August 23, 2023

Bradda Head Lithium Ltd (AIM:BHL, TSX-V:BHLI, OTCQB:BHLIF), the North America-focused lithium development group, is pleased to announce assay results from the latest 2 drill holes of the Basin East Extension ("BEE") 2023 drill programme, returning the highest single interval grade so far of 2,791ppm Li over 0.40m and a separate sample of 641 ppm Mo over 1.22m. Drilling has now finished and Bradda Head is busy working on the upgraded Mineral Resource Estimate ("MRE") and anticipated in mid-September.

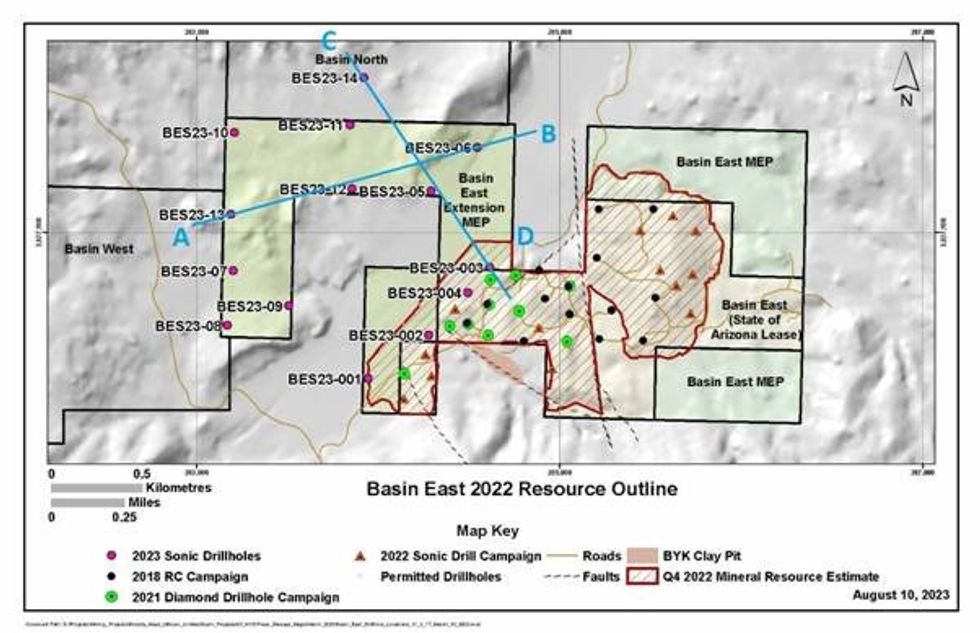

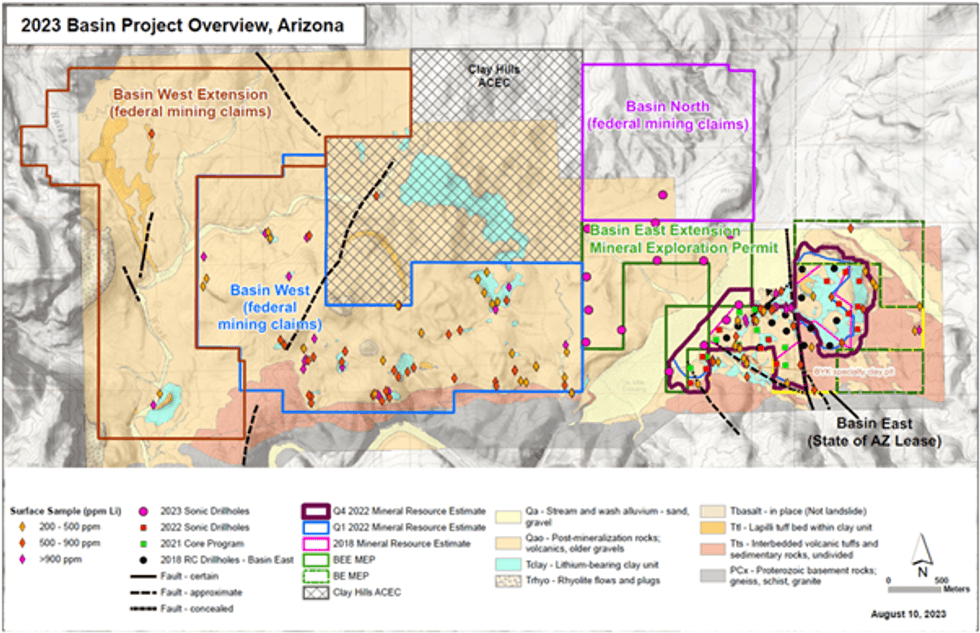

The programme has continued to encounter better-than-expected thicknesses of clay, further confirming that lithium-bearing clays continue and appear to thicken to the north into the Company's Basin North ("BN") claims, and likely west into Basin West ("BW") claims. These positive indicators are expected to lead to significant resource expansion for the Company this year.

Drilling campaign highlights:

1. Notable lithium intercepts:

· Notable intervals from the next 2 widely-spaced sonic core holes continue to be encouraging and include:

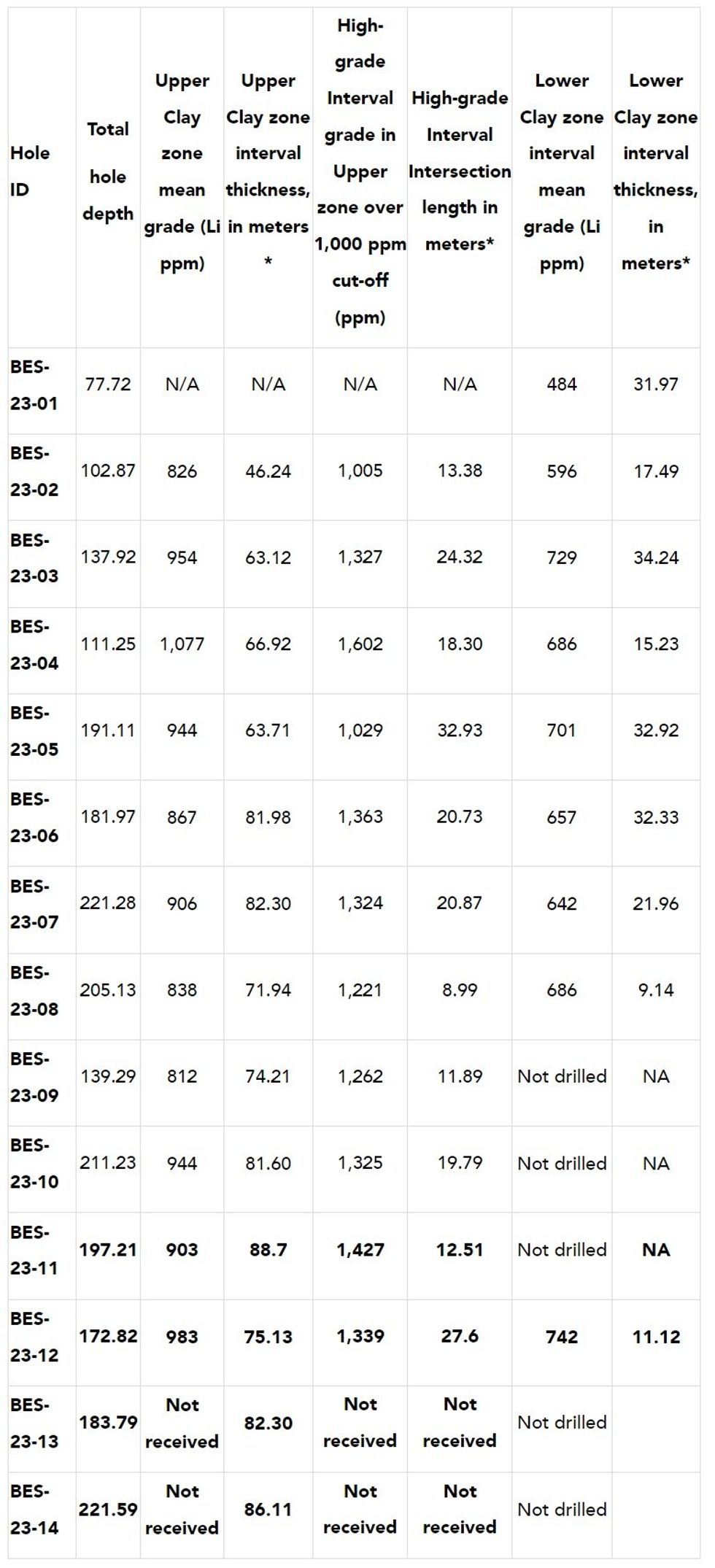

o 88.70m @ 903ppm Li in hole BES23-11, including 12.51m @ 1,427ppm,

o 75.12m @ 983ppm Li in hole BES23-12, including 27.6m @ 1,339ppm. See Table 1 for highlighted results.

2. High-grade unit

· The high-grade unit previously found in Basin East ("BE") has similar grades and maintains strong continuity across all of BEE and now confirmed into BN, likely extending into BW.

· This is positive for any future mining operation as the high-grade unit sits in the upper clay unit which forms the shallowest part of the deposit and cropping out at BE.

· The assay results continue to detect high levels of molybdenum associated with these two drill holes within the high-grade unit such as 289ppm Mo over 8.84m in BES23-11 within 21.04m of 167ppm and 15.56m of 148 I BES23-12. A detailed XRD analysis of the Basin core is under construction with the intent of identifying the mineralogy associated with high grade lithium and molybdenum.

3. Resource Expansion:

· The first hole in Basin North encountered an intercept of 86.12m of upper clay, which is very promising for further resource expansion into Basin North.

· The remarkable continuity and consistency of the lithium intercepts in the upper clay suggest the presence of extensive lithium mineralisation throughout the project area, indicating the potential for a sizeable lithium deposit.

· Bradda is targeting a +1Mt lithium carbonate equivalent (LCE) Resource this year, which would trigger the next royalty payment of US$2.5m from LRC.

4. Further Exploration Potential:

· The lithium-clay mineralisation remains open to the west and north, indicating further resource upside, as backed up by the previously reported 1Mt to 6Mt LCE JORC-compliant Exploration Target identified by SRK.

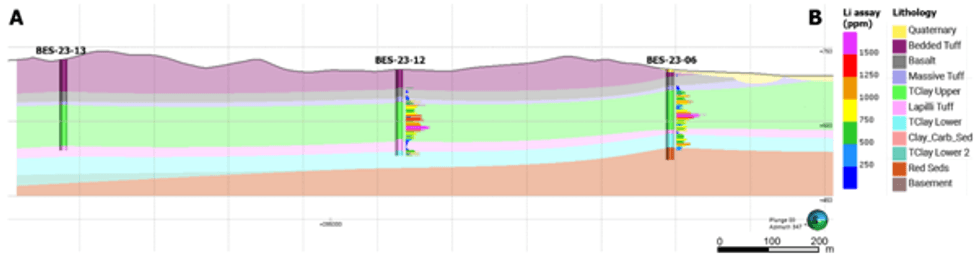

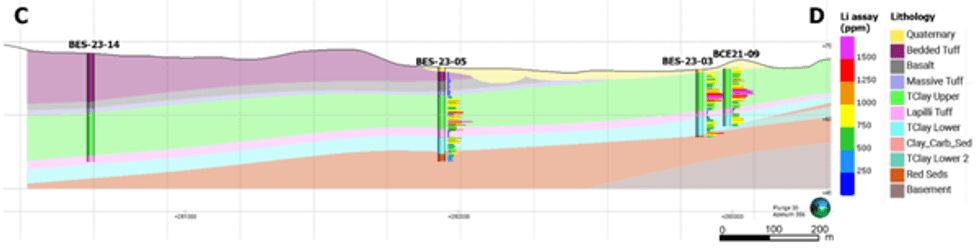

· The total upper clay unit is 78.40m in width on average in BEE and the first hole into BN intercepted 86.11m of upper clay. To put that in context, the average thickness of the upper clay unit at BE is 34.00m in all the previous 34 holes that intercepted upper clay in the last 3 drill programmes (2018, 2021 and 2022). See Cross-section Figures 3 and 4.

· Resource estimation work is now underway to produce an updated Mineral Resource Estimate, with SRK incorporating this new drill data.

· The recent drill results on BEE and BN solidify Bradda's belief in a widespread and continuous lithium-rich stratigraphic sequence with potential further into BN and across to BW that the Company believes will lead to significant resource growth and opportunity to become a Tier 1 deposit.

Charles FitzRoy, CEO of Bradda Head Lithium, commented:

"We are excited about the potential for significant expansion of the resource at the Basin Project. These latest assays solidify the resource expansion potential at Basin and the high-grade lithium intercepts encountered in the recent drilling campaign demonstrate the exceptional potential of the project and underscore its importance as a potential strategic lithium asset.

"The 2023 drilling programme at the Basin Project is focussed on further expanding the resource base, delineating additional lithium-rich zones, and is working with SRK to release an updated MRE. Hole 14 is the first hole into BN and confirms the presence of the upper clay unit.

"The Company has now kicked off its Phase 3 drill programme at its 31km2 San Domingo pegmatite district in Arizona, with the main aim to delineate a Resource and also to build on the promising results of the maiden drill programme which finished earlier this year."

Detailed assay results, including additional intercepts and technical details, will be made available on the Company's website at www.braddaheadlithium.com.

Background

The successful 2022 drilling at BE led to BHL permitting holes on BEE, then mobilising a sonic drill rig to drill up to 25 holes in the Company's BEE State Lease (see PR dated 16 March 2023).

The 2022 sonic drilling at BE tested c.1.4km2 of the overall c.46km2 property, including Wikieup.

Initial results released on 23 May 2023 at Basin demonstrated the presence of a complete clay sequence across the Burro Creek, which is absent at BE due to varying levels of erosion and basin margin thinning. The dramatically consistent sedimentary sequences over BEE and into BN demonstrates the potential for significant resource expansion within the 2.5km2 BEE Mineral Exploration Permit (MEP) and southern portion of the 2.6km2 BN claim. Bradda's existing compliant Resource is located primarily in the 1.5km2 BE state MEP.

The Upper Clay sequence, now confirmed to thicken to the west, northwest, and north extent of the previously drilled area towards and into Bradda's BEE claim, could potentially form part of a phased mining operation. This could be mined early in the mine plan as a high-grade lithium zone sits in the upper part of the current resource.

Holes BES-23-05 to 10 (the first drill holes ever drilled by BHL to the north of the creek, see Figure 1), encountered a completely intact upper and lower clay sequence preserved by a basalt layer, signifying the continuation of lithium bearing clays across to BEE from BE and now confirmed into BN with the completion of hole BES-23-14. See Figures 1, 3 & 4 for cross-sections.

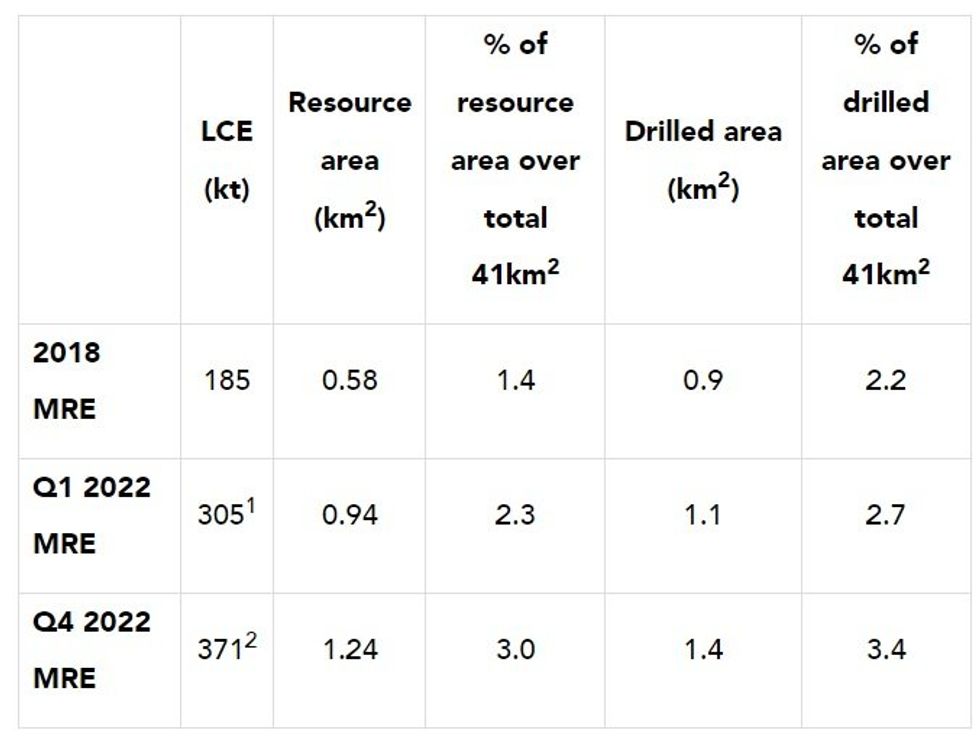

BHL released an updated MRE in January this year (see PR dated 16 January 2023), which was the 2nd MRE that BHL has released in 18 months since Listing on AIM in July 2021.

BHL obtained drill hole permits for 120 sites on the MEP from the State of Arizona at BEE in 2022 and 10 holes on its BN Claims (BLM-administered lands), which is where sonic drilling commenced in late March of this year and was completed on 10 August.

Bradda Head is in the process of permitting exploratory drilling at its BW and Basin West Extension ("BWE") claims through an Exploration Plan of Operations, a procedure with the BLM.

Bradda is targeting to grow its Resource at its Basin project this year with the drill programmes at BEE and BN. Bradda has two royalty payments due through expansion of its clay resources (see PR dated 22 December 2021). The next payment of US$2.5 million will be paid to Bradda by expanding its resource base to 1Mt LCE, and then the third payment of US$3 million is achieved when Bradda expands its resource base to 2.5Mt LCE.

Bradda is working with its geologists to hit these targets as soon as is feasible with the programmes mentioned above and the planned programmes in 2024 at Basin West and Basin West Extension.

2023 programme, highlights:

Related Tables

The following table is for information and context, comparing Q4 2022, Q1 2022 and 2018 MRE totals in relation to the areas on which work had been conducted at each time.

[1] National Instrument 43-101 compliant technical report filed for the Basin Project in November 2022

2 National Instrument 43-101 compliant technical report filed for the Basin Project in March 2023

QAQC, Sample Preparation

All core samples have been split in half, bagged on site, numbered in depth sequence with certified standards added into the sample stream for quality control. Bags were kept under lock and key prior to their direct shipment to ISO-certified laboratory, SGS, in Burnaby, BC, Canada. Samples were weighed, dried, crushed, then split by rotary convention and placed into 250gram envelopes. The samples were then pulverized to 85% passing 75 microns, then analysed by 4-acid digest, ICP-AES / ICP-MS.

Qualified Person (BHL)

Joey Wilkins, B.Sc., P.Geo., is COO at BHL and the Qualified Person who reviewed and approved the technical disclosures in this news release. Mr. Wilkins is a graduate of the University of Arizona with a B.Sc. in Geology with more than 37 years of experience in mineral exploration and is a qualified person under the AIM Rules. Mr. Wilkins consents to the inclusion of the technical information in this release and context in which it appears.

Reference is made to the report entitled "Independent Technical Report On The Basin And Wikieup Lithium Clay Projects, Arizona, USA" (the Report) dated October 18 2022 with an effective date of June 10 2022.The Report was prepared by Martin Pittuck, CEng, MIMMM, FGS, and Kirsty Reynolds MSci, PhD, FGS and reviewed by Nick Fox MSc, ACA, MIMMM. Reference is made to the report entitled "Technical Report On The Mineral Resource And Exploration Target Estimates For The Basin Lithium Project, USA" dated February 28 2023 with an effective date of October 13 2022. The Report was prepared by Martin Pittuck, CEng, MIMMM, FGS, Kirsty Reynolds MSci, PhD, FGS and Jamie Price MESci, PhD. The Reports are available for review on SEDAR (www.sedar.com) and the Company's website.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF THE MARKET ABUSE REGULATION (EU No. 596/2014) AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN AND SUCH PERSONS SHALL THEREFORE CEASE TO BE IN POSSESSION OF INSIDE INFORMATION.

ENDS

About Bradda Head Lithium Ltd.

Bradda Head Lithium Ltd. is a North America-focused lithium development group. The Company currently has interests in a variety of projects, the most advanced of which are in Central and Western Arizona: The Basin Project (Basin East Project, and the Basin West Project) and the Wikieup Project.

The Basin East Project has an Indicated Mineral Resource of 21.2 Mt at an average grade of 891 ppm Li and 3.5% K for a total of 100 kt LCE and an Inferred Mineral Resource of 73.3 Mt at an average grade of 694 ppm Li and 3.2% K for a total of 271 kt LCE. In the rest of the Basin Project SRK has estimated an Exploration Target of between 300 to 1,300 Mt of material grading between 600 to 850 ppm Li which is equivalent to a range of between 1 to 6 Mt LCE. The Group intends to continue to develop its three phase one projects in Arizona, whilst endeavouring to unlock value at its other prospective pegmatite and brine assets in Arizona, Nevada, and Pennsylvania. All of Bradda Head's licences are held on a 100% equity basis and are in close proximity to the required infrastructure. Bradda Head is quoted on the AIM of the London Stock Exchange with the ticker of BHL, on the TSX Ventures exchange with a ticker of BHLI, and on the US OTCQB market with a ticker of BHLIF.

Forward-Looking Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This News Release includes certain "forward-looking statements" which are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management's expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, following: The Company's objectives, goals or future plans. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to: failure to identify mineral resources; failure to convert estimated mineral resources to reserves; delays in obtaining or failures to obtain required regulatory, governmental, environmental or other project approvals; political risks; future operating and capital costs, timelines, permit timelines, the market and future price of and demand for lithium, and the ongoing ability to work cooperatively with stakeholders, including the local levels of government; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices; delays in the development of projects, capital and operating costs varying significantly from estimates; an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains; and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company's public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Technical Glossary

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

BHLI:CA

The Conversation (0)

13 September 2023

Bradda Head Lithium Limited

Diversified Lithium Deposits to Strengthen US Domestic Supply Chain

Diversified Lithium Deposits to Strengthen US Domestic Supply Chain Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00