- WORLD EDITIONAustraliaNorth AmericaWorld

April 27, 2023

Comet Resources Limited (Comet or Company) (ASX: CRL) is pleased provide the Quarterly Activities Report and Appendix 5B for the quarter ending 31 March 2023 (the Quarter).

Further to the Company’s announcement on 5 January 2023, and withdrawal of its prospectus dated 19 October 2022 by way of a second supplementary prospectus (announced on 20 January 2023), Comet announced the execution of an amended binding share sale agreement to acquire 100% interest of the Mt Margaret Copper Project and associated regional tenements near Cloncurry, Queensland (Project or Mt Margaret) from Mount Isa Mines Limited, a wholly-owned subsidiary of Glencore Plc (Glencore) (Acquisition).

Highlights:

- Key Transaction points remain unchanged:

- Comet to acquire 100% of Mt Margaret Copper Project from Glencore

- Company to raise $27m to fund acquisition and initial post-acquisition pre- development activities, with the raise including a $5m priority offer to existing Comet shareholders

- Glencore to provide 3-year loan of $27m to Comet – substantially reducing up front dilution for Comet shareholders

- Further improved transaction terms:

- 49.975m options previously approved to be issued as part of the transaction will now not be issued

- MMM1 New Shareholders, who will hold 52.3m shares, to enter into voluntary escrow agreements for 12-months following Comet’s re-listing

- Located only 7km from key processing infrastructure at Ernest Henry, where Mt Margaret ore was previously processed into export quality copper concentrate

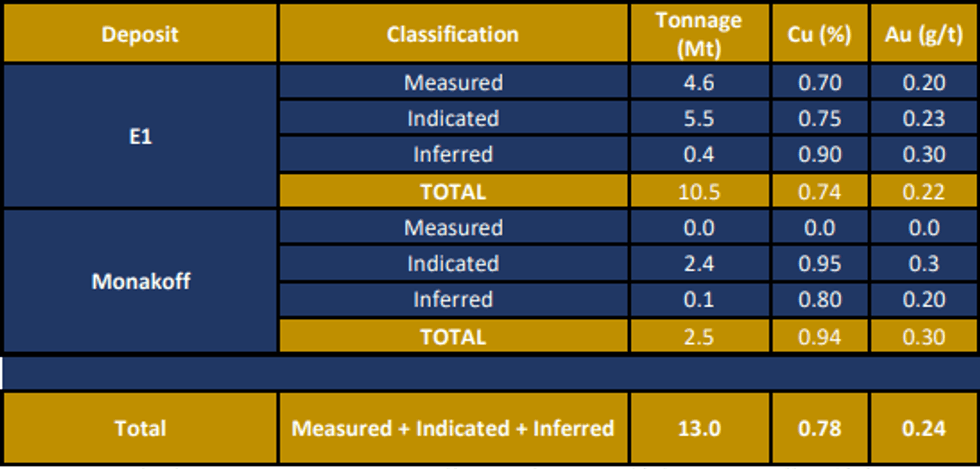

- JORC open-pit Resources of 13.0Mt at 0.78% copper and 0.24g/t gold with >95% in the Measured and Indicated categories (refer to Table 1)2

- Near-term production potential – 2 open pits already pre-stripped

- Significant potential for Resource growth through further exploration

- Defined high priority exploration targets – Both extensional and regional

On 24 February 2023 the Company lodged a prospectus with the Australian Securities & Investment Commission and ASX (Prospectus) for the public offer, comprising the priority offer to Shareholders and an offer to the general public, and the secondary offers as detailed in Section 4.2 of the Prospectus. On 27 April 2023 the closing date for the general offer was extended to 11 May 2023.

Corporate Activities:

On 24 February 2023 the Company lodged a Notice of General Meeting for a meeting of shareholders to be held on 27 March 2023, with all resolutions subsequently passed at that meeting.

The following options expired during the Quarter:

- 3,112,588 options exercisable at $0.30 on 12 February 2023

- 612,588 options exercisable at $0.50 on 12 February 2023

- 612,588 options exercisable at $0.70 on 12 February 2023

Pursuant to Section 6 of the Appendix 5B, the Company accrued director fees, superannuation and wages to the board of Comet Resources Limited for the prior quarters and March quarter. Expenditure incurred from operating and investing activities during the Quarter relates to legal and technical due diligence in regard to project acquisitions, exploration costs and for general working capital purposes (the MAR Q Expenditure). A further breakdown is included below.

Click here for the full ASX Release

This article includes content from Comet Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CRL:AU

The Conversation (0)

25 February 2021

Comet Resources

Battery Commodities for the Low-Carbon Revolution

Working to develop resource projects including gold, copper and graphite.

Working to develop resource projects including gold, copper and graphite. Keep Reading...

19 February

Northern Dynasty Shares Plunge as DOJ Backs EPA Veto of Alaska’s Pebble Mine

Northern Dynasty Minerals (TSX:NDM,NYSEAMERICAN:NAK) shares plunged on Wednesday (February 18) after the US Department of Justice (DOJ) filed a court brief backing the Environmental Protection Agency’s (EPA) January 2023 veto of the company’s long-contested Pebble project in Alaska.The brief... Keep Reading...

18 February

BHP Reports Strong Half-Year Copper Results, Boosts Guidance for 2026

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has published its financial results for the half-year ended December 31, 2025.The mining giant said its copper operations, which span multiple continents, accounted for the largest share of its overall earnings for the first time, coming in at 51 percent of... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00