August 23, 2023

Bryah Resources Limited (ASX: BYH, “the Company” or “Bryah”) is pleased to announce its updated Manganese Mineral Resource. Bryah owns 49% of the manganese rights in a Joint Venture with OM (Manganese) Ltd, (“OMM”) a wholly owned subsidiary of OM Holdings Limited (ASX: OMH).

HIGHLIGHTS

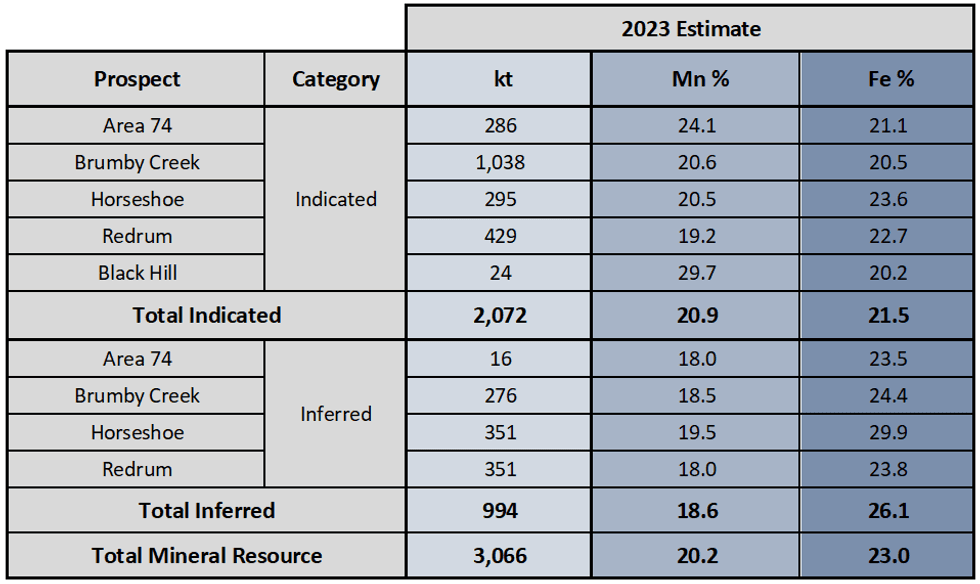

- Total Inferred and Indicated JORC 2012 compliant Mineral Resource Estimate 3.07 Million tonnes (Mt) at 20.2% Mn

- Indicated Resource increased by 91% and Inferred Resource increased by 32%

- Mineral Resources estimated at Area 74, Redrum, Brumby Creek, Black Hill and Horseshoe areas - 5 prospects in total

- Manganese defined as a critical mineral by many countries, including the United States for its use in steelmaking and batteries1

MANGANESE EXPLORATION - WHAT’S COMING UP?

- Mining Licence applications lodged in addition to existing granted mining lease at Horseshoe Manganese M52/806

- Environmental approvals progressing

- Ongoing drilling to extend the current Mineral Resource

- Further metallurgical test work to define beneficiation yields

Commenting on the updated Mineral Resource, Bryah CEO Ashley Jones said:

“We are very pleased to announce an updated JORC Mineral Resource Estimate for the Bryah Basin JV Project with OM Manganese. The JV with OMM has allowed us to complete substantial extensional and infill resource drilling at our prospects, delivering a 67% increase in the combined Indicated and Inferred Mineral Resource.

Importantly, we have now achieved a ‘critical mass’ (3 Mt) that allows the JV to progress mining studies and planning to the production stage. The Horseshoe deposits are located within an active mining lease (M 52/806), with recent mining license applications now covering the remainder of deposits included in this Mineral Resource (M 52/1087 and M 52/1088).

The 15% manganese cut-off grade used in this MRE is superior to many of our peers with potentially greater yields to make a saleable manganese product. Historical production at the Horseshoe pits gives us further confidence in achieving a successful mining operation.

We look forward to drill-testing more gradient array induced polarisation and geologically mapped exploration targets and will conduct further resource extension drilling throughout the remainder of 2023. We believe we have just started to unlock the true manganese production potential of the Bryah Basin and look forward to some fruitful years ahead.”

Note: Appropriate rounding applied. kt = 1,000 tonnes

All the Mineral Resources are now including on either granted or mining licences under application.

- Mineral Resource includes 0.65 Mt at 20.0% Mn on a granted Mining Lease M52/806

- Mineral Resource includes 2.42 Mt at 20.2% Mn on Mining License Applications M52/1087 andM52/1088

- Over 67 % of the resources are in the Indicated Mineral Resource category.

- Indicated Mineral Resources of 2.07Mt at 20.9% Mn and Inferred Mineral Resources of 0.99Mt at 18.6% Mn.

Click here for the full ASX Release

This article includes content from Bryah Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BYH:AU

The Conversation (0)

11 October 2022

Bryah Resources

Battery Metal Exploration and Development Opportunities in Western Australia

Battery Metal Exploration and Development Opportunities in Western Australia Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00