Highlights:

- First of seven new nickel resources expected to be published by end of the first quarter of 2025 demonstrating the potential scale of the Timmins Nickel District

- Initial Deloro indicated Resource of 81 million tonnes grading 0.25% nickel containing 202kt of nickel plus a further Inferred Resource of 357 million tonnes grading 0.25% nickel containing 885kt of nickel

- Seven exploration rigs currently drilling across the Timmins Nickel District

Canada Nickel Company Inc. (" Canada Nickel " or the " Company ") (TSXV: CNC) (OTCQB: CNIKF) today announced an initial mineral resource for its 100% owned Deloro Nickel Sulphide Project ("Deloro") near Timmins, Ontario .

The Deloro Nickel Sulphide Project is located in the heart of the prolific Timmins - Cochrane mining camp in Ontario, Canada , and is adjacent to well-established, major infrastructure associated with over 100 years of regional mining activity. The Deloro project is accessible year-round by road, is located just 8 km south of Timmins , 7 km southwest of the Dome Mine-Mill Complex and less than 2 km from existing powerlines.

Mark Selby , CEO of Canada Nickel commented, "We are very pleased with the size of this initial resource on Deloro particularly given the relatively small scale of the target footprint relative to the 20+ targets in our portfolio. Deloro has an advantageous location near both Timmins and the mining and processing infrastructure at the Dome Mill, and benefits from a relatively low overburden of an average of just 9 metres."

Selby continued, "Our exploration program continues to successfully demonstrate the potential of the Timmins Nickel District and now has seven drill rigs operating – four drilling on our Mann Central and Mann Northwest properties, two completing the next phase of drilling at our Reid project, and one targeting the east end of our Reaume project. Updates on drilling at each of these properties will be provided as assay results are compiled."

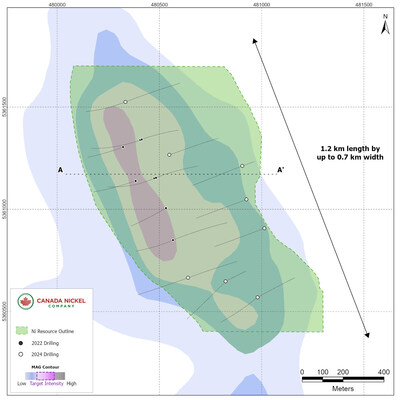

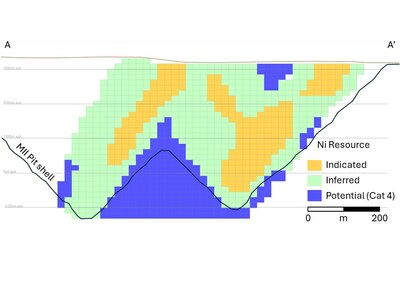

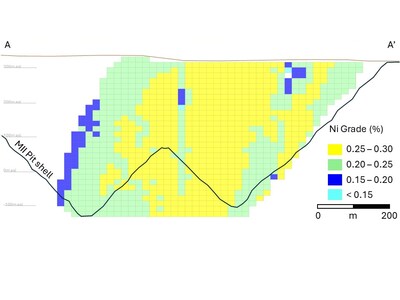

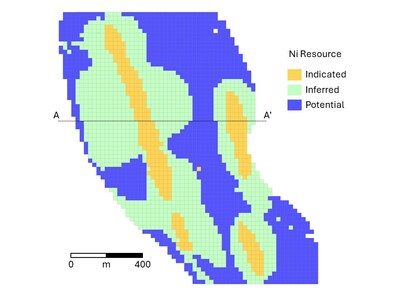

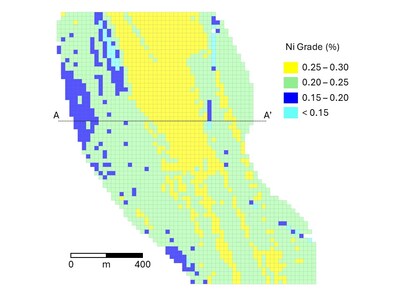

Deloro Mineral Resource Estimate

For the initial Mineral Resource Estimate, a total of 8,242 metres of core drilling in 22 drill holes was utilized to calculate the Mineral Resources in two categories as provided in Table 1 below. Inferred Resources totalled 357 million tonnes grading 0.25% Ni, for a total of 885 kt of contained nickel, and Indicated Resources totalled 81 million tonnes grading 0.25% Ni, for a total of 202 kt of contained nickel. A cut-off grade of 0.10% Ni was used. Example cross-section and block model views of the resource estimate are provided in Figures 1 through 4 below.

Drilling at Deloro was completed in 2022 and 2024. The 2024 campaign successfully completed the goal of infilling previous sections in order to define an initial resource estimate, gain understanding on the geology of the deposit as well as systematically collecting samples for mineralogical analysis that would help define the potential of nickel recovery.

This Mineral Resource Estimate was prepared by Caracle Creek International Consulting Inc. in accordance with CIM Definition Standards on Mineral Resources and Reserves. A Technical Report in support of the Mineral Resource Estimate will be filed on SEDAR+ ( www.sedarplus.ca ) within 45 days.

Table 1 – Initial Mineral Resource Estimate (in-pit resources) for the Deloro Nickel Sulphide Project, Ontario

| Mineral Resource Estimate | | Contained Metal | |||||||||||||||

| DOMAIN | CLASS | TONNES (Mt) | Ni (%) | Co (%) | Fe (%) | Cr (%) | S (%) | Pd (g/t) | Pt (g/t) | Ni (kt) | Co (kt) | Fe (Mt) | Cr (kt) | S (kt) | Pd (koz) | Pt (koz) | |

| MAIN | Indicated | 81.3 | 0.25 | 0.011 | 5.2 | 0.24 | 0.056 | 0.0029 | 0.0045 | 201.8 | 8.6 | 4.2 | 193.6 | 45.6 | 7.7 | 11.8 | |

| Inferred | 357.5 | 0.25 | 0.011 | 5.2 | 0.23 | 0.063 | 0.0040 | 0.0053 | 885.4 | 38.0 | 18.6 | 835.4 | 224.9 | 45.7 | 60.6 | ||

| *Totals may not add due to rounding. |

| 1. | The independent Qualified Person for the Mineral Resource Estimate, as defined by NI 43-101, is Dr. Scott Jobin-Bevans (P.Geo., PGO #0183), of Caracle Creek International Consulting Inc. The effective date of the Mineral Resource Estimate is July 15, 2024. |

| 2. | The quantity and grade of reported Inferred Resources in this Mineral Resource Estimate are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as Indicated or Measured. However, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. |

| 3. | A cut-off grade of 0.10% Ni was used for the Main Domain (combined high- and low-grade estimated domains). Cut-offs were determined on the basis of core assay geostatistics and drill core lithologies for the deposit, and by comparison to analogous deposit types. |

| 4. | Geological and block models for the Mineral Resource Estimate used data from a total of 22 surface drill holes, completed by CNC in 2022-2024. The drill hole database was validated prior to resource estimation and QA/QC checks were made using industry-standard control charts for blanks, core duplicates and commercial certified reference material inserted into assay batches by CNC and by comparison of umpire assays performed at a second laboratory. |

| 5. | Estimates have been rounded to two significant figures. |

| 6. | The Mineral Resource Estimate was prepared following the CIM Estimation of Mineral Resources & Mineral Reserves Best Practice Guidelines (November 29, 2019) and the CIM Definition Standards for Mineral Resources & Mineral Reserves (May 19, 2014). |

| 7. | The geological model as applied to the Mineral Resource Estimate comprises three mineralized domains hosted by variably serpentinized ultramafic rocks: a relatively higher-grade core (dunite) and two, western and eastern, lower-grade envelopes (peridotite). Individual wireframes were created for each domain in Leapfrog Geo 2023.2.3 software. |

| 8. | A 20 m x 20 m x 15 m block model was created, and samples were composited at 7.5 m intervals. Grade estimation from drill hole data was carried out for Ni, Co, Fe, Cr, S, Pd and Pt using the Ordinary Kriging interpolation method in Isatis 2024.04 software. |

| 9. | The mineral resource estimates have been revised to include a conceptual pit envelope constraint that was developed using the following optimization parameters. Metal prices used were US$21,000/t nickel, US$40,000/t cobalt, US$325/t magnetite, US$1,350/oz palladium, and US$1,150/oz platinum. Different pit slopes were used for each layer (in degrees): 9.5 in clay, 11.6 in sand, and 45.0 in rock. Exchange rate utilized was US$/C$ at $0.75. Mining costs utilized different values for overburden (clay, gravel), selective mining, and bulk mining, ranging from C$1.62 to C$3.28/t mined. Processing costs and general and administration costs for a 60 ktpd operation (similar to the initial stage of Crawford) were C$8.40/t. Based on the range of grade and ratio of sulphur to nickel, calculated recovery averages 49% for Ni, 56% for Fe, 5% for Co and 21% for Pt and Pd. |

| 10. | Grade estimation was validated by comparison of input and output statistics (Nearest Neighbour and Inverse Distance Squared methods), swath plot analysis, cross-plots of declustered samples against the nearest OK estimate, and by visual inspection of the assay data, block model, and grade shells in cross-sections. |

| 11. | Density estimation was carried out for the mineralized domains using the Ordinary Kriging interpolation method, on the basis of 954 specific gravity measurements collected during the core logging process, using the same block model parameters of the grade estimation. As a reference, the average estimated density value within dunite is 2.62 g/cm 3 (t/m 3 ), while peridotite domains yielded averages of 2.69 g/cm 3 (t/m 3 ) in the west and 2.75 g/cm 3 (t/m 3 ) in the east. |

Exploration Update

The Company's 2024 exploration program focused on demonstrating the potential of the Company's portfolio in the Timmins Nickel District. The Company has completed 112 holes so far for a total of 47,482 metres. The Company has drilled 32 holes in Crawford defining the Crawford PGM Zone, 28 holes at Reid, 26 holes at Texmont, 13 holes at Mann, and 11 holes at Deloro which formed the basis of this resource. The Company plans to next publish an initial resource for the Crawford PGM Zone followed by an initial resource for Texmont. The Company then plans to publish five additional resources before the end of the first quarter of 2025.

Next Steps:

- A technical report with respect to the Mineral Resource Estimate disclosed today will be filed within 45 days as required by National Instrument 43-101.

- Mineralogical studies and metallurgical testwork will continue through the fourth quarter of 2024, as well as infill drilling to further upgrade the resource.

Assays, Quality Assurance/Quality Control and Drilling and Assay

Edwin Escarraga , MSc, P.Geo., a "qualified person" as defined by National Instrument 43-101, is responsible for the on-going drilling and sampling program, including quality assurance (QA) and quality control (QC). The core is collected from the drill in sealed core trays and transported to the core logging facility. The core is marked and sampled at 1.5 metre lengths and cut with a diamond blade saw. One set of samples is transported in secured bags directly from the Canada Nickel core shack to Actlabs Timmins, while a second set of samples is securely shipped to SGS Lakefield for preparation, with analysis performed at SGS Burnaby or SGS Callao ( Peru ). All are ISO/IEC 17025 accredited labs. Analysis for precious metals (gold, platinum, and palladium) are completed by Fire Assay while analysis for nickel, cobalt, sulphur and other elements are performed using a peroxide fusion and ICP-OES analysis. Certified standards and blanks are inserted at a rate of 3 QA/QC samples per 20 core samples making a batch of 60 samples that are submitted for analysis.

Qualified Person and Data Verification

Stephen J. Balch P.Geo . (ON), VP Exploration of Canada Nickel and a "qualified person" as is defined by National Instrument 43-101, has verified the data disclosed in this news release, and has otherwise reviewed and approved the technical information in this news release on behalf of Canada Nickel Company Inc.

The magnetic images shown in this press release were created from Canada Nickel's interpretation of datasets provided by the Ontario Geological Survey.

About Canada Nickel Company

Canada Nickel Company Inc. is advancing the next generation of nickel-sulphide projects to deliver nickel required to feed the high growth electric vehicle and stainless-steel markets. Canada Nickel Company has applied in multiple jurisdictions to trademark the terms NetZero Nickel TM , NetZero Cobalt TM , NetZero Iron TM and is pursuing the development of processes to allow the production of net zero carbon nickel, cobalt, and iron products. Canada Nickel provides investors with leverage to nickel in low political risk jurisdictions. Canada Nickel is currently anchored by its 100% owned flagship Crawford Nickel-Cobalt Sulphide Project in the heart of the prolific Timmins-Cochrane mining camp. For more information, please visit www.canadanickel.com.

For further information, please contact:

Mark Selby

CEO

Phone: 647-256-1954

Email: info@canadanickel.com

Cautionary Note and Statement Concerning Forward Looking Statements

This press release contains certain information that may constitute "forward-looking information" under applicable Canadian securities legislation. Forward looking information includes, but is not limited to, the potential of the Deloro Nickel Sulphide Project, timing for filing a technical report in support of the Mineral Resource Estimate, the significance of drill results, the ability to continue drilling, the impact of drilling on the definition of any resource, timing and completion (if at all) of additional mineral resource estimates, the potential of the Timmins Nickel District, strategic plans, including future exploration and development plans and results, and corporate and technical objectives]. Forward-looking information is necessarily based upon several assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Factors that could affect the outcome include, among others: future prices and the supply of metals, the future demand for metals, the results of drilling, inability to raise the money necessary to incur the expenditures required to retain and advance the property, environmental liabilities (known and unknown), general business, economic, competitive, political and social uncertainties, results of exploration programs, risks of the mining industry, delays in obtaining governmental approvals, failure to obtain regulatory or shareholder approvals. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. All forward-looking information contained in this press release is given as of the date hereof and is based upon the opinions and estimates of management and information available to management as at the date hereof. Canada Nickel disclaims any intention or obligation to update or revise any forward-looking information, whether because of new information. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/canada-nickel-company-announces-initial-deloro-nickel-sulphide-project-resource-302200420.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/canada-nickel-company-announces-initial-deloro-nickel-sulphide-project-resource-302200420.html

SOURCE Canada Nickel Company Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/July2024/18/c1403.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/July2024/18/c1403.html