Final Assay Results from the M&I Conversion Program Confirm High-Grade Continuity of Gold and Silver Mineralization over 350 Metres in the M&I Conversion Area

HIGHLIGHTS:

- TXC25-139 cut 9.05 metres grading 367 grams per tonne (g/t) silver equivalent (AgEq) (182.8 g/t silver (Ag) & 2.04 g/t gold (Au)) from 187.5 metres, including 0.82 metres grading 2,886 g/t AgEq (1,411 g/t Ag & 16.13 g/t Au), Ag/Au ratio 90:1;

- TXC25-150 drilled 2.84 metres grading 671.5 AgEq (367 g/t Ag & 3.41 g/t Au) from 162.3 metres, including 0.76 metres grading 1,554 g/t AgEq ( 819 g/t Ag & 8.14 g/t Au);

- TXC25-146 intercepted 1.16 metres of 1,111 g/t AgEq (615 g/t Ag & 5.50 g/t Au) from 189.5 metres;

- Results from the entirety of the M&I Conversion Program have validated the geologic model, successfully establishing continuity of the high-grade shoots bearing robust geometry over 350 metres. The shoots remain open to the Northwest and downdip;

- Significant new zones of near-surface mineralization were encountered during the M&I Conversion Program at higher-than-average grades updip from the existing resource shell;

- Modelling of the M&I Conversion Program drillholes is now underway with an updated mineral resource estimate on Tonopah West on track for Q3, 2025; and

- Assay results for 7 drillholes from the Company's Northwest step out resource expansion area are currently pending. (see February 24, 2025 news release)

Blackrock Silver Corp. (TSXV: BRC) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") announces the final set of high-grade silver and gold drill intercepts from its recently completed M&I Conversion Program (as defined herein) at its 100% owned Tonopah West project ("Tonopah West") located in Nye and Esmeralda Counties, Nevada, United States.

The Company has completed its in-fill drilling program (the "M&I Conversion Program") at Tonopah West which commenced in mid July 2024 and consisted of 62 drillholes totalling 12,580 metres (41,271 feet) within the shallow southern portion of the Bermuda-Merten vein group ("DPB") resource area (the "M&I Conversion Area"). The objective of the M&I Conversion Program is to convert between 1.0 and 1.5-million tonnes of material from inferred mineral resources to measured and indicated mineral resources. The M&I Conversion Area represents the initial years of anticipated production at Tonopah West based on the mine plan laid out in the Company's Preliminary Economic Assessment on Tonopah West (see September 4, 2024 news release).

Andrew Pollard, the Company's President and Chief Executive Officer, stated: "With all assays now received from our M&I Conversion Program, we've validated our geologic model at Tonopah West and confirmed continuous high-grade mineralization over a 350-metre zone. Results from this program featured standout grades that reinforce the Tonopah West project's position as one of the top undeveloped silver assets in the sector. In addition to strengthening confidence in known zones through tighter drill spacing, the program also outlined new near-surface zones of ultra-high-grade gold and silver mineralization, representing meaningful new tonnage potential. These results will be incorporated into an updated mineral resource estimate on Tonopah West anticipated to be completed Q3 2025, aimed at upgrading significant tonnage to the measured and indicated categories to help de-risk the early years of anticipated production."

Table 1: Tonopah West Assay Intercepts using 150 g/t AgEq cut off

| Drillhole ID | Hole Type | Program | From (m) | To (m) | Drill Interval (m) | Ag (g/t) | Au (g/t) | AgEq (g/t)(2)(3) |

| TXC25-139 | RC/Core(1) | M&I Conversion | 187.54 | 196.60 | 9.05 | 182.8 | 2.038 | 366.6 |

| Including | 187.54 | 188.37 | 0.82 | 1,411.0 | 16.133 | 2,866.4 | ||

| TXC25-141 | RC/Core(1) | M&I Conversion | 273.59 | 275.17 | 1.59 | 106.6 | 0.787 | 177.6 |

| TXC25-141 | RC/Core(1) | M&I Conversion | 447.66 | 448.27 | 0.61 | 694.9 | 7.512 | 1,372.5 |

| Including | 447.97 | 448.27 | 0.31 | 1,226.0 | 13.733 | 2,464.9 | ||

| TXC25-142 | RC/Core(1) | M&I Conversion | 347.08 | 347.60 | 0.52 | 5.1 | 1.610 | 150.3 |

| TXC25-142 | RC/Core(1) | M&I Conversion | 361.01 | 361.80 | 0.79 | 597.6 | 4.540 | 1,007.1 |

| Including | 361.01 | 361.37 | 0.37 | 1,122.0 | 8.160 | 1,858.1 | ||

| TXC25-146 | RC/Core(1) | M&I Conversion | 189.50 | 190.65 | 1.16 | 615.0 | 5.497 | 1,110.9 |

| Including | 189.95 | 190.65 | 0.70 | 920.1 | 8.330 | 1,671.6 | ||

| TXC25-147 | RC/Core(1) | M&I Conversion | 148.19 | 151.85 | 3.66 | 176.7 | 1.228 | 287.5 |

| Including | 150.88 | 151.43 | 0.55 | 704.0 | 4.250 | 1,087.4 | ||

| TXC25-147 | RC/Core(1) | M&I Conversion | 182.58 | 183.34 | 0.76 | 277.5 | 5.586 | 781.5 |

| Including | 183.00 | 183.34 | 0.34 | 315.0 | 6.620 | 912.2 | ||

| TXC25-148 | RC/Core(1) | M&I Conversion | 124.66 | 125.43 | 0.76 | 111.0 | 1.270 | 225.6 |

| TXC25-148 | RC/Core(1) | M&I Conversion | 238.35 | 240.49 | 2.13 | 198.1 | 2.383 | 413.1 |

| Including | 238.35 | 238.96 | 0.61 | 512.0 | 5.590 | 1,016.3 | ||

| TXC25-149 | RC/Core(1) | M&I Conversion | 129.36 | 129.97 | 0.61 | 491.0 | 4.570 | 903.3 |

| TXC25-149 | RC/Core(1) | M&I Conversion | 238.35 | 239.57 | 1.22 | 93.7 | 1.919 | 266.8 |

| TXC25-149 | RC/Core(1) | M&I Conversion | 252.59 | 253.59 | 1.01 | 38.2 | 2.157 | 232.8 |

| TXC25-150 | RC/Core(1) | M&I Conversion | 162.37 | 165.20 | 2.84 | 363.6 | 3.413 | 671.5 |

| Including | 163.47 | 164.23 | 0.76 | 818.9 | 8.144 | 1,553.6 | ||

| TXC25-151 | RC/Core(1) | M&I Conversion | 274.47 | 275.42 | 0.95 | 208.7 | 3.149 | 492.8 |

| (1)RC/Core = RC pre-collar with core tail. (2)AgEq = Ag + Au*(Factor); where Factor = (Au Price/Ag Price)*(Au Recovery/Ag Recovery or Factor=($1900/$23)*(95%/87%)=90.21; True thickness is 90 to 100% of interval thickness based on the modelled vein geometries. (3)Cut-off grade is 150 g/t AgEq. | ||||||||

The geometry of the high-grade silver and gold is sizable with high-grade shoots plunging to the northwest and showing continuity over 350 metres within the M&I Conversion Area. These shoots remain open to the northwest and open down plunge. Multiple high-grade intercepts have been returned pursuant to the M&I Conversion Program. TXC25-139 returned over 9-metres grading 183 g/t silver and 2.04 g/t gold for 367 g/t AgEq. This intercept is immediately adjacent to mineralization found in TXC25-138 (see May 8, 2025 news release) where a composite zone of 11.46 metres of 514 g/t AgEq (290 g/t Ag & 2.48 g/t Au) was encountered. The thickness of this mineralized vein is approaching those seen in the historic mining at the Victor and Ohio mines at Tonopah West where Victor was 24 metres thick and Ohio was 15 metres thick.

The completion of the M&I Conversion Program now allows for modelling of the vein shoots and high-grade gold and silver for an updated mineral resource estimate which is anticipated to be completed this fall. Management of the Company believes the updated mineral resource estimate will show excellent continuity between the high-grade zones and an increase in confidence of the DPB portion of the mineral resource. This information will assist in the design and implementation of an exploration decline, underground test mining and extraction of a bulk sample for metallurgical processing at Tonopah West.

Table 2 shows all of the intercepts above 150 g/t AgEq encountered pursuant to the M&I Conversion Program. Approximately 65% of the drilling returned values above 150 g/t AgEq with the remaining drillholes returning mineralization, albeit below the cutoff. No drillhole in the campaign was completely barren of gold or silver.

Table 2:Significant Assays From The M&I Conversion Program Above 150 g/t AuEq Cutt Off

| Drillhole ID | Hole Type | Program | From (m) | To (m) | Drill Interval (m) | Ag (g/t) | Au (g/t) | AgEq (g/t) (2)(3) |

| TXC24-076 | RC/Core(1) | M&I Conversion | 195.62 | 195.93 | 0.31 | 99.2 | 1.440 | 229.1 |

| TXC24-080 | RC/Core(1) | M&I Conversion | 367.29 | 369.27 | 1.98 | 174.0 | 0.844 | 250.1 |

| TXC24-081 | RC/Core(1) | M&I Conversion | 181.51 | 183.49 | 1.98 | 131.9 | 1.503 | 267.5 |

| TXC24-085 | RC/Core(1) | M&I Conversion | 171.60 | 172.67 | 1.07 | 152.7 | 1.613 | 298.2 |

| TXC24-085 | RC/Core(1) | M&I Conversion | 249.48 | 252.07 | 2.59 | 32.1 | 2.740 | 279.3 |

| TXC24-087 | RC/Core(1) | M&I Conversion | 172.21 | 174.80 | 2.59 | 1,920.9 | 20.262 | 3,748.7 |

| Including | 173.74 | 174.80 | 1.07 | 4,328.3 | 46.506 | 8,523.6 | ||

| TXC24-090 | RC/Core(1) | M&I Conversion | 161.85 | 162.92 | 1.07 | 436.0 | 5.110 | 897.0 |

| TXC24-091 | RC/Core(1) | M&I Conversion | 242.32 | 244.08 | 1.77 | 111.0 | 1.060 | 206.6 |

| TXC24-091 | RC/Core(1) | M&I Conversion | 249.02 | 252.13 | 3.11 | 350.1 | 3.519 | 667.5 |

| Including | 250.55 | 252.13 | 1.59 | 469.5 | 4.931 | 914.3 | ||

| TXC24-092 | RC/Core(1) | M&I Conversion | 141.64 | 142.77 | 1.13 | 534.0 | 6.910 | 1,157.4 |

| TXC24-092 | RC/Core(1) | M&I Conversion | 145.70 | 149.05 | 3.35 | 470.6 | 5.356 | 953.8 |

| Including | 148.32 | 149.05 | 0.73 | 1,706.0 | 19.467 | 3,462.1 | ||

| TXC24-092 | RC/Core(1) | M&I Conversion | 186.02 | 187.30 | 1.28 | 303.0 | 3.660 | 633.2 |

| TXC24-094 | RC/Core(1) | M&I Conversion | 213.67 | 215.80 | 2.13 | 92.3 | 1.530 | 230.3 |

| TXC24-095 | RC/Core(1) | M&I Conversion | 192.94 | 194.62 | 1.68 | 572.7 | 5.379 | 1,057.9 |

| TXC24-095 | RC/Core(1) | M&I Conversion | 195.99 | 197.82 | 1.83 | 147.0 | 2.160 | 341.9 |

| TXC24-095 | RC/Core(1) | M&I Conversion | 238.96 | 240.03 | 1.07 | 343.7 | 3.213 | 633.5 |

| Including | 239.48 | 240.03 | 0.55 | 665.0 | 6.230 | 1,227.0 | ||

| TXC24-095 | RC/Core(1) | M&I Conversion | 242.47 | 247.50 | 5.03 | 461.5 | 3.478 | 775.3 |

| Including | 245.36 | 246.13 | 0.76 | 1,362.0 | 9.810 | 2,247.0 | ||

| TXC24-098 | RC/Core(1) | M&I Conversion | 326.75 | 327.97 | 1.22 | 265.6 | 4.097 | 635.2 |

| Including | 327.66 | 327.97 | 0.30 | 1,034.0 | 16.067 | 2,483.4 | ||

| TXC24-100 | Core | M&I Conversion | 140.97 | 143.23 | 2.26 | 530.3 | 4.085 | 898.8 |

| Including | 141.67 | 142.59 | 0.92 | 943.0 | 7.156 | 1,588.5 | ||

| TXC24-101 | Core | M&I Conversion | 137.56 | 138.84 | 1.28 | 687.2 | 6.656 | 1,287.6 |

| TXC24-101 | Core | M&I Conversion | 169.26 | 169.56 | 0.31 | 181.0 | 2.970 | 448.9 |

| TXC24-101 | Core | M&I Conversion | 255.42 | 256.49 | 1.07 | 66.4 | 1.310 | 184.6 |

| TXC24-102 | Core | M&I Conversion | 152.95 | 153.92 | 0.98 | 628.0 | 4.670 | 1,049.3 |

| Including | 153.32 | 153.92 | 0.61 | 756.0 | 6.280 | 1,322.5 | ||

| TXC24-103 | Core | M&I Conversion | 232.26 | 233.78 | 1.52 | 134.0 | 1.675 | 285.1 |

| Including | 232.26 | 232.56 | 0.31 | 660.0 | 8.230 | 1,402.4 | ||

| TXC24-104 | Core | M&I Conversion | 295.20 | 295.60 | 0.40 | 125.0 | 1.610 | 270.2 |

| TXC24-115 | RC/Core(1) | M&I Conversion | 332.54 | 336.50 | 3.96 | 375.2 | 3.154 | 659.7 |

| Including | 332.54 | 333.91 | 1.37 | 624.8 | 5.066 | 1,081.8 | ||

| TXC24-116 | RC/Core(1) | M&I Conversion | 199.34 | 199.89 | 0.55 | 987.0 | 11.467 | 2,021.4 |

| TXC24-116 | RC/Core(1) | M&I Conversion | 218.12 | 218.69 | 0.58 | 135.0 | 1.440 | 264.9 |

| TXC24-117 | RC/Core(1) | M&I Conversion | 246.46 | 247.04 | 0.58 | 105.0 | 1.460 | 236.7 |

| TXC24-117 | RC/Core(1) | M&I Conversion | 261.21 | 263.23 | 2.01 | 1,141.0 | 7.139 | 1,785.0 |

| Including | 262.83 | 263.23 | 0.40 | 3,712.0 | 26.133 | 6,069.5 | ||

| TXC24-118 | RC/Core(1) | M&I Conversion | 205.98 | 206.35 | 0.37 | 1,610.0 | 15.333 | 2,993.2 |

| TXC24-118 | RC/Core(1) | M&I Conversion | 332.17 | 332.54 | 0.37 | 91.3 | 1.280 | 206.8 |

| TXC24-119 | RC/Core(1) | M&I Conversion | 370.42 | 375.12 | 4.69 | 379.0 | 3.722 | 714.8 |

| Including | 372.16 | 373.38 | 1.22 | 770.5 | 7.757 | 1,470.3 | ||

| TXC24-121 | RC/Core(1) | M&I Conversion | 262.13 | 266.00 | 3.87 | 179.3 | 1.365 | 302.4 |

| TXC24-122 | RC/Core(1) | M&I Conversion | 270.05 | 270.97 | 0.92 | 477.7 | 4.880 | 917.9 |

| Including | 270.66 | 270.97 | 0.31 | 875.0 | 8.880 | 1,676.1 | ||

| TXC24-122 | RC/Core(1) | M&I Conversion | 337.11 | 342.32 | 5.21 | 291.7 | 3.018 | 564.0 |

| Including | 341.59 | 342.32 | 0.73 | 1,834.0 | 18.081 | 3,465.1 | ||

| TXC25-125 | RC/Core(1) | M&I Conversion | 327.97 | 329.31 | 1.34 | 118.2 | 1.336 | 238.7 |

| Including | 328.27 | 328.58 | 0.31 | 432.0 | 4.900 | 874.0 | ||

| TXC25-126 | RC/Core(1) | M&I Conversion | 319.61 | 320.22 | 0.61 | 247.8 | 2.554 | 478.2 |

| Including | 319.92 | 320.22 | 0.31 | 421.0 | 4.380 | 816.1 | ||

| TXC25-128 | RC/Core(1) | M&I Conversion | 300.81 | 302.21 | 1.40 | 244.8 | 2.070 | 431.6 |

| TXC25-128 | RC/Core(1) | M&I Conversion | 348.14 | 348.75 | 0.61 | 300.5 | 3.030 | 573.8 |

| TXC25-128 | RC/Core(1) | M&I Conversion | 427.76 | 428.46 | 0.70 | 129.0 | 1.360 | 251.7 |

| TXC25-129 | RC/Core(1) | M&I Conversion | 307.24 | 308.15 | 0.91 | 155.5 | 1.322 | 274.8 |

| TXC25-129 | RC/Core(1) | M&I Conversion | 344.94 | 345.55 | 0.61 | 237.0 | 2.520 | 464.3 |

| TXC25-131 | RC/Core(1) | M&I Conversion | 319.19 | 319.80 | 0.61 | 292.7 | 2.480 | 516.5 |

| Including | 319.49 | 319.80 | 0.31 | 584.0 | 4.940 | 1,029.6 | ||

| TXC25-132 | RC/Core(1) | M&I Conversion | 437.60 | 438.52 | 0.92 | 125.8 | 1.804 | 288.6 |

| TXC25-138 | RC/Core(1) | M&I Conversion | 230.40 | 234.64 | 4.24 | 378.5 | 3.572 | 700.7 |

| Including | 232.72 | 233.02 | 0.31 | 1,805.0 | 15.267 | 3,182.2 | ||

| TXC25-138 | RC/Core(1) | M&I Conversion | 236.68 | 241.86 | 5.18 | 328.2 | 2.528 | 556.3 |

| Including | 238.35 | 238.66 | 0.31 | 1,987.0 | 15.000 | 3,340.2 | ||

| TXC25-139 | RC/Core(1) | M&I Conversion | 187.54 | 196.60 | 9.05 | 182.8 | 2.038 | 366.6 |

| Including | 187.54 | 188.37 | 0.82 | 1,411.0 | 16.133 | 2,866.4 | ||

| TXC25-140 | RC/Core(1) | M&I Conversion | 362.90 | 363.81 | 0.91 | 335.6 | 3.803 | 678.7 |

| Including | 362.90 | 363.20 | 0.30 | 371.0 | 4.310 | 759.8 | ||

| TXC25-140 | RC/Core1 | M&I Conversion | 378.11 | 380.09 | 1.98 | 96.0 | 1.215 | 205.6 |

| Including | 379.05 | 380.09 | 1.04 | 136.5 | 1.787 | 297.7 | ||

| TXC25-141 | RC/Core(1) | M&I Conversion | 273.59 | 275.17 | 1.59 | 106.6 | 0.787 | 177.6 |

| TXC25-141 | RC/Core(1) | M&I Conversion | 447.66 | 448.27 | 0.61 | 694.9 | 7.512 | 1,372.5 |

| Including | 447.97 | 448.27 | 0.31 | 1,226.0 | 13.733 | 2,464.9 | ||

| TXC25-142 | RC/Core(1) | M&I Conversion | 347.08 | 347.60 | 0.52 | 5.1 | 1.610 | 150.3 |

| TXC25-142 | RC/Core(1) | M&I Conversion | 361.01 | 361.80 | 0.79 | 597.6 | 4.540 | 1,007.1 |

| Including | 361.01 | 361.37 | 0.37 | 1,122.0 | 8.160 | 1,858.1 | ||

| TXC25-146 | RC/Core(1) | M&I Conversion | 189.50 | 190.65 | 1.16 | 615.0 | 5.497 | 1,110.9 |

| Including | 189.95 | 190.65 | 0.70 | 920.1 | 8.330 | 1,671.6 | ||

| TXC25-147 | RC/Core(1) | M&I Conversion | 148.19 | 151.85 | 3.66 | 176.7 | 1.228 | 287.5 |

| Including | 150.88 | 151.43 | 0.55 | 704.0 | 4.250 | 1,087.4 | ||

| TXC25-147 | RC/Core(1) | M&I Conversion | 182.58 | 183.34 | 0.76 | 277.5 | 5.586 | 781.5 |

| Including | 183.00 | 183.34 | 0.34 | 315.0 | 6.620 | 912.2 | ||

| TXC25-148 | RC/Core(1) | M&I Conversion | 124.66 | 125.43 | 0.76 | 111.0 | 1.270 | 225.6 |

| TXC25-148 | RC/Core(1) | M&I Conversion | 238.35 | 240.49 | 2.13 | 198.1 | 2.383 | 413.1 |

| Including | 238.35 | 238.96 | 0.61 | 512.0 | 5.590 | 1,016.3 | ||

| TXC25-149 | RC/Core(1) | M&I Conversion | 129.36 | 129.97 | 0.61 | 491.0 | 4.570 | 903.3 |

| TXC25-149 | RC/Core(1) | M&I Conversion | 238.35 | 239.57 | 1.22 | 93.7 | 1.919 | 266.8 |

| TXC25-149 | RC/Core(1) | M&I Conversion | 252.59 | 253.59 | 1.01 | 38.2 | 2.157 | 232.8 |

| TXC25-150 | RC/Core(1) | M&I Conversion | 162.37 | 165.20 | 2.84 | 363.6 | 3.413 | 671.5 |

| Including | 163.47 | 164.23 | 0.76 | 818.9 | 8.144 | 1,553.6 | ||

| TXC25-151 | RC/Core(1) | M&I Conversion | 274.47 | 275.42 | 0.95 | 208.7 | 3.149 | 492.8 |

| (1)RC/Core = RC pre-collar with core tail. (2)AgEq = Ag + Au*(Factor); where Factor = (Au Price/Ag Price)*(Au Recovery/Ag Recovery or Factor=($1900/$23)*(95%/87%)=90.21; True thickness is 90 to 100% of interval thickness based on the modelled vein geometries. (3)Cut-off grade is 150 g/t AgEq. | ||||||||

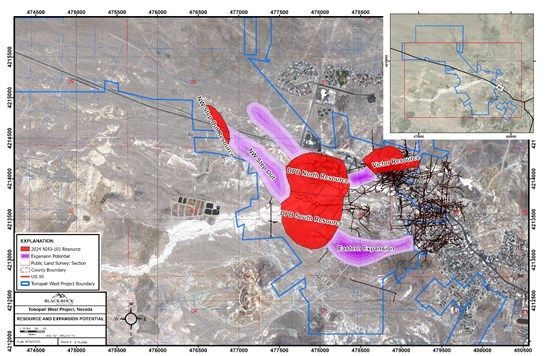

Figure 1: Tonopah West project showing NI43-101 resource location and expansion potential

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/676/255788_d1bf53a51451fba6_001full.jpg

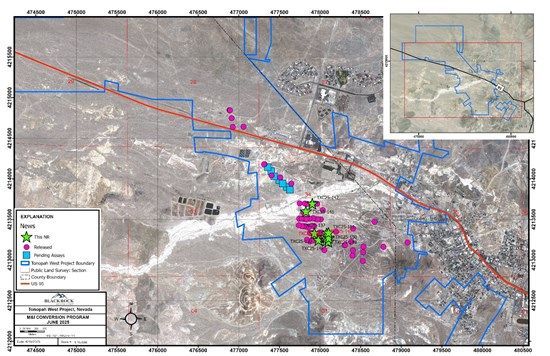

Figure 2 is a plan map showing the location of all the drillholes completed under the M&I Conversion Program and highlighting those reported in this news release.

Figure 2: Drillhole location map of the M&I Conversion Program showing drillholes reported in this news release.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/676/255788_d1bf53a51451fba6_002full.jpg

Table 3: Tonopah West Drillhole Location Coordinates (based on GPS readings in the field, Datum UTM, NAD 1927, Zone 11)

| Drillhole ID | Area | Program | Type | UTM_NAD27 E | UTM_NAD27 N | Elevation (m) | Depth (ft) | Depth (m) | Azimuth | Dip |

| TXC25-137 | DPB South | M&I Conversion | RC/Core | 477930.7 | 4213330.8 | 1776.3 | 1028.0 | 313.3 | 180 | -62 |

| TXC25-139 | DPB South | M&I Conversion | RC/Core | 477980.6 | 4213246.5 | 1778.4 | 1061.0 | 323.4 | 180 | -67 |

| TXC25-141 | DPB South | M&I Conversion | RC/Core | 477826.6 | 4213599.2 | 1770.7 | 1647.0 | 502.0 | 180 | -62 |

| TXC25-142 | DPB South | M&I Conversion | RC/Core | 477905.7 | 4213694.6 | 1772.9 | 1717.0 | 523.3 | 180 | -50 |

| TXC25-146 | DPB South | M&I Conversion | RC/Core | 478081.5 | 4213327.2 | 1780.6 | 912.0 | 278.0 | 180 | -60 |

| TXC25-147 | DPB South | M&I Conversion | RC/Core | 478067.5 | 4213281.7 | 1781.7 | 953.5 | 290.6 | 180 | -60 |

| TXC25-148 | DPB South | M&I Conversion | RC/Core | 478073.8 | 4213237.8 | 1781.8 | 979.0 | 298.4 | 180 | -60 |

| TXC25-149 | DPB South | M&I Conversion | RC/Core | 478101.9 | 4213225.4 | 1783.3 | 902.0 | 274.9 | 180 | -60 |

| TXC25-150 | DPB South | M&I Conversion | RC/Core | 478107.8 | 4213270.4 | 1783.1 | 897.5 | 273.6 | 180 | -60 |

| TXC25-151 | DPB South | M&I Conversion | RC/Core | 478104.9 | 4213335.4 | 1781.1 | 943.0 | 287.4 | 180 | -60 |

Quality Assurance/ Quality Control

All sampling is conducted under the supervision of the Company's project geologists, and a strict chain of custody from the project to the sample preparation facility is implemented and monitored. The RC and core samples are hauled from the project site to a secure and fenced facility in Tonopah, Nevada, where they are loaded on to American Assay Laboratory's (AAL) flat-bed truck and delivered to AAL's facility in Sparks, Nevada. A sample submittal sheet is delivered to AAL personnel who organize and process the sample intervals pursuant to the Company's instructions.

The RC samples are lined out at the lab and logged in to AAL's system. The core samples are cut using core saws and personnel at AAL's facility in Sparks, Nevada according to the Company's instructions delivered with each core hole.

All samples are dried, crushed to 85% passing 10 mesh (2mm) and a 250-gram sub-sample split is collected and pulverized to 200 mesh (74 micron) in a ring and puck pulverizer. Then the pulverized material is digested and analyzed for gold using fire assay fusion and an Induced Coupled Plasma (ICP) finish on a 30-gram assay split (FA-PB30-ICP). Silver is determined using five-acid digestion and ICP analysis (ICP-5AM48). Over limits for gold and silver are determined using a gravimetric finish (GRAVAU30 and GRAVAG30). Data verification of the assay and analytical results are completed to ensure accurate and verifiable results. Blackrock personnel insert a blind prep blank, lab blank or a certified reference material approximately every 15th to 20th sample.

Qualified Persons

Blackrock's exploration activities at Tonopah West are conducted and supervised by Mr. William Howald, Executive Chairman of Blackrock. Mr. William Howald, AIPG Certified Professional Geologist #11041, is a Qualified Person as defined under National Instrument 43-101 - Standards of Disclosure for Mineral Projects. He has reviewed and approved the contents of this news release.

About Blackrock Silver Corp.

Backed by gold and silver ounces in the ground, Blackrock is a junior precious metal focused exploration and development company driven to add shareholder value. Anchored by a seasoned Board of Directors, the Company is focused on its 100% controlled Nevada portfolio of properties consisting of low-sulphidation, epithermal gold and silver mineralization located along the established Northern Nevada Rift in north-central Nevada and the Walker Lane trend in western Nevada.

Additional information on Blackrock Silver Corp. can be found on its website at www.blackrocksilver.com and by reviewing its profile on SEDAR at www.sedarplus.ca.

Cautionary Note Regarding Forward-Looking Statements and Information

This news release contains "forward-looking statements" and "forward-looking information" (collectively, "forward-looking statements") within the meaning of Canadian and United States securities legislation, including the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, are forward-looking statements. Forward-looking statements in this news release relate to, among other things: the Company's strategic plans; the anticipated objectives and results from the Company's drill programs at Tonopah West; the incorporation of the results from the M&I Conversion Program in an updated mineral resource estimate on Tonopah West and the anticipated timing of release thereof; the Company's de-risking initiatives at Tonopah West; estimates of mineral resource quantities and qualities; estimates of mineralization from drilling; geological information projected from sampling results; and the potential quantities and grades of the target zones.

These forward-looking statements reflect the Company's current views with respect to future events and are necessarily based upon a number of assumptions that, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include, among other things: conditions in general economic and financial markets; accuracy of assay results; geological interpretations from drilling results, timing and amount of capital expenditures; performance of available laboratory and other related services; future operating costs; the historical basis for current estimates of potential quantities and grades of target zones; the availability of skilled labour and no labour related disruptions at any of the Company's operations; no unplanned delays or interruptions in scheduled activities; all necessary permits, licenses and regulatory approvals for operations are received in a timely manner; the ability to secure and maintain title and ownership to properties and the surface rights necessary for operations; and the Company's ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

The Company cautions the reader that forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements contained in this news release and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the timing and content of work programs; results of exploration activities and development of mineral properties; the interpretation and uncertainties of drilling results and other geological data; receipt, maintenance and security of permits and mineral property titles; environmental and other regulatory risks; project costs overruns or unanticipated costs and expenses; availability of funds; failure to delineate potential quantities and grades of the target zones based on historical data; general market and industry conditions; and those factors identified under the caption "Risks Factors" in the Company's most recent Annual Information Form.

Forward-looking statements are based on the expectations and opinions of the Company's management on the date the statements are made. The assumptions used in the preparation of such statements, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statements were made. The Company undertakes no obligation to update or revise any forward-looking statements included in this news release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For Further Information, Contact:

Andrew Pollard

President and Chief Executive Officer

(604) 817-6044

info@blackrocksilver.com

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/255788