August 06, 2024

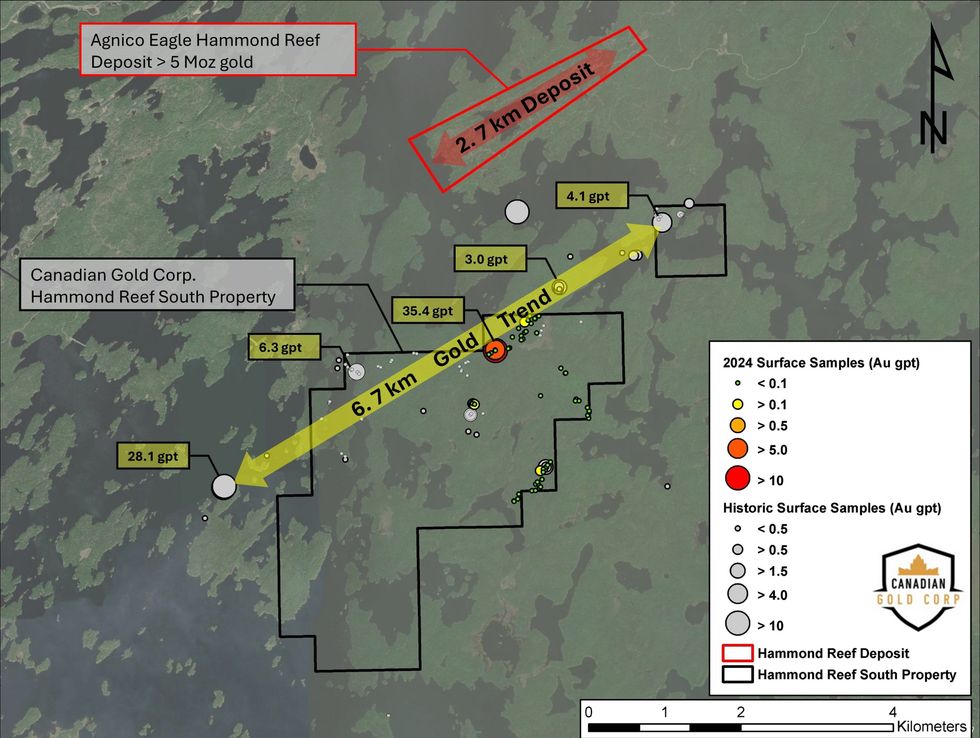

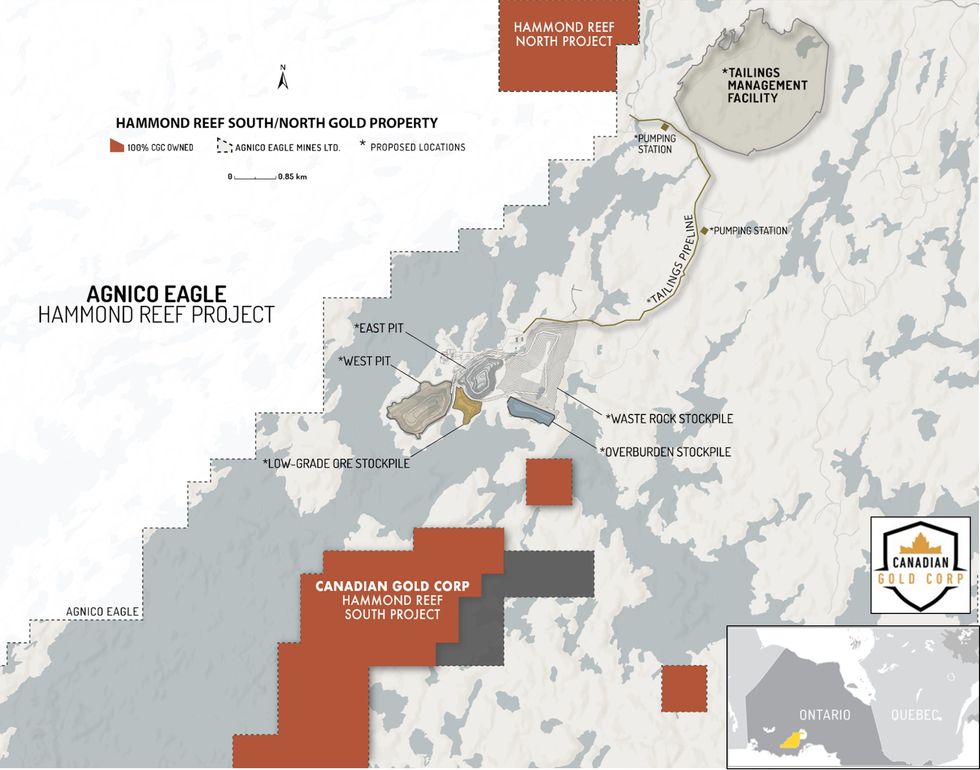

Canadian Gold Corp. (TSXV: CGC) ("Canadian Gold" or the "Company") is pleased to provide an exploration update on its 100% owned Hammond Reef South Project, located near Atikokan, Ontario, and adjacent to Agnico Eagle's fully permitted Hammond Reef Project (Fig. 1). Hammond Reef South was acquired in 2023 as part of the Company's strategy of acquiring prospective mineral rights around Canada's largest mines and development projects, which provides additional optionality for shareholders beyond the exploration drilling currently taking place at the Tartan Mine in Manitoba.

Highlights

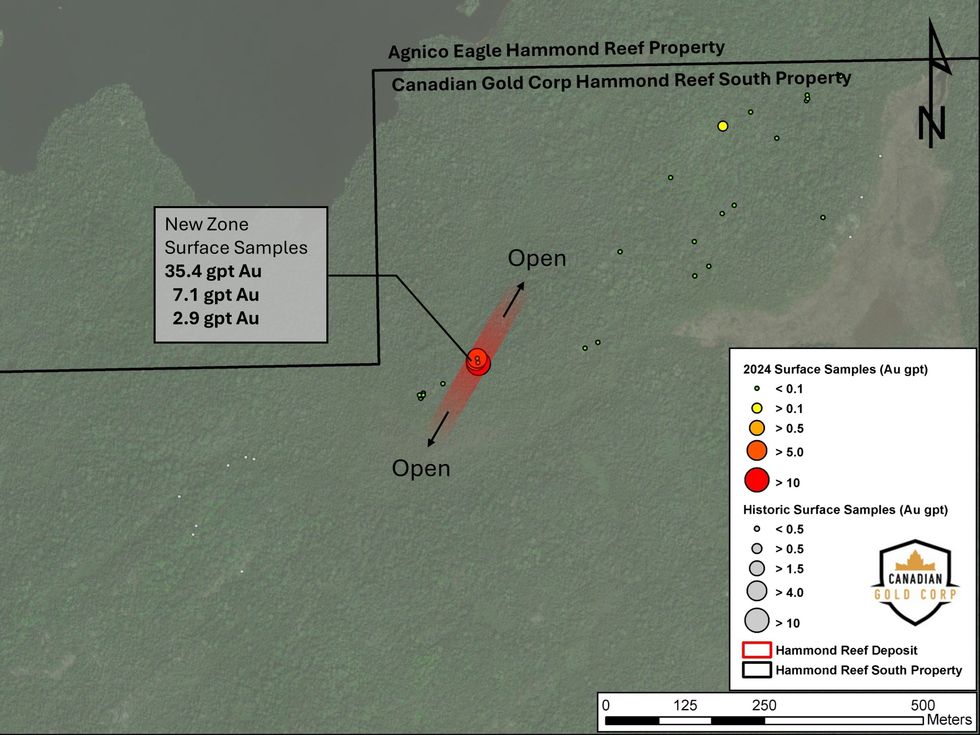

- Surface sampling returns 35.4 and 7.1 gpt gold at Hammond Reef South, in addition to other gold-bearing samples, discovering a new high-grade zone approximately 2 km from Agnico Eagle's Hammond Reef Deposit, which is one of the few fully permitted mine projects in Canada (Fig. 1).

- The Hammond Reef South Project had its exploration permit approved on July 24, 2024, which allows for drilling, trenching and ground geophysical work.

- The Company has applied for the Ontario Junior Exploration Program grant, which provides for 50% reimbursement for exploration expenses up to $200,000.

- Follow-up field work is scheduled to begin this week.

Hammond Reef South Project

During June of this year, a field program was initiated on the property to evaluate the surface for gold mineralization. The program successfully identified a new high-grade gold zone with assays returning 35.4 gpt, 7.1 gpt, and 2.9 gpt gold (Table 1 & Fig. 2). The Hammond Reef South property is located only 2 km from Agnico Eagle's Hammond Reef Deposit, which contains a large mineral resource of more then 5 million ounces of gold and occurs in the same geological environment (Fig. 1).

Table 1. Hammond Reef South Surface Sample Highlights

| Sample Number | Easting | Northing | Gold g/t |

| 473583 | 612360 | 5418397 | 35.4 |

| 473584 | 612356 | 5418401 | 7.1 |

| 473586 | 612358 | 5418405 | 2.9 |

Gold mineralization at the new zone occurs within a large gossanous shear-hosted quartz vein with up to 10% sulphides, mainly pyrite with accessory chalcopyrite and galena, discovered in the Northeast part of the property (Fig. 2). The vein was at least 2 metres in width and exposed for more than 10 metres along strike which remains open to the Northeast and Southwest. The strike of the vein, its mineralization and geological setting is analogous to Agnico Eagle's Hammond Reef Deposit to the north. Recent and historic surface samples are now revealing a very large 6.7 km trend of gold mineralization across the Hammond Reef South property representing a potentially significant discovery (Fig. 3).

A follow-up program has been scheduled, and will commence this week that aims to evaluate the length, width and distribution of grade at the discovery zone. The Company has also applied for the Ontario Junior Exploration Program grant, which, if accepted, would provide a 50% reimbursement for exploration expenses up to $200,000 for the project.

President and CEO Michael Swistun comments: "We are very excited with the discovery of high-grade gold on the Hammond Reef South property. We were prospecting the property looking for large, low-grade gold system like the Hammond Reef Deposit next door and this gives us a new and exciting opportunity to follow up on."

For Further Information, Please Contact:

Michael Swistun

President & CEO

Canadian Gold Corp.

(204) 232-1373

info@canadiangoldcorp.com

Qualified Person

The scientific and technical information disclosed in this news release was reviewed and approved by Wesley Whymark, P. Geo., Consulting Geologist for the Company, and a Qualified Person as defined under National Instrument 43-101.

Technical Information

The samples collected by Canadian Gold Corp. described in this news release were transported in secure sealed bags for preparation and assay by Act Labs in Thunder Bay, Ontario. The samples reported were crushed in their entirety to 80% passing -10 mesh, with one 500 g subsample split and pulverized to 95% passing 150 mesh. One 50 g aliquot was taken from the subsample for fire assay (FA) with an AAS finish. Samples over 5 g/t gold were subject to a 50 g aliquot FA with gravimetric finish.

About Canadian Gold Corp.

Canadian Gold Corp. is a Toronto-based mineral exploration and development company whose objective is to expand the high-grade gold resource at the past producing Tartan Mine, located in Flin Flon, Manitoba. The historic Tartan Mine currently has a 2017 indicated mineral resource estimate of 240,000 oz gold (1,180,000 tonnes at 6.32 g/t gold) and an inferred estimate of 37,000 oz gold (240,000 tonnes at 4.89 g/t gold). The Company also holds a 100% interest in greenfields exploration properties in Ontario and Quebec adjacent to some of Canada's largest gold mines and development projects, specifically, the Canadian Malartic Mine (QC), the Hemlo Mine (ON) and Hammond Reef Project (ON). The Company is 35% owned by Robert McEwen, who was the founder and CEO of Goldcorp and is Chairman and CEO of McEwen Mining.

CAUTION REGARDING FORWARD-LOOKING INFORMATION

This news release of the Company contains statements that constitute "forward-looking statements." Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Canadian Gold's actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements.

Figure 1. Overview location of the Hammond Reef South property illustrating the location of Agnico Eagle's Hammond Reef Deposit.

Figure 2. Location of the new high-grade discovery on the Hammond Reef South property.

CGC:CA

The Conversation (0)

5h

Selta Project - Gold Exploration Update

First Development Resources plc (AIM: FDR), a UK-based, Australia-focused mineral exploration company with interests in Western Australia and the Northern Territory, is pleased to provide an update on its gold ("Au") focused exploration at the Selta Project ("Selta" or the "Project"), located in... Keep Reading...

9h

Tectonic Metals Drills 4.50 g/t Au over 48.77 metres with 7.79 g/t Au over 24.38 metres at New Target, Flat Gold Project, Alaska

First-Ever Drilling by Tectonic at Black Creek Intrusion Delivers High-Grade Gold Six Kilometres North of Chicken Mountain, Validating Multi-Intrusion Gold System Across 99,800-Acre Flat Property VANCOUVER, BC / ACCESS Newswire / January 29, 2026 / Tectonic Metals Inc. ("Tectonic" or the... Keep Reading...

9h

Flow Metals Provides Structural Interpretation Update from Sixtymile Gold Project

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to announce a technical update on its Sixtymile Gold Project, Yukon. Recent re-logging of historic drill core has resulted in a revised structural interpretation of gold mineralization.The revised interpretation supports a... Keep Reading...

10h

Peruvian Metals Provides Update on the Minas Visca Silver Project in Northern Peru and Announces Financing

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to provide an update on the Company's Minas Visca Silver property (the "Property") located in Northern Peru. Peruvian Metals acquired the Property in 2021 by submitting a superior offer... Keep Reading...

11h

Blackrock Silver Appoints Sean Thompson as Head of Investor Relations

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) (the "Company" or "Blackrock") is pleased to announce the appointment of Sean Thompson as Head of Investor Relations for the Company.Mr. Thompson is a seasoned capital markets professional with over 17 years of experience in... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00