May 02, 2023

Bryah Resources Ltd (ASX:BYH) (“Bryah” or “the Company”) is pleased to announce that it is undertaking a 1 for 3 renounceable rights issue (“Rights Issue”) at 1.9 cents per share to raise up to approximately$1.78 million (before costs). For every 3 new shares subscribed, eligible shareholders will receive 2 free attaching New Options with an exercise price of 3.5 cents and expiring 1st December 2025. The Company will apply for the quotation of the new options on the ASX.

HIGHLIGHTS

- 1 for 3 Renounceable Rights Issue to raise up to $1.78 million

- Attractively priced at 1.9 cents per share

- Discount of 17% to the last price of 2.3 cents and 17% to the 20‐day VWAP

- With every 3 New Shares, shareholders re9ceive 2 free attaching New Options

- New Options will have an Exercise Price of 3.5 cents, expiring 1st December 2025 and will be quoted subject to ASX approval

- Shareholders can trade their rights and apply for additional shares and options

- Rights to commence trading from 5th May 2023

- Funds to be used for ongoing Copper exploration

The rights issue price represents a discount of:

- 17% to the Company’s last close of 2.3c on the ASX; and

- 17% to the Company’s 20‐day VWAP of 2.3c

The Rights Issue is open to all eligible shareholders who have a registered address within Australia, New Zealand or Singapore, and who hold Shares on the Record Date. The Rights Issue will close on 25th May (unless extended), and eligible shareholders can apply for shortfall in excess of their entitlement. Shareholders can also trade their rights from 5th May.

Funds raised will be used to enable the Company to:

- Drill Copper Hills South targets

- Complete Assay Downhole EM at Windalah

- Complete Aquarius RC Drilling

- IP Lines at the Olympus Target

- West Bryah Uranium/ REE Stage 1 – Twin Holes and re‐assay for REE

- General Working Capital

The Rights Issue is partially underwritten to $0.5 million (“Underwritten Amount”) by Lead Manager and Underwriter Mahe Capital Pty Ltd (ACN 634 087 684) (AFSL 517246) ("Mahe Capital").

All New Shares issued will rank equally with existing shares on issue and the Company will apply for quotation of the New Shares and New Options. A prospectus in relation to the Rights Issue was lodged with ASIC on 3rd May and, together with a personalised entitlement acceptance form, will be sent to eligible shareholders shortly after the Record Date.

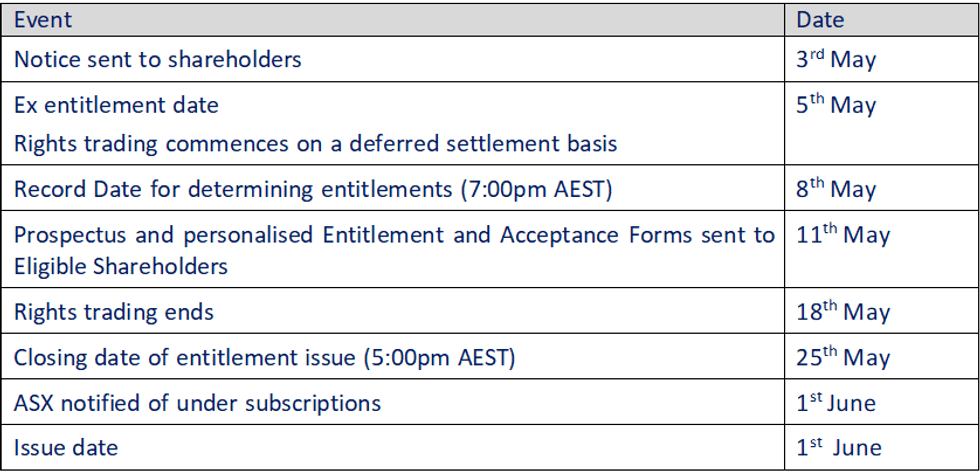

Eligible shareholders should consider the prospectus in deciding whether to acquire securities under the Rights Issue and will need to follow the instructions on the entitlement and acceptance form that will accompany the prospectus. The following are indicative dates in respect of the capital raising:

The Company’s Chairman Ian Stuart said: “This fundraising is a major step in the value creation journey for the Company and we look forward to continued shareholder support as we advance our copper gold VMS targets and manganese joint venture in the Bryah Basin and take our copper nickel resource and copper exploration at the Gabanintha Project, near Meekatharra to the next level to deliver value for our shareholders”.

Click here for the full ASX Release

This article includes content from Bryah Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BYH:AU

The Conversation (0)

11 October 2022

Bryah Resources

Battery Metal Exploration and Development Opportunities in Western Australia

Battery Metal Exploration and Development Opportunities in Western Australia Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00