June 28, 2024

Australian uranium producer Boss Energy (ASX:BOE) has two projects – the 100 percent-owned Honeymoon uranium project in South Australia and the 30 percent-owned Alta Mesa project in the US.

The macro-environment and steps taken by the US government remain favorable for uranium producers such as Boss Energy. The US Congress recently enacted legislation prohibiting the importation of Russian uranium products known as the Prohibiting Russian Uranium Imports Act (HR 1042), valid until 2040.

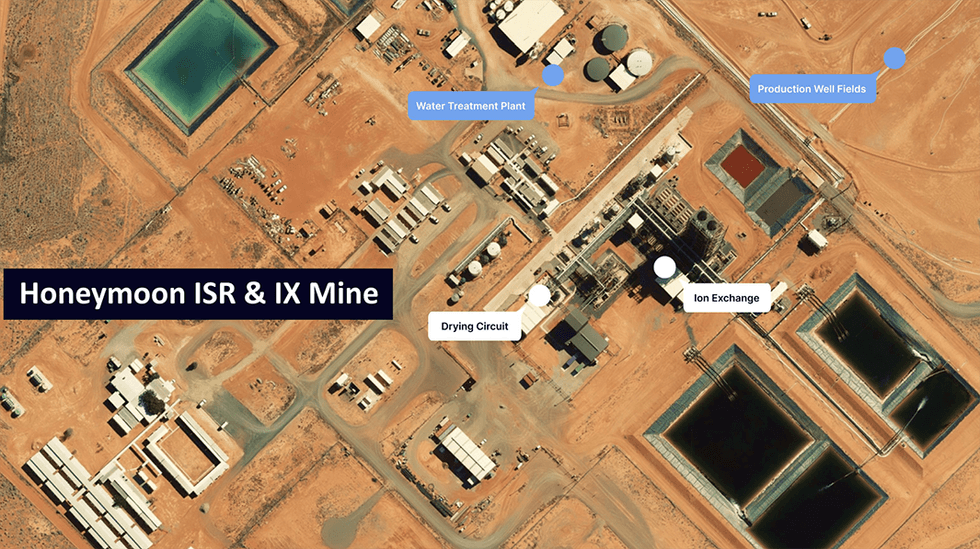

The Honeymoon uranium project in South Australia spans approximately 80 kms northwest of Broken Hill. The project is home to the historical Honeymoon uranium mine, Australia's second operating in-situ recovery uranium mine. It began production in 2011 under the previous ownership of Uranium One. Operations at Honeymoon were halted in November 2013 due to declining uranium prices. Subsequently, Boss Energy acquired the project in 2015. The company has since restarted the mine, with the first drum of uranium produced in April 2024.

Company Highlights

- Boss Energy is an Australia-based uranium producer focused on its two key projects – the 100 percent owned Honeymoon Uranium Project in South Australia and the 30 percent owned Alta Mesa Project in the US.

- In June 2024 Boss became a multi-mine uranium producer through the Honeymoon and Alta Mesa Projects.

- The Honeymoon uranium mine commenced production in April 2024, with the first sale of uranium expected in July 2024.

- Annual production at Honeymoon is forecast to reach 2.45 Mlbs of U3O8.

- The Alta Mesa uranium mine commenced production in June 2024, with first sale of uranium expected in October 2024.

- Annual production at Alta Mesa is forecast to reach 1.50 Mlbs of U3O8. Once steady-state operations are established, Boss’s 30 percent share of the production amounts to 500,000 lbs per year.

- Uranium prices have been the highest since 2008 at over US$80/lb. Prices are expected to remain strong due to the tightness of the uranium supply/demand balance. The company’s first production is timed with strong market fundamentals.

- The company has signed two sales agreements to supply 1.8 million pounds of U3O8 to leading power utilities in Europe and the US, spanning eight years from 2024 to 2032. The company plans to pursue additional agreements as the price of uranium increases.

This Boss Energy profile is part of a paid investor education campaign.*

Click here to connect with Boss Energy (ASX:BOE) to receive an Investor Presentation

BOE:AU

The Conversation (0)

27 June 2024

Boss Energy Limited

Multi-mine uranium producer in Australia and the US

Multi-mine uranium producer in Australia and the US Keep Reading...

28 January 2025

December 2024 Quarterly Results Presentation

Boss Energy Limited (BOE:AU) has announced December 2024 Quarterly Results PresentationDownload the PDF here. Keep Reading...

28 January 2025

Quarterly Cashflow Report - December 2024

Boss Energy Limited (BOE:AU) has announced Quarterly Cashflow Report - December 2024Download the PDF here. Keep Reading...

28 January 2025

Quarterly Activities Report - December 2024

Boss Energy Limited (BOE:AU) has announced Quarterly Activities Report - December 2024Download the PDF here. Keep Reading...

5h

Deep Space Energy Secures US$1.1 Million to Advance Lunar Power and Satellite Resilience Goals

Latvian startup Deep Space Energy announced it has raised approximately US$1.1 million in a combination of private investment and public funding to advance a radioisotope-based power generator designed to operate on the Moon.The company closed a US$416,500 pre-seed round led by Outlast Fund and... Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00