(TheNewswire)

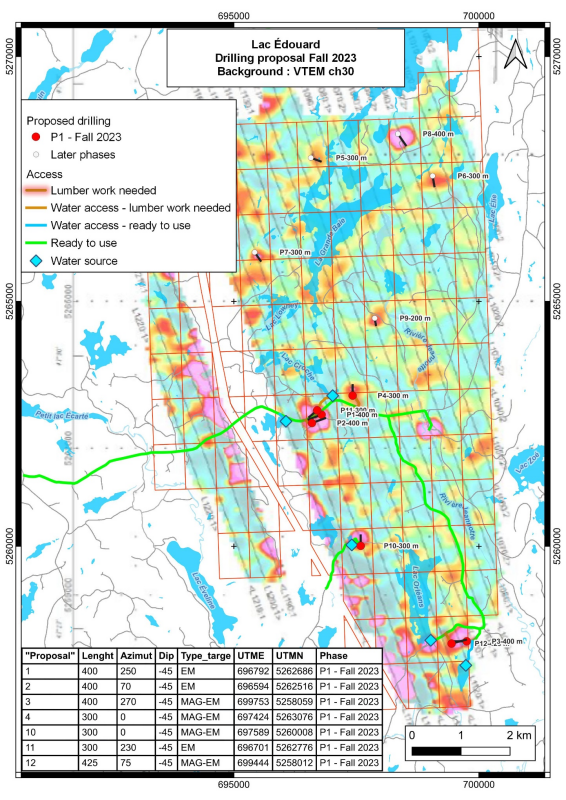

The property has many yet-to-be-drilled targets and prospective electromagnetic anomalies identified by an airborne geophysical survey.

Canada Silver Cobalt Works Inc. (TSXV:CCW) (OTC:CCWOF) (Frankfurt:4T9B) (the " Company " or " Canada Silver Cobalt ") is pleased to announce that it has commenced drilling at its Lowney-Lac Edouard property as part of the first phase of an exploration program targeting prospective areas identified previously in an airborne geophysical survey

The drilling is being conducted in the center and southern part of the 7,237-hectare property in areas where five electromagnetic anomalies were identified by a Geotech VTEM airborne geophysical survey conducted for Canada Silver Cobalt (see news releases May 24, 2022 and August 29, 2022).

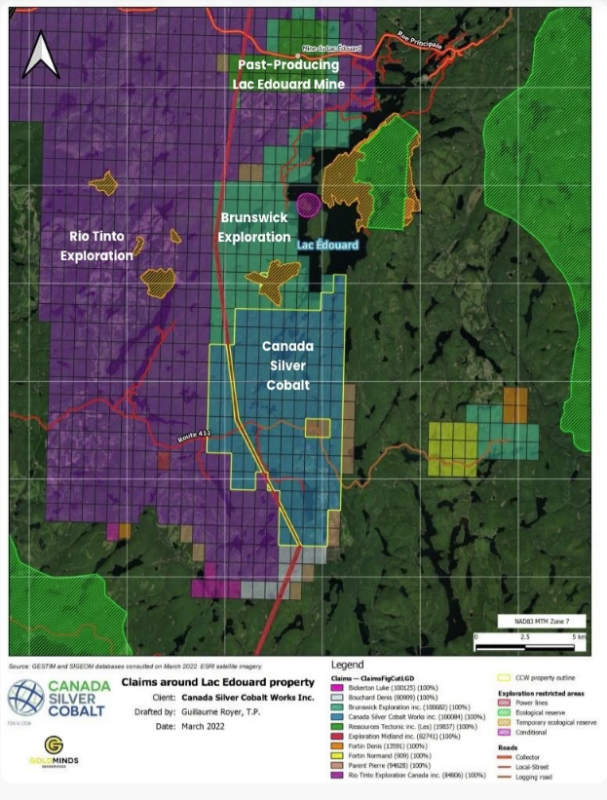

The Lowney-Lac Edouard property is south of the past-producing nickel-copper Lac Edouard Mine and right next to a property where Rio Tinto, in a 2023 drilling program in the Savane area of a Midland Exploration Inc. property, discovered high-grade nickel with copper. Midland reported in an April 27, 2023 news release that Hole MDLD0001, drilled by Rio Tinto, intersected an interval grading 1.07% Ni and 0.13% Cu over 0.78 metres, from 101.87 to 102.65 metres. Midland also reported that grab samples taken by prospectors in the Savane area in 1995 yielded historical values of 1.80% Ni and 0.20% Cu. Another grab sample from a sub-cropping boulder also yielded grades of 1.98% Ni and 0.46% Cu about 250 metres north of the Savane showing (Source: SIGEOM NTS sheet 31P07; GM55352). This may not be representative of the mineralisation of Lowney-Lac Edouard.

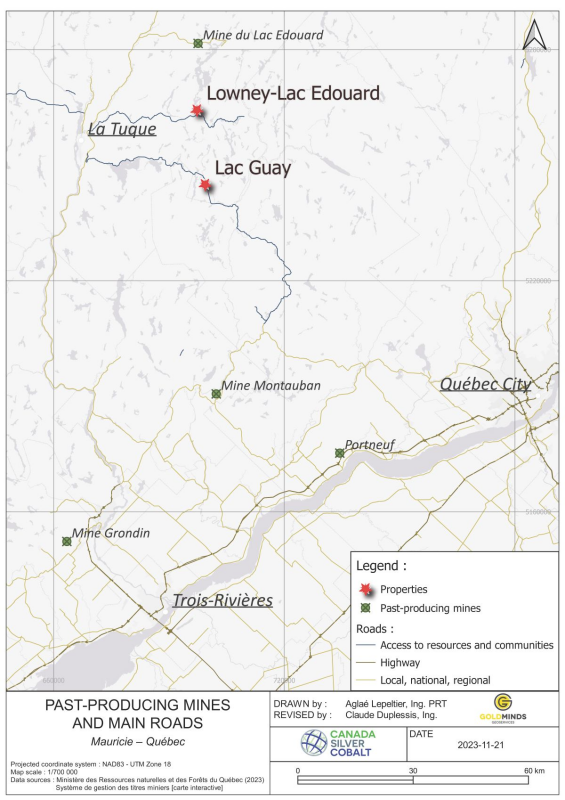

The area, which has good road access and infrastructure, is near La Tuque in Central Quebec and is located north of the port of Trois Rivieres and approximately 100 km northwest of Quebec City. (See maps below.)

"We are excited to be following up on what we found in the VTEM geophysical survey. We had to limit our exploration activity this past summer due to forest fires in Quebec but now is the time to catch up and we are looking forward to seeing this property develop further," said Frank J. Basa, Chief Executive Officer.

The first phase is expected to involve 1,500 metres of drilling and the second phase, planned for 2024, dependent on drill results from the first phase, could include the testing of additional targets. The Company has engaged Laurentia Exploration, Multi Drilling Services and GoldMinds Geoservices for this campaign. Drilling in this first phase is limited to targets near existing logging roads where permits allow and the Company is awaiting permits needed for drilling in other areas of the property.

The Lowney-Lac Edouard property is one of 14 critical metals properties in Quebec acquired in late 2020 by Canada Silver Cobalt targeting nickel, copper, and cobalt mineralization in preparation for the significantly increased demand for the metals expected for the ongoing electrification programs planned by governments. (See news releases February 16 and April 20, 2021 and August 29, 2022 for descriptions of the Lowney-Lac Edouard property).

One of the 14 Quebec properties – the Graal property, where the Company drilled extensively and successfully in 2021 and 2022 – has been shown to have potentially a large area of near-surface, high-grade nickel-copper mineralization with cobalt byproduct and showings of platinum and palladium in a 6 km strike length as well as in other areas of the property. The Graal property is characterized by a large Bouguer gravity anomaly as is the case with Lowney-Lac Edouard. The Company plans to spin out the Graal Property into a new Company called Coniagas Battery Metals Inc. (See news release September 26, 2023.)

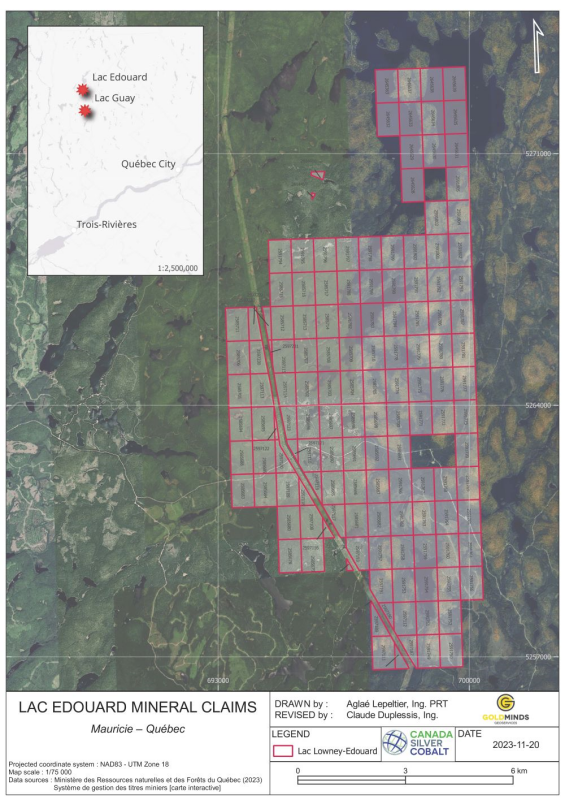

Note that the Figure 2 map below is updated to November 20, 2023 and the Figure 3 map is from March 2022.

Figure 1: Location of the Lowney-Lac Edouard and recently acquired Lac Guay properties

Figure 2: Lowney-Lac Edouard property mineral claims

Figure 3: Location of the Lowney-Lac Edouard property with adjacent properties

Figure 4: Planned drill locations at Lowney-Lac Edouard South

Qualified person

The technical information in this news release has been provided by Laurentia technical team and the content was reviewed and approved by Claude Duplessis, P.Eng., GoldMinds Geoservices Inc., a m ember of Québec Order of Engineers and an independent qualified person in accordance with National Instrument 43- 101 standards.

About Canada Silver Cobalt Works Inc.

Canada Silver Cobalt Works Inc. recently discovered a major high-grade silver vein system at Castle East located 1.5 km from its 100%-owned, past-producing Castle Mine near Gowganda in the prolific and world-class silver-cobalt mining district of Northern Ontario. The Company has completed a 60,000m drill program aimed at expanding the size of the deposit with an update to the resource estimate underway.

In May 2020, based on a small initial drill program, the Company published the region's first 43-101 resource estimate that contained a total of 7.56 million ounces of silver in Inferred resources, comprising very high-grade silver (8,582 grams per tonne un-cut or 250.2 oz/ton) in 27,400 tonnes of material from two sections (1A and 1B) of the Castle East Robinson Zone, beginning at a vertical depth of approximately 400 meters. Note that mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to Canada Silver Cobalt Works Press Release May 28, 2020, for the resource estimate. Report reference: Rachidi, M. 2020, NI 43-101 Technical Report Mineral Resource Estimate for Castle East, Robinson Zone, Ontario, Canada, with an effective date of May 28, 2020, and a signature date of July 13, 2020.

The Company also has: (1) 14 battery metals properties in Northern Quebec where it has recently completed a nearly 16,000-metre drill program on the Graal property; (2) the prospective 1,000-hectare Eby-Otto gold property close to Agnico Eagle's high-grade Macassa Mine near Kirkland Lake, Ontario; and (3) the St. Denis-Sangster lithium project – 260 square kilometers of greenfield exploration ground with numerous pegmatites focussed along a significant volcanic sedimentary rock – Archean granite contact near Cochrane, Ontario contiguous to Power Metals' Case Lake Lithium properties.

Canada Silver Cobalt's flagship silver-cobalt Castle mine and 78 sq. km Castle Property feature strong exploration upside for silver, cobalt, nickel, gold, and copper. With underground access at the fully owned Castle Mine, an exceptional high-grade silver discovery at Castle East, a pilot plant to produce cobalt-rich gravity concentrates, a processing facility (TTL Laboratories) in the town of Cobalt, and a proprietary hydrometallurgical process known as Re-2Ox (for the creation of technical-grade cobalt sulphate as well as nickel-manganese-cobalt (NMC) formulations), Canada Silver Cobalt is strategically positioned to become a Canadian leader in the silver-cobalt space. More information at www.canadasilvercobaltworks.com .

"Frank J. Basa"

Frank J. Basa, P. Eng.

Chief Executive Officer

For further information, contact:

Frank J. Basa, P.Eng.

Chief Executive Officer

416-625-2342

Or:

Wayne Cheveldayoff,

Corporate Communications

P: 416-710-2410

E: waynecheveldayoff@gmail.com

Caution Regarding Forward-Looking Statements

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements which include, but are not limited to, comments that involve future events and conditions, which are subject to various risks and uncertainties. Except for statements of historical facts, comments that address resource potential, upcoming work programs, geological interpretations, receipt and security of mineral property titles, availability of funds, and others are forward-looking. Forward-looking statements are not guarantees of future performance and actual results may vary materially from those statements. General business conditions are factors that could cause actual results to vary materially from forward-looking statements. Canada Silver Cobalt Works Inc. does not undertake, and assumes no obligation, to update or revise, any such forward-looking statements or forward-looking information contained herein or in other communications to reflect new events or circumstances, except as may be required by law.

Copyright (c) 2023 TheNewswire - All rights reserved.