similar lithium brine found at Silver Peak, as well as Ioneer’s billion-dollar Rhyolite Ridge Lithium-Boron project, which recently entered an agreement with Ford Motor Co, Toyota and Panasonic to supply lithium for electric vehicle production in the US.

- ACME Lithium has acquired and is under the option to acquire a combined 100-percent interest in 122 claims totaling 2,440 acres in Clayton Valley, and holds 100-percent interest in 144 lode mining claims totaling approximately 2,975 acres in Fish Lake Valley.

- ACME Lithium holds 100-percent interest in 21 claims totaling 8,883 acres in the Shatford Lake pegmatite field, 10 claims totaling 5,196 acres at Birse Lake, and six claims totaling 2,930 acres in the Cat-Euclid Lake shear zone in southeastern Manitoba.

- ACME has entered an option agreement to purchase a 100-percent interest in a core block of 13 contiguous mineral claims encompassing 25,900 hectares and a purchase agreement of five additional contiguous claims comprised of 15,794 hectares, totaling 41,694 hectares at Bailey Lake in northeastern Saskatchewan.

- The company’s management team is highly experienced with a strong history of success in building and financing resource companies around the world, including the development of lithium-based projects.

- ACME Lithium announced a significant lithium discovery from the recently drilled DH-1 hole at its Clayton Valley lithium brine project.

- The company has signed an agreement with ASTERRA, an Israel-based satellite technology company, to use its technology to identify lithium-specific targets. ASTERRA's satellite-based technology has already helped ACME Lithium identify high-grade lithium targets at Fish Lake Valley, Nevada, with values up to 1,325 parts per million (ppm) lithium.

Get access to more exclusive Lithium Investing Stock profiles here